Most people need to save for retirement if they are going to secure a decent standard of living in old age, and they principally do so through private pensions, arranged either through an employer or individually. To understand how people are currently saving and the implications for their retirement, how that has been affected by recent policy reforms, and how it may be affected by possible future policy reforms, researchers need reliable data on the patterns of private pension saving undertaken in the UK.

There is no one ‘gold standard’ data on pension contributions – there are many different data sources with different strengths and weaknesses. For example, administrative, employer and industry data (which exist to varying degrees of accessibility for researchers) contain high-quality information on pension contributions made, but are limited to certain types of pensions and there is typically little further information available aside from very basic demographic information of the individual in question. In contrast, various household surveys capture some information on pension saving of each individual in the household and also have the advantage of being observed alongside wider household characteristics and circumstances. But this information has been little used by researchers to date, and the quality of the data on pension contributions in particular is therefore somewhat unclear.

This short report focuses on the quality of data collected in some household surveys, principally considering two frequently used longitudinal surveys: Understanding Society – the UK Household Longitudinal Study (UKHLS) and the Wealth and Assets Survey (WAS). The report also highlights differences between Understanding Society and its predecessor survey, the British Household Panel Survey (BHPS), and shows some analysis comparing to what extent Understanding Society and the WAS differ from the highest quality measure of workplace pension saving for employees – that is, the Annual Survey Hours and Earnings (ASHE) dataset, which provides employer-reported measures of workplace pension saving.1

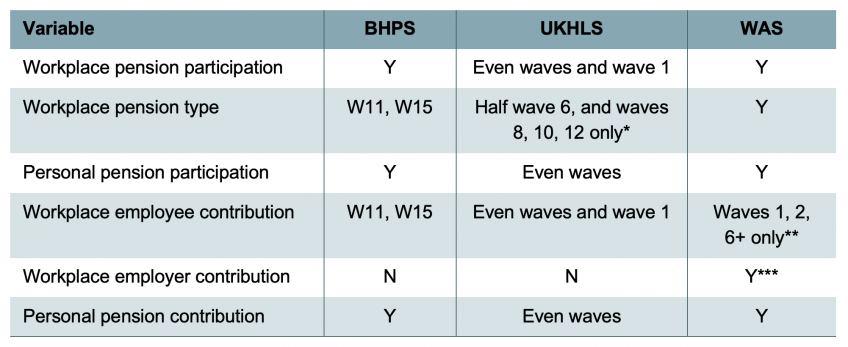

For each survey, this report describes the information on pension saving collected, and the structure of the relevant questions (which, in some cases, is complicated). Table 1 provides an overview of the information contained in the three datasets around pension participation and contributions. All three datasets contain information on workplace and personal pension participation in (most) waves, although information on the type of workplace pension is only reliably available in the WAS. All three datasets contain regular data on contributions to personal pensions, but there are some limitations with the pension contributions data to workplace pensions, due to either a lack of questions (in the BHPS/UKHLS) or data issues (in the WAS).

Table 1. Types of information on private pension participation and contributions in survey data

Note: * As explained in Section 2, we have found a potential issue with the workplace pension type variable in the UKHLS in waves 10 and 12. ** There is also an issue with the employee contribution variable in the WAS between waves 3 and 5, which is explained in more detail in Section 3. *** The WAS provides data on the employer pension contribution for those with a defined contribution pension; for respondents with a defined benefit pension, it instead provides the scheme accrual rules.

The rest of the report sets out the details of data on private pension participation and contributions in Understanding Society (and its predecessor the BHPS) and shows how workplace pension participation and contributions compare to ASHE in a number of respects. It highlights a problem in the data that we reported to Understanding Society and should be fixed in from Autumn 2023 onwards. We also provide information on the data on private pension participation and contributions in the WAS. The Appendix contains detailed schematics on the routing of questions on this topic through Understanding Society, the BHPS and the WAS, which are referred to in the report and may be of use to researchers in their own right.