In this episode, we discuss the tight fiscal situation after the next budget, and also look at how the education system is faring.

Subscribe now: Apple Podcasts | Spotify | ACAST | Stitcher | YouTube | Google Podcasts | RSS

The last few days have seen plenty of competing claims about tax rises, but very little discussion of the very tight fiscal situation facing the next government. What problems will they face? Can growth ride to the rescue?

Also in this episode, we explore what's happened to the education system, from funding and teacher pay, to falling pupil numbers and the impact of COVID.

Zooming In: discussion questions

Every week, we share a set of questions designed for A Level economics students to discuss, written by teacher Will Haines.

1. Explain how higher economic growth may help to improve government finances.

2. Pay across the economy has risen by 18% in real terms since 2001 whilst teacher pay has not experienced a real terms increase. Outline the impact of this on a supply and demand diagram for the market for teachers.

3. Discuss the potential impact on income inequality of the finding that 37% of disadvantaged pupils are now recorded as 'persistently absent' from school.

Host

Director

Paul has been the Director of the IFS since 2011. He is also currently visiting professor in the Department of Economics at University College London.

Participants

Deputy Director

Carl, a Deputy Director, is an editor of the IFS Green Budget, an expert on the UK pension system and sits on the Social Security Advisory Committee.

Associate Director

Christine's research examines inequalities in children's education and health, especially in the early education and childcare sector.

Podcast details

- DOI

- 10.1920/pd.ifs.2024.0011

- Publisher

- Institute for Fiscal Studies

More from IFS

Understand this issue

What is this government’s ‘theory of growth’? Nobody knows

"Shifting the performance of an entire economy requires a long-term, consistent and persistent direction." Paul Johnson writes for the Times.

20 January 2025

Rethinking the Education Maintenance Allowance: Lessons from a long-term analysis

This evidence should prompt us to look beyond simple financial incentives for classroom attendance.

10 March 2025

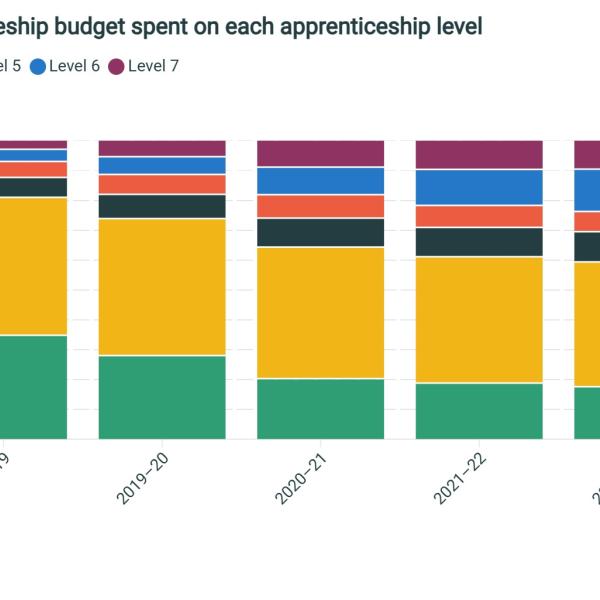

Share of apprenticeship budget spent on each apprenticeship level

The proportion of funding directed to higher-level apprenticeships (level 4 and above) has trebled between 2017–18 and 2021–22 from 13% to 39%.

16 January 2025

Policy analysis

How can policy boost productivity growth?

At this policy conference, four panels of experts will give their perspectives and recommendations on four key areas of the UK’s productivity problem.

A look ahead to the 2025 Spring Forecast

What are the Chancellor’s options if – and it is very much an if – the upcoming Spring Forecast puts her on track to miss her fiscal targets?

6 March 2025

The short- and long-run effects of the Education Maintenance Allowance

This report studies the long-run effect of the Education Maintenance Allowance on educational attainment, earnings and crime.

26 February 2025

Academic research

The short- and long-run effects of paying disadvantaged teenagers to go to school

This working paper studies the long-run effect of a cash transfer to disadvantaged students on educational attainment, earnings and crime.

26 February 2025

TaxDev collaborating with Government of Ghana on VAT, customs, and distributional analysis

Ghana Ministry of Finance officials explain how the partnership with TaxDev is helping to improve tax policy analysis

24 February 2025

Vog: using volcanic eruptions to estimate the impact of air pollution on student test scores

We demonstrate that poor air quality disproportionately impacts the human capital accumulation of economically disadvantaged children.

20 February 2025