Next week, Shona Robison, the Scottish Finance Minister, will deliver her 2024–25 Budget in one of the most financially challenging environments the Scottish Government has faced since devolution. Earlier this year, the Scottish Government’s Medium-Term Financial Strategy (MTFS) projected a gap between funding and what would be needed to maintain services of £1 billion in the coming year – and argued that there was a need to consider whether targeting help rather than universal provision ‘may offer greater value for money and an improved offer to those most in need’. And while better-than-expected tax revenue collections, a revised Fiscal Framework and additional funding from the UK government have boosted the funding the Scottish Government is set to receive next year, larger-than-planned increases in public sector pay and still-elevated inflation mean the funding gap next year is likely to be even larger than projected in the MTFS. Moreover, financial pressures are only set to intensify in the second half of the 2020s and beyond.

One area where Scotland’s public service provision has long appeared more generous than that in England and Wales is higher education, with students who choose to stay in Scotland for university not required to pay any tuition fees. Instead, the costs of their teaching are all met by the Scottish Government, at a cost of around £900 million in 2022–23. In addition, Scotland still provides the poorest students with non-repayable bursaries of up to £2,000 per year towards their living costs, alongside loans.

Preserving this model will be increasingly difficult given the financial pressures facing the Scottish Government as well as Scottish universities and students.

Tuition is free for students, but Scottish universities receive less funding per student and face caps on numbers

The costs of providing student loans to Scottish students – for their living costs, as well as their tuition fees if they study elsewhere in the UK – are met by the UK government, and fall outside of the Scottish Government’s main budget. But under the current system, it does cover the full costs of tuition for Scottish undergraduates who study in Scotland. The Scottish Government controls these tuition costs in two ways: through control of per-student funding and by restricting the number of funded places.

The majority of funding is provided through the ‘main teaching grant’, which was worth around £5,790 per student in 2023–24. Universities also charge Scottish students a notional ‘tuition fee’, which is paid by the Scottish Government on their behalf. This has been frozen in cash terms at £1,820 per year since 2009–10.

Together, this means Scottish universities received direct public funding of £7,610 for each Scottish student this academic year. This is around 19% less in real terms than in 2013–14, as a result of the freeze in the ‘tuition fee’ and below-inflation rises in per-student teaching grants.

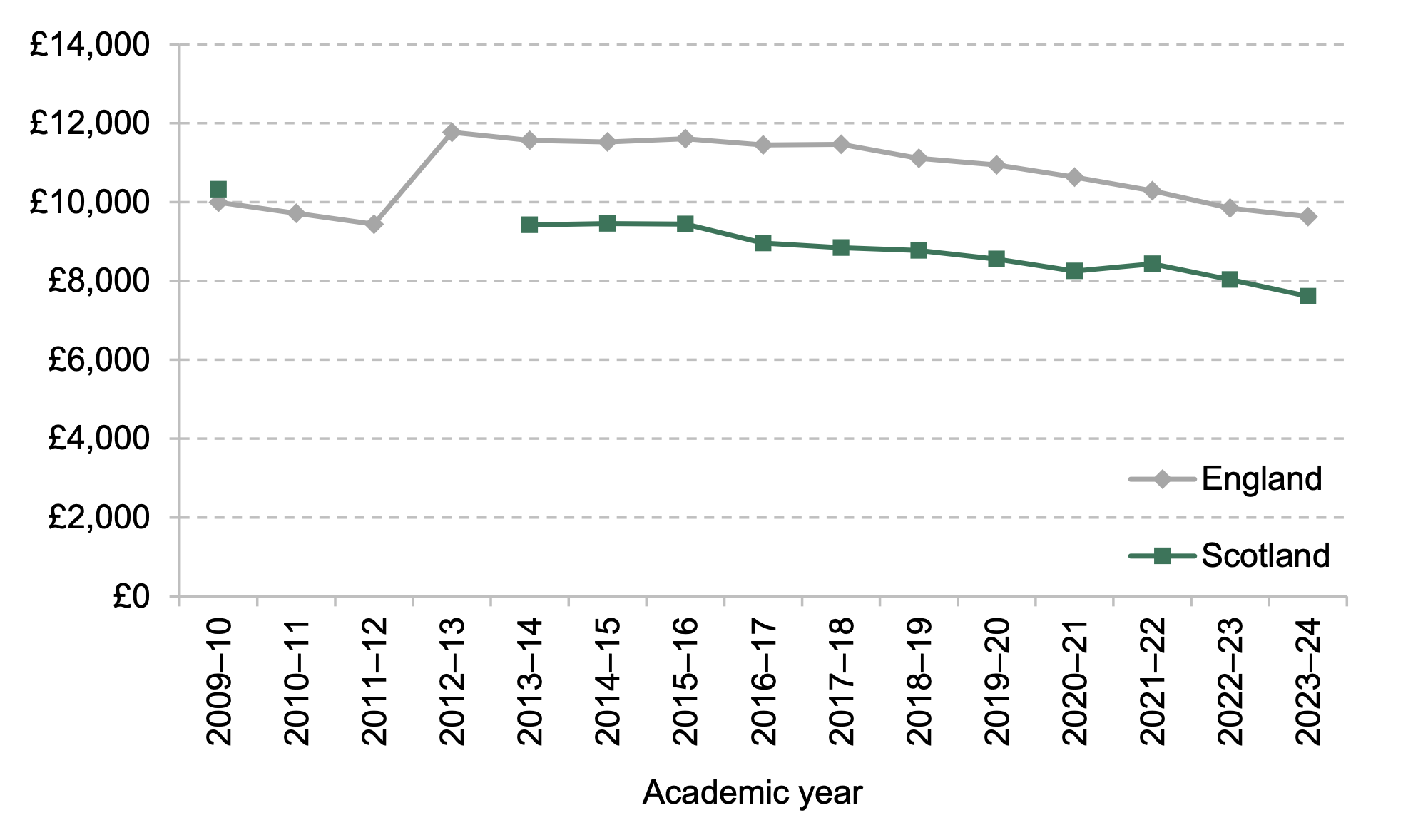

This is also around £2,020 (21%) lower than the resources available for an English university teaching an England-domiciled undergraduate in 2023–24. As shown in Figure 1, resources for undergraduate teaching were very similar north and south of the border in 2009–10, before the increase in tuition fees charged by English universities from 2012–13 injected additional funding for English students. Since then, the trends – a gradual erosion of resources, with fees frozen and below-inflation increases in grants – have been very similar.

Figure 1. Up-front per-student resources for teaching home undergraduates per year of study, 2023–24 prices

Note: Tuition fee for ‘home fee’ full-time first-degree student from the Student Awards Agency Scotland (SAAS), plus main teaching grant divided by the number of ‘funded’ places. Data not available for years 2010–11 to 2012–13. Real-terms figures based on financial year GDP deflator.

Source: Scottish Funding Council’s final funding allocations (various years); Drayton et al. (2023).

This is in stark contrast to trends in spending on school pupils. Sibieta (2023) estimated that in 2022–23, school spending in Scotland was over £8,500 per pupil, around 20% more in real terms than per-pupil spending in Scotland in 2013–14, and £1,300 more than per-pupil school spending in England, the inverse of what we see for higher education. Indeed, Scotland spends around £1,000 more per year teaching school-aged pupils than it does on teaching undergraduates. The university figures are per year of study, and undergraduate degrees are typically longer in Scotland (four years instead of three), so total funding for teaching a Scottish undergraduate over their whole course is likely to be around 5% higher than funding for teaching an English undergraduate.

Another key aspect of the current funding system for university finances is the operation of what are effectively caps on the number of Scotland-domiciled students Scottish universities can recruit. The Scottish Funding Council allocates each university a number of ‘funded places’ for eligible Scottish students, which attract funding from the main teaching grant. They are able to recruit up to 10% above this number, receiving only around a quarter of the average per-student funding for them, and then face financial penalties for recruitment beyond this. No such caps exist south of the border.

In contrast, universities in Scotland can charge students from the rest of the UK (rUK) tuition fees of up to £9,250 per year, and international students much more, and face no caps on numbers. At the margin, they receive much more funding for teaching an additional rUK or international student than an additional Scottish student. This means Scottish universities have a financial incentive to expand provision, but not for Scottish students.

Scottish students graduate with less debt, but are entitled to less support with their living costs

Despite studying for longer, Scottish students graduate with far lower student loan balances on average than their English counterparts (£15,430 in 2022–23, compared with £44,940). This is largely due to free tuition; the 96% who study in Scotland face no tuition costs, whereas most English students would borrow around £28,000 for three years of tuition fees.

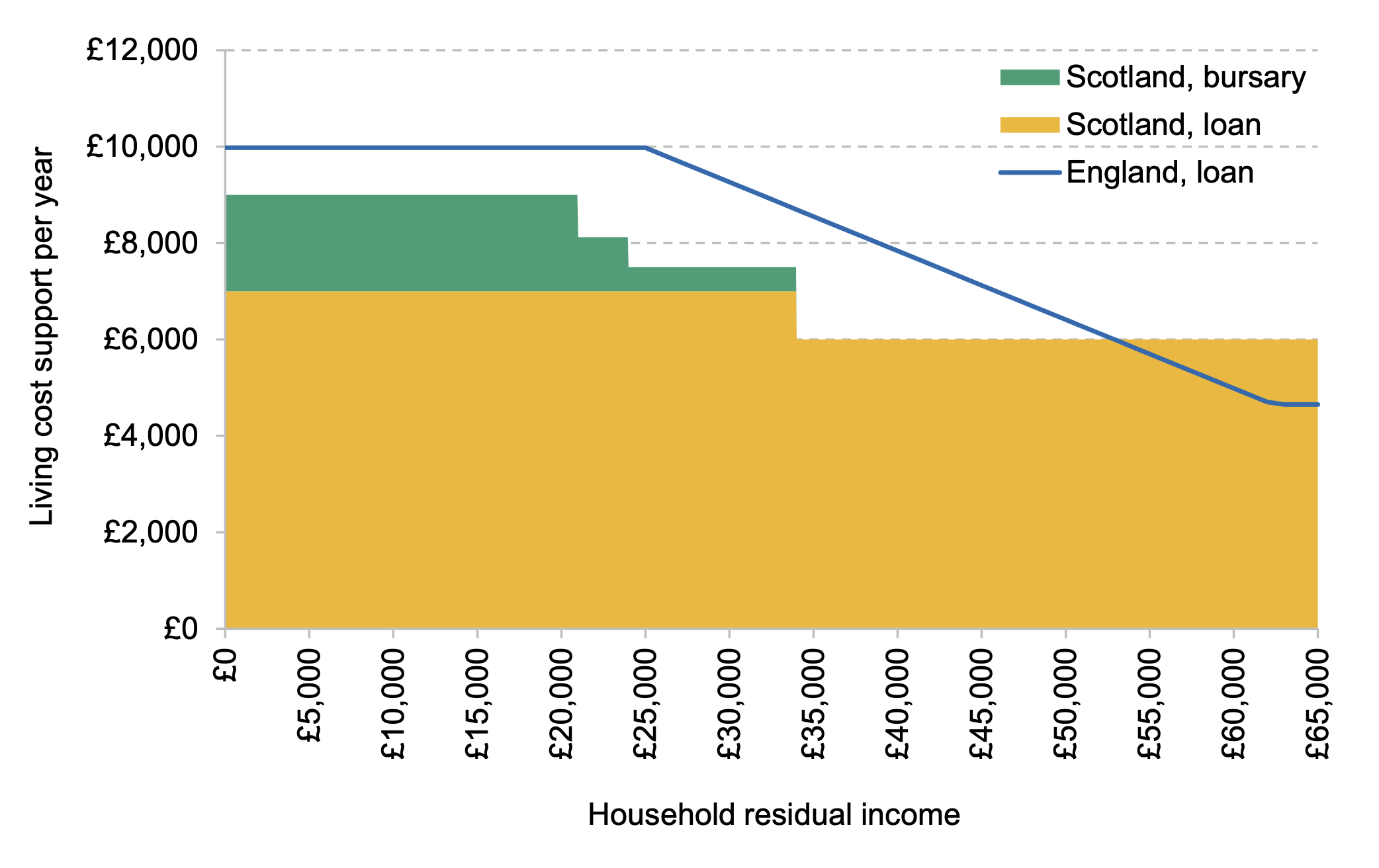

But many Scottish students are also entitled to borrow less per year towards their living costs than their English counterparts would be, and to less support overall. As shown in Figure 2, support for living costs is predominantly through loans, with students entitled to borrow £6,000 or £7,000. Those with household incomes below £34,000 are also entitled to non-repayable bursaries of between £500 and £2,000 per year. Even including this bursary, students from the poorest households are entitled to 10% less total support with their living costs than an English student living away from home. This is despite a £900 increase this year in the maximum amount all Scottish students can borrow, in response to cost of living pressures.

Figure 2. Entitlements to living cost support by household income, academic year 2023–24

Note: Entitlements for Young Students in Scotland, and for England-domiciled students living away from home and not attending a London university.

Source: SAAS, 2023; Bolton, 2023.

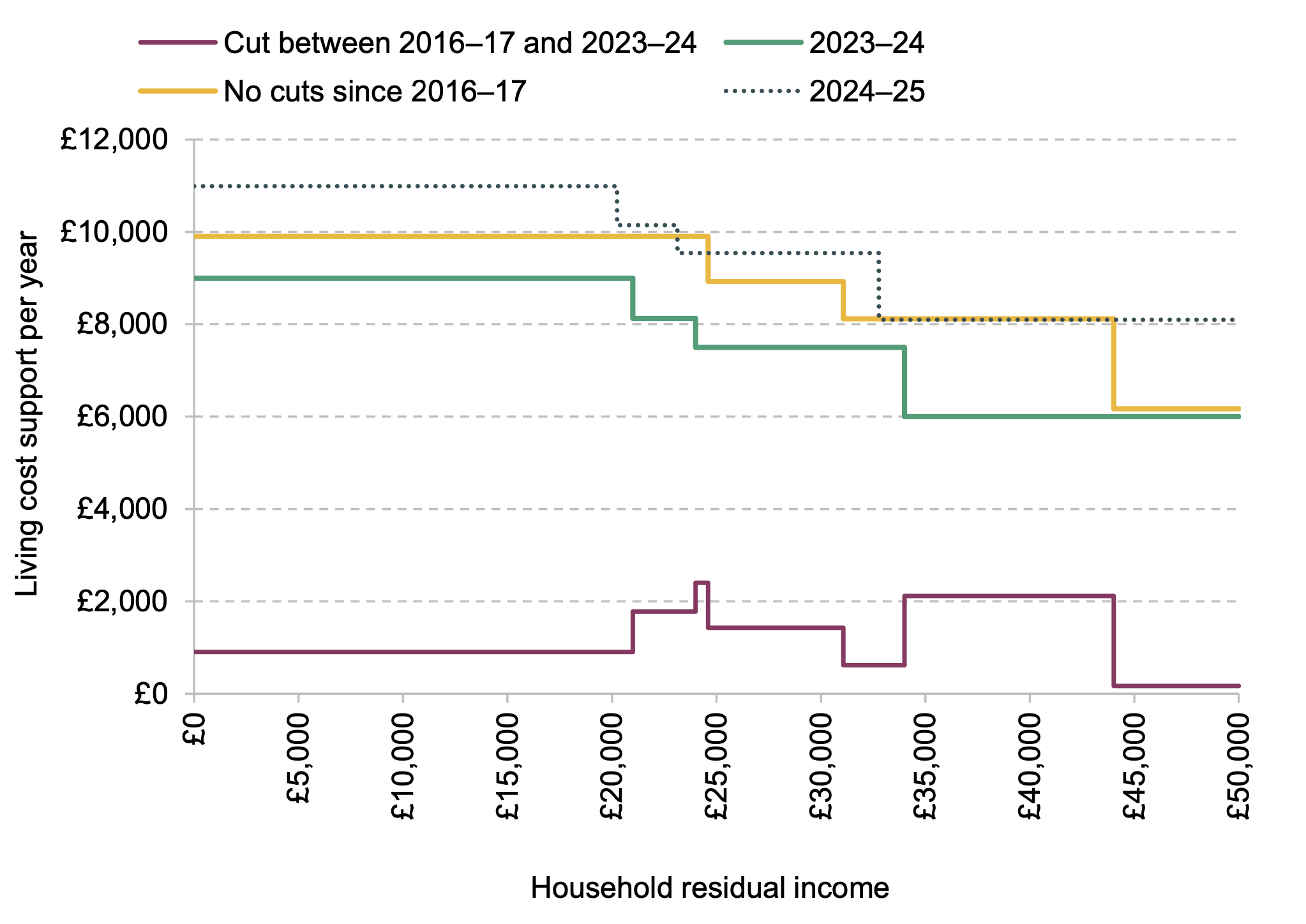

Taking a slightly longer view, the system of living cost support for Scottish students has become substantially less generous over time. The parental earnings thresholds that determine entitlements have changed little since 2016–17, despite growth in average earnings of 29%, and maximum entitlements have risen by less than the cumulative growth in consumer prices (30%). As shown in Figure 3, the combined effect of this is that some students were eligible for a quarter (£2,120) less in real terms in 2023–24 than an equivalent student would have been entitled to in 2016–17.

Figure 3. Entitlements to living cost support by household income, academic year 2023–24 and if there had been no cuts to generosity since 2016–17

Note: For Scotland-domiciled Young Students. Includes entitlements to living cost loans and Young Students’ bursary. ‘No cuts since 2016–17’ shows entitlements if 2016–17 levels had been increased by latest Office for Budget Responsibility forecasts of Consumer Prices Index (CPI) inflation between 2016 and 2023 calendar years, and if parental earnings thresholds had been increased in line with average earnings growth over the same period. Figures for 2024–25 assume the only change is a nominal increase in loan entitlements of £2,400 for all students.

Source: SAAS, 2016; SAAS, 2023; Office for Budget Responsibility’s Economic and Fiscal Outlook – November 2023.

The system is set to become more generous for students and graduates next year

While the current system results in Scottish students graduating with much less debt than their English counterparts, it is perhaps less generous than it seems – with spending on teaching tightly controlled and lower than in England, and a long-run decline in living cost support. Several changes are set to make it substantially more generous for Scottish students and graduates from next year.

First, the amount of living cost support for students will increase significantly. On Tuesday, the Scottish Government announced that all Scottish students will see their loan entitlement increase by £2,400 next academic year, taking the maximum living cost support for Young Students from £9,000 to £11,400. This delivers on a 2021 commitment to provide a total package of student support ‘the equivalent of the Living Wage’ by 2024–25. Importantly, this calculation has been based on the real living wage of £12 an hour produced by the Living Wage Foundation, which is higher than the National Living Wage (which will rise to £11.44 an hour from April 2024). Accounting for inflation, this represents a real-terms increase of £1,990 (+22%) for the poorest, and will restore the real-terms generosity of the 2016–17 system for most, as shown in Figure 3. It will bring entitlements for Scottish students with household incomes between around £20,000 and £40,000 roughly in line with their English counterparts, and will be much more generous than the English system for those from the poorest and the richest households.

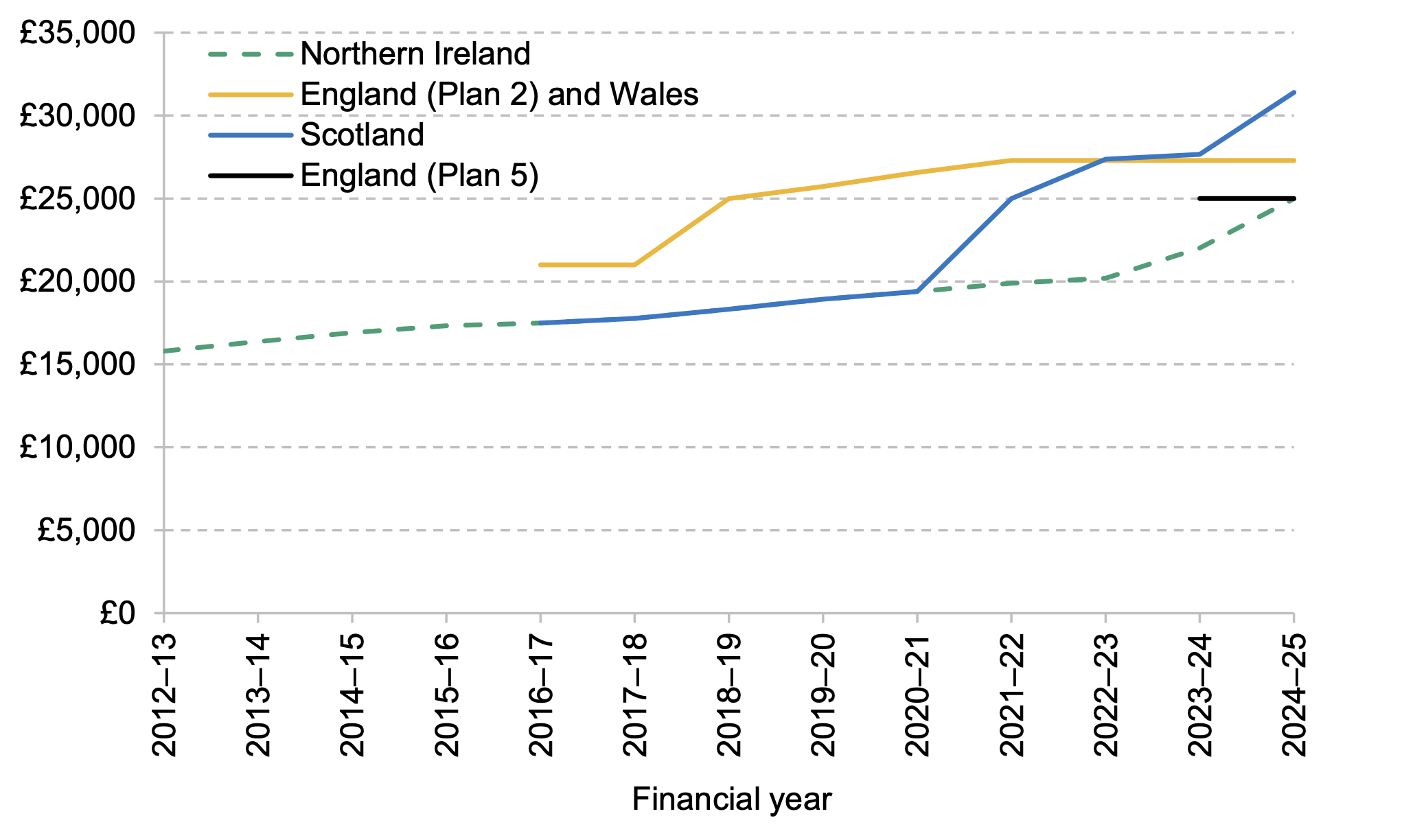

Second, Scottish students will repay less next year towards any loans that they do have. Graduates repay 9% of any earnings above a repayment threshold and, under current policy, the threshold for Scottish graduates is increased each April in line with the Retail Prices Index (RPI) in the year to the previous March. This implies a 13.5% increase in April 2024, from £27,660 to £31,395, which would see graduates earning above the new threshold repaying £336 less per year. (This has not yet been officially announced by the Scottish Government, although a similar 13.5% increase has been confirmed for students from Northern Ireland.)

This is again in stark contrast to the direction of travel in England, where the repayment threshold was previously much higher than that in Scotland, but will continue to be frozen through next financial year at £27,295 (the same level as in 2021–22). A high-earning Scottish graduate will have gone from repaying £647 more per year than an English graduate in 2020–21, to repaying £369 less per year by 2024–25.

Figure 4. Student loan repayment thresholds over time, by student domicile

Note: Thresholds are expressed in nominal prices. England-domiciled students starting courses from 2023 onwards will be eligible for Plan 5 loans. Threshold for Scotland in 2024–25 assumes an increase of 13.5%, in line with current policy.

Source: https://www.gov.uk/guidance/previous-annual-repayment-thresholds; https://www.gov.uk/repaying-your-student-loan/what-you-pay; https://www.gov.uk/government/news/student-loans-interest-rates-and-repayment-threshold-announcement--4.

This is likely to have a material impact on the speed with which Scottish students repay their loans. When the repayment threshold was increased in 2021–22 from £19,390 to £25,000 (+29%), there was a 22% reduction in total repayments by Scottish students year-on-year.

Concluding remarks

Importantly, both of these changes – an increase in entitlements to living cost support and a fall in loan repayments – will benefit Scottish students and graduates, but may not impact the Scottish Government’s main budget. Under the current funding model, the Scottish Government can increase entitlements to loans for living costs, with the cost of providing additional loans being met through additional ring-fenced funding from the UK government. It can also reduce monthly student loan repayments from Scottish graduates, with any costs covered by the UK government, as long as HM Treasury continues to agree that the Scottish policy ‘offers broadly similar terms’ to that in England.

The most pressing problem at the upcoming Budget will be providing additional resources for teaching, which would be needed to arrest the decline in per-student funding or to fund more places for Scottish students. Under the current ‘free tuition’ model, any increase in funding for teaching impacts directly on the Scottish departmental expenditure limit (DEL), which is already under huge pressure. The Scottish Government may need to reassess whether the principles in its MTFS – the targeting of resources to improve value for money and to best support the most needy – are consistent with its current model of higher education finance.