This briefing note provides background material for the 2017 General Election. IFS Election 2017 analysis is being produced with funding from the Nuffield Foundation as part of its work to ensure public debate in the run-up to the general election is informed by independent and rigorous evidence. For more information, go to http://www.nuffieldfoundation.org.

Cuts to corporation tax rates announced between 2010 and 2016 are estimated to reduce revenues by at least £16.5 billion a year in the short to medium run. Accounting for measures that raise revenue, including anti-avoidance measures, onshore corporate tax policies over this period reduce revenues by an estimated £12.4 billion a year. Changes to corporate tax have represented some of the largest giveaways in both parliaments since 2010.

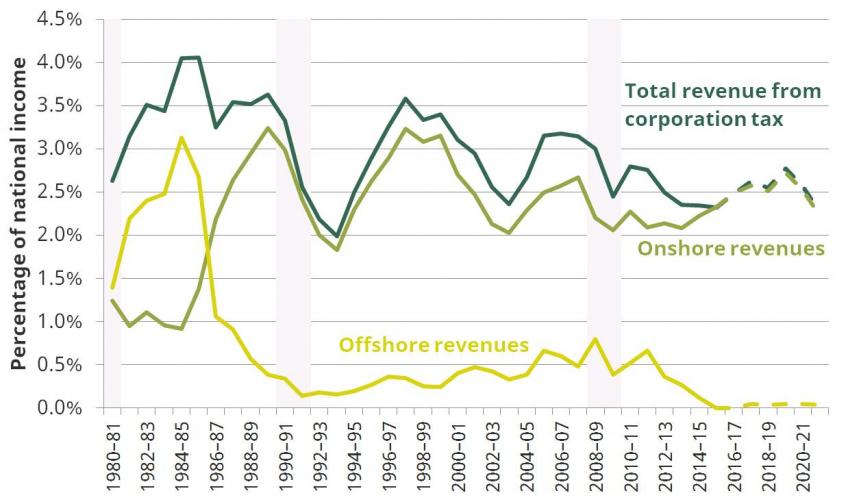

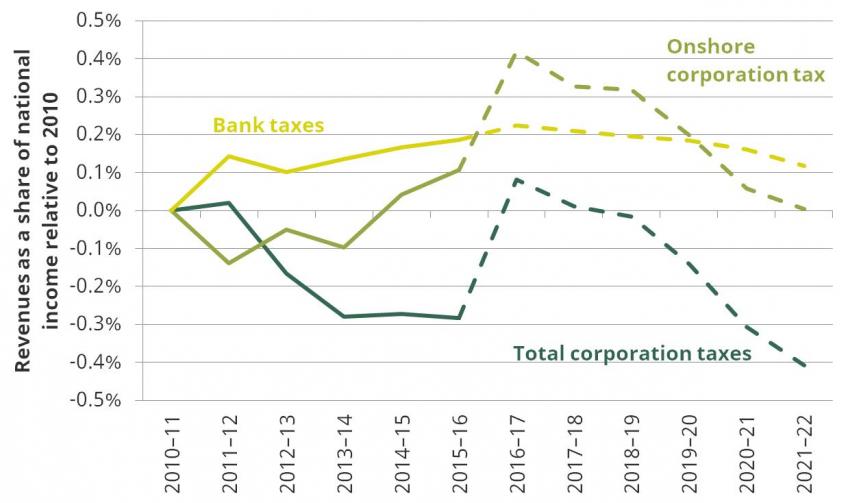

Onshore corporate tax receipts as a share of national income are set to be at the same level in 2021–22 as they were in 2010–11. This is not evidence that cuts to corporation tax rates have not reduced revenues. Instead, it reflects the effect of other factors, including the ongoing recovery of financial sector (and other) profits following the Great Recession. Corporation tax receipts are forecast to be 2.3% of national income by 2021–22, substantially below the pre-recession high of 3.2%.

North Sea revenues have collapsed in recent years (the North Sea tax regime is actually forecast to cost the exchequer money in 2016–17) and look unlikely to form a substantial part of the UK tax base in future.

Onshore receipts set to fall and offshore receipts non-existent

In 2017–18 we are forecast to raise £53.2 billion from corporation tax. This represents 7.8% of total tax receipts and 2.6% of national income. This has fallen from the pre-recession high of 3.2% of national income and is forecast to fall to 2.3% by 2021–22.

Onshore receipts, while volatile over the economic cycle, displayed no strong downward trend in the 30 or so years up to the great recession despite the main corporation tax rate being cut from 52% in 1981 to 28% in 2008. This was due to an increase in the size and profitability of the corporate sector, and to some extent to a broadening of the tax base. Receipts are forecast to be lower in future as a result of recent rate cuts.

Forecasts for North Sea revenues have been regularly revised down in recent years with the fall in the oil price. In 2016–17 the North Sea tax regime is forecast to cost the exchequer money as a result of weak profitability combined with relief for decommissioning costs.[1] Offshore receipts are forecast to be negligible (i.e. near zero) until at least the end of the forecast horizon. Given the underlying decline in resources, North Sea revenues look unlikely to form a substantial part of the UK tax base in future.

Figure 1: Corporation tax receipts as a share of national income

Notes: Dashed lines show forecasts. Onshore receipts include revenues from the Diverted Profits Tax and the Windfall Tax (1997-98). Offshore receipts include revenues from the Petroleum Revenue Tax and the Supplementary Petroleum Duty (1981-83). Total revenues include all of the above. Measures are based on cash receipts (not accruals), which are available on a consistent basis for a longer period.

Source: Author’s calculations using IFS revenue composition spreadsheet, cash measures: https://www.ifs.org.uk/uploads/publications/ff/revenue_composition.xlsx.

Onshore receipts to return to 2010 levels despite rate cuts

Onshore corporation tax receipts are set to fall by 0.3% of national income between 2017–18 and 2021–22. At that point, they would, if the forecast proves correct, be at the same share of national income as in 2010–11. This may be surprising given that the main corporation tax rate has been cut from 28% in 2010 to 20% in 2015, 19% this year and, on current plans, is set to fall to 17% in 2020. However, the lack of a decline in revenues cannot be interpreted as evidence that cuts to corporation tax have not reduced them. There have been a number of offsetting factors (listed below).

Two new taxes on banks – the bank levy and an 8% surcharge on banks’ profits – have been used to boost receipts from the financial sector, which were much higher pre-recession than currently.[2]

Figure 2: Onshore corporation tax receipts set to fall to around 2010 levels

Notes: Dashed lines show forecasts. Onshore receipts include revenues from the Diverted Profits Tax. Bank taxes are the bank levy and bank surcharge. Total includes corporation tax (onshore and offshore) and bank taxes. Measures are based on accruals and include the recent change to a ‘time-shifted accruals’ method.

Source: Author’s calculations using Office for Budget Responsibility, ‘Public finances databank’, March 2017 (http://budgetresponsibility.org.uk/data/) and Table 4.6, Economic and Fiscal Outlook, March 2017 (http://budgetresponsibility.org.uk/efo/economic-fiscal-outlook-march-2017/).

Factors affecting corporation tax receipts since 2010–11[3]:

- Underlying profits have been growing. This was always expected as the UK and, in particular, the financial sector continued to recover from the recession. Absent rate cuts, revenues would have been expected to increase between 2010 and 2020. Forecast receipts for 2016–17 were revised up substantially in March 2017 as a result of recorded profits in 2016 being higher than previously expected.

- There have been policy changes that increase revenues, including measures to reduce avoidance. More on this below.

- There have been restrictions on losses that bring revenues forward. A 50% cap was placed on the share of banks’ profits that could be offset using carried forward losses from April 2015. In April 2016, this was tightened to 25% and a 50% cap added for all non-bank companies. These measures – for which there is no good economic rationale – acted to boost revenues over the near-term from 2015–16 but to reduce them slightly over the longer-term.

- Growth in incorporation has boosted corporation tax receipts but reduced receipts overall (because incomes generated by individuals working for their own business are taxed more lightly than employment income).

- Weak investment post Brexit is forecast to boost receipts in the short run because it is expected that firms will make less use of tax-deductible capital allowances. There has also been a boost to the profits (and therefore tax payments) of life assurance companies, which have seen a post-referendum increase in bond prices. However, the Office for Budget Responsibility (OBR) expects receipts to be depressed going forward as a result of financial company profits growing more slowly, in part due to post-referendum uncertainty.

Corporation tax rate cuts cost at least £16.5 billion a year in the near term

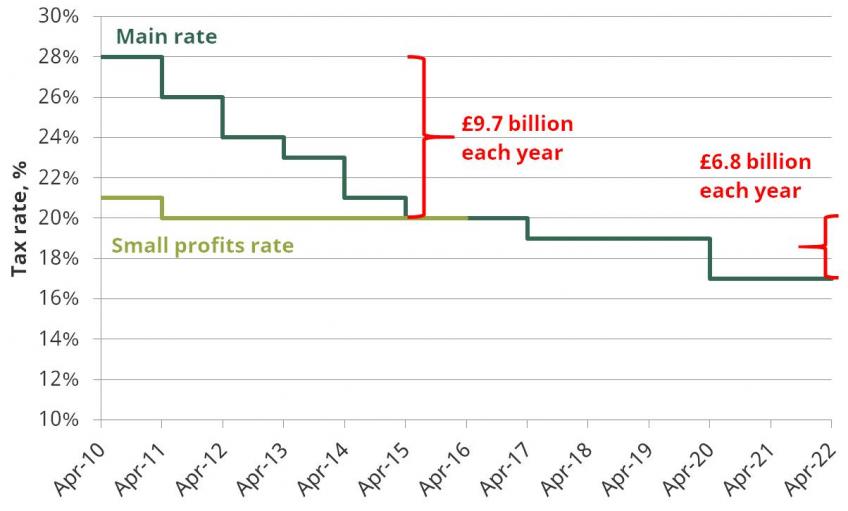

Based on official policy costings, cutting the main rate from 28% to 20%, the small profits rate from 21% to 20%, and the (newly) combined rate from 20% to 17%, costs £16.5 billion each year in 2017–18 terms.

Figure 3: Rates of UK corporation tax and revenue cost of rate cuts in 2017–18 terms

Source: Author’s calculations. See Appendix I.

Caution is required with these figures. Official policy costings reflect the best estimate of the policy cost when the policy was announced. They do not necessarily reflect the actual realised cost of a policy, or even the latest best estimate of its cost. There are three main reasons for this:

- If profits turn out to be higher/lower than expected, cutting corporation tax will be more/less expensive than forecast. For example, the cost of cutting the rate from 28% to 24% was higher when estimated in 2011 than when originally costed in 2010. This suggests that £16.5 billion is likely to be an underestimate of the current annual cost.

- The cost of policies may not be fully realised within the forecast horizon. For example, the cut to 24% in 2014 was announced and costed in Budget 2010. The full cost would not have fully materialised by the end of the forecast horizon (at that point 2014–15).

- Official policy costings consider the direct effect of cutting corporation tax and account for some behavioural responses. They do not account for any wider long run effects on the economy. With corporation tax cuts these are likely to be beneficial: we expect some of the cost of lower corporation tax rates to be recouped through higher investment and economic growth (see below). This suggests £16.5 billion is likely to be an overestimate of the long run cost.

Tax increases and anti-avoidance bring net giveaway down to £12.4 billion

Table 1 shows the cost of all corporation tax policies since 2010; the same caveats about original policy costings highlighted above apply here. In both parliaments, cuts to corporation tax rates have been the biggest giveaway. There are two reasons why rate cuts are more expensive per percentage point since 2015. Most importantly, cuts now apply to all companies (there is no longer a small profits rate). In addition, profits’ forecasts are higher in recent years, which increases the estimated cost of cuts.

Anti-avoidance measures have been the main way revenues have been raised. Since 2015, this includes measures announced following the OECD Base Erosion and Profit Shifting (BEPS) project – an international effort to foster consensus on how to reduce avoidance.[4] The most significant measure is a restriction on interest deductibility. The revenue gain from these policies is especially difficult to estimate. A 2016 OBR evaluation of a number of anti-avoidance measures concluded that there were “more under-performing measures than over-performing ones“ and that the “costings have, on average, underestimated the amount of time that it would take before a measure becomes fully effective”.[5]

Table 1: Cost of onshore corporation tax policy

Policy | £ billion, 2017–18 terms |

Measures announced since 2015 | –3.9 |

Reduction in corporation tax rate from 20% to 17% | –6.8 |

8% corporation tax surcharge on banks & reduced Bank Levy | +0.1 |

Annual Investment Allowance set at new permanent level of £200,000 | –0.7 |

Anti-avoidance measures | +3.1 |

of which: restriction on relief for interest | +0.9 |

Other measures* | +0.4 |

Measures announced 2010–2015 | –8.5 |

Main rate cut from 28% to 20% & small profits rate cut 21% to 20% | –9.7 |

Increase in Annual Investment Allowance & cut in capital allowances | +0.8 |

Avoidance measures | +1.2 |

Other measures† | –0.8 |

Note: * Includes restriction on deductibility of banks’ pre-2015 losses and extension of capital allowance for lower emission business cars. † Includes Patent Box, CFC rules and R&D tax credit changes, among other policies. Source: see Appendix I.

Reversing recent rate cuts would raise up to £19.7 billion a year in the near term

HMRC’s most recent estimates (April 2017) suggest that a 1 percentage point increase in corporation tax for all companies would raise £2.6 billion in 2020–21, which is equivalent to £2.3 billion in 2017–18 terms.[6] A two percentage point increase would be expected to raise twice this (£4.6 billion in 2017–18 terms).

If this figure (i.e. £2.3 billion per percentage point) is used to cost all rate cuts made since 2010, a simple ‘back of the envelope’ calculation is that policy changes have reduced revenues in the near-term by roughly £19.7 billion per year in 2017–18 terms.[7]

This calculation suggests that the cost of rate cuts (or, conversely, the amount that could be raised by reversing them) is higher than the £16.5 billion cited above. This illustrates that the exact cost of corporation tax changes is sensitive to when the calculation is carried out, not least because it is heavily dependent on forecast profits: corporation tax cuts are cheaper when profits are depressed.

However, £19.7 billion should also be seen as an upper bound on how much revenue will be foregone from rate cuts (or on how much could be raised by reversing them). This is because HMRC’s forecast cost of how much would be raised from a 1 percentage point rate rise embeds assumptions about how firms would respond to a tax increase. It is reasonable to expect that at higher tax rates an increase in the rate would lead to a larger reduction in investment and make it more likely that firms would move their activities offshore. These factors would mean that revenue gains would be lower as the tax rate increased.

It is also important to remember that, as highlighted above, official policy costings do not take account of the long run effect of tax rate changes. In the same way that we would expect rate cuts to be less costly in the medium to long run because lower rates boost investment, we would expect rate increases to be more expensive because they reduce investment which, over time, would translate into the UK having a smaller capital stock.

Long run cost of rate cuts may be substantially less depending on how the economy responds

Cutting corporation tax rates can cost less than official policy costings suggest if they lead to higher level of economic activity, including higher investment. Similarly, rate increases can raise less revenue in the long run if they depress economic activity. It is not possible to provide accurate estimates of how large these effects are likely to be. However, there is some evidence that the effects may be substantial.

In 2013, HMRC published a so-called ‘dynamic costing’ of cuts to the main rate and small profits rate announced up until at that point (not including changes to the tax base).[8] This aimed to capture more of the potential behavioural responses, including through changes in investment, and to consider the general equilibrium effects – that is, the effects on the rest of the economy, including through higher employment and consumption (and therefore higher income and indirect taxes) - when the distortions created by corporation tax are reduced. The resulting estimates suggest that within 20 years 45%–60% of lost corporation tax receipts would be recouped through higher receipts resulting from increased economic activity. If correct, then the actual cost of cuts to the corporation tax rate would be substantially below £16.5 billion in the medium to long run.

The HMRC analysis followed techniques developed in the academic literature and attempted to make reasonable assumptions. There is, however, necessarily a high degree of uncertainty around the precise estimates. This is because creating a policy cost that accounts for all effects, on all agents in the economy, is impossible and estimating an approximation to the full effects requires a number of modelling simplifications and assumptions (e.g. how responsive investment is to tax and the extent to which firms substitute between capital and labour). In practice, this is a difficult exercise and the models will be a very long way from being perfect.[9]

In addition, in any estimate of long run effects it will matter how the government makes up for the revenue short fall from rate cuts (or spends the revenue from rate increases). The decisions over whether to increase borrowing, or cut spending (and, if so, which spending to cut), or increase other taxes will also have dynamic effects that affect the size of the economy over the long run. The HMRC estimate makes no allowance for this.

In summary, we would expect that some of the revenue costs of rate cuts will be recaptured through higher investment, but we cannot say whether 45%-60% of receipts will be recouped or even how much confidence we should have around the figures. This could be an overestimate (underestimate) if, for example, investment is less (more) responsive to tax than assumed or if wages rise by less (more) than expected.

UK now has a competitive rate...

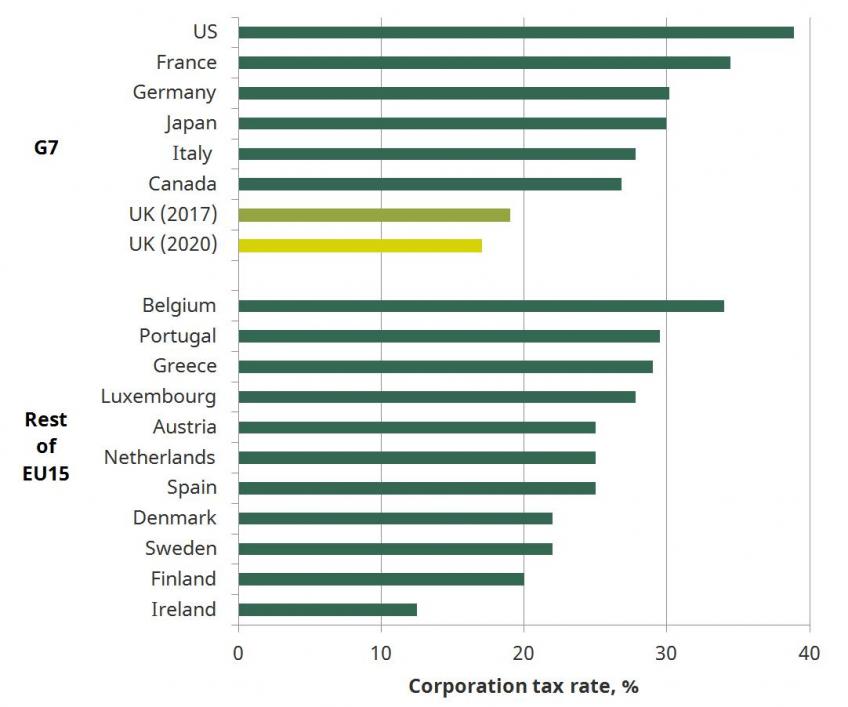

The UK now has the lowest headline corporation tax rate in the G7, and the second lowest rate in the EU15. Cuts to the main rate have made the UK corporation tax regime more competitive (Figure 4).

Figure 4: In 2017 the UK has an internationally low corporation tax rate

Note: Measure refers to the 2017 combined corporation income tax rate, including local taxes where relevant.

Source: OECD Tax Database, http://www.oecd.org/tax/tax-policy/tax-database.htm.

... but still has an uncompetitive base

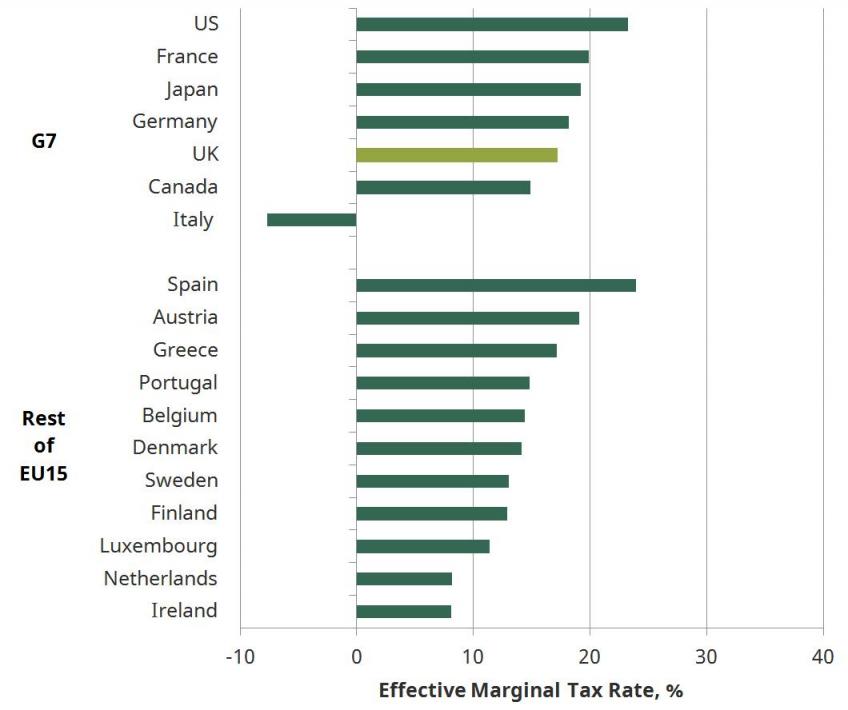

Compared with other countries, the UK has a much less competitive tax base, largely due to a particularly ungenerous set of capital allowances. That is, the UK allows a smaller share of capital expenditure to be deducted from revenues each year. The Annual Investment Allowance (AIA) is an exception to this – it allows 100% of most plant and machinery costs up to £200,000 to be deducted from revenues in year 1. Therefore, the UK base is uncompetitive for investments not covered by the AIA. This can be seen by comparing the Effective Marginal Tax Rate (EMTR) across countries (Figure 5). This measure shows the tax rate for an investment that just breaks even (meaning it just covers its investment costs) and incorporates the effect of capital allowances. The UK EMTR will fall when the rate is cut to 17% but remain above a number of EU countries.

Figure 5: In 2017 the UK has less competitive EMTR due to a less generous tax base

Note: Measure refers to the 2017 Effective Marginal Tax Rate. A negative EMTR for Italy – which arises from an Allowance for Corporate Equity that gives relief for the opportunity cost of equity finance – implies that marginal investments are subsidised by the Italian tax.

Source: CBT tax database http://www.sbs.ox.ac.uk/faculty-research/tax/publications/data. For discussion of method see http://www.sbs.ox.ac.uk/sites/default/files/Business_Taxation/Docs/Publications/Reports/cbt-tax-ranking-2012.pdf

Corporation tax is ultimately paid by people

Under current plans, corporation tax receipts are set to form a smaller, and possibly decreasing, proportion of receipts in the future. This is not necessarily a concern. It has long been recognised that corporate income taxes can distort incentives in a number of harmful ways, and they are thought to have a particularly damaging effect on economic growth.[10] Corporate tax is top of an OECD ranking of the most damaging types of tax.[11]

One concern may be over the distributional consequences of lower corporation taxes. Corporation tax can reduce the return to company shareholders (for example through lower dividends). This will affect not only individuals with direct holdings but also those with private pensions since most pension funds will be at least somewhat invested in UK corporate equities (i.e. shares). However, an important feature of corporation tax is that the ultimate burden is not necessarily entirely borne by company shareholders. It can be borne by workers. In short, if firms decide to respond to higher corporation tax rates by doing less investment in the UK, that leaves UK employees with fewer job opportunities and lower average wages. Evidence suggests that, because capital tends to be much more mobile than workers, a significant share of the burden of corporation tax tends to get shifted to labour.[12] Corporation tax can also be borne by consumers if firms respond by increasing the prices they charge. Overall, because of these factors, the distributional impact of a cut to corporation tax is not clear. In addition, what matters for welfare is the distributional consequences of the whole tax and benefit system, not any individual part of it.

Notes

[1] For discussion receipts post recession see H. Miller and T. Pope, "The changing composition of UK tax revenues", IFS Briefing note 182, 2016, www.ifs.org.uk/uploads/publications/bns/BN_182.pdf.

[2] For a discussion of financial sector receipts see H. Miller and T. Pope, ‘The changing composition of UK tax revenues’, IFS Briefing Note BN182, 2016, https://www.ifs.org.uk/uploads/publications/bns/BN_182.pdf.

[3] For a discussion of receipts in recent years see paragraphs 4.34 and 4.57 of Office for Budget Responsibility, Economic and Fiscal Outlook, March 2017 (http://budgetresponsibility.org.uk/efo/economic-fiscal-outlook-march-2017/) and paragraphs 4.56- 4.60 of Office for Budget Responsibility, Economic and Fiscal Outlook, November 2016http://budgetresponsibility.org.uk/efo/economic-and-fiscal-outlook-november-2016/.

[4] See H. Miller and T. Pope, ‘Corporate tax avoidance: tackling Base Erosion and Profit Shifting’ , in C. Emmerson, P. Johnson and R. Joyce (eds), The IFS Green Budget: February 2016, https://www.ifs.org.uk/uploads/gb/gb2016/gb2016ch8.pdf.

[5] See S. Johal and J. Sousa, ‘Anti-avoidance costings: an evaluation’, Office for Budget Responsibility, http://budgetresponsibility.org.uk/docs/dlm_uploads/Working-paper-No8-Anti_avoidance.pdf

[6] See www.gov.uk/government/statistics/direct-effects-of-illustrative-tax-changes.

[7] We assume that: the rate is increased from 17% to 20% for all companies (revenue: 3*£2.348bn= £7.0bn); a small profits rate is reintroduced at 21% (0.3712*£2.348bn*1= £0.95bn); the main rate is increased to 28% (0.6288*£2.348bn *8= £11.8bn). The share of revenue raised from the main rate (63%) vs the small profits rate (37%) is an estimate based on policy costs in the last two years in which both rates were in operation.

[8] HM Revenue & Customs and HM Treasury, ‘Analysis of the dynamic effects of corporation tax reductions’, 2013, https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/263560/4069_CT_Dynamic_effects_paper_20130312_IW_v2.pdf. The analysis is based on a computable general equilibrium model that embeds a number of assumptions. The analysis does not represent an official costing.

[9] A full discussion of the issues is provided by S. Adam and A. Bozio, ‘Dynamic scoring’, OECD Journal on Budgeting, 2009/2, http://www.ifs.org.uk/docs/dynamic_scoring.pdf.

[10] For discussions, see Y. Lee and R. H. Gordon, ‘Tax structure and economic growth’, Journal of Public Economics, 2005, 89, 1027–43 and A. Auerbach, M. Devereux and H. Simpson, ‘Taxing corporate income’, in J. Mirrlees, S. Adam, T. Besley, R. Blundell, S. Bond, R. Chote, M. Gammie, P. Johnson, G. Myles and J. Poterba (eds), Dimensions of Tax Design: The Mirrlees Review, OUP for IFS, Oxford, 2010, http://www.ifs.org.uk/publications/7184.

[11] Å. Johansson, C. Heady, J. Arnold, B. Brys and L. Vartia, Tax and Economic Growth, OECD ECO/WKP(2008) https://www.oecd.org/tax/tax-policy/41000592.pdf.

[12] For a review of work on incidence, A. Auerbach, ‘Who bears the corporate tax? A review of what we know’, in J. Poterba (ed.), Tax Policy and the Economy, Volume 20, National Bureau of Economic Research, Washington DC, 2006. Recent work suggests that capital may also bear a significant share of the burden; see K. Clausing, ‘Who pays the corporate tax in a global economy?’, National Tax Journal, 2013, 66(6), 151–84.

IFS Election 2017 analysis is being produced with funding from the Nuffield Foundation as part of its work to ensure public debate in the run-up to the general election is informed by independent and rigorous evidence. For more information, go to http://www.nuffieldfoundation.org.