Today, the Labour party will announce that they would not implement planned corporation tax cuts and would reverse most of the cuts introduced since 2010. This would be the first time the main rate of the modern corporation tax in the UK had been increased. The policy could raise around £19 billion in the near term, but substantially less in the medium to long run because companies would respond by investing less in the UK. Part of the revenue raised would be used to increase spending on education by £9 billion a year (£8.4 billion in 2017–18 terms).

Alongside this observation, we are today publishing a new analysis of what’s happened to corporation tax and receipts since 2010. Rate cuts announced since 2010 are forecast to cost at least £16.5 billion a year in the near term, with tax raising measures bringing the net cost to £12.4 billion a year. Under current plans, corporation tax receipts are forecast to be 2.3% of national income by 2021–22, substantially below the pre-recession high of 3.2%.

The Labour policy

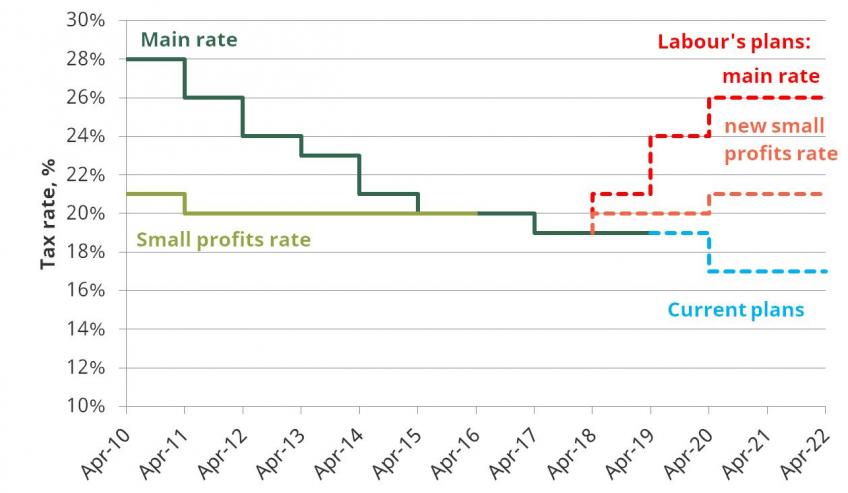

Labour would increase the headline rate of corporation tax from 19% in 2017–18 to 21% in 2018–19, 24% in 2019–20 and 26% in 2020–21, as shown in Figure 1. This would return the rate to its 2011 level. For companies with annual profits below £300,000, they would reintroduce a small profits rate at 20% in 2018–19, rising to 21% in 2020–21. So under Labour, from April 2020 most profits would be subject to corporation tax at a rate of 26%, substantially higher (9 percentage points) than the 17% rate that would apply to most profits under the government’s current plan.

Figure 1: Rates of UK corporation tax under current and Labour’s proposed plans

Source: Author’s calculations.

The revenue raised

This substantial rise in the rate of corporation tax would raise a substantial sum. HMRC estimate that a 1 percentage point increase in the rate of corporation tax this year would raise £2.7 billion a year in 2021–22 (£2.3 billion a year in 2017–18 terms). If this figure is used, a simple ‘back of the envelope’ calculation suggests that Labour’s plans (relative to a 17% rate) could raise around £19 billion in 2021–22 (£16.8 billion in 2017–18 terms). That compares to forecast onshore corporation tax revenues of £53 billion in 2021–22. However, this should be seen as an overestimate of how much revenue would be raised because at higher tax rates an increase in the rate would lead to a larger reduction in UK investment and therefore bring in less revenue.

Labour’s increase in the rate of corporation tax, if it did raise revenues by £19 billion, would add 0.8% of national income to government receipts, which are already forecast to rise to the highest share of national income since 1986–87.

The trade-offs

Increasing tax on corporations may appear to be an attractive way to raise revenue. But, as ever, there are trade-offs:

- Increasing rates will raise less revenue in the medium to long run because firms would respond by investing less in the UK. This in turn would depress economic activity and lead to fewer jobs and lower wages. There is a very high degree of uncertainty about how large these effects are but estimates suggest that they may be substantial. The potential size of these effects is an indication of why the OECD and others judge corporation tax to have a particularly damaging effect on economic growth.

- Of course, when considering longer run effects it is also important to consider how a government would spend revenue raised, since these decisions (such as higher spending on education) will also have effects on the size of the economy.

- All taxes are paid by people and corporation tax is no different. Higher rates can reduce the returns to company owners (shareholders), but there is also evidence that a significant share of the burden is passed to workers in the form of lower wages.

Where a 26% corporation tax rate would leave the UK

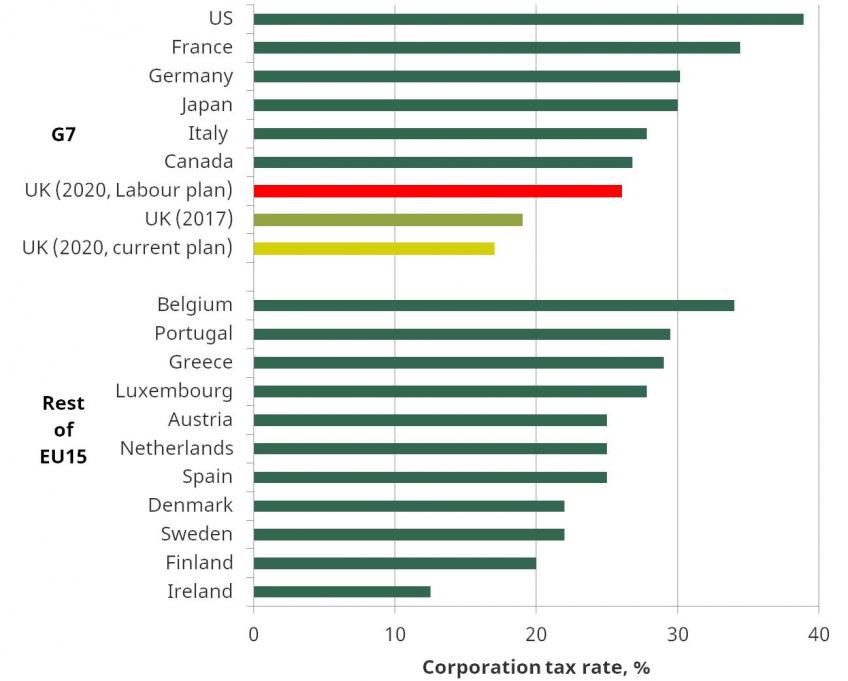

A rate of 26% would still leave the UK with the lowest rate in the G7. We would, however, move down the competitiveness ranking relative to some other EU countries (Figure 2). Under both the current Conservative plans and the Labour plans, the UK would continue to have a less competitive tax base than other countries because we allow a smaller share of capital expenditure to be deducted from revenues each year. A higher rate will reduce the incentive for both domestic and multinational companies to invest in the UK.

An unfortunate side effect of the Labour plan is that it will entail reintroducing the so-called Small Profits Rate – a preferential rate for companies with low profits. The oft-cited justification for having a separate and lower small profits rate is to encourage new business formation and, in particular, entrepreneurship. However, there is a lack of compelling evidence that levying a lower rate of corporate tax on the basis of companies’ profits achieves this aim. In addition, the redistributional motivation for a progressive personal income tax system does not apply to firms. Reintroducing the small profits rate would reintroduce unnecessary and unwelcome complexity into the corporation tax system.

Figure 2: International comparison under Labour’s plan

Note: Measure refers to the 2017 combined corporation income tax rate, including local taxes where relevant.

Source: OECD Tax Database, http://www.oecd.org/tax/tax-policy/tax-database.htm.

IFS Election 2017 analysis is being produced with funding from the Nuffield Foundation as part of its work to ensure public debate in the run-up to the general election is informed by independent and rigorous evidence. For more information, go to http://www.nuffieldfoundation.org.