Inheritances have been growing as a share of national income in the UK since the 1970s. This trend looks set to continue as generations at older ages hold more wealth than their immediate predecessors but younger generations have no higher incomes than the generations born just before them.

What will this mean for inequalities in living standards and wealth? Does the growth in inheritances mean people’s living standards will increasingly be determined by who their parents are? If people anticipate that they are going to inherit in future, could that influence their decisions about how much to spend and save today?

New IFS research, released today and funded by the Nuffield foundation, makes projections of the inheritances to be received by the 1960s, 1970s and 1980s-born generations in the UK.

Key findings:

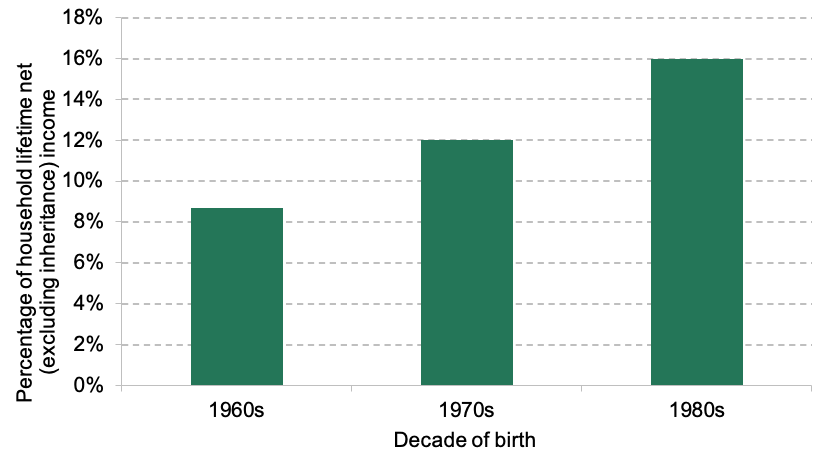

1. Inheritances are likely to be larger compared with lifetime incomes for younger generations than for their predecessors

- For those born in the 1980s, average inheritances compared to lifetime income are projected to be almost twice as large as for those born in the 1960s. We project that, on average, inheritances will be worth 9% of household lifetime (non-inheritance) income for those born in the 1960s, rising to 16% for those born in the 1980s (Figure 1).

Figure 1. Median of inheritances as a percentage of household lifetime net (excluding inheritance) income, by decade of birth

Source: Data from Figure 2.7 of main report.

2. While inheritances are set to be larger for those with higher incomes, inheritances as a percentage of lifetime income look likely to be similar, on average, for low- and high-income households

- Among the 1980s-born, we project that the median lifetime inheritance receipt for households in the bottom fifth by lifetime income will be around £150,000, and for households in the top fifth it will be around £390,000.

- Among the 1980s-born, we project that the median lifetime inheritance receipt as a percentage of lifetime income will be around 15% for households in the bottom fifth by lifetime income, very similar to the 16% projected for the top fifth.

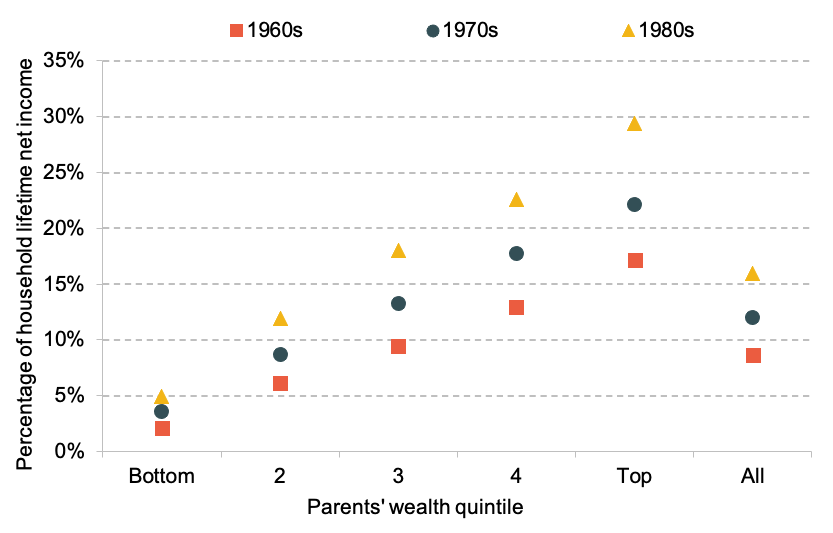

3. Inheritances are set to be increasingly important in increasing inequalities between those with richer and poorer parents, reducing social mobility

- Inheritances are set to increase inequalities in lifetime income between those with richer and poorer parents. For those born in the 1960s, inheritances are projected to increase lifetime incomes by 2%, on average, for those with parents in the bottom fifth of the wealth distribution and by 17% for those with parents in the top fifth (Figure 2).

- The effect of inheritances on inequalities by parental background is projected to be larger for younger generations. For those born in the 1980s, inheritances are projected to increase lifetime incomes by 5%, on average, for those with parents in the bottom fifth of the wealth distribution and by 29% for those with parents in the top fifth (Figure 2).

Figure 2. Median inheritance as a percentage of lifetime (excluding inheritance) net income, by parental wealth quintile and decade of birth

Source: Figure 2.9 of main report.

4.While inheritances are likely to have their biggest effect on living standards later in life, once they are received, the anticipation of future inheritances may have consequences for outcomes today:

- The percentage of individuals expecting to receive an inheritance rose from 72% of those born in the 1960s to 81% of those born in the 1980s.

- An economic model of savings decisions projects that those born in the 1980s will on average hold 9%, or around £16,000, less wealth at the age of 45 because they anticipate a future inheritance.

5. As those with higher incomes are more likely to be able or willing to reduce the amount that they save in anticipation of inheriting, they likely see a larger effect on their living standards today:

- Our modelling finds that for 1980s-born, the bottom fifth of households by lifetime income effectively spend 11% of their inheritance in advance of receiving it whereas the top fifth by lifetime income spend 33% in advance.