Last month, the Chancellor set out additional funding for the National Health Service (NHS) in the Autumn Statement. This came alongside the promise of new recovery plans and targets for emergency care and primary care, a recommitment to the elective recovery plan, and a promise of a comprehensive workforce plan. These announcements come against a backdrop of continued operational pressure on all parts of the NHS, and high inflation putting pressure on NHS budgets and staff pay.

The Autumn Statement also came one week after NHS figures showed that the waiting list for treatment – commonly known as the ‘backlog’ – had risen to 7.1 million in September 2022, a total that has risen to 7.2 million in the month since. In the first part of this three-part series (Warner and Zaranko, 2022), we showed that the NHS is treating fewer patients from the waiting list than it was managing pre-pandemic, and that it is primarily for this reason that the backlog continues to grow.

In this report, the second part of the three-part series, we dig deeper into the resources available to the NHS and how they are being used, looking beyond just the waiting list. We first examine how the funding, staffing and hospital beds available to the NHS have changed since 2019. We then show how the number of patients treated by the NHS in eight different areas compares with 2019 levels. For most areas of care, the NHS is still struggling to treat more people than it was pre-pandemic, despite having – on the face of it – additional staff and funding. We therefore go on to consider a range of different factors that could explain this seeming fall in performance and output.

1. NHS funding

In the Autumn Statement on 17 November 2022, the Chancellor announced that NHS England would receive an additional £3.3 billion of funding in both 2023–24 and 2024–25, in recognition of the significant pressures facing the health service. This follows numerous funding top-ups in recent years to allow the NHS to meet the challenges of the COVID-19 pandemic (though top-ups to the NHS budget are very much the historic norm; see Zaranko, 2021).

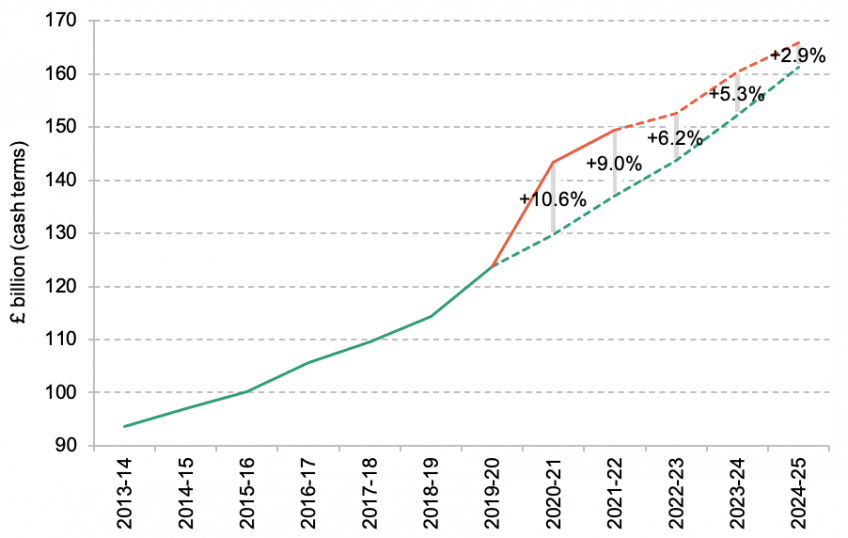

Figure 1 illustrates how the NHS budget has evolved compared to pre-pandemic plans, in cash terms (we return to the issue of inflation below). The key point is that following large top-ups since the onset of the pandemic (with spending in 2020–21 and 2021–22 turning out to be 10.6% and 9.0% higher than originally planned, respectively), the NHS budget is now converging back towards its pre-pandemic trajectory. By 2024–25, the NHS budget will be 2.9% higher than under pre-pandemic plans – and were it not for the £3.3 billion of additional funding announced in the Autumn Statement, that figure would have been less than 1%.

A 2.9% budget increase is substantial: it is equivalent to almost £5 billion extra. But the challenges and cost pressures facing the health service are also considerably greater than was anticipated before the COVID-19 pandemic.

The values presented in Figure 1 are in cash terms, without any adjustment for inflation. But higher-than-expected inflation has also eaten into the real-terms value (Zaranko, 2022a) and purchasing power of the NHS budget. Year-on-year comparisons are complicated by pandemic-induced oscillations in the GDP deflator (the measure of inflation typically used for such calculations) and COVID-19 funding. To assess what is happening to the NHS budget in real terms, it is more instructive to consider funding growth over the five-year parliament as a whole.

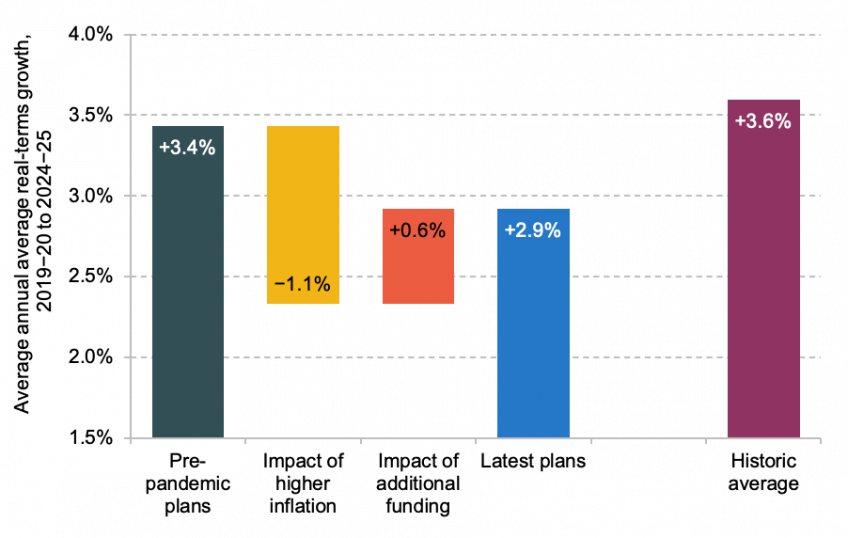

The leftmost bar in Figure 2 shows that under the pre-pandemic NHS funding plan, the budget was set to grow at an average real-terms rate of 3.4% per year between 2019–20 and 2024–25. On the basis of the latest inflation figures and forecasts, taken from the November 2022 Economic and Fiscal Outlook of the Office for Budget Responsibility (OBR, 2022), the average real-terms growth under those plans would be reduced by 1.1 percentage points to 2.3% (as shown by the second, yellow bar). This has been partly offset by additional funding, which increases average real-terms growth by 0.6 percentage points, to 2.9% per year (shown by the red and blue bars).

Figure 1. NHS England cash-terms resource (day-to-day) funding trajectory

Note: Values denote NHS England resource departmental expenditure limits, excluding depreciation.

Source: Out-turn figures for 2013–14 to 2019–20 are taken from Department of Health and Social Care (2021) and HM Treasury Public Expenditure Statistical Analysis 2022 (https://www.gov.uk/government /statistics/public-expenditure-statistical-analyses-2022). Pre-pandemic plans include additional funding for the increase in NHS employer pension contributions from 2019–20 onwards, and are calculated using Department of Health and Social Care (2018, 2019), OBR (2019) and HM Treasury Public Expenditure Statistical Analysis 2020 (https://www.gov.uk/government/statistics/public-expenditure-statistical-analyses-2020), assuming that funding growth in 2024–25 is equal to the average over the preceding five years. Latest plans are taken from HM Treasury Public Expenditure Statistical Analysis 2022 ((https://www.gov.uk/government/statistics/public-expenditure-statistical-analyses-2022) and the Autumn Statement 2022 (https://www.gov.uk/government/publications/autumn-statement-2022-documents).

The central conclusion of this analysis, then, is that looking across the parliament as a whole, the NHS has been allocated additional cash, but this has been sufficient to undo only around half of the real-terms hit from higher inflation. This is not to say that the NHS budget will be cut over the period: funding in 2022–23 is 11.1% higher than in 2019–20, and is set to rise to 15.5% above its pre-pandemic level by 2024–25 (equivalent to average growth of 2.9% per year for five years). But, the NHS will experience less real-terms budget growth, on average, than originally planned. It would require around £4 billion of additional funding in 2024–25 to undo the remainder of the real-terms hit to NHS spending plans (under the OBR’s latest inflation forecasts). One conclusion from this, and from historic experience (Zaranko, 2021), is that it would not be at all surprising if the NHS budget for 2024–25 were topped up again.

Figure 2. NHS England, average annual real-terms budget growth, 2019–20 to 2024–25

Note: Historic average refers to the average annual real-terms growth in UK-wide health spending between 1949–50 and 2019–20.

Source: Authors’ calculations using all sources for Figure 1, IFS TaxLab (https://ifs.org.uk/taxlab/taxlab-key-questions/what-does-government-spend-money) and GDP deflator forecasts as of March 2020 and November 2022.

There are two further points worth making on the question of funding. First, the analysis above uses the GDP deflator as its measure of inflation. The GDP deflator – the measure that underpins HM Treasury’s calculations – is a measure of economy-wide domestic inflation. A great deal of the inflation facing households stems from higher gas, fuel and food prices (Bank of England, 2022): all of which are largely imported to the UK and so excluded from a measure of domestic inflation. The fact that import prices are rising faster than export prices actually lowers the GDP deflator in the near term (Zaranko, 2022b). The OBR forecasts growth in the GDP deflator of 4.9% and 3.2% in 2022–23 and 2023–24, respectively, versus 10.1% and 5.5% for CPI inflation. It is likely that the GDP deflator understates the true cost pressures facing the NHS and other public services.

Second, real-terms budget growth of 2.9% per year (as under latest plans) is not just below what was originally planned, but also comfortably below the 3.6% historic average, as shown by the rightmost bar in Figure 2. This, though, must be seen in the present economic and fiscal context. The UK has suffered an adverse terms-of-trade shock, which makes us a poorer country. The resulting dire outlook for economic growth, alongside rising interest rates, creates a severe fiscal challenge and makes any given NHS funding increase more difficult to deliver.

2. NHS staffing

How many staff does the NHS have?

NHS funding matters not in its own right, but because it determines the quantity and quality of resources that the NHS can use to provide healthcare. One key input is staffing, which accounts for roughly half of the NHS budget: spending on staff in hospital and community health settings, which does not include GPs and other staff in primary care settings, amounted to 46.6% of total NHS spending in 2019–20 (Department of Health and Social Care, 2021).

Figure 3 shows how the number of NHS staff changed between 2019 and 2022, using the most recent data available (from a mixture of June and July 2022). The green bars show the percentage change in the number of full-time equivalent (FTE) staff for different clinical and non-clinical staff groups. Over the same period, however, rates of sickness absence (defined as the fraction of total staffing days lost to sickness absence) have also increased from 4.2% to 6.1% across the NHS as a whole, and are running well above the sickness absence rates observed pre-pandemic (which exceeded 5% in only one month between April 2009 and February 2020). This means that the same number of staff on paper likely translates into fewer staff on the ground. This is of particular concern for clinical staff. We therefore adjust for changes in rates of sickness absence, with these adjustments shown by the yellow bars. A negative yellow bar indicates that sickness absence rates were higher in July 2022 than in July 2019, which implies lower levels of ‘effective’ FTE staffing. The black diamonds show the net staffing – that is, the total increase in FTE staffing after adjusting for the effects of changes in sickness absences.

Starting first with secondary (hospital) care on the left, the past three years have seen large increases in the employment of consultants, junior doctors, nurses and health visitors, and support to clinical staff (the green bars). For example, there were 10.2% more consultants in July 2022 than in July 2019, and 10.7% more nurses and health visitors. The 10.7% increase in the number of nurses and health visitors over the past three years is particularly striking, given that the equivalent increase over the nine years between July 2010 and July 2019 was just 3.0%.

Sickness absence rates for these groups have also increased, as shown by the negative yellow bars. For example, the consultant sickness absence rate has risen from 1.3% in July 2019 to 2.1% in July 2021, while the nurse and health visitor absence rate has risen from 4.5% to 6.6%. However, as the figure shows, these increases in sickness absences reduce staffing levels by far less than the increase in total employment. For example, for nurses and health visitors, there are 10.7% more FTE staff now employed, only partially offset by a 2.5% increase in staffing lost to sickness absences, meaning an 8.2% increase in ‘effective’ staffing levels of nurses and health visitors. A similar pattern can be seen for consultants (9.2% increase in ‘effective’ staffing), junior doctors (15.3%) and clinical support staff (9.7%). In other words, a greater number of staffing days are being lost to sickness, but nowhere enough to offset the increase in overall staffing numbers.

The next set of bars in Figure 3 shows the change in the number of managers working within secondary care. Unlike clinical staff, sickness absence rates for these groups have remained more or less flat. There were around 14.5% more senior managers in July 2022 than in July 2019, but 0.3% fewer mid-level managers (junior managers and supervisors are not included in these groups, nor are clinical staff with management roles). This equates to a 4.4% increase in managers as a whole – a considerably lower rate of growth than that seen for clinical staff. As we discuss below, it could be that a shortage of managers could be contributing to weak NHS performance.

Finally, we consider changes in the primary care workforce. There are no available absence data for primary care staff, and so we only consider the change in FTE employment (the green bars). There were 1.9% fewer GPs in June 2022 compared with June 2019, and 2.0% more primary care nurses. The difference between GPs and consultants is large, but consistent with a long-run trend of increasing numbers of hospital consultants alongside falling or flat-lining numbers of GPs (Warner and Zaranko, 2021).

Has the composition of NHS staffing changed?

One concern may be that although the NHS has more staff overall, it may have lost more experienced or skilled members of staff, which could have an adverse impact on the productivity of its workforce. There are very limited public data on the composition of the NHS workforce, which means we cannot conclusively determine whether this has occurred. But there are several pieces of evidence that all suggest a similar pattern: that the numbers of highest and lowest paid staff are growing faster than those in the middle.

Figure 4 shows how the number of staff employed on each Agenda for Change (AfC) band has changed over time. AfC is the contract that most NHS staff, excluding doctors, are employed on. The data are imperfect: the AfC pay-band does not fully capture seniority or experience, and the data have been published as headcounts rather than FTEs at irregular intervals. But this analysis nonetheless provides some indication of how the staffing mix within the NHS has changed. The bars show how headcount changed between March 2019 and December 2021 for each staffing band.

Bands 5 and 6 include many qualified clinical professionals, including registered nurses and paramedics. Bands 4 and below include healthcare assistants, housekeeping assistants and porters, while bands 7 and above include senior nurses, practitioners and non-clinical managers. The figure shows that the number of staff on bands 5 and 6 (in the middle) has grown more slowly than staff in lower (left-hand side) and higher (right-hand side) bands. This is consistent with Figure 3, which shows that the number of senior managers grew much faster than the number of mid-level managers, and that the number of clinical support staff grew somewhat faster than the number of nurses and health visitors.

Moreover, we find a similar pattern when looking at a different set of staffing definitions. The number of senior adult and general nurses (FTE nurse consultants, modern matrons, and nurse managers) rose by 20% between July 2019 and July 2022. This compares with a 14% increase for more junior adult and general nurses.

Taken together, this suggests that the NHS might be struggling to recruit or retain mid-level staff, including registered nurses and managers – or potentially that staff in such roles are being promoted more quickly than they are being replaced. These groups are likely to be particularly important for the day-to-day delivery of care. However, without more detailed staffing data, it is difficult to draw strong conclusions about changes in the experience and skill of the NHS workforce and what this might mean for productivity.

Are NHS staff working fewer hours?

Another concern might be that the same number of staff on paper now translates into less patient care than would have been the case previously, because each full-time member of staff now works less (paid or unpaid) overtime. There are some signs in the national data consistent with such a story. For consultants, pay for additional work represented 15.5% of basic pay between July 2018 and June 2019. Between July 2021 and June 2022, this fell to 15.0%, indicating that consultants are providing slightly less paid overtime than before the pandemic. But, the same data suggest that junior doctors are providing slightly more overtime (payment for additional work rose from 10.3% to 11.0% of basic pay). These are both relatively small changes and not sufficient to offset the much larger increases in overall staffing numbers.

Making a more complete or comprehensive assessment is hampered by data limitations. We are not able to examine changes in overtime or bank work for nurses, nor are we able to observe changes in unpaid or unofficial overtime (which are by their very nature not recorded in payroll systems). But, on the basis of what data are available, there are no clear signs of major changes in hours of work (at least among doctors).

More staff does not necessarily mean ‘enough’

From the above, we can conclude that for most staff groups, the NHS has substantially more staff in 2022 than it did in 2019. This has not been offset by higher sickness absences. Two exceptions are GPs and mid-level managers, for which the NHS has fewer in 2022 than in 2019.

However, this does not necessarily mean that the NHS has enough staff. As we will discuss later, it may be that in a post-pandemic world, the NHS needs more staff to deliver the same quantity of care. Fatigued NHS staff could be less willing to take on overtime shifts, or the unofficial, unpaid work that previously plugged gaps in staffing rotas. And it may be that the NHS was under-staffed prior to the pandemic, and so the large increase in staffing since 2019 might still not be ‘enough’.

It is very hard to estimate how many staff the NHS ‘needs’, particularly as this depends on political decisions about the quantity and quality of services that the NHS should provide. One (imperfect) proxy for the NHS’s own assessment of staffing need is the reported number of vacancies. According to NHS Digital, the overall number of vacancies in the third quarter of 2022 was 26.2% (27,680) higher than in the third quarter of 2019. Within that, the number of nursing vacancies was 9.3% (4,044) higher, and the number of medical (doctor) vacancies 2.1% (194) lower. These are experimental statistics that should be treated and interpreted with caution, but they suggest that rising staffing numbers have not been sufficient to keep pace with the NHS’s own assessment of staffing ‘need’, especially for nurses and non-clinical staff.

3. NHS equipment and capital

How has the number of hospital beds changed over time?

Staffing is, of course, not the only input that matters. Another important input for the NHS is the equipment and capital those staff use to provide treatment. One particularly important example is the number of hospital beds and, by extension, the capacity of NHS hospitals to treat patients. Figure 5 shows how the number of available overnight hospital beds has changed between 2016 and 2022 (note that a bed must be staffed in order to be counted). The solid green line shows the total number of available beds, while the yellow, orange and blue lines show the number of general and acute, maternity and mental illness beds, respectively.

The number of each type of hospital bed was on a slight downward trend prior to the start of the pandemic (as part of a longer-run downward trend, driven in part by reductions in the average length of hospital stays; Ewbank, Thompson and McKenna, 2017). Then at the beginning of the pandemic, there was a large reduction in available general and acute beds as hospitals reorganised their services and implemented infection control measures. The number of hospital beds has since started to increase again, and the NHS now has almost exactly the same number of total beds as in 2019.

However, unlike in 2019, many of these beds are occupied by COVID-19 patients. Figure 6 shows the number of COVID-19 patients in hospital since 2020. In 2022, there was an average of about 9,400 COVID-19 patients in hospital per day (about 7% of the total number of available beds), compared to about 7,700 per day in 2021. This is notable, as at the point when NHS budgets were set in the autumn of 2021, it was widely expected – or hoped – that the severity of the COVID-19 pandemic, and the associated burden on hospitals, would lessen rather than worsen over time following the successful vaccination campaign. Of course, some of those patients were in hospital and had tested positive for COVID-19, but were there primarily to be treated for something else. In the third quarter of 2022, a little more than one-third (35%) of these patients were in hospital primarily for COVID-19 (a fraction that has fallen substantially over time).

The presence of these COVID-19 patients in hospital reduces the number of beds available for routine patients who do not have COVID-19. To adjust for this, the dashed green line in Figure 5 shows the total number of available hospital beds after subtracting those that are occupied by all COVID-19 patients. The dotted green line shows the total number of available hospital beds after subtracting those that are occupied by patients in hospital primarily for COVID-19. Although the total number of hospital beds has increased to 1% above pre-pandemic levels, the number of beds available for non-COVID-19 patients was still lower in the third quarter of 2022 than pre-pandemic levels: 1% lower if we adjust only for beds occupied by patients primarily being treated for COVID-19, and 5% lower if we adjust for all beds occupied by patients testing positive for COVID-19.

How has the maintenance backlog changed over time?

Hospital beds are just one aspect of the NHS’s physical capital and equipment. It could also be that the quality or condition of the NHS estate has deteriorated and that this is having an adverse impact on service performance. One way to examine this is to look at the size of the estimated maintenance backlog: the estimated cost of the work required to restore parts of the NHS estate to a ‘suitable condition’. This does not include routine maintenance work, but only work that should have previously been done. Figure 7 shows how the estimated cost to clear the maintenance backlog has changed since 2010.

The figure shows that the maintenance backlog has been growing for a number of years. This represents a failure to invest adequately in hospital infrastructure, as well as a tendency to use capital funding to cover shortfalls in day-to-day funding in the 2010s. The total cost of the backlog has continued to rise during the pandemic, and the estimated cost to eradicate it fully stood at £10.2 billion in 2021–22. This is 7% higher in real terms than in 2019–20, and double the 2010–11 level. Most concerning is the rise in the high-risk maintenance backlog (‘where repairs/replacement must be addressed with urgent priority in order to prevent catastrophic failure, major disruption to clinical services or deficiencies in safety liable to cause serious injury and/or prosecution’), which now stands at £1.8 billion and is 13% higher in real terms than in 2019–20 and 355% higher than in 2010–11.

There are signs, then, that the condition of the NHS estate has deteriorated somewhat since the onset of the pandemic, as part of a gradual deterioration since around 2013.

4. How many patients is the NHS treating?

We now consider how many patients the NHS has treated this year compared with 2019. In our previous work (Warner and Zaranko, 2022), we focused on the number of patients being treated from the waiting list for elective treatment. However, this is only one part of NHS activity, and so in this section we look more broadly at the different types of care that the NHS delivers.

Figure 8 shows how the number of patients treated by the NHS has changed between 2019 and 2022. For each type of care, the green bars show how patient volumes in 2022 so far compare with the same period in 2019, while the yellow bars show how the volumes of patients treated in the latest month of data compare with the same month in 2019.

For five of the eight care types in Figure 8, the NHS is treating substantially fewer patients than it was in 2019. Focusing on the latest month of data, there were 13.8% fewer outpatient appointments, 13.8% fewer emergency admissions (despite this including COVID-19 admissions), and 11.1% fewer elective and maternity admissions than in 2019. Because many elective admissions and outpatient appointments are for patients on the waiting list for care, the number of patients treated from the waiting list was also down 10.5% compared with the same month in 2019. There were also 9.5% fewer incidents recorded by ambulance services (and 19.1% fewer conveyances to A&E, despite 4.1% more 999 calls – which, in part, reflects a deliberate effort to treat more people outside of hospitals).

For the other three care types, volumes were at or above their 2019 levels. The number of A&E arrivals in November was 1% above its pre-pandemic level, and the NHS carried out substantially more GP appointments (4.0% more in the latest month of 2022 data compared with the same month in 2019) and first cancer outpatient appointments (8.6% more). The increase in GP appointments is particularly striking, as the number of GPs has fallen (Figure 3) while the number of hospital staff has increased.

Across almost all of these services, the volume of patients treated (relative to 2019 volumes) was substantially lower in the latest month of data than in 2022 overall, and lower than in the previous month. This suggests that NHS performance relative to 2019 levels has particularly declined in October and November of this year. But the story holds true across the year as a whole: for six of the eight types of care we have considered, the total number of patients treated for the whole of 2022 was still below 2019 levels.

Taken together, the evidence suggests that the NHS is clearly struggling to increase treatment volumes above 2019 levels for many types of care. GP appointments and first cancer appointments are important exceptions, but for almost all of the other categories examined here, the NHS is delivering substantially less care than it was before the pandemic. And, this exercise almost certainly understates the actual pandemic impact on treatment volumes, because we would in normal times have expected treatment volumes to grow as the population grew larger and older. For example, the number of patients treated from the waiting list in 2019 was 8.4% higher than in 2016, equivalent to 2.7% annual growth in treatment volumes. The NHS is treating fewer patients than it was in 2019, but even fewer than we would have expected it to be treating had the pandemic not occurred.

5. What’s going on?

What can we take from all of the above? From the outside, it seems clear that the NHS is struggling and that there is no simple, one-size-fits-all explanation or solution. Our analysis suggests that while funding and staffing levels are higher than in the past, the number of beds available for non-COVID-19 treatment is not. Staff undoubtedly feel stretched. But it is not obvious that (somehow) adding more staff or money would immediately unclog the system. There are several other factors that could be hampering efforts to increase treatment volumes. We examine a number of these below and, where possible, try to examine whether they are supported by the data.

Hospital beds

Perhaps the simplest explanation for lower patient volumes is that the NHS just doesn’t have enough hospital beds. Figure 6 showed that there were fewer beds available for non-COVID-19 care in the third quarter of 2022 than there were pre-pandemic. A bed needs to be staffed in order to be counted, and so it could be that staffing shortages are putting hospital beds out of action. But the data do not seem to support this: we showed earlier that staffing levels in hospitals have substantially increased (Figure 4). This would instead seem to point to physical beds as the limiting factor, which could explain why hospital admissions have seen some of the largest reduction in treatment volumes (Figure 8), despite much higher hospital staff numbers.

If physical beds are indeed the constraint, it is not clear that increasing the number of NHS staff would, by itself, solve the problem. It might allow some additional beds to be staffed, and might help relieve some of the pressure on existing staff, but it could prove insufficient to improve the flow of patients through the system and increase overall treatment capacity. The clear challenge posed by this is that increasing the number of beds in the NHS would require considerable time and capital investment.

It is also clear, though, that the number of hospital beds is far from the only explanation. Fewer beds would not alone explain why hospitals are also providing fewer outpatient appointments, which do not require a bed (Figure 8). If anything, if beds were the only constraint, we would expect the NHS to be delivering more care that does not require hospital beds, not less, as it has more hospital staff (Figure 4). Yet the number of new non-admitted treatment pathways from the waiting list is still lagging pre-pandemic levels.

Problems discharging patients

It could also be that the beds the NHS does have are being used less efficiently, and that bottlenecks in the system are harming the productivity with which those beds are used. One such problem that has been highlighted is difficulty in discharging patients. If medically fit patients cannot be discharged, they require ongoing monitoring (which requires staffing time), and their beds cannot be used to treat other patients.

There are some clear signals in the data that NHS hospitals are struggling to discharge patients. Figures 9 and 10 show the numbers of patients in hospital for longer than 7 and 21 days compared with previous winters. In both cases, the number of long-stayers in hospital is much higher in November this year than at the worst point of any of the last five winters. (Rising length of stay more generally could also be a result of patients being sicker on average – something to which we return below.) And, although there are concerns about the quality of delayed discharge data (Discombe, 2022), the latest data suggest that 40% of those still in hospital for more than 21 days are medically ready to be discharged, compared to 34% at the same point last year.

Part of the explanation for this could lie in the adult social care sector. Data from Skills for Care (2022) suggest that the size of the adult social care workforce in England shrank in 2021–22 for the first time in at least nine years. This was not due to a reduction in demand for social care staff: the number of total posts increased, but fewer were filled, with the number of vacant posts increasing by 52% between 2020–21 and 2021–22. This strongly suggests that the size of the workforce has not kept pace with rising demand, and this could feasibly make it more difficult to discharge patients with a social care need. However, it remains an open debate (Flinders and Scobie, 2022) the extent to which issues in adult social care are driving problems with hospital discharge, rather than challenges posed by a tight labour market more generally (such as limited availability of workers to fit stairlifts) or issues within the NHS itself (Discombe, 2022).

Patient severity

Another potential explanation is that patients are, on average, sicker than they were in 2019 – something that would not be captured by a simple focus on the overall volumes of treatment. This could mean that it now takes more resources to treat the same number of patients, who each require more expensive, more complicated, or lengthier treatment. Therefore, even if the NHS is treating fewer patients, it may still be delivering just as much care as it was pre-pandemic.

There is evidence that wider population health has declined since the start of the pandemic. For example, recent IFS analysis has shown that the number of new disability benefit claimants has doubled between July 2021 and July 2022 (Joyce, Ray-Chaudhuri and Waters, 2022). Similarly, there has been a substantial rise in health-related economic inactivity (Boileau and Cribb, 2022; Institute for Employment Studies, 2022).

But without detailed hospital data, it is hard to know whether patient severity has increased sufficiently to explain the apparent reduction in NHS output and performance. An increase in the number of patients with a long hospital stay could be indicative of patients being sicker on average – but could instead be the result of delayed discharges. The fraction of patients treated from the waiting list who required an admission to hospital (a crude measure for the complexity of treatment) is, if anything, lower than pre-pandemic. There is some evidence for changing patient severity in the types of patients arriving at A&E departments. In late November 2022, the number of arrivals with acute respiratory infections, influenza-like illnesses and gastroenteritis were all above their expected levels. Equally, however, the number of patients arriving with cardiac conditions were below their expected levels. We are unable to reach a definitive judgement with the (public) data available.

Staff productivity

Managers

The whole system could also be functioning less effectively because of insufficient or ineffective management. To simplify enormously, managers can improve productivity by taking on operational tasks, leaving clinical staff to focus on treating patients: their comparative advantage. Managers, in turn, can stick to what should be their comparative advantage: planning staffing schedules, for instance, or scheduling operating theatre use. Although the number of managers within the hospital sector has grown since 2019, it has grown more slowly than the number of clinical staff. And although cross-country comparisons are difficult, the available evidence suggests that, before the pandemic, the UK spent less on the governance and financial administration of its healthcare system than many OECD countries (though this of course reflects many differences between health systems); see Office for National Statistics (2019). The quality of management, as well as the quantity of managers, also matters: hospitals with more effective management practices have been shown to provide higher-quality clinical care (Tsai et al., 2015).

Summary

Overall, it is likely that all these factors are playing at least some role in reducing the amount of care the NHS is able to deliver with the resources available. However, we have insufficient data even to attempt to decompose their relative importance. To improve NHS productivity in the coming years, it is necessary to know what the largest actual underlying problems are, and not just those that that are the most salient. NHS resources can then be focused on the improvements that will make the most difference.

6. Conclusion

The NHS is struggling to treat more patients than it was before the pandemic. It is carrying out more GP appointments and first cancer appointments, and is obviously treating more COVID-19 patients, but it is managing lower treatment volumes for many other types of care, despite having a greater number of staff and more funding than pre-pandemic. This is a puzzle, and a concerning one, without a simple explanation.

The available evidence points, in our view, to a myriad of contributing, interacting factors. Perhaps most important among these is the fact there are fewer hospital beds available for non-COVID-19 patients than pre-pandemic. On top of this, the NHS is finding it increasingly difficult to discharge patients into the community or social care, which further clogs up the system and acts as a drain on staff resources. The NHS now employs greater numbers of (hospital) staff, but higher rates of sickness mean that a non-trivial portion of these is effectively lost: higher levels of staffing on paper do not translate in full into higher levels of staffing on the ground. It could also be that a larger workforce is now needed to deliver the same amount of care, if staff productivity is significantly hindered by ongoing infection control measures and pandemic-induced fatigue. It is likely that some patients who missed out on care during the pandemic are now presenting in a more complex, difficult-to-treat condition, and there are signs that population health has deteriorated more generally.

More generally, the risk is that rather than imposing a one-off, time-limited shock to the healthcare system, the COVID-19 pandemic has dealt a more lasting adverse hit to NHS performance. This is not inevitable: it is possible that in the coming months and years the NHS will successfully ramp up treatment volumes and deliver on its various plans and ambitions. But if the changes brought about by the pandemic do mean a permanent hit to the performance of the health service, this has important consequences for the NHS and beyond.

It could be that in a post-pandemic world, the NHS is able to treat fewer patients with a given level of resources than it could in the past. At the same time, the UK has suffered an adverse economic shock that makes us poorer as a country (Nabarro, 2022). A weaker outlook for the economy, combined with higher levels of debt interest spending (Emmerson, 2022), means that providing a given level of public service funding will require higher taxes. In other words, any given increase in NHS funding is now more difficult to achieve – and lasting COVID-19 impacts mean that we might have to expect to get less healthcare from that funding. This would raise extremely difficult fiscal questions.

There are some reasons to be hopeful. The NHS is delivering more GP appointments than it was pre-pandemic (despite having fewer GPs) and is delivering substantially more first cancer outpatient appointments. The numbers of ‘long waiters’ – those on the waiting list for more than two years – has come down extremely quickly. In the final part of this three-part series, we will examine in more detail the successes of the NHS in the last year, and what lessons we might draw from them.

References

Bank of England, 2022. Monetary Policy Report - November 2022, https://www.bankofengland.co.uk/monetary-policy-report/2022/november-2022.

Boileau, B. and Cribb, J, 2022. Is worsening health leading to more older workers quitting work, driving up rates of economic inactivity? Institute for Fiscal Studies (IFS), Comment, https://ifs.org.uk/articles/worsening-health-leading-more-older-workers-quitting-work-driving-rates-economic.

Department of Health and Social Care, 2018. Prime Minister sets out 5-year NHS funding plan, https://www.gov.uk/government/news/prime-minister-sets-out-5-year-nhs-funding-plan.

Department of Health and Social Care, 2019. DHSC annual report and accounts: 2018 to 2019, https://www.gov.uk/government/publications/dhsc-annual-report-and-accounts-2018-to-2019.

Department of Health and Social Care, 2021. The Department of Health and Social Care's written evidence to the NHS Pay Review Body (NHSPRB) for the 2021/22 Pay Round, https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/966702/DHSC-written-evidence-to-the-NHSPRB-2021-to-2022.pdf.

Discombe, M., 2022. Former NHSE chief: ‘Most hospital discharge data is useless’. HSJ article, https://www.hsj.co.uk/quality-and-performance/former-nhse-chief-most-hospital-discharge-data-is-useless/7033794.article.

Emmerson, C., 2022. Outlook for the public finances, Institute for Fiscal Studies (IFS), https://ifs.org.uk/sites/default/files/2022-11/Outlook-for-the-public-finances-Carl-Emmerson.pdf.

Ewbank, L., Thompson, J. and McKenna, H., 2017. NHS hospital bed numbers: past, present, future. The King’s Fund report, https://www.kingsfund.org.uk/publications/nhs-hospital-bed-numbers.

Flinders, S. and Scobie, S., 2022. Hospitals at capacity: understanding delays in patient discharge. QualityWatch blog, https://www.nuffieldtrust.org.uk/news-item/hospitals-at-capacity-understanding-delays-in-patient-discharge.

Institute for Employment Studies, 2022. Labour Market Statistics, October 2022, https://www.employment-studies.co.uk/system/files/resources/files/IES%20briefing%20-%20Labour%20Market%20Statistics%20October%202022.pdf.

Joyce, R., Ray-Chaudhuri, S. and Waters, T, 2022. The number of new disability benefit claimants has doubled in a year. Institute for Fiscal Studies (IFS), https://ifs.org.uk/publications/number-new-disability-benefit-claimants-has-doubled-year.

Nabarro, B., 2022. Chapter 2: UK outlook: why we need to do things differently. In C. Emmerson, P. Johnson and B. Zaranko (eds), IFS Green Budget, London: Institute for Fiscal Studies (IFS), https://ifs.org.uk/publications/uk-outlook-why-we-need-to-do-things-differently.

OBR, 2019. Economic and fiscal outlook – March 2019, https://obr.uk/efo/economic-fiscal-outlook-march-2019/.

OBR, 2022. Economic and fiscal outlook – November 2022, https://obr.uk/efo/economic-and-fiscal-outlook-november-2022/.

Office for National Statistics, 2019. How does UK healthcare spending compare with other countries? 5. How is healthcare funded?, https://www.ons.gov.uk/peoplepopulationandcommunity/healthandsocialcare/healthcaresystem/articles/howdoesukhealthcarespendingcomparewithothercountries/2019-08-29#how-is-healthcare-funded.

Skills for Care, 2022. The state of the adult social care sector and workforce 2022. Skills for Care report, https://www.skillsforcare.org.uk/Adult-Social-Care-Workforce-Data/Workforce-intelligence/documents/State-of-the-adult-social-care-sector/The-state-of-the-adult-social-care-sector-and-workforce-2022.pdf.

Tsai, T. C., Jha, A. K., Gawande, A. A., Huckman, R. S., Bloom, N. and Sadun, R., 2015. Hospital board and management practices are strongly related to hospital performance on clinical quality metrics. Health Affairs, 34, 1304–11, https://doi.org/10.1377/hlthaff.2014.1282.

Warner, M. and Zaranko, B, 2021. Chapter 6: Pressures on the NHS. In C. Emmerson, P. Johnson and B. Zaranko (eds), IFS Green Budget, London: Institute for Fiscal Studies (IFS), 231–94, https://ifs.org.uk/books/pressures-nhs.

Warner, M. and Zaranko, B, 2022. The NHS needs to ramp up treatment volumes if waiting lists are to start falling any time soon. Institute for Fiscal Studies (IFS), Comment, https://ifs.org.uk/articles/nhs-needs-ramp-treatment-volumes-if-waiting-lists-are-start-falling-any-time-soon.

Zaranko, B, 2021. An ever-growing NHS budget could swallow up all of this week’s tax rise, leaving little for social care. Institute for Fiscal Studies (IFS), Comment, https://ifs.org.uk/articles/ever-growing-nhs-budget-could-swallow-all-weeks-tax-rise-leaving-little-social-care.

Zaranko, B, 2022a. The inflation squeeze on public services. Institute for Fiscal Studies (IFS), Comment, https://ifs.org.uk/articles/inflation-squeeze-public-services.