Key findings

Living standards and inequality

1. Average (median) disposable household income before deducting housing costs rose by 0.5% in 2021–22, but remained 1.2% lower than its pre-pandemic level. The relatively muted increase in 2021–22 reflected a 4.8% rebound in nominal incomes being largely offset by a sharp rise in inflation. A fall in housing costs over the pandemic means that average incomes measured after deducting housing costs were 0.2% higher in 2021–22 than in 2019–20.

2. Income growth was stronger among poorer households, with those in the bottom third of the distribution seeing a rise between 2019–20 and 2021–22 of 1.5% before deducting housing costs and 2.7% after deducting housing costs. Large falls in employment income among this group were more than offset by a rise in benefit incomes (in particular the temporary £20 uplift to universal credit) and a fall in housing costs, both of which affected low-income households more than households further up the income distribution.

3. The increase in benefit incomes among low-income households did not simply reflect a fall in employment income. Average benefit receipt in 2021–22 was higher than in 2019–20 at every level of earnings, due to the £20 universal credit uplift that persisted until October 2021 and the increased generosity of universal credit for in-work households from November 2021. The share of households in the bottom third of incomes that received disability benefits rose by 26%, from 12% in 2019–20 to 15% in 2021–22, driven entirely by an increase among working-age households.

4. Individuals aged 50–70 who moved from employment into economic inactivity in 2020–21 were more likely to end up in poverty (in the year of exit) than those who became inactive in previous years. This is despite poverty rates falling among 50- to 70-year-olds who had been inactive for more than a year (that is, it does not reflect an overall fall in living standards among inactive individuals in the age group). Measures of self-reported well-being also declined more for recently inactive individuals in 2020 than for those who had been inactive for longer. For people who became inactive in 2021–22, outcomes were much more similar to those seen among people who became inactive pre-pandemic, suggesting that there is particular cause for concern for the 2020–21 cohort.

5. This decline in living standards and well-being challenges the perception that exits into inactivity over the pandemic were driven by wealthy individuals who could afford to retire in comfort. Instead, many of those who left the workforce in 2020–21 may have been ‘forced’ into early retirement, with an associated hit to their living standards and well-being. People who become inactive at older ages often never re-enter the workforce, so it is likely that many in this cohort will experience persistently low living standards. In contrast, those who became inactive in 2021–22, when the labour market disruption and health risk had largely subsided, are more likely to have done so out of choice.

Poverty

1. The overall absolute poverty rate fell in the first year of the pandemic (2020–21) and was little changed in 2021–22, leaving it nearly 1 percentage point (ppt) or 480,000 people lower than its pre-pandemic level. This is largely due to changes in benefits policy, in particular the (temporary) £20 universal credit uplift and (permanent) changes to the universal credit taper rate and work allowances, which allow workers to keep more of the benefit as their earnings rise.

2. The £20 uplift reduced absolute poverty rates by 0.3ppts during the six months it was in place in 2021–22, or by 0.6ppts in annualised terms (379,000 people). The changes to work allowances and the taper rate that succeeded it had a much more muted impact on poverty. Their annualised effect is only 0.2ppts (133,000 people) – a third of the impact of the uplift. Even on a per-pound basis, the £20 uplift had a 40% larger effect on poverty. This is because changes to work allowances and the taper rate mainly benefit somewhat higher-earning households further up the income distribution and do not affect out-of-work households at all.

3. The first instalment of the cost of living payments to households receiving means-tested benefits – £326 paid in July 2022 – substantially boosted spending. Discretionary spending was £33 a week (12%) higher for recipient households on average in the four weeks after the payment than in the four weeks before, and remained somewhat elevated up to 15 weeks after the initial payment. The rise in discretionary spending was driven by an increase in cash withdrawals, spending on groceries, and spending on entertainment (e.g. restaurants, streaming services), which accounted for 17%, 15% and 28% of the total increase in discretionary spending respectively. That recipients responded strongly to the payment suggests that, prior to the payment, many had limited savings or means of borrowing available to them, and wanted to spend more than they were able to. That a substantial fraction of the cost of living payment went on basic goods such as groceries, but also on more discretionary goods such as entertainment, indicates a variety of levels of ‘need’ among recipient households.

4. Recipients with lower earnings increased their spending by more immediately after receiving the cost of living payment, which may indicate higher cash constraints in the lead-up to the payment. However, the distribution of extra spending across categories (groceries, entertainment etc.) was similar across recipients with different levels of earnings.

Housing quality and affordability for lower-income households

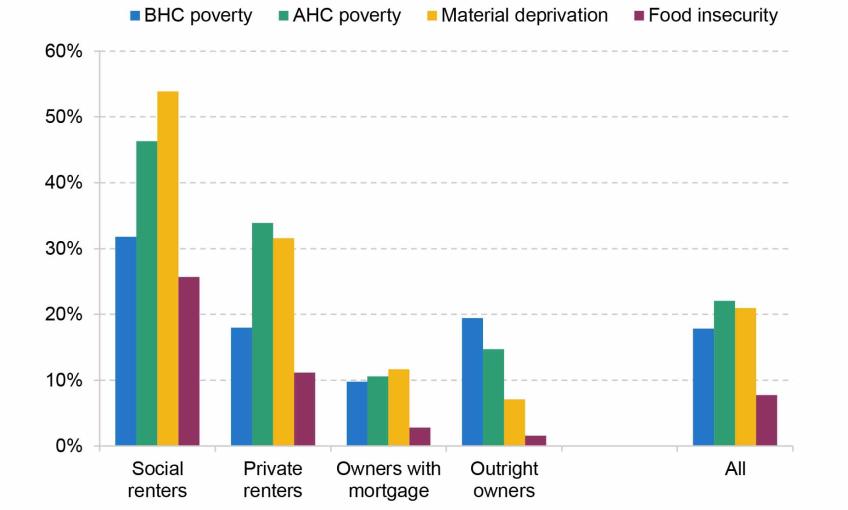

1. Facing higher housing costs, renters are considerably more likely than owner-occupiers to have low living standards on a variety of measures. Social and private renters have poverty rates of 46% and 34% respectively, compared with 12% for owner-occupiers. And they are also far more likely to be materially deprived or to live in food insecurity.

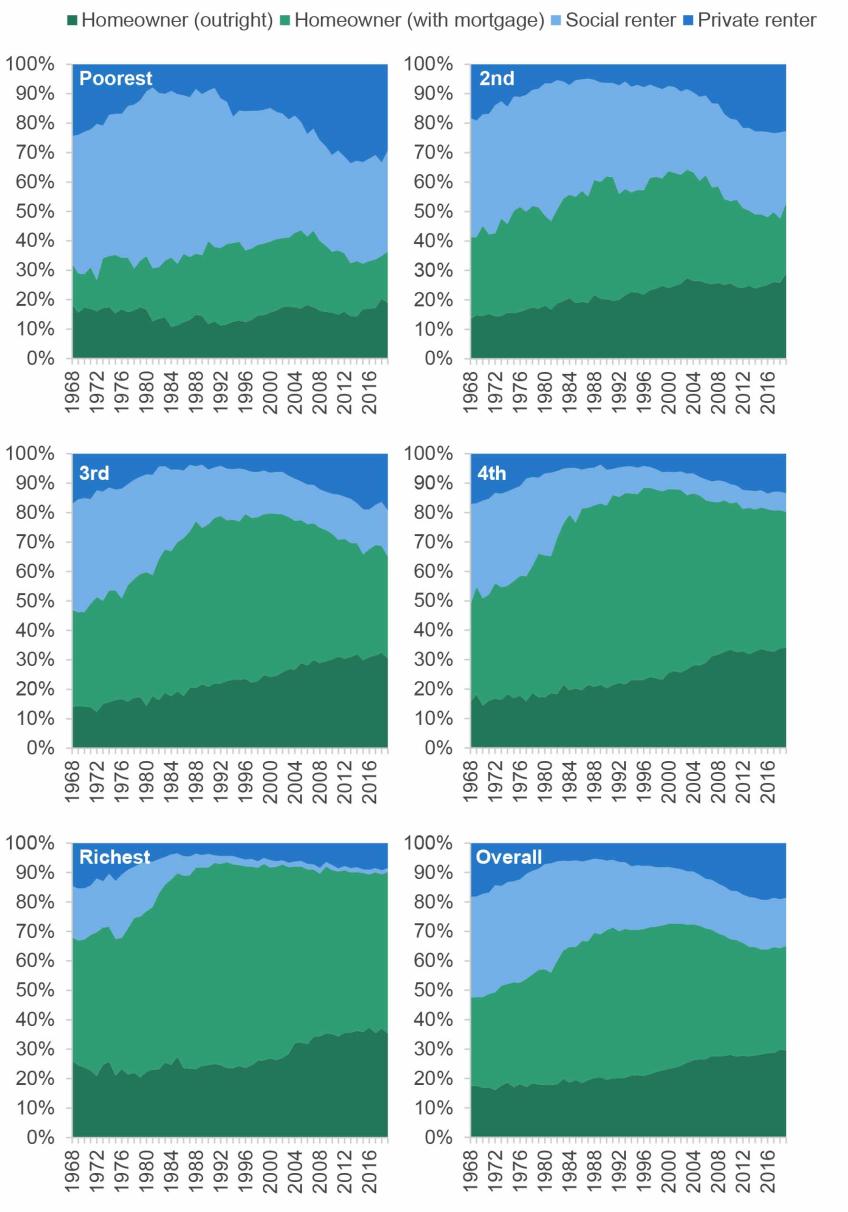

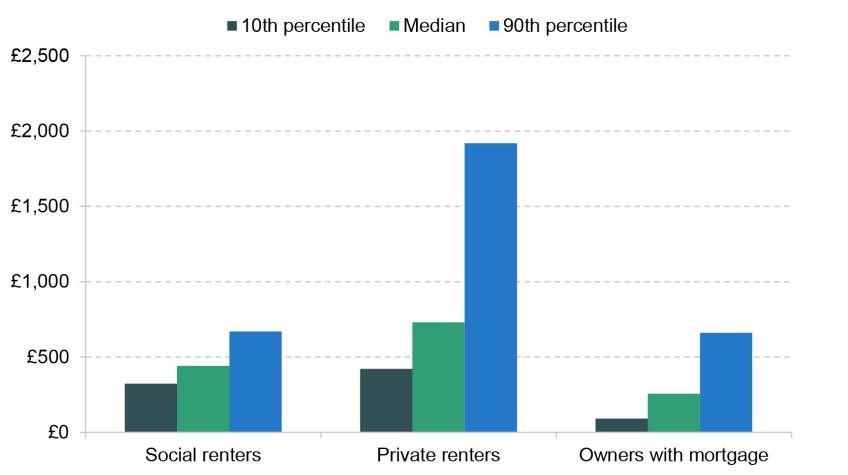

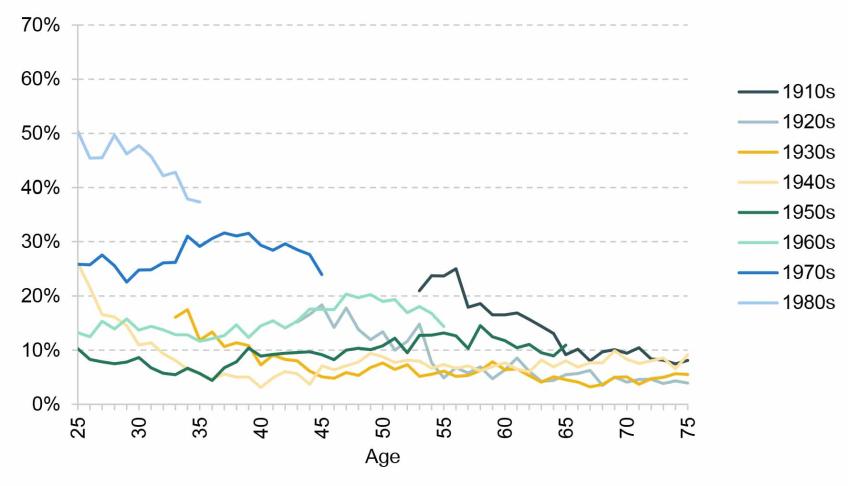

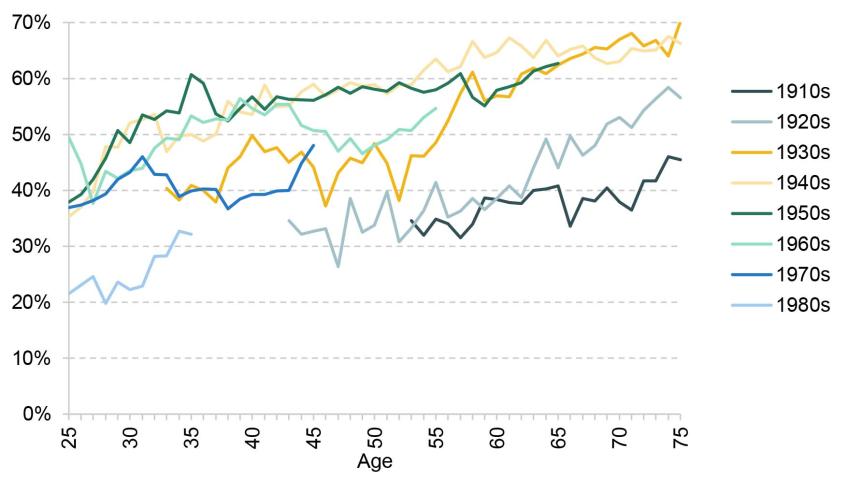

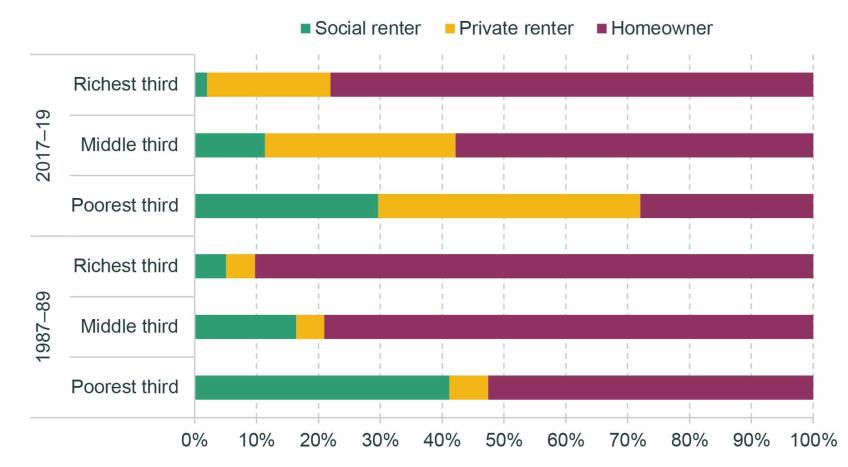

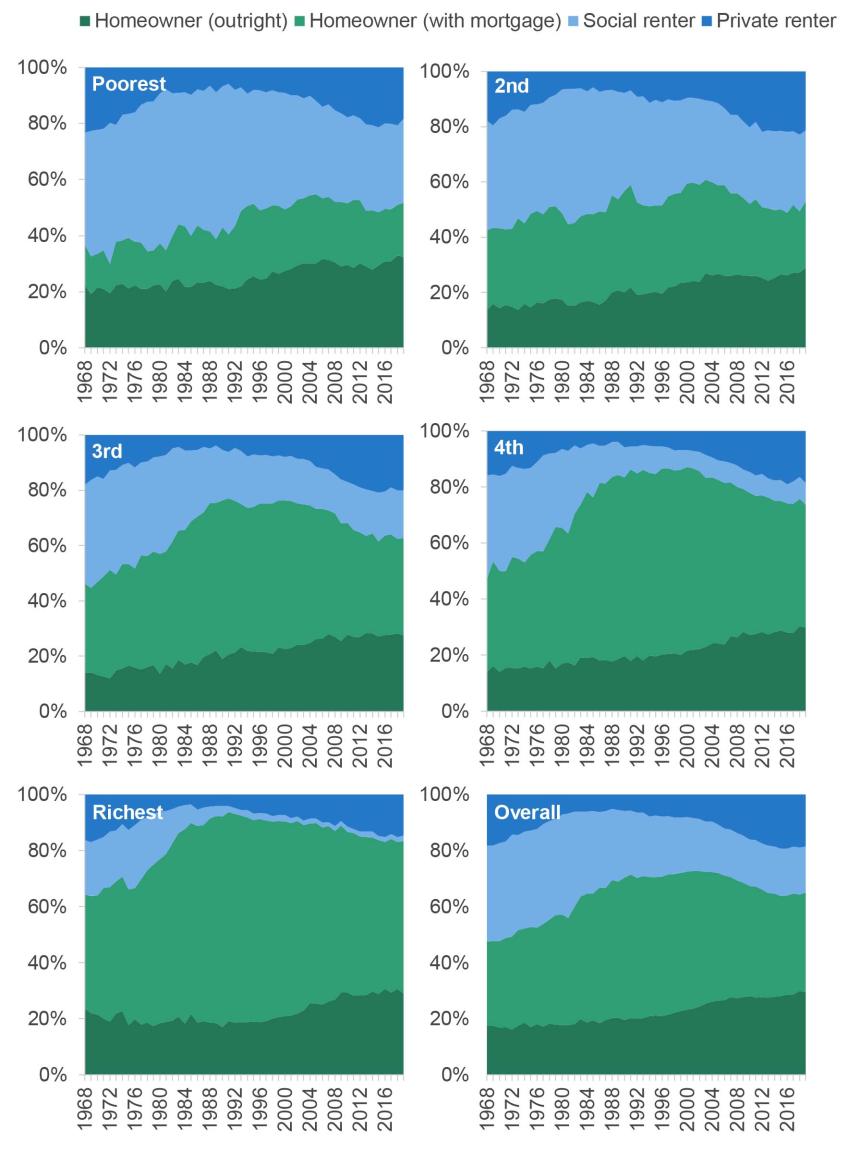

2. A steadily growing fraction of low-income households are in the private rented sector, while the share in social housing has declined, as has (in more recent years) the share who own their own home. Younger generations of low-income individuals are now especially likely to be renting privately. For low-income adults born in the 1960s or before, private renting rates ranged from 5% to 20% at almost every age. But for those born in the 1970s it has persistently been in the 25–30% region, and for those born in the 1980s around 40–50%, as social renting and owner-occupation have declined. These patterns suggest that private renting will become even more common among low-income families going forward. This matters because those in the private rented sector have higher housing costs than both social renters and those owning with a mortgage, as well as having less security of tenure.

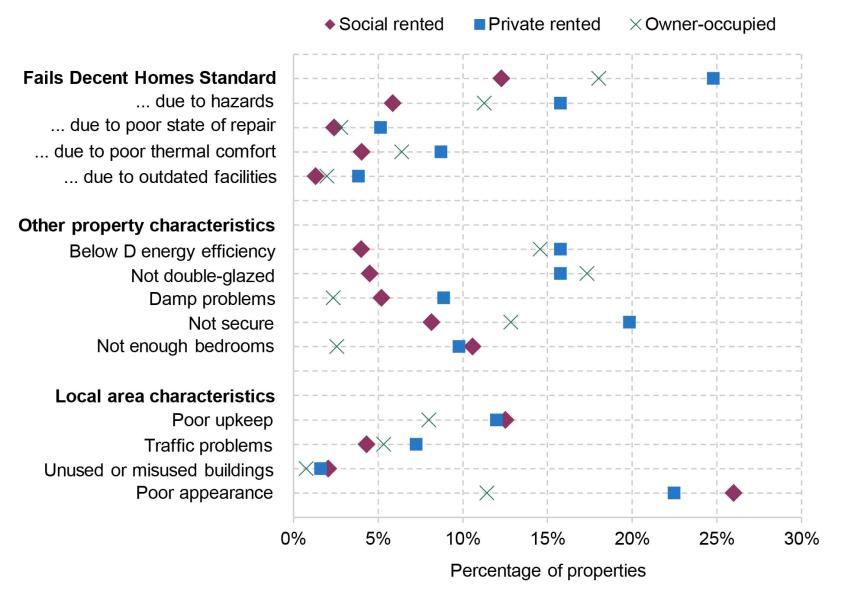

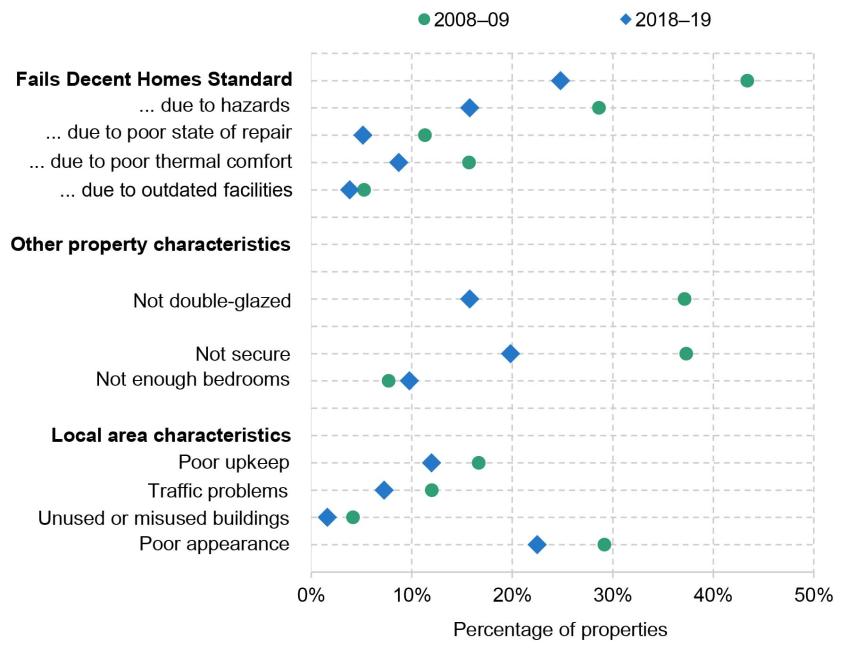

3. As well as the private sector having higher costs for tenants, the quality of homes, at least for low-income families, is worse. Among lower-income families, those in the private rented sector are more likely than social renters or owner-occupiers to be living in a home that is unsafe, in disrepair, difficult to adequately heat or lacking modern facilities. 25% of their homes would therefore fail the Decent Homes Standard required of social housing, compared with 18% of owner-occupied homes and 12% of social rented homes. Private rented homes are also more likely to have poor energy efficiency, be insecure or be damp, while rented homes in both sectors are more likely to be overcrowded and in areas of poor upkeep and appearance.

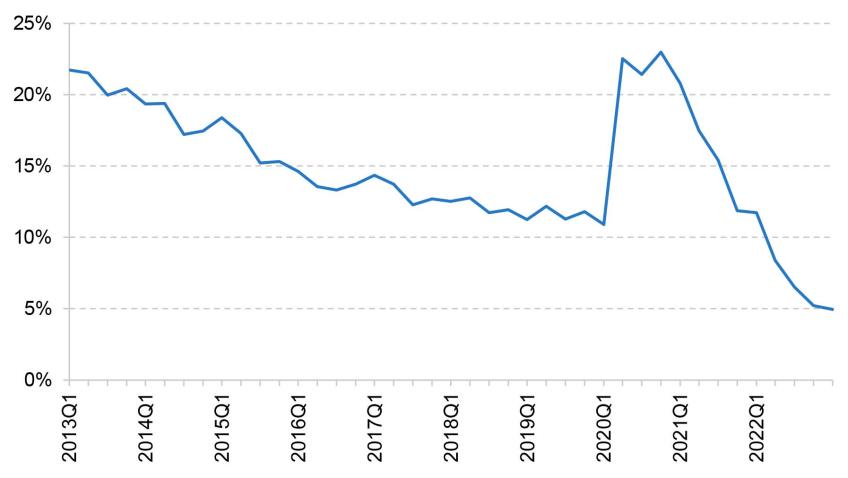

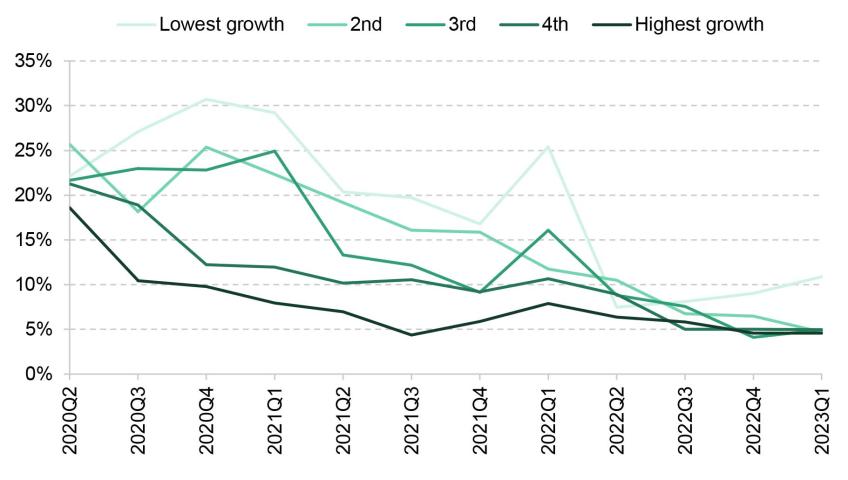

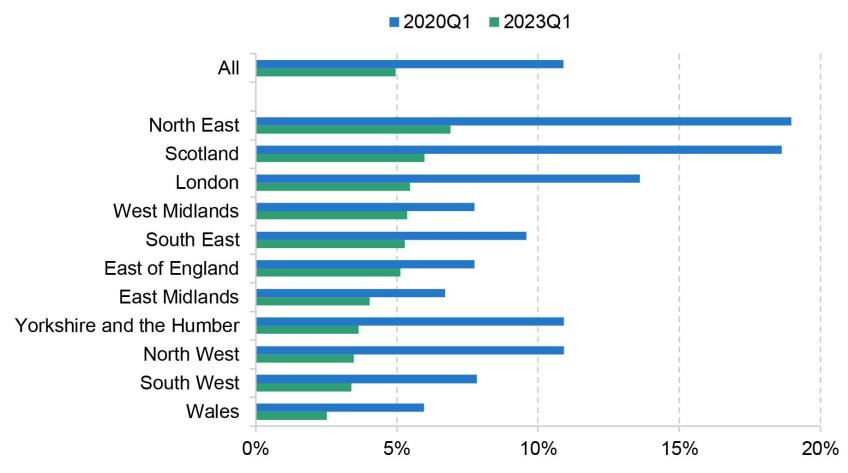

4. In the wake of the pandemic, the local housing allowance (LHA) rates which cap maximum housing benefit entitlements were increased to the 30th percentile of local rents. At that point, 23% of private rental properties listed on Zoopla were affordable for housing benefit recipients, which we define as having rents that can be completely covered by housing benefit. Since then, LHA rates have been frozen in cash terms and rents for new lets have risen by over a fifth on average. As a result, in 2023Q1 just 5% of private rental properties were affordable for housing benefit recipients. The rapid decline in affordability has been seen across all parts of the country.

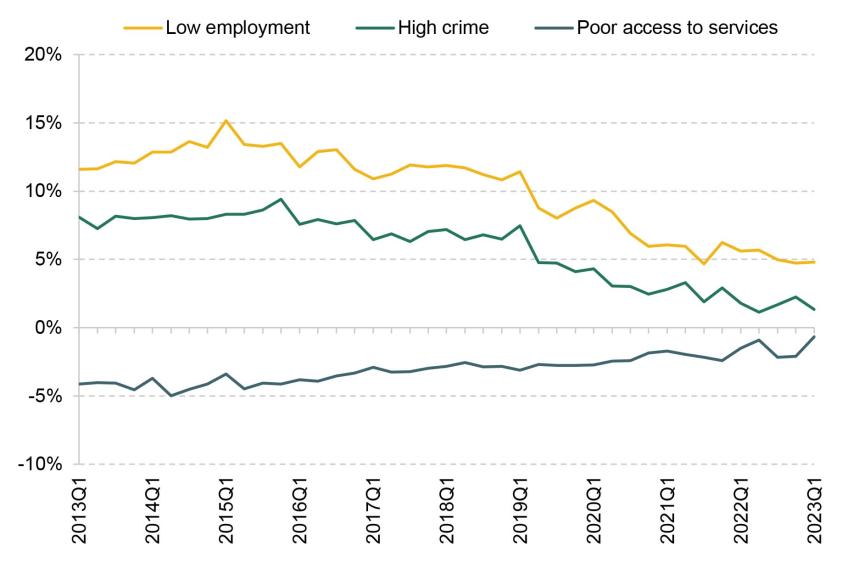

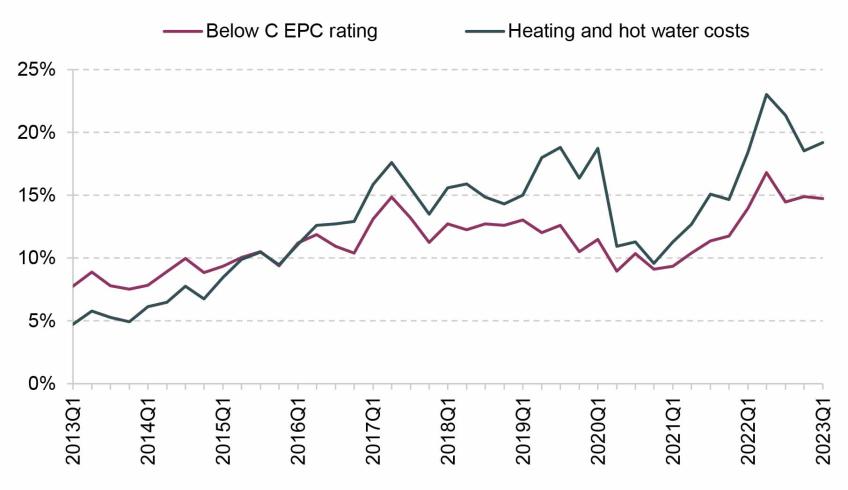

5. A declining share of properties being affordable to housing benefit recipients affects the relative quality of those that are affordable. Relative to the nation as a whole, affordable properties in 2023Q1 were 15% more likely to have an energy rating of D or below, and had 19% higher heating and hot water costs. These gaps have increased as the number of affordable properties has declined in the past few years. This shift is especially pertinent given recent increases to energy costs. Affordable properties are also generally more likely to be in low-employment and high-crime areas, though have slightly better access to local services such as post offices, supermarkets and GPs.

1. Introduction

This report explores how material living standards have changed since the beginning of the pandemic, based on household incomes as well as other indicators. We use the latest official data, covering years up to 2021–22, to describe the effect of the pandemic and subsequent response on household incomes in the UK, looking in detail at living standards of those individuals who became inactive during the pandemic. We study the impact of various benefit policies implemented during these years, considering their implications for poverty. And we examine the quality and affordability of the private rental sector, which has become especially important for analysing the living standards of people on lower incomes in recent years.

The analysis in this report is chiefly based on data from the Family Resources Survey (FRS), a survey of around 20,000 households a year, which contains detailed information on different sources of household incomes. We use household income variables derived from the FRS by the UK government’s Department for Work and Pensions (DWP). These measures of incomes underlie DWP’s annual statistics on the distribution of income, known as ‘Households Below Average Income’ (HBAI). The FRS/HBAI data are available for the years from 1994–95 to 2021–22. They are supplemented by HBAI data derived from the Family Expenditure Survey (FES) for the years from 1961 to 1993.

In addition, Chapter 2 draws on data from Understanding Society: the UK Household Longitudinal Study (UKHLS) and the Annual Population Survey (APS) to explore changes in the living standards of recently inactive individuals. Chapter 3 makes use of bank transaction data from ClearScore to study the effects of cost of living payments. Chapter 4 uses data from the English Housing Survey and Zoopla microdata to investigate changes in housing.

Measures of household income are the key outcomes used in this report. We use the measure of income that is used in the HBAI statistics, or construct a measure as similar as possible when using other data sources. Further details regarding the methodology of HBAI can be found in Appendix A, but it is worth noting that when we refer to household income, we specifically mean ‘net equivalised household income’. ‘Net’ indicates that we are looking at incomes measured after direct taxes (including council tax) are paid, and after benefits and tax credits are received. ‘Equivalised’ means that incomes are rescaled to account for the fact that households of different sizes and compositions have different needs. ‘Household income’ means that we add up the income (from all sources) of each person in the household. We sometimes term this measure of income ‘disposable income’. Although we measure household incomes, we conduct our analysis at the individual level, meaning that we look at poverty, inequality and differences in living standards between individuals, not between households.

All cash figures for incomes are presented in 2021–22 prices and all income growth rates are given after accounting for inflation. We adjust for inflation using measures of inflation based on the Consumer Prices Index, which are the same measures as are used by DWP in the government’s official HBAI statistics.

Throughout this report, many statistics will be presented for the whole of the UK; however, for those series looking at longer-term trends, we present statistics for Great Britain (GB) only, as Northern Ireland has only been included in the HBAI data since 2002–03.

The rest of this report proceeds as follows.

Chapter 2 examines trends in households’ living standards, focusing particularly on the two years since the beginning of the pandemic. This chapter shows how average incomes have changed, and how that has varied for households at different points in the income distribution. We go on to explore the implications of these changes for income inequality. We then look at the role played by different income sources in driving these trends, contrasting with households’ experiences between 2011–12 and 2019–20. Finally, we focus on the living standards of individuals aged 50–70 who became economically inactive during the pandemic, looking at measures of income as well as subjective well-being.

Chapter 3 explores changes in poverty, considering particularly the importance of reforms to the benefit system in driving these. We start by describing changes in absolute and relative poverty for different groups of the population that have occurred since the start of the pandemic. We then use microsimulation to estimate the effects on poverty of two key reforms to the benefit system – the £20 per week uplift to universal credit (UC) and changes to the UC taper rate and work allowances. This is followed by analysis of changes in spending in response to the latest policy, cost of living payments for recipients of mean-tested benefits. This makes use of bank transaction data to explore how quickly individuals spent these payments, and the types of goods and services they spent them on.

Chapter 4 looks at the quality and affordability of the private rental sector. We first note the increasing importance of the private rented sector for the living standards of lower-income people, with the sector filling the gap left by a shrinking social rented sector and, more recently, lower rates of owner-occupation. We then move on to examine the quality of private rented homes, noting that lower-income private renters are more likely to live in homes that are hazardous, difficult to heat and in a poor state of repair, compared with their social-renting and owner-occupying counterparts. Finally, we show a significant decline in the affordability of private rented housing in the last two years, as the local housing allowances which cap housing benefit have remained frozen while rents have increased dramatically. And we show that the shrinking pool of affordable properties are of lower quality than average.Living standards and inequality.

2. Living standards and inequality

Key findings

1. Average (median) disposable household income before deducting housing costs rose by 0.5% in 2021–22, but remained 1.2% lower than its pre-pandemic level. The relatively muted increase in 2021–22 reflected a 4.8% rebound in nominal incomes being largely offset by a sharp rise in inflation. A fall in housing costs over the pandemic means that average incomes measured after deducting housing costs were 0.2% higher in 2021–22 than in 2019–20.

2. Income growth was stronger among poorer households, with those in the bottom third of the distribution seeing a rise between 2019–20 and 2021–22 of 1.5% before deducting housing costs and 2.7% after deducting housing costs. Large falls in employment income among this group were more than offset by a rise in benefit incomes (in particular the temporary £20 uplift to universal credit) and a fall in housing costs, both of which affected low-income households more than households further up the income distribution.

3. The increase in benefit incomes among low-income households did not simply reflect a fall in employment income. Average benefit receipt in 2021–22 was higher than in 2019–20 at every level of earnings, due to the £20 universal credit uplift that persisted until October 2021 and the increased generosity of universal credit for in-work households from November 2021. The share of households in the bottom third of incomes that received disability benefits rose by 26%, from 12% in 2019–20 to 15% in 2021–22, driven entirely by an increase among working-age households.

4. Individuals aged 50–70 who moved from employment into economic inactivity in 2020–21 were more likely to end up in poverty (in the year of exit) than those who became inactive in previous years. This is despite poverty rates falling among 50- to 70-year-olds who had been inactive for more than a year (that is, it does not reflect an overall fall in living standards among inactive individuals in the age group). Measures of self-reported well-being also declined more for recently inactive individuals in 2020 than for those who had been inactive for longer. For people who became inactive in 2021–22, outcomes were much more similar to those seen among people who became inactive pre-pandemic, suggesting that there is particular cause for concern for the 2020–21 cohort.

5. This decline in living standards and well-being challenges the perception that exits into inactivity over the pandemic were driven by wealthy individuals who could afford to retire in comfort. Instead, many of those who left the workforce in 2020–21 may have been ‘forced’ into early retirement, with an associated hit to their living standards and well-being. People who become inactive at older ages often never re-enter the workforce, so it is likely that many in this cohort will experience persistently low living standards. In contrast, those who became inactive in 2021–22, when the labour market disruption and health risk had largely subsided, are more likely to have done so out of choice.

This chapter examines recent trends in and drivers of households’ living standards, with a particular focus on the impact of the COVID-19 pandemic in 2020–21 and 2021–22. We begin by reviewing trends in household incomes across the income distribution, documenting the effects of the onset of the pandemic and subsequent recovery and discussing their implications for income inequality. We then examine the sources of changes to household incomes in more detail, focusing on changes in income from employment and benefits across the income distribution, and setting post-pandemic trends in their recent historical context. Finally, we examine how the recent rise in economic inactivity among older individuals has affected their living standards and well-being.

We primarily rely on the Households Below Average Income (HBAI) statistics. To examine the living standards of recently inactive individuals, we also corroborate results using the HBAI data with data from Understanding Society: The UK Household Longitudinal Study (UKHLS), a panel survey that samples households at annual intervals. We also draw on the Annual Population Survey (APS) to track self-reported well-being measures among those who recently entered economic inactivity.

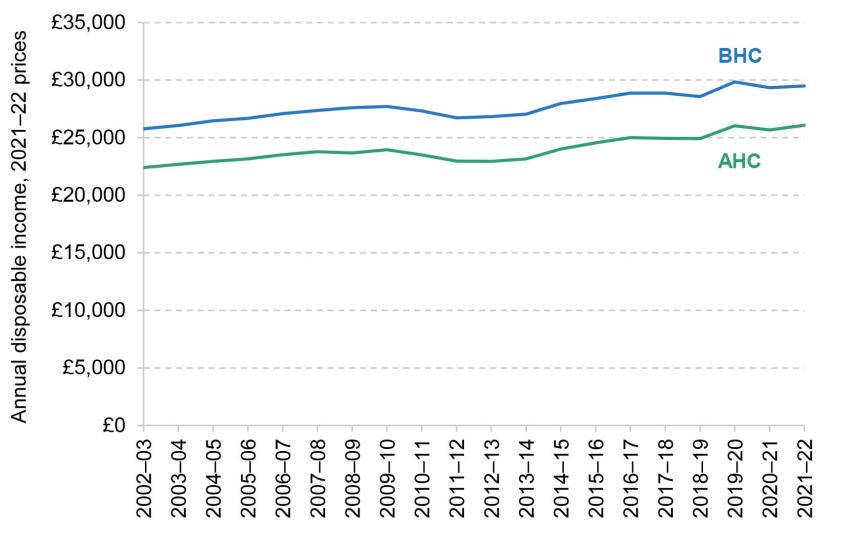

2.1 Trends in household incomes

Figure 2.1 shows recent trends in average (median) household income, adjusted for inflation and household size and expressed as the equivalent income for a childless couple in 2021–22. When measured before deducting housing costs (BHC), median household income grew by 0.87% a year on average in the years before the pandemic, from 2002–03 to 2019–20. Median household income fell by 1.7% in the first year of the pandemic, a relatively small change given the disruption to the economy, which reflects the huge government interventions to mitigate falls in income, including the Coronavirus Job Retention Scheme (or furlough scheme, which cost around £60 billion in 2020–21) and the £20 a week uplift to universal credit. Between 2020–21 and 2021–22, median income rebounded slightly, but at £29,495 remained £350 (1.2%) below its pre-pandemic level. A fall in housing costs since the start of the pandemic means that the initial fall in median income after deducting housing costs (AHC) was slightly smaller, at 1.4%, and by 2021–22 median AHC income was 0.2% higher than its pre-pandemic level.

Figure 2.1. Median disposable household income

Note: Incomes have been measured net of taxes and benefits, and are expressed in 2021–22 prices. All incomes have been equivalised using the modified OECD equivalence scale and are expressed in terms of equivalent amounts for a childless couple.

Source: Authors’ calculations using the Family Resources Survey, 2002–03 to 2021–22.

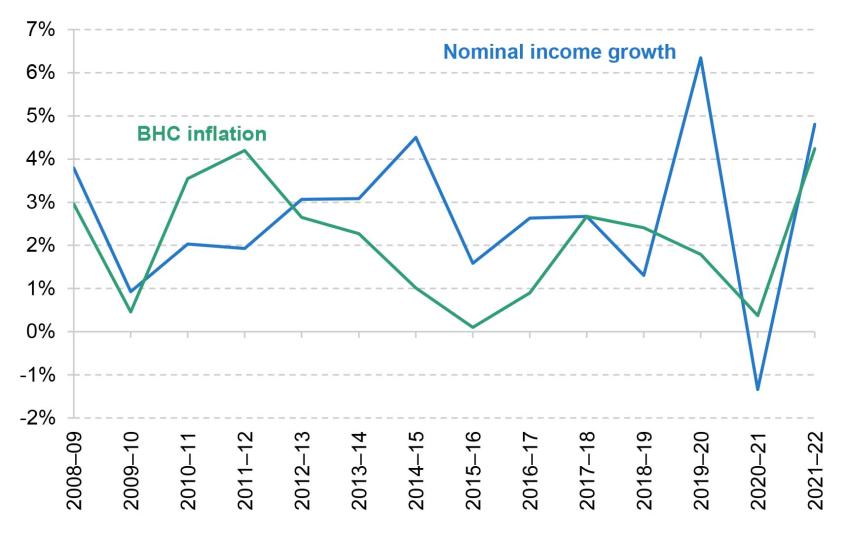

The recovery in household incomes in 2021–22 was substantially moderated by a sharp rise in inflation over the year, from 0.4% in 2020–21 to 4.2% in 2021–22. Figure 2.2 shows that in cash terms (not adjusted for inflation), median household income grew by 4.8% in 2021–22, a high growth rate by historical standards. However, this recovery was eroded by rising price levels, which increased by 4.0% that year. As a result, real household incomes (adjusted for inflation) increased by only 0.5%. It is worth noting that this is before the very high rates of inflation seen recently: between April 2022 and April 2023, inflation has averaged about 9%.

Figure 2.2. Median household income growth compared with BHC inflation

Note: Incomes have been measured net of taxes and benefits and before housing costs have been deducted. All incomes have been equivalised using the modified OECD equivalence scale.

Source: Authors’ calculations using the Family Resources Survey, 2008–09 to 2021–22.

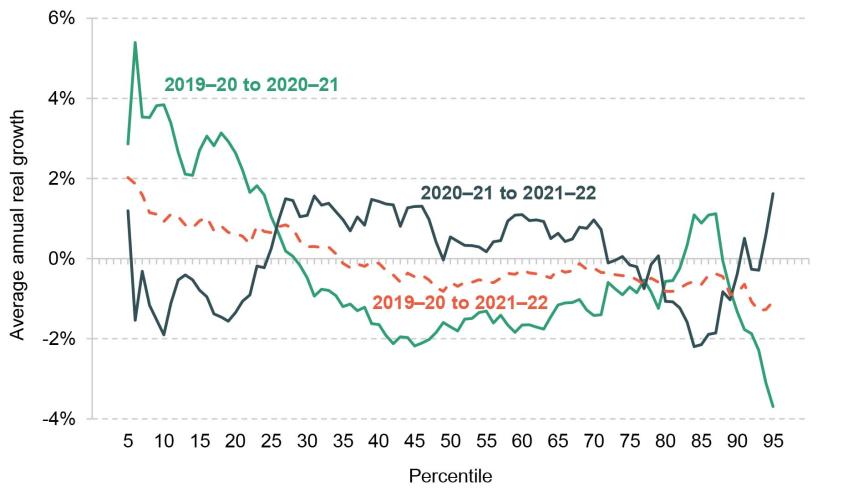

The stagnation in real median household incomes since 2019–20 masks significant differences across the income distribution. These are shown in Figure 2.3, which plots the average annual growth in BHC household incomes at each percentile of the distribution. A line sloping downwards indicates that poorer households have seen higher income growth than richer households, whereas a line sloping upwards indicates that richer households enjoyed higher income growth.

Figure 2.3. Average disposable household income growth (BHC), by income percentile

Note: Incomes have been measured net of taxes and benefits and before housing costs have been deducted, and are expressed in 2021–22 prices. All incomes have been equivalised using the modified OECD equivalence scale.

Source: Authors’ calculations using the Family Resources Survey, 2019–20 to 2021–22.

Focusing on the first year of the pandemic (the green line), we see that whilst incomes fell across most of the distribution between 2019–20 and 2020–21, households in the bottom quarter of the income distribution actually saw their incomes increase. As we discuss in more detail in Section 2.2, this is because low-income households were more affected by benefit increases during this period, in particular the £20 per week uplift to universal credit. In addition, low-income households receive less of their income from employment, so the labour market disruption over the pandemic had a smaller effect on them.

This pattern was partly reversed in the second year of the pandemic, between 2020–21 and 2021–22 (the black line). Households at the bottom of the income distribution saw modest declines in their income, as the £20 uplift was withdrawn, while households around the middle saw a modest increase in their income as the labour market rebounded.

The dashed red line brings the other two together and shows annualised income growth between 2019–20 and 2021–22. Growth in household incomes over this period was generally progressive, with households at the lower end of the income distribution seeing modest increases in income and those at the higher end slight falls. The pattern of growth is similar to that seen in the four years after the Great Recession, between 2007–08 and 2011–12, as documented in Cribb et al. (2022).

Implications for income inequality

We now turn to the headline measures of income inequality that come out of the changes examined above. Figure 2.4 plots the 90:50 ratio, which gives the ratio between the 90th and 50th percentiles of the income distribution, and the 50:10 ratio, which is defined correspondingly. There has been little change in the 90:50 ratio since the start of the pandemic. In contrast, the 50:10 ratio fell rapidly from 2.07 in 2019–20 to 1.96 in 2020–21, as household incomes increased at the bottom of the income distribution whilst falling in the middle. It then rebounded to 2.01 in 2021–22, below its level immediately before the pandemic, reflecting the overall progressive pattern of income growth since the start of the pandemic shown in Figure 2.3.

Figure 2.4. 90:50 and 50:10 ratios for disposable household income (BHC)

Note: Incomes have been measured net of taxes and benefits and before housing costs have been deducted. All incomes have been equivalised using the modified OECD equivalence scale.

Source: Authors’ calculations using the Family Resources Survey, 1994–95 to 2021–22.

Taking a longer view, both ratios have hovered around 2 since the mid 1990s (meaning that households at the 90th percentile have about double the incomes of those at the middle, and those at the middle have double the incomes of those at the 10th percentile). The 90:50 modestly declined in the decade leading up to the pandemic and the 50:10 modestly increased.

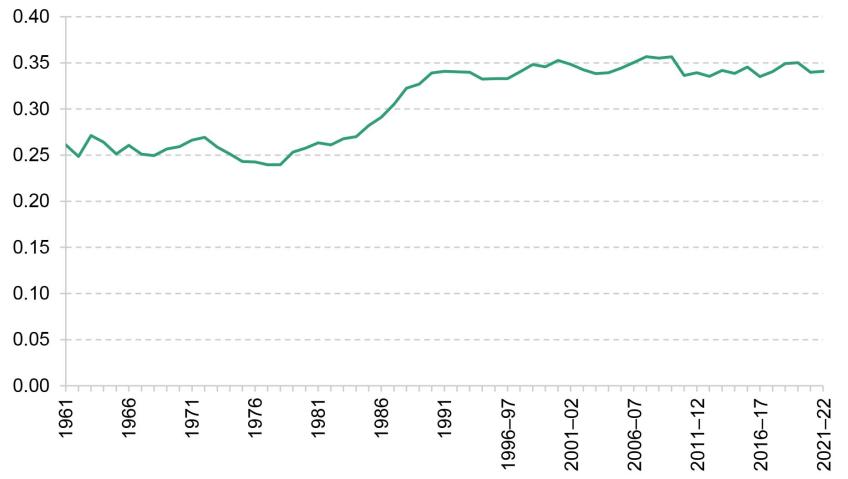

Figure 2.5 plots the Gini coefficient, a measure of inequality that takes the entire distribution of incomes into account. A higher score implies greater inequality, with 1 indicating one person having all the income and 0 indicating all individuals having equal income. Since the beginning of the pandemic, there has been a slight fall in the Gini coefficient, from 0.35 to 0.34. This continues the pattern seen since the early 1990s, during which time the Gini coefficient has changed very little indeed, following a substantial increase in the 1980s.

Figure 2.5. Gini coefficient

Note: Incomes have been measured net of taxes and benefits and before housing costs have been deducted. All incomes have been equivalised using the modified OECD equivalence scale.

Source: Authors’ calculations using the Family Resources Survey, 1994–95 to 2021–22, and the Family Expenditure Survey, 1961 to 1993.

2.2 Contributions to household income trends

In this section, we examine the changes in household incomes since the pandemic in more detail, and set them in their recent historical context. To do this, we separate out different components of households’ income, showing the contributions of employment income, benefits, income from investment, savings and private pensions, and housing costs to overall AHC income growth. We consider income growth across all households, as well as across the income distribution, splitting households into three equally sized income groups or ‘tertiles’. We distinguish between benefits for pensioner households (households with at least one pensioner in them) and benefits for working-age households, further splitting the latter into disability benefits and benefits unrelated to disability.

To contextualise changes over the pandemic, we start by showing the role played by the various income sources in driving household income growth between 2011–12 and 2019–20 – in other words, between the recovery from the Great Recession and the pandemic. The first black diamond in Figure 2.6 shows that total household incomes grew by 10.5% between 2011–12 and 2019–20, an average of 1.25% a year. By far the most important contributor was growth in employment incomes, which more than accounts for total income growth over this period. Employment incomes increased faster at the bottom of the income distribution than at the top, contributing 18.9% among the lowest-income households, 14.5% among middle-income households and 7.0% among the highest-income households. However, this was partly offset by reductions in working-age benefits, which overwhelmingly affected households in the bottom third of the income distribution. There was also an increase in other income for households in the middle and top tertiles, largely a consequence of higher incomes from private pensions. Taken together, growth in total incomes was similar across the income distribution, and slightly higher for middle-income households.

Figure 2.6. Contributions to net household income growth (AHC), 2011–12 to 2019–20, by AHC income tertile

Note: Incomes have been measured net of taxes and benefits and after housing costs have been deducted. All incomes have been equivalised using the modified OECD equivalence scale. Very-high-income households and those with negative incomes are excluded. ‘Other’ income contains mostly pension income, investment income and payments such as student loan repayments, but also includes private benefits and child income.

Source: Authors’ calculations using the Family Resources Survey, 2011–12 and 2019–20.

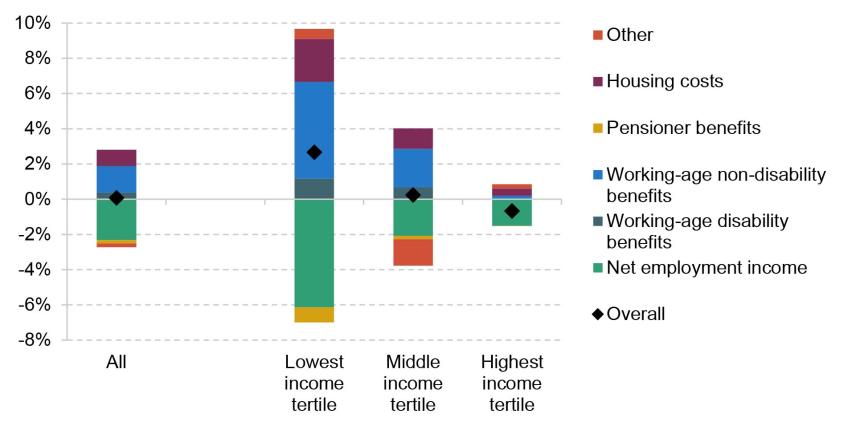

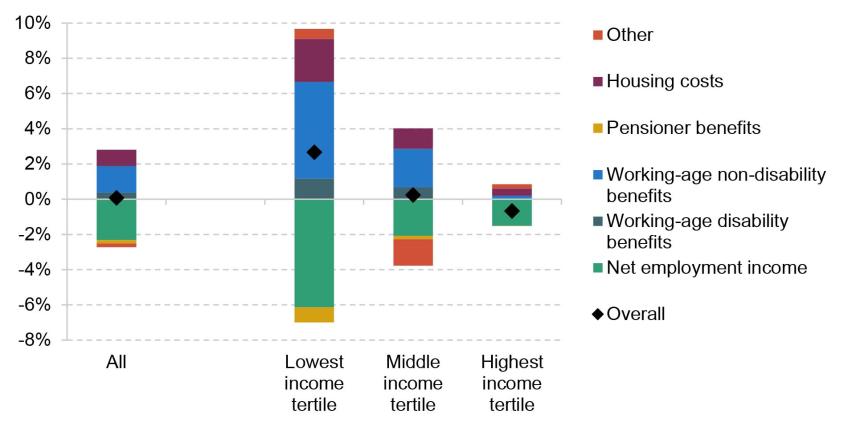

Patterns of income growth were very different in the two years since the pandemic, as shown in Figure 2.7. Employment incomes fell across the income distribution, and more so at the bottom, in a reversal of pre-pandemic trends. This reflects the labour market disruption at the start of the pandemic, which was only partly offset by the furlough scheme and its self-employment equivalent, as well as earnings not keeping up with inflation in 2021–22.

Figure 2.7. Contributions to net household income growth (AHC), 2019–20 to 2021–22, by AHC income tertile

Note: Incomes have been measured net of taxes and benefits and after housing costs have been deducted. All incomes have been equivalised using the modified OECD equivalence scale. Very-high-income households and those with negative incomes are excluded. ‘Other’ income contains mostly pension income, investment income and payments such as student loan repayments, but also includes private benefits and child income.

Source: Authors’ calculations using the Family Resources Survey, 2019–20 and 2021–22.

However, these falls in employment income were offset by an increase in working-age benefits, which particularly benefited lower-income households. Again, this represents a reversal of pre-pandemic trends. Two key policies were the £20 per week uplift to universal credit, which lasted from the start of the pandemic until October 2021, and the increases in work allowances and reduction in the taper rate for universal credit from the end of November 2021. In addition, local housing allowance rates, which govern the maximum amount of housing support private renters can receive and which had been frozen for four years, were significantly increased at the start of the pandemic. There was also a rise in disability benefits, which contributed 1.2% to total income growth among the lowest-income households. A progressive fall in housing costs further pushed up AHC incomes among lower-income households. Taken together, total incomes increased by 2.7% among the lowest-income third of households, remained roughly constant at the middle (0.2%) and fell slightly (–0.7%) among the highest-income households between 2019–20 and 2021–22.

In the rest of this section, we discuss the key changes in income sources since the beginning of the pandemic in more detail: the fall in employment incomes which was concentrated among lower-income households; the rise in benefit incomes; and in particular the rise in disability benefits among working-age households.

Employment incomes

The decline in net employment income between 2019–20 and 2021–22, especially among lower-income households, was a notable departure from pre-pandemic trends. This has been caused by both a fall in the proportion of households in work and a fall in earnings for those in work.

Figure 2.8 shows the share of workless households in each income tertile, split by whether the household contains at least one pensioner or only working-age adults. The fraction of low-income households with no one in paid work rose by 2.9 percentage points, driven by working-age households. The changes for households in the middle and upper tertiles were much more modest (0.4 and 0.8 percentage points respectively). Part of this rise in worklessness reflects an increase in exits from employment into economic inactivity among people aged 50 and over, documented by Boileau and Cribb (2022) and discussed in more detail in Section 2.3.

Figure 2.8. Share of households out of work, by AHC income tertile

Note: Incomes have been measured net of taxes and benefits and after housing costs have been deducted. All incomes have been equivalised using the modified OECD equivalence scale. Very-high-income households and those with negative incomes are excluded.

Source: Authors’ calculations using the Family Resources Survey, 2019–20 and 2021–22.

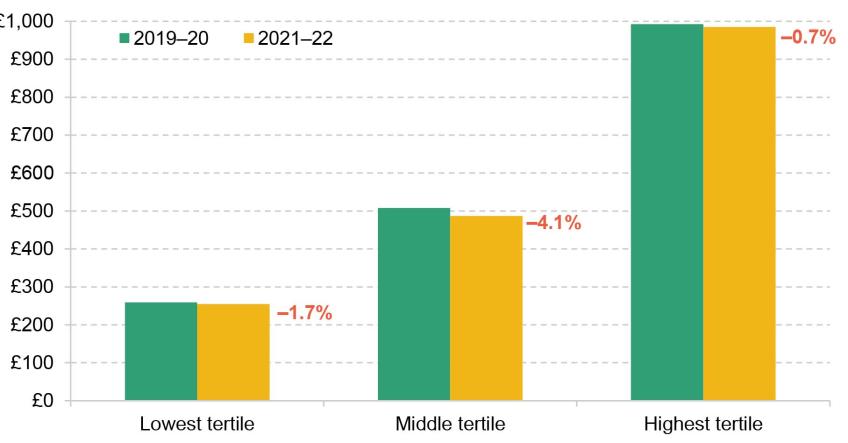

As well as more households out of work, Figure 2.9 shows that those who remained in work saw a decline in their net earnings. The fall was biggest for the middle tertile, where employment income of in-work households fell by more than 4%. Among high-income households, the fall was 0.7% For the lowest-income households, those in work saw their employment income fall by 1.7%, on top of the changes in worklessness discussed above. The combination of these two trends led to the particularly stark decline in employment income for the poorest households.

Figure 2.9. Average weekly net employment income for in-work households, by AHC income tertile

Note: Incomes have been measured net of taxes and benefits and after housing costs have been deducted, and are expressed in 2021–22 prices. All incomes have been equivalised using the modified OECD equivalence scale. Very-high-income households and those with negative incomes are excluded.

Source: Authors’ calculations using the Family Resources Survey, 2019–20 and 2021–22.

Benefit incomes

Changes to employment incomes have direct consequences for benefit incomes: in broad terms, as earnings fall, households’ benefit entitlements rise.1 However, the rise in benefit incomes shown in Figure 2.7 was not only the result of falling employment incomes. Instead, it reflects a number of policy changes, in particular the £20 per week uplift to universal credit rates between March 2020 and September 2021, and changes to the universal credit work allowances and taper rate from the end of November 2021.

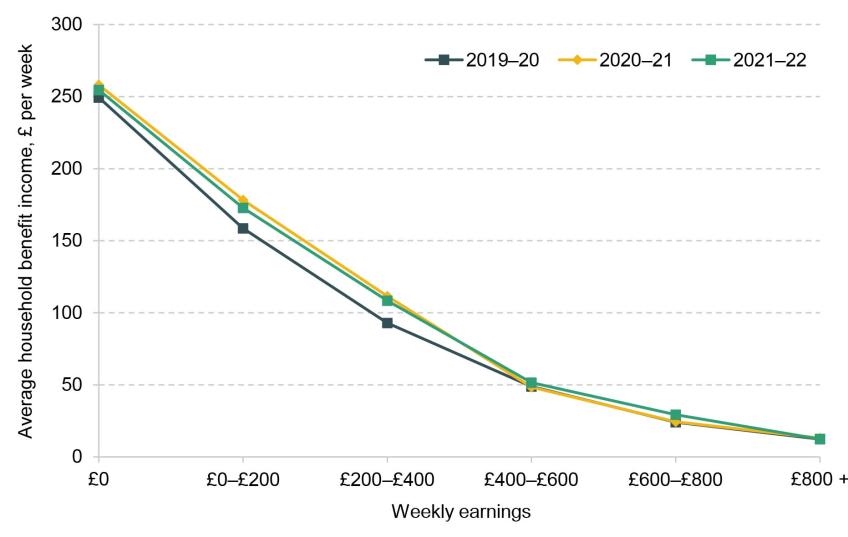

Figure 2.10 plots the average weekly benefit income (adjusted for inflation and household size) for households by their pre-tax weekly earnings. We restrict to households not receiving disability benefits to strip out changes caused by increased numbers of disability benefit claimants, discussed below. First, we can see that for non-disabled households earning up to £400 a week, average benefit incomes were higher in 2021–22 than in 2019–20. This is driven by the £20 uplift to universal credit, which was in place for the first six months of the financial year, and the changes to the taper rate and work allowances, which were in place for the last four months of the year. Second, average benefit incomes for households earning less than £400 per week were lower in 2021–22 than in 2020–21, whilst the reverse is true for slightly higher-earning households (between £400 and £800 per week). This reflects the fact that the changes to the taper rate and work allowances more than compensated for the removal of the £20 uplift for higher-earning households on low incomes, but not for lower-earning households.

Figure 2.10. Household benefit income by gross earnings level, 2019–20 to 2021–22

Note: Earnings and benefits have been equivalised using the modified OECD equivalence scale, and are expressed in 2021–22 prices.

Source: Authors’ calculations using the Family Resources Survey, 2019–20 to 2021–22.

Perhaps surprisingly, the increase in benefit levels is smaller for out-of-work households than for those on low earnings, with benefit incomes for this group rising by only £5 per week between 2019–20 and 2021–22, compared with £14–£15 for those earning £0–£200 and £200–£400 per week. This may partly reflect a change in composition of workless benefit claimants following the start of the pandemic. An increase in out-of-work single individuals making claims will tend to pull down the average benefit amount, since they have lower entitlements to universal credit.2 Another contributing factor could be the fact that workless households may be subject to the benefit cap, which limits the total amount of income a household can get from certain benefits. The benefit cap was not raised between 2019–20 and 2021–22, and so if a household was already capped before the uplift it would not have benefited from the £20 uplift.

Disability benefits

Another notable difference between the pre- and post-pandemic periods is the increased importance of working-age disability benefits, which accounted for more than 1% of income growth for the bottom income tertile between 2019–20 and 2021–22. This is consistent with other work that has shown large increases in the number of new disability benefit claimants across the UK (Joyce, Ray-Chaudhuri and Waters, 2022). It is worth noting that, although increases in disability benefit receipt lead to higher incomes for households, these may not translate into higher living standards due to the higher costs associated with disability – indeed, it is precisely these costs that disability benefits are supposed to compensate for.

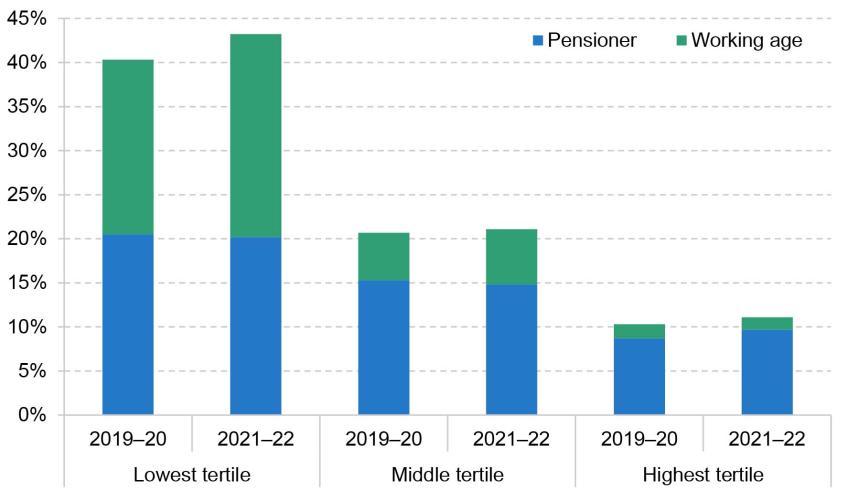

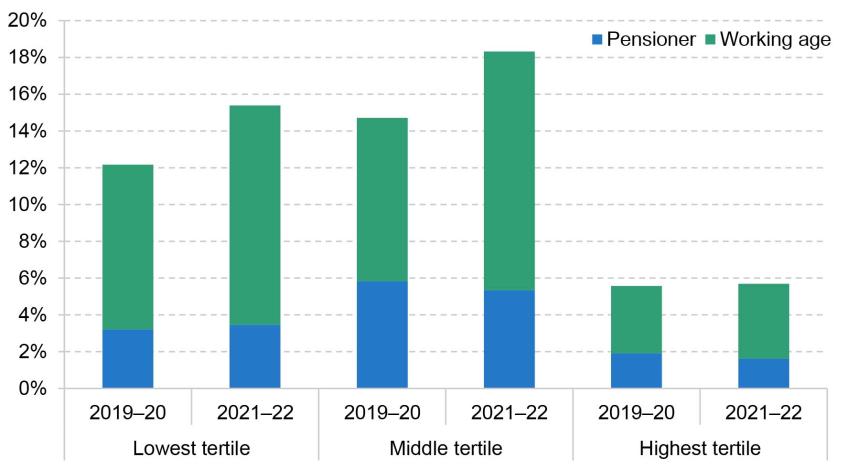

The higher receipt of disability benefit among the working-age population is a consequence of a higher number of claimants rather than increases to the rates paid to existing claimants. Figure 2.11 plots the share of households receiving disability benefits by income level both before the pandemic and in the latest year of data. For the bottom income tertile, the share of households receiving disability benefits rose by 3 percentage points between 2019–20 and 2021¬–22, from 12% to 15%, driven entirely by an increase among working-age households. For households in the middle of the income distribution, the change was similar (rising from 15% to 18%). In proportional terms, a given rise in disability benefit receipt will have a bigger impact on the incomes of poorer households, leading to its bigger contribution for them in Figure 2.7.

Figure 2.11. Share of households receiving disability benefit, by AHC income tertile

Note: Incomes have been measured net of taxes and benefits and after housing costs have been deducted. All incomes have been equivalised using the modified OECD equivalence scale.

Source: Authors’ calculations using the Family Resources Survey, 2019–20 and 2021–22.

2.3 Living standards of the recently inactive

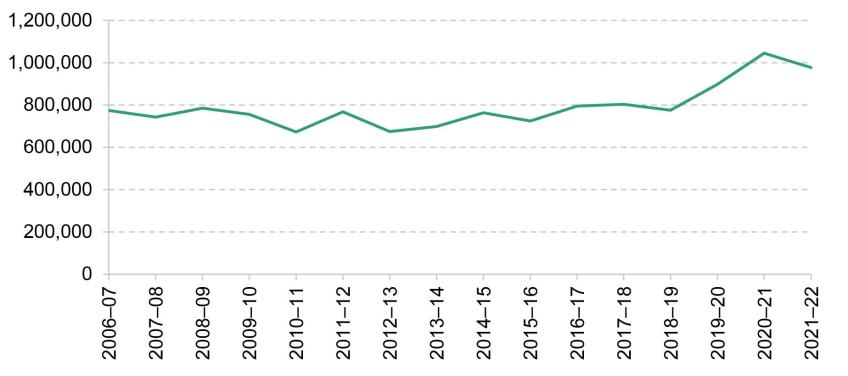

One of the most widely discussed economic legacies of the pandemic has been a rise in economic inactivity. This has been driven by older individuals close to the state pension age, with flows from employment into inactivity mostly driven by early retirements (Boileau and Cribb, 2022). As Figure 2.12 shows, labour market exits of people aged 50–64 peaked in the first year of the pandemic and remained well above pre-pandemic levels in 2021–22. This section examines the implications of this wave of exits into inactivity for individuals’ living standards and well-being.

Figure 2.12. Flows from employment into inactivity among 50- to 64-year-olds

Note: Financial year 2006–07 includes data from 2006Q2 to 2007Q1.

Source: Authors’ calculations using the two-quarter Labour Force Survey, April–June 2006 to January–March 2022.

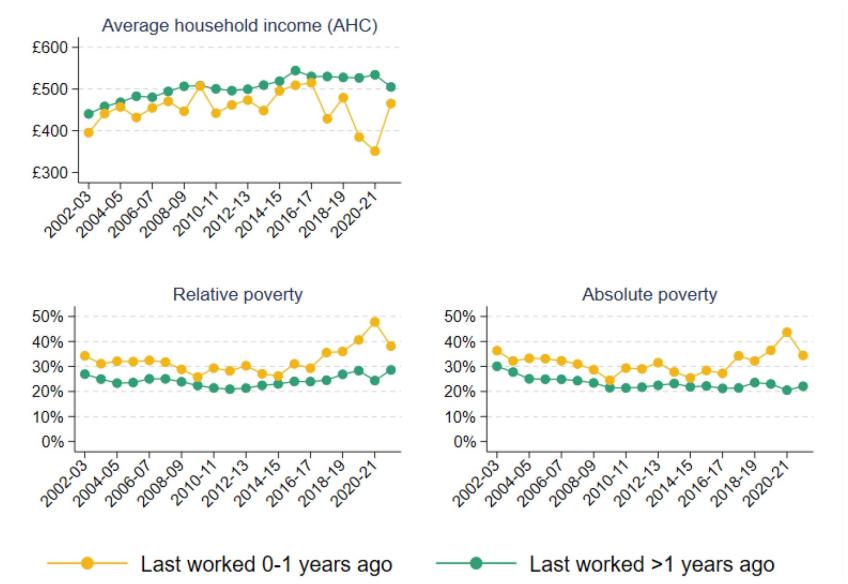

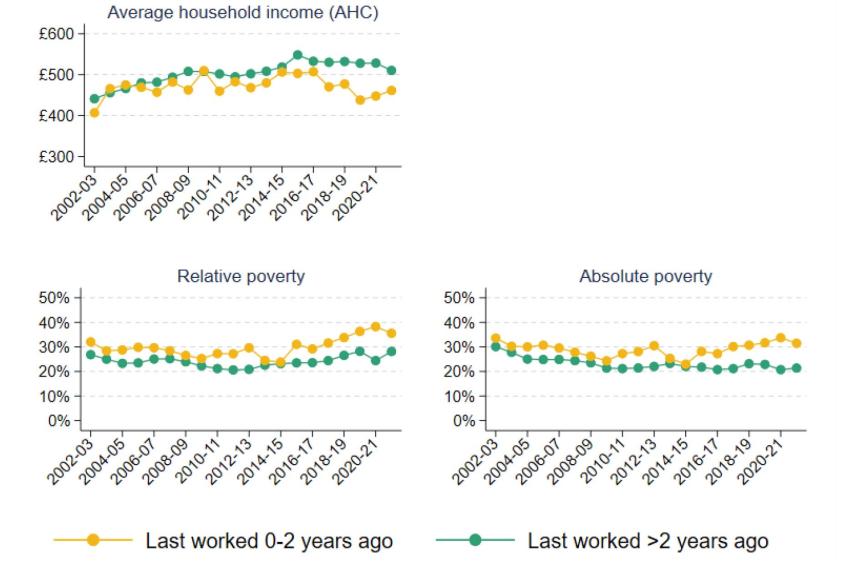

To understand how exits into inactivity have affected living standards, we start by examining how the living standards of recently inactive individuals have changed over time. Figure 2.13 plots various measures of living standards for individuals aged 50–70 who entered economic inactivity from employment one year ago or less, using data from the Family Resources Survey. For comparison, it also plots the same measures for economically inactive individuals who last worked more than one year ago. Note that the individuals represented by the yellow dots are not the same over time: those who are in the ‘Last worked 0-1 years ago’ series in one year will not be in it in the subsequent year. Figure 2A.1 in the appendix plots the same outcomes, breaking down inactive individuals by whether they last worked two years ago or less, or more than two years ago.

Figure 2.13. Living standards of inactive individuals aged 50–70, by when last worked

Note: Absolute poverty is defined as having income below 60% of median income in 2010–11. Average (mean) household incomes are measured net of taxes and benefits and after housing costs have been deducted, and have been equivalised using the modified OECD equivalence scale. Individuals who have never worked are included in the ‘Last worked >1 years ago’ category.

Source: Authors’ calculations using the Family Resources Survey, 2002–03 to 2021–22.

We first focus on those who became inactive during 2020–21 – the penultimate yellow dot in each of the panels in Figure 2.13. The first panel shows that average household income among the recently inactive was low by historical standards in 2020–21, though the data are noisy and incomes were not that much lower than for the equivalent group who became inactive the year before. Measures of low living standards, however, clearly show an increase in the incidence of poverty among those who became inactive in the first year of the pandemic. The share of recently inactive 50- to 70-year-olds who were in relative poverty increased by 7 percentage points (18%) between 2019–20 and 2020–21, a large increase at a time when relative poverty fell among inactive individuals as a whole (due to the fall in employment incomes among middle-income households discussed in Section 2.2). The share of recently inactive individuals in absolute poverty also increased by 7 percentage points in the first year of the pandemic.

Turning to those who became inactive in the second year of the pandemic (the last yellow dot – those who last worked a year ago or less in 2021–22), living standards look notably better: average income, relative poverty and absolute poverty among this group were all similar to those among the cohort who became inactive immediately before the pandemic. This suggests that it is the 2020–21 cohort of people who became inactive who are a particular cause for concern.

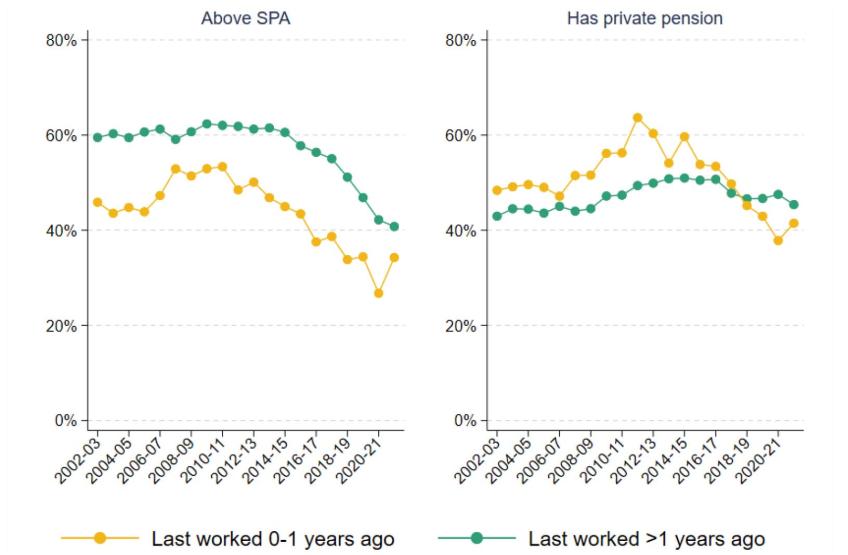

The increase in poverty among the 2020–21 cohort reflects the fact that individuals who moved from employment into economic inactivity in that year were less likely to have access to the state pension and private pensions than those who moved into inactivity in previous years. As shown in Figure 2.14, those who became inactive in 2020–21 were 8 percentage points less likely to be above the state pension age, and 5 percentage points less likely to have a private pension, than those who became inactive in 2019–20. Nearly half (49%) of the 2020–21 cohort did not have access to either private or state pensions, compared with 43% of the 2019–20 cohort.

Figure 2.14. Pension status of inactive individuals aged 50–70, by when last worked

Note: SPA refers to state pension age.

Source: Authors’ calculations using the Family Resources Survey, 2002–03 to 2021–22.

In contrast, whilst the number of flows into inactivity in 2021–22 remained higher than pre-pandemic, recently inactive individuals in that year had similar access to the state pension and private pensions to those who became inactive before the pandemic. This suggests that there was something different about the 2020–21 cohort, who were perhaps more likely to have been ‘forced’ into leaving work because of labour market disruptions or health concerns. In contrast, by 2021–22 the labour market had largely recovered and the vaccine had been rolled out,3 so those who became inactive in that year are more likely to have done so out of choice.

The fall in living standards among those who became inactive at the start of the pandemic is corroborated by data from Understanding Society, a panel survey that interviews the same individuals year after year. The survey is conducted in overlapping waves of two calendar years each (Wave 10 spans 2019 and 2020, Wave 11 spans 2020 and 2021, and so on), so the timing of the data does not map precisely onto the financial years discussed above. Because we follow the same individuals, here we focus on the change in various outcomes they experience between one wave and the next.

The Understanding Society data suggest that older individuals (aged 50–70) who have exited the labour market since the pandemic began experienced larger deteriorations in their living standards than previous cohorts, based on a number of measures in Figure 2.15. For example, the average weekly food expenditure among those who became inactive in 2020–2021 fell by around £60 on average compared with the year before they became inactive, and 20% of this group entered relative poverty upon exiting the labour market, up from 16% the previous wave. These changes were much larger than among individuals who became inactive more than a year ago, which means that they do not simply reflect wider declines in living standards among the older inactive population over the pandemic. In addition, the fact that the data track the same individuals over time shows that the trends in Figure 2.13 are not simply due to a selection effect. That we see consistent patterns, even when following the same individuals, suggests that the trends are not because those who became inactive in 2020–21 already had low living standards. Instead, the results indicate that those who became inactive during that year experienced a deterioration in their living standards.

Figure 2.15. Change in living standards of inactive individuals aged 50–70, by when last worked

Note: Average household incomes are measured net of taxes and benefits and after housing costs have been deducted, and have been equivalised using the modified OECD equivalence scale. Food expenditure includes expenditure on groceries, food outside the home and alcohol. Household income is measured at the monthly level. Subjective financial situation is coded on a 1–5 scale, ranging from ‘finding it very difficult’ to ‘living comfortably’; in a given wave, an individual is coded as being in a worse subjective financial situation if their self-reported score is worse than their score in the previous wave. Individuals who have never worked are included in the ‘Last worked >1 wave ago’ category.

Source: Authors’ calculations using Understanding Society, Waves 2–12.

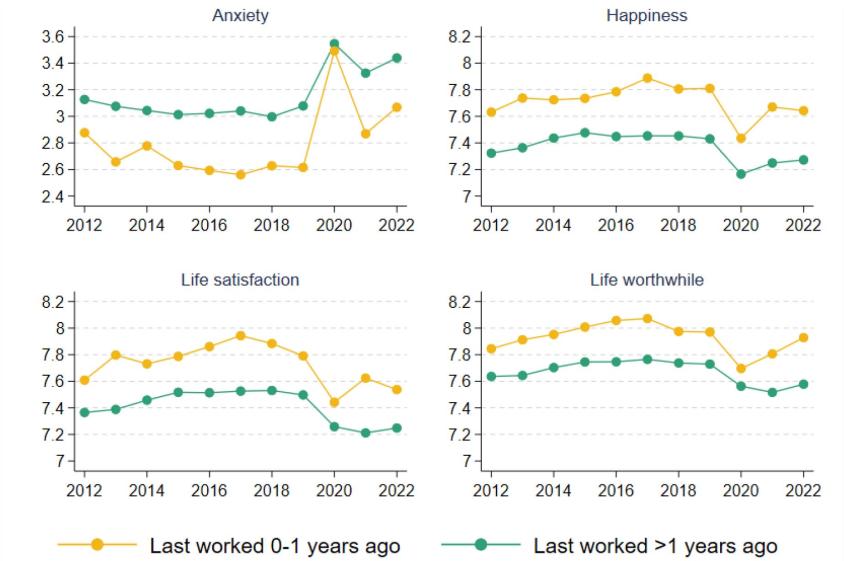

Finally, we turn to self-reported well-being in Figure 2.16, which uses data from the Annual Population Survey. Levels of anxiety, happiness, life satisfaction and the perception of life being worthwhile all deteriorated in 2020, but the deterioration was much larger among those who had become inactive one year ago or less than among those who became inactive more than a year ago. In particular, in 2020, the percentage increase in anxiety among the cohort who became inactive that year was more than double the increase among those who had been inactive for longer, and the percentage fall in the perception of life being worthwhile was 60% larger. As with measures of living standards shown in Figure 2.13, self-reported well-being largely rebounded among those who were recently inactive in 2021 and 2022.

Figure 2.16. Well-being of inactive individuals aged 50–70, by when last worked

Note: All outcomes are scored on a 0–10 scale. Individuals who have never worked are included in the ‘Last worked >1 years ago’ category.

Source: Authors’ calculations using the Annual Population Survey, January–December 2012 to January–December 2022.

This analysis challenges the perception that all exits into inactivity over the pandemic were driven by wealthy individuals who could afford to retire in comfort. Existing research shows that the rise in inactivity is mainly a lower-middle-income phenomenon, concentrated in sectors that were hit hard by the pandemic and not amenable to working from home (Carrillo-Tudela, Clymo and Zentler-Munro, 2022). Consistent with this, our analysis suggests that many of those who became inactive in the first year of the pandemic may have been ‘forced’ into early retirement, to the detriment of their living standards and well-being. Conversely, those who became inactive in 2021–22 – when the labour market turmoil had largely dissipated and the vaccine had been rolled out – are more likely to have done so out of choice.

The fact that those who became inactive more recently have better living standards does not mean that this is an issue of only historical interest. People do not usually experience much change in their incomes after retirement, and so – unless they are able to get back into work – it is likely that many of the 2020–21 cohort will experience persistent low living standards. This is especially true for those who retired many years before their state pension age.

2.4 Conclusion

The recovery in household incomes in 2021–22 was stifled by a sharp rise in inflation. As result, average (median) household income was 1.2% below the pre-pandemic peak, and just back to pre-pandemic levels when measured after deducting housing costs. However, low-income households saw modest increases in their incomes in the two years since the pandemic started, implying a fall in income inequality at the bottom of the distribution.

This rise in incomes among low-income households was seen despite large falls in their incomes from employment. This is because lower employment rates and earnings were offset by lower housing costs and higher benefit incomes. The changes to benefit policy over this period – in particular the £20 uplift to universal credit, which persisted until October 2021, and changes in the universal credit work allowances and taper rate from November 2021 – increased benefit entitlements at any given level of earnings, and the share of low-income households receiving disability benefits also rose substantially over this period.

Looking beyond 2021–22, important changes in benefits policy will shape patterns in incomes. While six months of 2021–22 had the £20 uplift to universal credit, going forward that uplift has been withdrawn and replaced with an increase to work allowances and a reduction in the taper rate. Those reforms are worth about half the £20 uplift to claimants on average, and are targeted towards households slightly higher up the income distribution (Waters and Wernham, 2021a and 2021b). Local housing allowances – which had been increased in the pandemic – have once again been frozen in nominal terms, further pushing down real incomes at the bottom of the income distribution (Ray-Chaudhuri and Waters, 2023). Pushing in the other direction is the £37 billion support package implemented in response to the cost of living crisis which will have substantially bolstered incomes at the bottom of the distribution. At the same time, earnings have not kept pace with inflation, reducing real incomes across the board but especially among middle- and higher-income households. Taken together, it is likely that income inequality will have continued to fall in the period since 2021–22, largely due to the temporary cost of living support. How living standards and inequality evolve into the future will depend, among other things, on the path of earnings growth across the distribution and the government’s tax and benefit policies.

A key legacy of the pandemic has been the rise in economic activity among older adults. Data on living standards and well-being suggest that the cohort of 50- to 70-year-olds who left the labour market in the first year of the pandemic experienced higher rates of poverty than previous cohorts, and suffered worse declines in self-reported well-being. This did not simply reflect a general deterioration in living standards and well-being among the older inactive population. Our analysis challenges the perception that exits into inactivity over the pandemic were driven by wealthy individuals who could afford to retire in comfort, and suggests that many individuals were ‘forced’ into early retirement at the start of the pandemic. Further analysis using the English Longitudinal Study of Ageing (ELSA) will be important to identify which groups saw the largest declines in living standards upon leaving the labour market, and to what extent they are continuing to experience low living standards.

3. Poverty

Key findings

1. The overall absolute poverty rate fell in the first year of the pandemic (2020–21) and was little changed in 2021–22, leaving it nearly 1 percentage point (ppt) or 480,000 people lower than its pre-pandemic level. This is largely due to changes in benefits policy, in particular the (temporary) £20 universal credit uplift and (permanent) changes to the universal credit taper rate and work allowances, which allow workers to keep more of the benefit as their earnings rise.

2. The £20 uplift reduced absolute poverty rates by 0.3ppts during the six months it was in place in 2021–22, or by 0.6ppts in annualised terms (379,000 people). The changes to work allowances and the taper rate that succeeded it had a much more muted impact on poverty. Their annualised effect is only 0.2ppts (133,000 people) – a third of the impact of the uplift. Even on a per-pound basis, the £20 uplift had a 40% larger effect on poverty. This is because changes to work allowances and the taper rate mainly benefit somewhat higher-earning households further up the income distribution and do not affect out-of-work households at all.

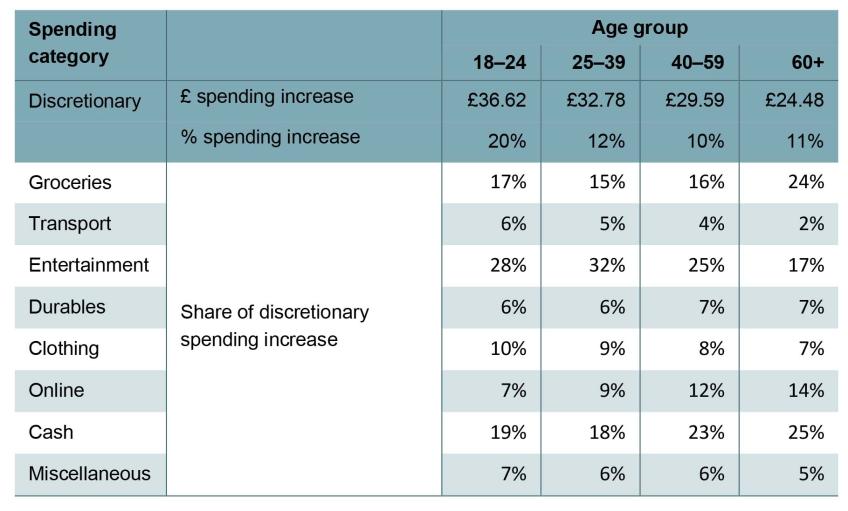

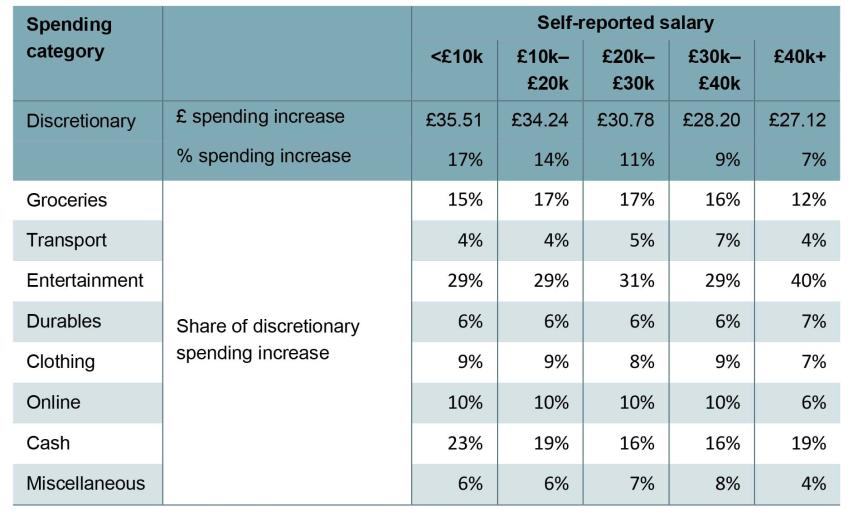

3. The first instalment of the cost of living payments to households receiving means-tested benefits – £326 paid in July 2022 – substantially boosted spending. Discretionary spending was £33 a week (12%) higher for recipient households on average in the four weeks after the payment than in the four weeks before, and remained somewhat elevated up to 15 weeks after the initial payment. The rise in discretionary spending was driven by an increase in cash withdrawals, spending on groceries, and spending on entertainment (e.g. restaurants, streaming services), which accounted for 17%, 15% and 28% of the total increase in discretionary spending respectively. That recipients responded strongly to the payment suggests that, prior to the payment, many had limited savings or means of borrowing available to them, and wanted to spend more than they were able to. That a substantial fraction of the cost of living payment went on basic goods such as groceries, but also on more discretionary goods such as entertainment, indicates a variety of levels of ‘need’ among recipient households.

4. Recipients with lower earnings increased their spending by more immediately after receiving the cost of living payment, which may indicate higher cash constraints in the lead-up to the payment. However, the distribution of extra spending across categories (groceries, entertainment etc.) was similar across recipients with different levels of earnings.

This chapter examines trends in household poverty, particularly looking at changes since the beginning of the COVID-19 pandemic in March 2020.

We start by describing trends in poverty rates in the UK for the latest two years of data, for the whole population as well as subgroups including children and pensioners, to assess the extent to which the pandemic and the policy response affected the number of households on low incomes. We then estimate the effects on poverty of two key reforms introduced during the pandemic: the £20 per week uplift to universal credit (UC) and the reduction in the UC taper rate. Finally, we use bank transaction data to look at how the cost of living payment in July 2022 affected spending patterns for recipients, to examine how beneficiaries spent this payment and how important it might have been in poverty alleviation.

The majority of analysis in this chapter is based on the Households Below Average Income data. When we refer to household income, the measure we use is net equivalised household income – income after taxes and benefits and adjusted for household composition – expressed as the equivalent for a childless couple. We measure household incomes after deducting housing costs (AHC). While there is clearly an element of choice in many people’s spending on housing, variation in housing costs may not reflect differences in housing quality, especially for low-income households. Further, incomes before housing costs include housing benefit as income. An increase in rent covered by housing benefit therefore shows up as an increase in ‘before-housing-costs’ income, which makes households appear better off even though their disposable income (after housing costs) remains unchanged.

Section 3.3 uses bank transaction data from ClearScore. We offer a full description of those data at the beginning of that section.

3.1 Poverty rate trends

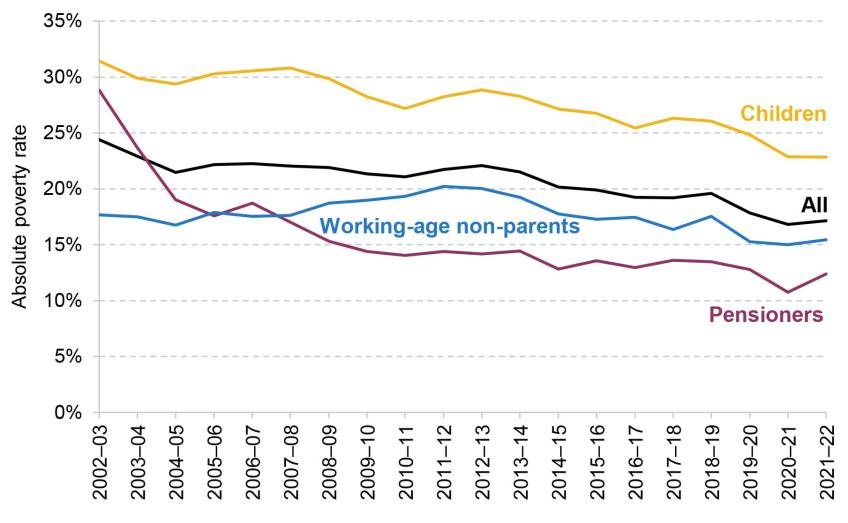

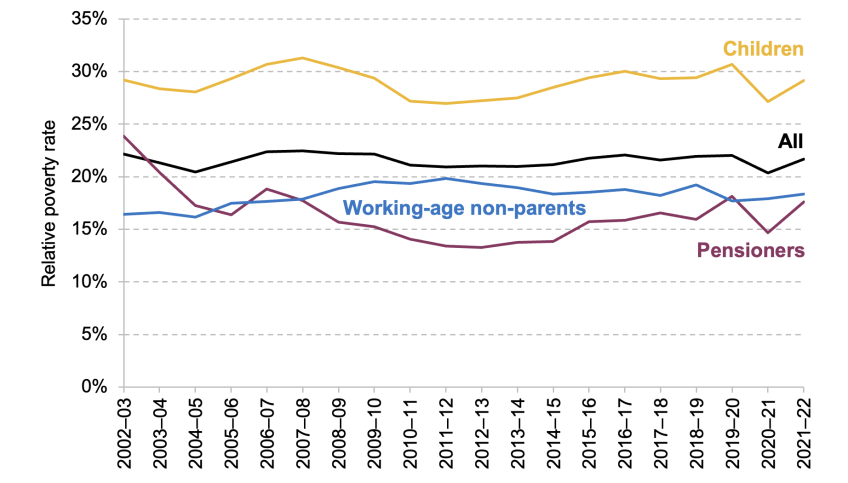

We begin by documenting changes in poverty rates, focusing on the period since the beginning of the pandemic. Figure 3.1 shows absolute poverty rates for various groups since 2002–03, defined as the share of individuals whose household income (adjusted for inflation) is below 60% of the median income in 2010–11. During the first year of the pandemic, 2020–21, absolute poverty among the whole population fell by around 1 percentage point (ppt) from 17.9% to 16.8%. In 2021–22, it rose back slightly, but at 17.1% it was still 0.7ppts (479,000 people) below the pre-pandemic level. As we show later, a key driver in this change was the increased generosity of benefits – in particular, the £20 per week uplift to UC entitlements and the changes to the UC work allowances and taper.

Figure 3.1. Absolute poverty (AHC), overall and for different groups

Note: Incomes have been measured net of taxes and benefits, with housing costs deducted. All incomes have been equivalised using the modified OECD equivalence scale. The absolute poverty measure gives the percentage living in a household with less than 60% of the 2010–11 median income, adjusted for inflation.

Source: Authors’ calculations using the Family Resources Survey, 2002–03 to 2021–22.

The fall in absolute poverty over the two latest years has been driven by a decline in the proportion of children living in poverty. Prior to the pandemic, 25% of children were living in a household with income below the absolute poverty line. This fell to 23% in 2020–21, and remained at that level in 2021–22. This is consistent with the fact that families with children are more likely to be receiving UC than pensioners or those without children, and so their outcomes are more sensitive to UC policy.

Figure 3.2 shows the evolution of relative poverty rates. These compare household incomes with a poverty line that changes over time, equal to 60% of the contemporaneous median income in each year. A consequence of this is that relative poverty rates are affected by changes in the middle of the income of the distribution: all else equal, an increase in median income would lead to a rise in relative poverty.

Figure 3.2. Relative poverty (AHC), overall and for different groups

Note: Incomes have been measured net of taxes and benefits, with housing costs deducted. All incomes have been equivalised using the modified OECD equivalence scale. The relative poverty measure gives the percentage living in a household with less than 60% of the contemporaneous median income.

Source: Authors’ calculations using the Family Resources Survey, 2002–03 to 2021–22.

Across the population, relative poverty fell by 1.7ppts between 2019–20 and 2020–21. This was larger than the decline in absolute poverty, as the labour market disruption at the start of the pandemic caused median income to fall. The subsequent recovery meant that median income rebounded, and as such relative poverty rates returned to close to their pre-pandemic level in 2021–22.

3.2 Effects of reforms to the benefit system

We now investigate the role of reforms to the benefit system in changes to absolute poverty since the pandemic. As discussed in the pre-released chapter on living standards (Ray-Chaudhuri and Xu, 2023), low-income households saw larger declines in their employment incomes between 2019–20 and 2021–22, but these were more than offset by increases in working-age benefit incomes. In particular, two key policies introduced since the beginning of the pandemic bolstered the incomes of low-income households. First, a £20 a week uplift to UC was introduced in March 2020 – meaning that the vast majority of UC recipients saw an increase in entitlement of that amount.4, 5 This remained in place until October 2021 (covering six months of the 2021–22 financial year). Second, work allowances in UC – the earnings thresholds above which benefit entitlements are gradually reduced – were raised by £500 a year, and the rate at which benefits are reduced above this point (the ‘taper rate’) was reduced from 63% to 55%. This change took place towards the end of November 2021, so was in place for the last four months of the 2021–22 financial year.

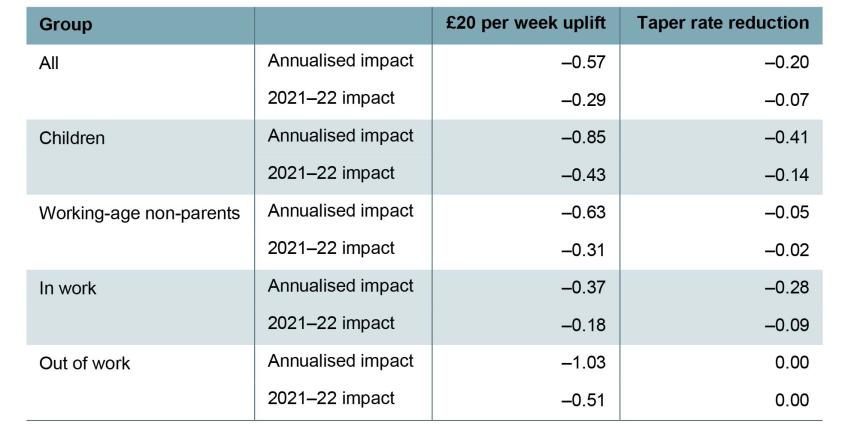

In this section, we estimate the impact of these two policies on absolute poverty using TAXBEN, the IFS tax and benefit microsimulation model. For brevity, we refer to the combined change in the UC work allowances and taper rate as the ‘taper rate reduction’. We present both the annualised impact of each policy – the effect if each policy were in place for a full year or if they were made permanent – and the impact in 2021–22, taking into account the number of months the policies were actually in place (six months in the case of the £20 uplift and four months in the case of the taper rate reduction).6 Table 3.1 shows the estimated effects of the two key reforms on absolute poverty rates for various groups, against a baseline without either reform. We assume no behavioural response such as a change in labour supply or take-up of benefits.

Table 3.1. Effects of benefit policy reforms on absolute poverty rates

Note: Shows percentage point change in absolute poverty rate, measured after housing costs are deducted.

Source: Authors’ calculations using TAXBEN, the IFS tax and benefit microsimulation model, and Family Resources Survey 2021–22.

Given that both policies increase support for low-income families, unsurprisingly both reduce poverty. However, our analysis shows that the £20 uplift had a much larger effect on overall poverty rates than the taper rate reduction. The impact of the uplift being in place for six months of 2021–22 was to reduce absolute poverty among the whole population by 0.3ppts, equivalent to 0.6ppts on an annualised basis (379,000 individuals), a result that is comparable to other simulation exercises based on pre-pandemic data.7 The taper rate reduction had a more muted effect, reducing poverty by 0.1ppts across 2021–22, equivalent to 0.2ppts (133,000 individuals) on an annualised basis.

This is partly due to who the two policies target. The taper rate reduction only benefits working households on UC, with bigger impacts for those with higher levels of earnings. These households tend to be further up the income distribution and often already above the poverty line. In contrast, the £20 uplift applied equally to all UC recipients (except those who were subject to the benefit cap) – therefore boosting incomes for those who were near the poverty line. Another reason that the £20 uplift had a bigger impact on poverty was simply that it was a larger policy, costing around £6 billion for a full year, compared with £3 billion for the taper rate reduction (HM Treasury, 2020 and 2021).8 Nonetheless, on a per-pound basis, the uplift had a roughly 40% larger impact on poverty than the taper rate reduction.

The two policies also affect different groups quite differently. The annualised impact of the uplift on child poverty is twice that of the taper rate reduction. The poverty rate of working-age non-parents is almost entirely insensitive to the taper rate, reflecting the fact that the nature of the means-tested benefit system results in few non-parents being entitled to benefits if they are working, and the fact that claimants without children are not eligible for work allowances (unless they also have a disability). Those in out-of-work families see a 1ppt fall in poverty from the uplift, and of course are not affected at all by the taper. Even for in-work families, the uplift has a bigger annualised impact on poverty than the taper rate reduction (though not on a per-pound spent basis).

These results suggest that the total impact of the two policies in 2021–22 on poverty was around 0.4ppts. They therefore explain about half the decline in overall poverty between 2019–20 and 2021–22. Looking forward, the taper rate reduction was a permanent reform, while the uplift has expired. We would therefore expect the absolute poverty rate to be 0.16ppts (106,000 people) higher in 2022–23 than in 2021–22 as a result of changes in these two policies.9

3.3 Cost of living payments

Benefits are uprated each April using a lagged measure of inflation from the previous September. This leads to temporary, but large, falls in the real value of benefits when inflation is rising quickly. For example, in the first quarter of 2023, real benefit entitlements for out-of-work households were more than 10% below their pre-pandemic value. Indeed, benefits are not set to return to pre-pandemic levels until April 2025 (Cribb et al., 2023).

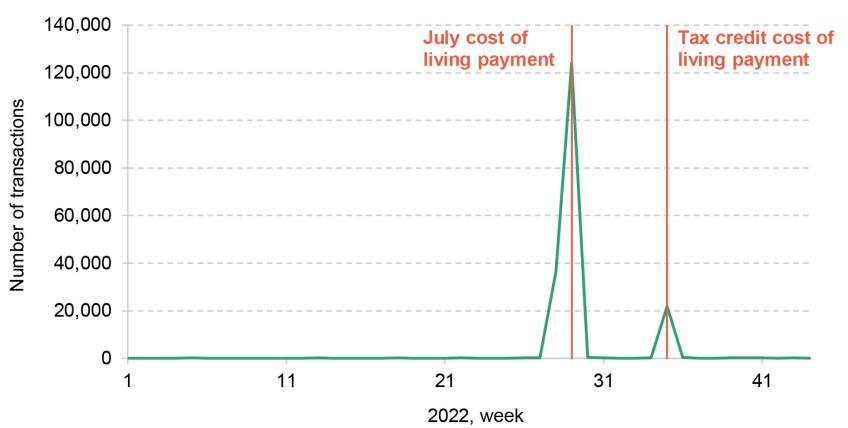

To protect low-income households from the rising cost of living, in 2022 the government introduced two cost of living payments totalling £650 for households receiving means-tested benefits. The amounts paid – £326 in July and £324 in November – were the same irrespective of a household’s circumstances or the amount of benefits it usually received.

In this section, we use transaction-level data to investigate how the first cost of living payment affected the spending of individuals who received them. In particular, we assess how quickly they spent the cash from this payment, and what type of goods or services they spent it on. The way in which households spent the payment is also informative of their living standards prior to the payment coming through. For example, if households quickly spent the payment on necessities such as groceries or rent, this suggests that households were highly cash-constrained prior to receiving the payment. On the other hand, more spending on luxuries such as eating out could imply that they had enough income to cover their essentials. We also look at whether the timing and categories of spending differed across types of households, differentiating by age and income.

Data and methodology

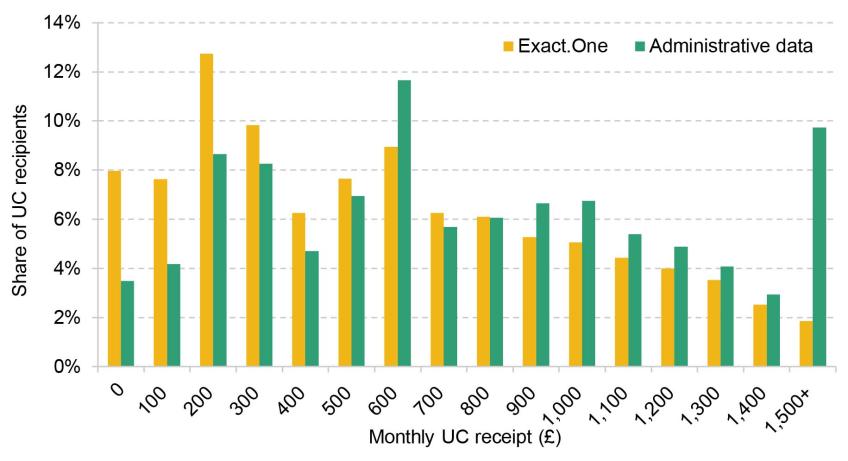

To conduct this analysis, we use the Exact.One Transactional Dataset, containing bank transaction data from ClearScore, a free credit rating app. Users of the app link in their bank accounts and credit cards to provide information about their financial circumstances, which may help improve the deals on credit products they are offered. ClearScore retrieves the historical transactions associated with these accounts, generally up to the previous three years. These data are then completely anonymised to construct the Exact.One dataset. For each transaction, we see the date it occurred, the amount, and usually the firm it was paid to or from and the category of spending (e.g. groceries, fuel). The spending category is automatically assigned by ClearScore based on the firm to which a payment is made. This means it is an imperfect measure: for example, if an individual bought clothes from a supermarket, the spending would be classed as groceries because it shows up on the bank statement simply as spending at the supermarket. The sample we use contains transactions for more than 900,000 users from the beginning of 2022 until the end of October 2022. To ensure that we have a consistent view of users’ accounts, we keep only users for whom we observe a transaction from all their linked accounts both before and after our window of analysis (20 weeks before to 10 weeks after), leaving us with a sample of just over 500,000 users. Within this, there are 98,000 users who received a cost of living payment in July 2022.

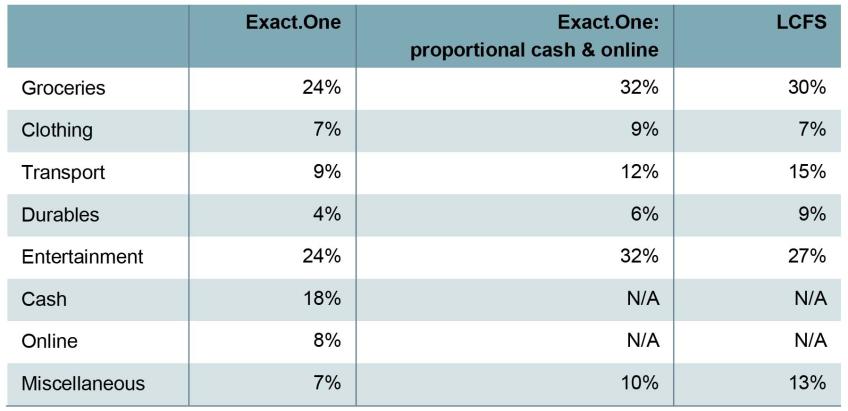

The sample is limited to people who have signed up to ClearScore, and as such may not be representative of the general population of benefit claimants. Figure 3A.1 in the appendix plots the distribution of monthly universal credit receipts among ClearScore users receiving the benefit – who are therefore entitled to cost of living payments – against the distribution of payments in the administrative data. It shows that the Exact.One data somewhat over-represent individuals getting very low benefit amounts (particularly those getting under £300 per month) and under-represent those getting very high amounts (particularly those getting £1,500 or more a month), but are reasonably representative between those points. This may be due to ClearScore users being more likely to be in work or being younger than the population of universal credit recipients. However, we would not expect this to significantly bias our results, as we do not find large differences in estimated spending responses to the cost of living payment by monthly benefit receipt. In particular, we find no systematic differences in the composition of spending across categories by monthly benefit receipt, as shown in Table 3A.3 in the appendix.

As an additional representativeness check, Table 3A.4 in the appendix compares spending prior to the cost of living payment among recipients in the Exact.One data with the spending of households entitled to universal credit in the Living Costs and Food Survey (LCFS).10 Despite coming from very different sources, average spending in the two datasets line up remarkably well.

We can identify those users who receive a cost of living payment since it is a very specific amount paid within a short time window. All users who receive a payment of exactly £326 into one of their accounts between 14 and 31 July are classified as a recipient. While it is possible that this method could misclassify a user if they happened to receive another payment of that amount at that time, the chances of this seem slim and so misclassification is unlikely to have a meaningful impact on our results. This can be seen in Figure 3A.2 in the appendix, which shows that almost no users receive payments of £326 into their accounts in the other weeks in our sample, while there is a huge spike around the time of the payments.11

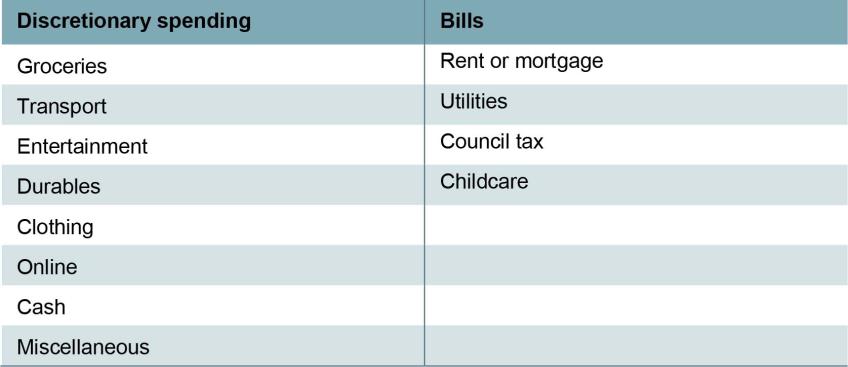

Our analysis involves looking into the types of spending done by individuals in response to the cost of living payments. We start by considering spending across two broad categories: bills and discretionary spending, where the latter is defined as spending on anything other than bills. We also consider effects on debt repayments. These categories are mutually exclusive, and cover all expenditures except for bank charges, insurance premiums, business expenses, and transactions that ClearScore was unable to categorise automatically. We further break down discretionary spending into spending on groceries, entertainment (such as dining out or streaming services), consumer durables (such as home appliances and furniture) and other categories. A full list of spending categories can be found in Table 3A.1 in the appendix. We list the most important types of spending in each category in Table 3A.2.

For the following results, we show the evolution of various types of spending around the time that individuals received cost of living payments. While this is informative, it is useful to get a sense of how the spending of these individuals might have changed had they not received a cost of living payment. General trends such as inflation could lead to higher spending on items such as bills and groceries, and there may be seasonal trends in spending over the year – for example, on entertainment over school holidays. To help account for these trends, we also show how spending evolved for a ‘control group’ of similar individuals who did not receive a cost of living payment.12 We select these individuals by matching each individual who received a cost of living payment to another individual who did not receive a cost of living payment but who had similar spending for the category in question and across all discretionary items between April and June.

Broad spending categories

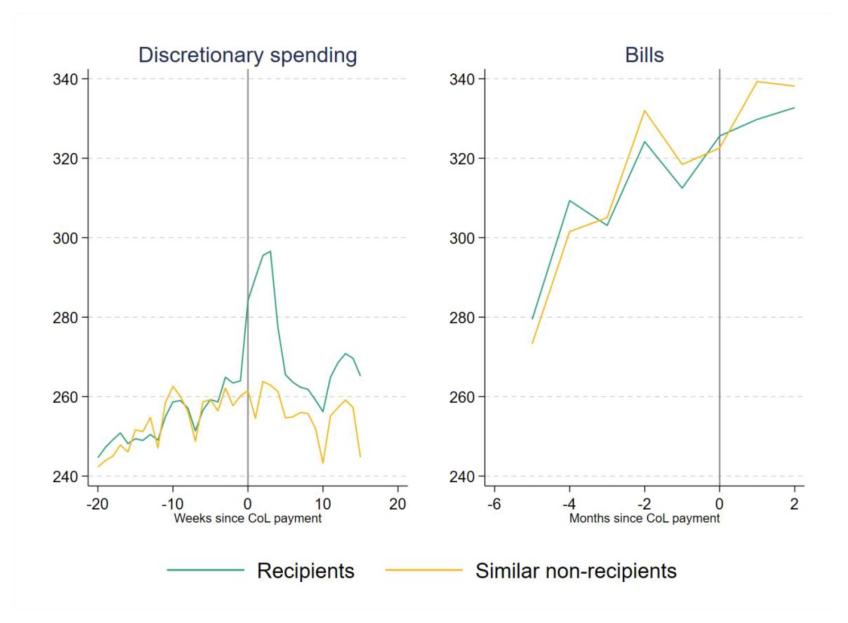

Figure 3.3 shows how spending on discretionary items and bills evolved for individuals around the time they received the cost of living payment, relative to a control group. The left panel shows weekly discretionary spending, smoothed using a backward-looking four-week moving average. The right panel shows spending on bills each month (comprised of mortgage and rent payments, utilities, council tax and childcare costs). To facilitate comparison, the vertical axes use the same scale.

Figure 3.3. Broad spending categories

Note: Backward-looking four-week moving average shown for discretionary spending. CoL is short for cost of living.

Source: Authors’ calculations using the Exact.One Transactional Dataset.

We observe that upon receiving the cost of living payment, individuals substantially increased their discretionary spending. Average discretionary spending in the four weeks after the payment was £33 higher than in the four weeks before, an increase of 12%, and there are signs of small anticipatory increases in spending in the weeks leading up to the payment.13 For non-recipients, we do not see any big jumps in spending, which implies that the effect is driven by the extra income from the cost of living payment. By contrast, there was very little change in spending on bills in July for recipients compared with non-recipients (notice, though, that the amount spent on bills was rising substantially during the period of our sample). These patterns suggest that, before receiving the payment, individuals were limiting their discretionary spending, but not necessarily falling behind on bills.14

That overall spending responded strongly to the cost of living payment suggests that, prior to the payment, many recipients had limited savings or means of borrowing available to them, restricting their capacity to spend (i.e. they were ‘credit-constrained’). The cost of living payment (partially) relaxed those constraints, allowing higher levels of expenditure.

The increase in discretionary spending fell away quickly after the initial jump. Still, 10–14 weeks after the payment, recipients were spending an average of £11 per week more than non-recipients. Adding up the total amount extra spent by recipients compared with non-recipients gives an additional £246 spent over 15 weeks. This indicates that individuals on average had exhausted most, but not all, of the cost of living payment before they received the second instalment in November 2022.

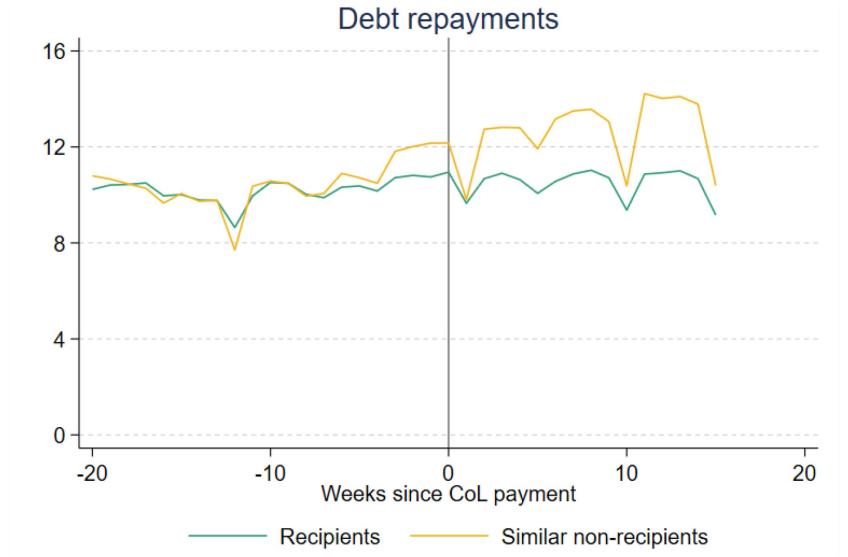

Figure 3.4 investigates the impact of the cost of living payment on debt repayments, a category that includes repayments for personal loans, including high-cost payday loans.15 Even though 45% of recipients in our sample had made some debt repayments in the few months in advance of the payment, we do not find evidence of any significant increase as a result of the cost of living payment. In fact, recipients appear to make fewer repayments than similar non-recipients after the payment, although this result is difficult to interpret since repayments appear to be increasing among non-recipients shortly before the cost of living payments were sent out. Nonetheless, focusing simply on the trends in the recipient group, we see that repayments remain remarkably stable at around £10 per week throughout our analysis window with very little change when or shortly after the cost of living payment arrives. It is worth noting that since we do not include credit card repayments, we cannot rule out that households responded by paying off credit card debt.

Figure 3.4. Spending on debt repayments

Note: Backward-looking four-week moving average. Does not include repayments to ‘buy now pay later’ firms, nor credit card repayments. CoL is short for cost of living.

Source: Authors’ calculations using the Exact.One Transactional Dataset.

Discretionary spending categories

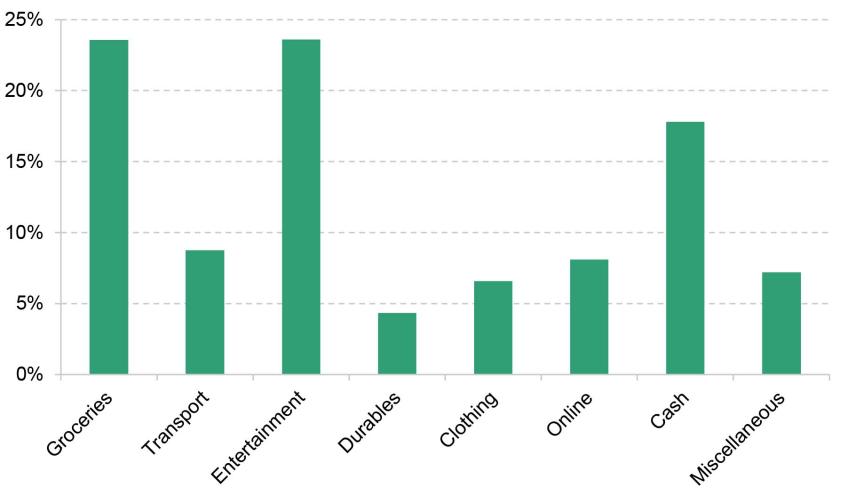

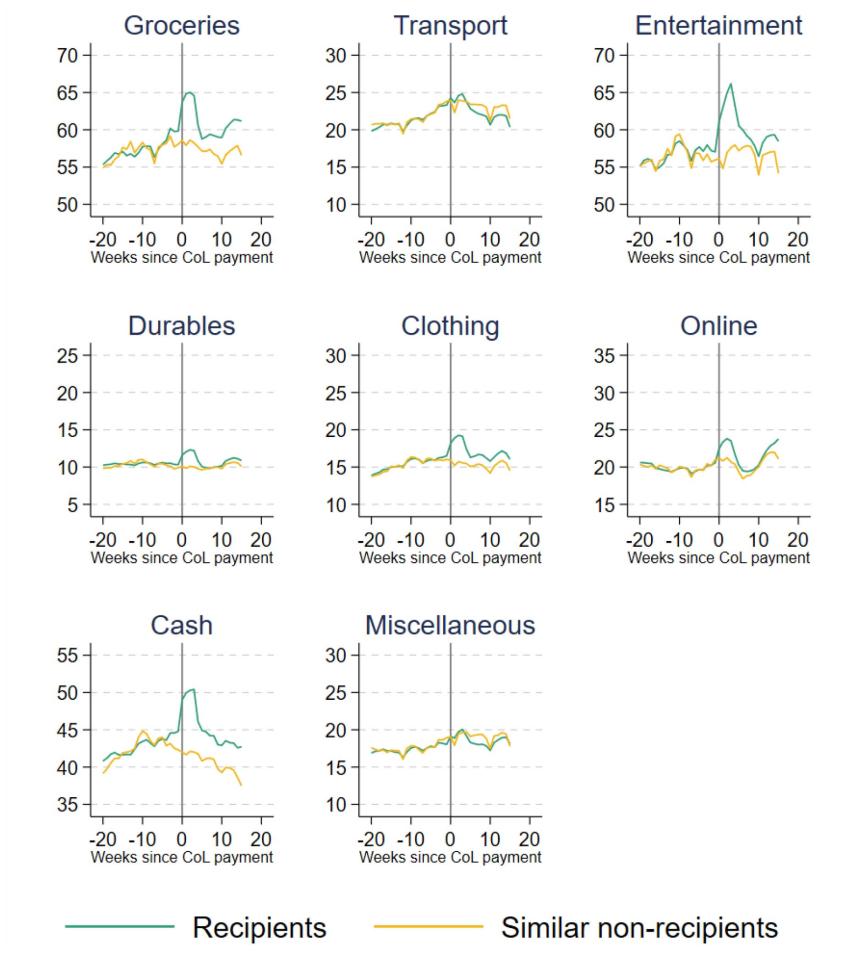

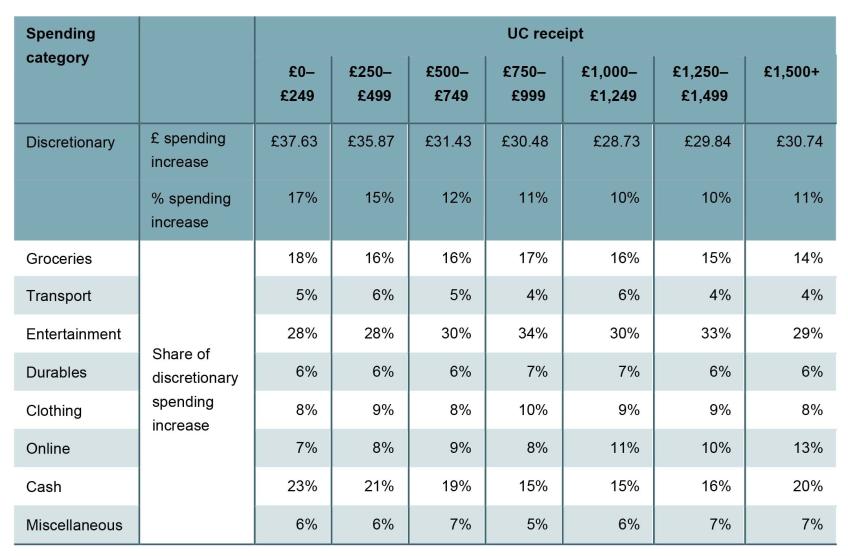

We now break down the changes in discretionary spending in Figure 3.3 into changes across eight narrower categories, to understand the type of goods or services that individuals choose to spend the payments on. Figure 3.5 shows the distribution of weekly spending across these eight categories in the 9–12 weeks before the cost of living payment. Before receiving the cost of living payments, around a quarter (24%) of recipients’ total discretionary spending went on groceries, and around a quarter (24%) on entertainment, a category that includes eating out, streaming services, and other leisure activities. Clothing (and appearance), transport, and durables (which include white goods such as washing machines and fridges) accounted for much smaller shares of discretionary spending – between 4% and 9% each.16

Figure 3.5. Share of spending by category, among cost of living payment recipients

Note: Average of spending between 9 and 12 weeks before the July cost of living payment.

Source: Authors’ calculations using the Exact.One Transactional Dataset.

Just under a fifth (18%) of discretionary spending was taken out as cash. We show this as a separate category, as we cannot tell what types of goods or services the cash was spent on. Similarly, we show online spending (PayPal, Amazon and eBay) as a separate category.

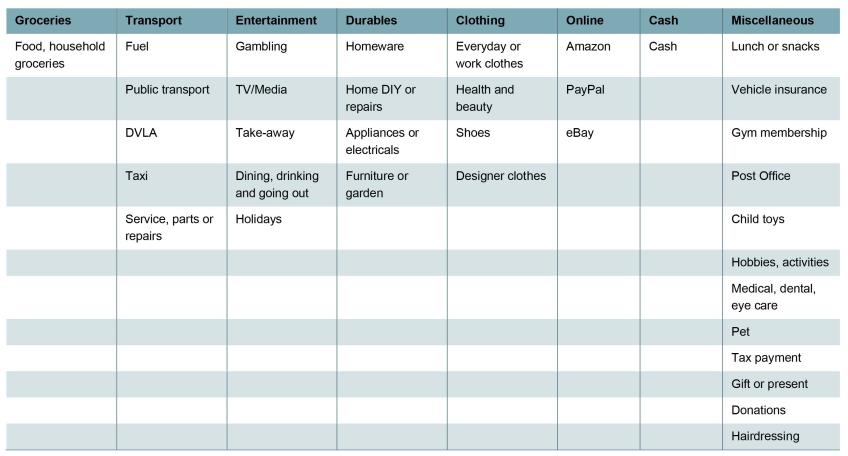

The evolution of spending across these categories, before and after the cost of living payment, is shown in Figure 3.6. For ease of comparison between the categories, each tick point on the vertical axes represents an increase of £5. We see that the biggest increases in spending were on groceries, entertainment and cash. Recipients’ spending on these categories in the four weeks after receiving the payment, relative to the four weeks before, increased by £4.80, £9.10 and £5.60 respectively (8%, 16% and 13% in percentage terms), accounting for 15%, 28% and 17% of the total increase in discretionary spending. Comparing recipients with similar non-recipients, we can also see some evidence of small anticipatory increases in this spending in the weeks immediately before the payment. Recipients continued to spend more on these categories than the control group 15 weeks after the initial payment.