Last year’s fiscal furore culminated in the November 2022 Autumn Statement. There, Jeremy Hunt confirmed the reversal of the majority of Kwasi Kwarteng’s ‘mini-Budget’, loosened the government’s fiscal rules, and pencilled in a raft of tax rises and spending cuts for after the next general election.

The forthcoming Budget – Mr Hunt’s first – promises to be a more restrained affair, though the Chancellor still has a bulging in-tray. Here, we consider how the outlook for the public finances has changed since the autumn and what this might mean for the Budget, with a particular focus on some of the key choices and challenges around public services and pay. Our key takeaway is that while developments since the autumn provide some positive fiscal news in the short term, it is far less clear that these improvements will persist into the medium term, where the outlook remains highly challenging. Indeed, even if the outlook for borrowing in the medium term has improved since November, it is still likely to be worse than forecast a year ago. The room for either permanent tax cuts or spending increases that are not offset elsewhere remains very limited.

An improved short-term outlook for the public finances

The short-term economic and fiscal news since the Office for Budget Responsibility (OBR) published its November forecast has largely been positive. The recession is now expected to be much shallower, with all but one of the independent forecasters surveyed by HM Treasury in February, as well as the Bank of England, now expecting a smaller contraction of the UK’s economic output in 2023 than under the OBR’s November forecast. In-year borrowing figures, similarly, have outperformed the OBR’s forecast, with borrowing in the current financial year now running £31 billion below forecast on a like-for-like basis. (The OBR forecast and the ONS out-turns temporarily differ in their treatment of reforms to the student loan system; we adjust based on the OBR’s estimate of the impact.) At 1.2% of national income, this is a large difference: the median absolute forecast error for the in-year borrowing forecast over the lifetime of the OBR is much smaller at 0.4% of national income.

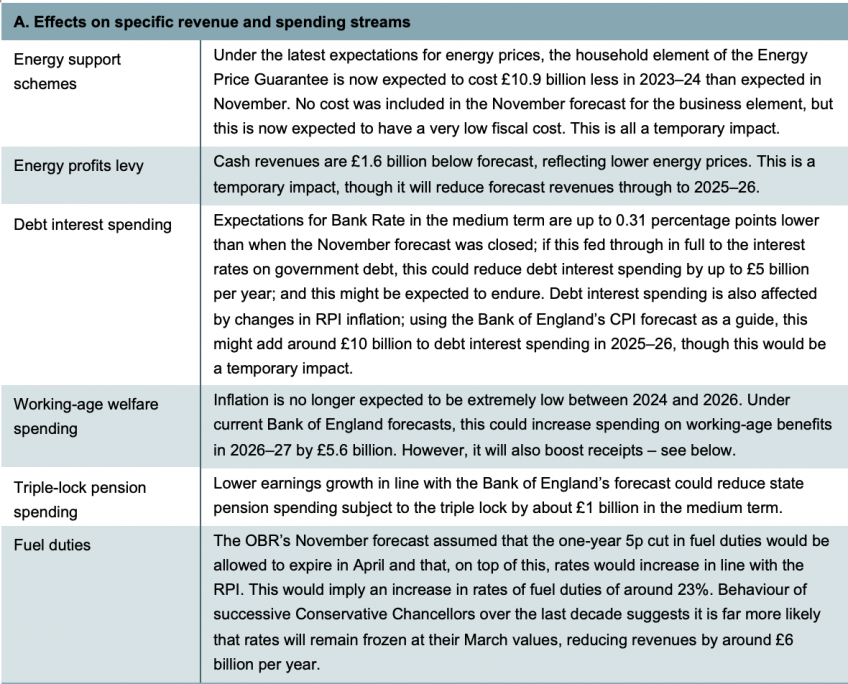

This reflects a number of factors. First, energy prices have fallen, reducing the fiscal cost of the Energy Price Guarantee. Over the financial year so far, central government has spent an estimated £6.8 billion less on subsidies (the bulk of which relate to energy subsidies for households and businesses) than forecast in November, and this number is likely to grow during the remainder of the lifetime of the energy support schemes. Under the latest expectations for energy prices, we expect the household element of the Energy Price Guarantee to cost £1.9 billion in 2023–24 (a saving of £10.9 billion compared with the November forecast). This boost to the public finances from lower energy prices is partially offset by reduced revenues from the energy profits levy. But this effect is smaller: £1.6 billion over the financial year so far (compared with a roughly £6.8 billion reduction in spending on support schemes over the same period) and with no further change expected during the rest of 2022–23 due to the timing of payments. Offsetting some of this, the Budget will see some cost for the business element from April 2023 which will be incorporated into the OBR forecasts for the first time, but we do not currently expect this to come at a very significant fiscal cost. If, as currently expected, energy prices drop below the support level provided by the Energy Price Guarantee from July 2023, this would eliminate government spending on this scheme from this point, but would also bring wider economic benefits. It does, however, remain the case that energy prices are very volatile.

Table 1. Key changes relative to the November forecast

In addition, lower interest rates on government debt are pushing down spending on debt interest. Interest payments are £3.7 billion below forecast in the first ten months of this financial year. If interest rates on gilts (government bonds) fall in lockstep with lower expectations for Bank Rate compared with November, we would expect this to reduce spending on debt interest by some £2 billion in 2023–24.

The final key explanation for lower-than-expected borrowing this year is higher-than-expected revenues across a whole range of taxes. In particular, income taxes and National Insurance contributions (NICs) are running £6.3 billion above forecast in the first ten months of the financial year. But corporation tax and VAT revenues are also above forecast, bringing overall revenues in the first ten months of the year almost £10 billion, or 1.3%, above the November forecast. If revenues continue to outperform at the same rate in the final two months of this financial year, it would mean them climbing to £14 billion above the OBR’s forecast for the year as a whole.

However, under the November forecast, rates of fuel duties are set to increase by an eye-watering 23% (5p plus forecast RPI inflation), the implementation of which might be thought politically implausible. Freezing fuel duty instead would cost £6 billion in 2023–24.

Altogether, and before any policy changes, we might expect borrowing in 2023–24 to be revised down by perhaps around £30 billion, reflecting £13 billion of savings on the Energy Price Guarantee and debt interest, a shallower recession and stronger revenues for a given size of the economy. With £6 billion very likely to be spent on freezing fuel duties, this would still leave borrowing around £115 billion. While this would be around £25 billion less than expected in November, it would still be more than £60 billion above that forecast in the March 2022 Spring Statement. The increase since last March would be largely driven by higher inflation, a much weaker-than-expected economy, and substantial government support for household energy bills along with the decision to scrap the health and social care levy. Of course, given uncertainties, we should not be surprised if the OBR’s revision is bigger – or smaller – than this.

How durable are these changes likely to be?

Short-term improvements in borrowing arising from lower debt interest spending and lower energy prices are certainly welcome. Some may argue that they open up fiscal space for one-off giveaways. But it is the medium-term fiscal outlook which matters for the broad sustainability of the public finances, and for judging the case for permanent tax cuts or spending increases. The medium-term outlook is also what matters for meeting the letter of the Chancellor’s (looser than previous) fiscal rules. The key question is therefore whether the short-term fiscal improvements since November can be expected to persist into a more permanent improvement in the public finances. In other words, should we expect an improvement in the outlook for borrowing three or four years from now?

By then, energy support schemes are assumed to have ended, so there will be no more savings on them from lower energy prices either. Savings from lower interest rates are, as long as inflation falls as the Bank of England expects, likely to be more persistent – if current market expectations for Bank Rate feed through to gilt rates, debt interest spending may still be reduced from the very high November forecast by some £4 billion in 2027–28. This would be welcome. But it is important to remember that such an improvement since November would reverse less than a fifth of the increase since last year’s Spring Statement. In addition, market expectations have recently risen, particularly for 2024–25 and 2025–26, after falling to an even lower level in the first week of February. Using market expectations on 1 February would predict around twice as big a saving as the most recent numbers, which highlights the continuing uncertainty and volatility in the interest rate environment.

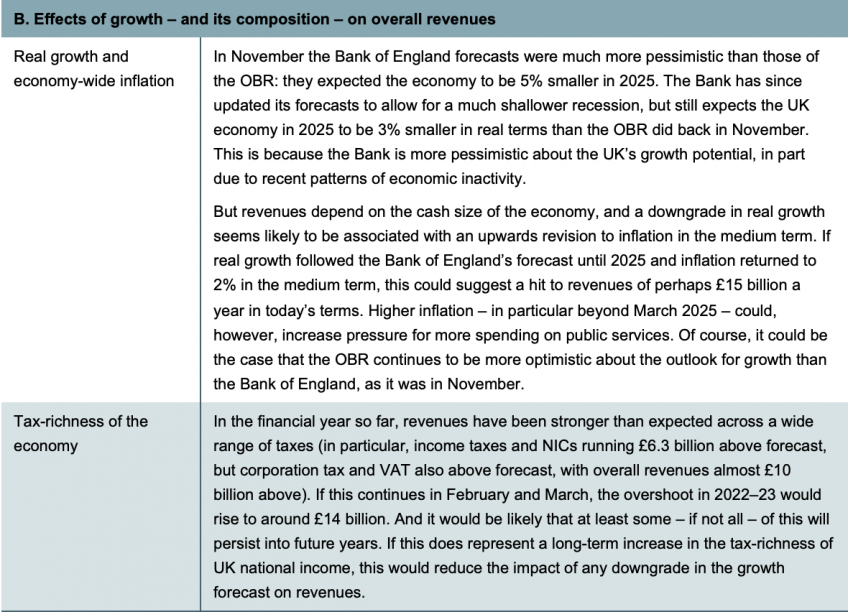

For the medium-term outlook, changes in economic growth will be the most important factor at play. Despite forecasting a shallower recession in the short term than previously expected, the most recent Bank of England forecast for the medium term made for grimmer reading. It updated its assessment of ‘potential supply growth’ – in other words, the pace of growth that the UK economy can sustain without generating inflation. This growth rate is determined by the number of people in paid work, the hours they work and how productive they are per hour worked (which depends, among other things, on the capital and equipment they work with). While in the short term economic turbulence may cause the economy to grow by more or less in any given year, on average over a longer period we would expect growth to return to this trend rate. The Bank now thinks that this rate of growth is below 1%. This dismal rate would be just over half the economy’s poor growth rate in the decade between the financial crisis and the pandemic, and only around a third of its average in the 50 years before the financial crisis (2.7%). While concerns about productivity growth remain, one of the key drivers of the latest downgrade is the more recent issue of declining economic activity rates.

While real-terms growth matters most for living standards, the nominal or cash size of the economy plays an important role for the public finances, as revenues are levied on cash quantities, and spending plans are typically set in cash terms. In November, the OBR expected economy-wide inflation (as measured by the GDP deflator) to drop to an extremely low level, remaining below 2% (considered as the long-run average) all the way to the end of the forecast. While other organisations do not typically forecast this measure of inflation, consumer price inflation (as measured by the CPI) is forecast to be higher than the OBR forecast in late 2024 by every single forecaster included in the HM Treasury survey, as well as by the Bank of England. By increasing the cash size of the economy, higher inflation would temper any hit to revenues from a downgrade to real growth, and this effect would likely more than outweigh increased spending on working-age benefits linked to inflation, and on interest on index-linked government debt.

Suppose real growth were now forecast by the OBR to be in line with that expected by the Bank of England, but that the OBR also expected inflation to run at around 2% a year over the medium term (rather than the lower figure it forecast in November). We might expect that, overall, this would push up borrowing by around £15 billion a year in today’s terms. This could therefore cancel out most – if not all – of any gains from more tax-rich growth and from lower debt interest spending. And if the outlook for borrowing has improved since November, this should be put in the context that the forecast for borrowing in 2026–27 deteriorated by £49 billion between last March and November. So any overall improvement since November is still very likely to represent a deterioration on the situation a year ago.

There is, of course, a huge amount of uncertainty over the cash size of the economy over the next few years – and with it the revenues that it will bring. Reasonable forecasters may easily differ in their views on future growth, and the OBR may continue to be more optimistic than the Bank, as was the case in November. But it is clear this will be key, rather than the shorter-term cost of the energy support packages, to the level of public spending that can be sustained for a given tax system.

Back in November, Mr Hunt was only meeting his target of having debt falling as a share of national income in five years’ time by £9 billion – a hair’s breadth on the scale of uncertainty around the public finances even in the absence of unexpected crises. The broad goal of having debt on a falling path relative to the size of the economy in ‘normal’ times has much to commend it – not least because we will want to allow debt to rise when the next large adverse shock hits the economy and therefore we should aim to reduce it in periods when these shocks are not occurring. However, even under the November forecast, despite meeting the letter of the fiscal target, debt was not on a decisively falling path, even after large tax rises and assuming that the government adheres to a set of spending plans that may be too tight to actually implement (more on that later).

Given that debt as a percentage of GDP was previously forecast, effectively, to flatline, even a modest downgrade to the OBR’s forecast for growth could be enough to put debt on a rising path. On the other hand, if recent strength in tax revenues is expected to persist and the UK economy is now more tax-rich than before, this could mitigate the effects of any growth downgrade and debt could be forecast to fall as a share of GDP by more than £9 billion. The official forecasts will depend on the judgement reached by the OBR on these and other uncertain factors. It would not be desirable for the government to take immediate policy action in response to technical changes in the forecast that mean debt is slightly rising rather than slightly falling in five years’ time – not least due to the uncertainty involved. Instead, the government should reaffirm its commitment to taking appropriate action – if required – to put the public finances on a sustainable footing over the medium term and, in the short term, avoid making permanent tax cuts or spending increases on the back of an improvement in the short-term borrowing figures that may not persist.

Public sector pay disputes

Perhaps the most acute short-term policy challenge for the Chancellor relates to public sector pay and the impacts of ongoing strike action. This is also an area where it is crucial to distinguish between the short and long term, and between one-off and permanent measures.

Pay offers for 2022–23 have led workers across the public sector – including nurses, junior doctors, ambulance drivers, civil servants and teachers – to take industrial action. The precise pay offers varied by sector and seniority, but averaged around 5% (in the face of inflation of close to 10%, meaning an average real-terms pay cut of around 5%). Even the 5% average award was higher than expected when budgets were set, and departments have been asked to absorb this additional cost from within existing budgets. The average offer was close to the Bank of England’s estimate of median pay settlements for 2022 (5.2%), and slightly above the Bank’s latest estimate of median private sector pay settlements for the year (4.0%) – which the Treasury argues is the best comparator measure to public sector pay settlements.

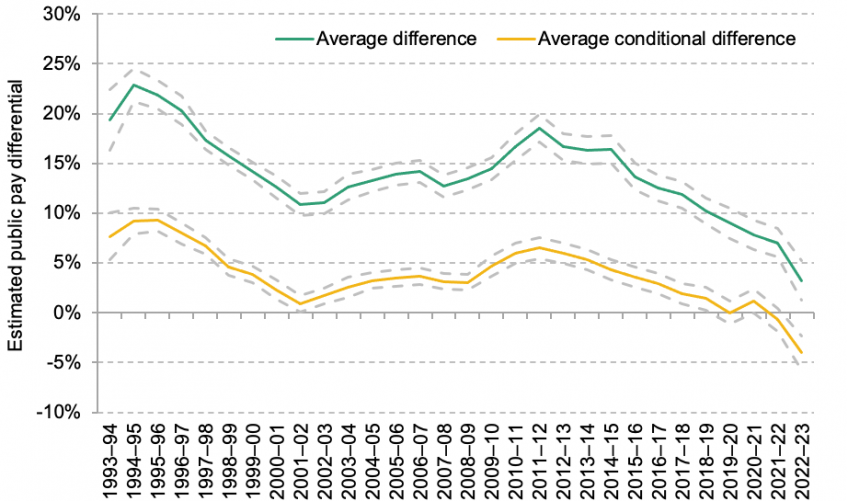

Other data sources paint a somewhat different picture, however. According to the Office for National Statistics, average earnings growth in the public sector over the first nine months of 2022–23 has lagged well behind average growth in the private sector (2.8% versus 6.4%). We see something similar when comparing average hourly pay in the two sectors in the Labour Force Survey: pay in the public sector fell sharply relative to the private sector over the first half of 2022–23, suffering the largest year-on-year (relative) fall – and to the lowest relative level – since comparable data began in the early 1990s (Figure 1).

Figure 1. Average public–private hourly pay differentials, 1993–94 to 2022–23

Note: 2022–23 figures calculated for 2022 Q2 and Q3 only. The average conditional difference is calculated using age, education, experience and region controls, all interacted with sex, and interactions between education and experience. Figures shown are the coefficient on an indicator variable for whether the individual works in the public sector, transformed into a percentage differential based on Halvorsen and Palmquist (1980). Dashed lines represent 95% confidence intervals. Figures are for hourly pay and exclude pension contributions; for a discussion and comparison of overall remuneration in the public and private sectors, see Boileau, O’Brien and Zaranko (2022).

Source: IFS calculations using the quarterly Labour Force Survey.

Given this, it is unsurprising that strikes are continuing. Against that backdrop, the government will soon need to make decisions about the 2023–24 pay round. The choices here are unlikely to be much easier. The latest OBR forecast is for CPI inflation of 5.5% over 2023–24, close to the latest Bank of England forecast of 5.4% for the same period. The Bank also expects median pay settlements of 5.7% in 2023. But when 2023–24 spending plans were originally set out at the 2021 Spending Review, they were predicated on pay awards in that year of ‘in the region of 2%’. In their evidence to Pay Review Bodies, departments have advised that even with reprioritisation, funding is available for pay awards of a maximum 3.5%.

In other words, if there is no additional funding made available by the Treasury and departmental budgets are left as they are, the ‘affordability constraint’ for Pay Review Bodies is likely to bind, and we could see below-inflation pay recommendations for the second year running. Departments already had to absorb a higher-than-budgeted pay award in 2022–23; it is extremely difficult to see how they could be asked to do so again without some tough choices around headcount, the government’s public service objectives, and the scope of the state.

It is difficult, therefore, to see an end to public sector pay disputes that does not involve the Treasury providing some extra cash to departments. Providing a CPI-matching 5.5% pay award across the entire public sector would add around £5 billion to the pay bill, relative to the 3.5% or so already apparently budgeted. That would more-or-less match expected settlements in the private sector in the coming year, but would mean locking in the real-terms pay cuts of 2022–23. Going further and acting to undo that year’s reduction vis-à-vis the private sector would cost a further £9 billion or so. And even this would still leave public sector workers worse off (on average) than in 2020–21.

Consolidated pay awards would represent permanent increases in spending – increases that could not be financed by any short-term savings from lower spending on the Energy Price Guarantee or any other temporary factors. One-off pay awards or bonuses would pose fewer fiscal challenges, at the cost of not compensating public sector workers for a permanently higher price level. Backdating any 2023–24 pay award to the start of 2023, for instance, would in practice mean a one-off, up-front bonus for public sector staff, but would not add to the long-term fiscal cost of any pay award.

One potentially important thing to note is the £13–14 billion ‘Reserve’ built into the government’s spending plans for 2023–24 and 2024–25, as a buffer to meet unforeseen spending requirements. Support provided to Ukraine will undoubtedly have eaten into the available sum, but it is conceivable that a few billion could be found from here to unlock pay disputes.

The Treasury does not object to higher public sector pay awards solely on the grounds of affordability, however. It also argues that higher awards risk exacerbating current inflationary pressures. Given the absence of market prices in public services such as the NHS, it is difficult to see how a higher public sector pay award could directly trigger a ‘wage–price spiral’. It is true that any increase in government spending (and for that matter any cut to taxes, such as the likely £6 billion cut to fuel duties in April) would, if financed via higher borrowing, add to the level of aggregate demand and therefore to inflationary pressure. But this is not a strong argument. Most obviously, the impact of injecting £5 billion into an economy with an annual GDP well in excess of £2,000 billion would surely be modest. In any case, given that a higher pay award would amount to a permanent increase in public service spending, there is an argument that it ought to be accompanied by a permanent tax rise on fiscal grounds, which would offset any inflationary pressure.

The stronger argument against higher public sector pay awards is that they risk spilling over into higher private sector pay awards, due to ‘benchmark’ effects or private sector employers raising wages to compete. The evidence here is mixed: one study found that higher public sector wages can in some cases spill over into higher private sector wages; another found that public sector pay increases have in the past had no systematic spillovers. This is a legitimate concern, but one that is far less acute when pay in the public sector is lagging the private sector – as it is now – or when proposed pay awards are roughly in line with those expected in the private sector.

The overarching point here is that any inflation impact of higher pay awards – and that is likely to be very modest at most – must be traded off against the adverse impacts on public services of an inadequate pay award. It must also be remembered that the government has other tools to offset any unwanted impact on economy-wide demand, most obviously taxes. Public sector pay policy might be more sensibly focused on ensuring that the government can recruit, retain and motivate the staff needed to deliver its desired public service outcomes.

Beyond 2025

The Chancellor faces difficult spending choices in the short term. But in the Autumn Statement, while he added to his spending plans for the next two years, he cut back his spending plans for beyond March 2025 (i.e. after the current Spending Review period and after the next general election). All of the public finance forecasts discussed above are predicated on those provisional plans. Those plans are tight – perhaps implausibly so, given the pressures on public services.

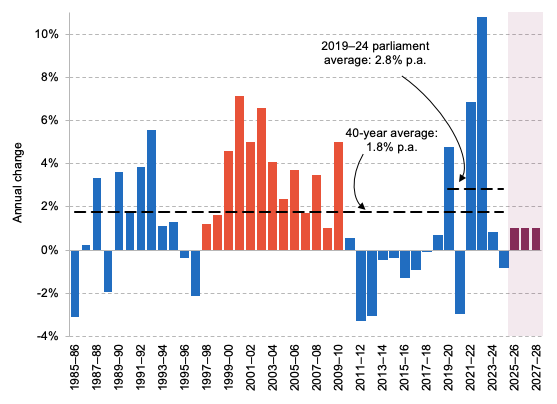

The plan, on paper, is for overall day-to-day departmental funding to grow by 1% per year in real terms in 2025–26, 2026–27 and 2027–28. Figure 2 places this in historical context: 1% annual increases would be comfortably below the 1.8% average seen over the past 40 years or so, and below the 2.8% average for this parliament. (Note that the sharp 11% increase in 2022–23 is largely driven by additional funding for COVID-19 recovery, which is excluded from the 2021–22 baseline.)

Figure 2. Annual real-terms change in day-to-day public service funding (excluding COVID)

Note: Figures for 1985–86 to 1998–99 refer to the New Control Total, which includes some non-public service elements (such as non-cyclical social security). Figures for 1999–2000 to 2018–19 refer to the OBR definition of PSCE in RDEL, adjusted for historical discontinuities. Figures for 2019–20 onwards refer to the HM Treasury definition of RDEL excluding depreciation, and excluding COVID-19 spending in 2020–21 and 2021–22 (figures for 2022–23 onwards include funding for COVID recovery). Shaded area shows the period beyond 2024–25, for which plans are only provisional.

Source: Authors’ calculations using OBR November 2022 EFO, HM Treasury Autumn Statement 2022, HM Treasury Public Expenditure Statistical Analyses (various) and Crawford, Johnson and Zaranko (2018).

Sticking to that overall envelope, while continuing to increase the health budget to meet the demands of an ageing population, continuing to meet the NATO pledge of spending 2% of GDP on defence, and avoiding cuts to per-pupil schools spending, would mean cuts to other budgets. History teaches us that the NHS budget is almost certain to get topped up. Geopolitical developments and considerations could lead the government to decide that 2% of GDP spent on defence is no longer enough. Legislation still commits the government to returning to spending 0.7% of national income on overseas aid. Together these would mean even bigger cuts elsewhere, if the plans for overall spending are adhered to. That points to an enormously difficult couple of years for other areas, such as local government, prisons, further education and the courts – services which faced deep cuts over the 2010s and which face their own deep-rooted challenges.

Capital budgets also face a squeeze. In the near term, departmental capital allocations were left unchanged in cash terms in the Autumn Statement. Inflation in the construction sector is currently running at close to 10% per year, eroding the real-terms value of those budgets. After 2024–25, investment plans are now frozen in cash terms (which equates to a £15 billion cut in 2027–28, relative to what was previously pencilled in). Some non-priority areas will be facing cuts here, also.

This parliament has seen a decisive break with austerity: public service spending is set to have grown by 2.8% a year between 2019–20 and 2024–25, well above the long-run average. Coming after the funding increases of this parliament, the 1% annual increases pencilled in for after 2025 might look manageable. They are certainly not as tight as those of the mid 1990s or early 2010s. But there are three key reasons why the present context differs from the past. The first is that most public services have already endured considerable spending cuts since 2010, and opportunities for ‘easy’ savings have been exhausted. The second is that the demands and pressures on public services post-pandemic are, in all likelihood, greater now than in the past. And third, while the ‘peace dividend’ from lower defence spending has historically allowed for greater spending on the NHS, we may now be facing a world where the government feels the need to increase health and defence budgets at the same time. Doing so within the government’s provisional spending envelope would necessitate severe cuts to other parts of the already-creaking state.

These plans are, of course, provisional and subject to change. In all likelihood, we will end up spending more. At the last four Spending Reviews, when the government has got around to setting allocations, it has topped up its spending plans, finding that it is easier to pencil in vague, unspecified cuts than to impose cuts on specific departments and spending programmes. There is no reason to expect this time to be different, and so we should not place too much weight on these provisional plans.

But these plans are still significant for two reasons. First, they underpin the official public finance forecasts, and so any future top-up is a ‘downside policy risk’ to the public finances. And second, these plans are likely to still be in place going into the next general election, and so could act as the baseline from which the major political parties make spending promises in their manifestos. They could, therefore, cast a long shadow onto the fiscal choices of the next government, just as the Conservatives’ post-1997 spending plans did in the first years of Tony Blair’s premiership. As Figure 2 shows, the plans for spending in (what could be) the first three years of the next parliament are even tighter than those delivered in the first two years following the May 1997 general election.

Conclusion

Ahead of the Budget on 15 March, there is some welcome good news for the Chancellor. The UK can now expect a shorter, shallower economic downturn than expected in the autumn, and borrowing this year and next could come in around £30 billion lower than forecast in November, owing largely to lower energy prices and interest rates than previously expected, and stronger-than-expected tax revenues.

Unfortunately, this improvement might not last. Savings on energy support can only be temporary. The indications are that a downgrade in the OBR’s medium-run growth forecast is possible, which could easily offset much, if not all, of any enduring fiscal improvements elsewhere (such as a reduction in forecast debt interest spending, or an increase in the ‘tax-richness’ of growth). The Chancellor will doubtless also need to find £6 billion a year to freeze fuel duties. In any case, any improvement in borrowing since November will still represent a deterioration on the forecast from a year ago.

Debt may well remain on course to fall very slightly by the end of the forecast horizon, as the government’s new fiscal rules stipulate. Or, forecast revisions could put debt on a slightly rising path in five years’ time. This judgement is extremely sensitive to the OBR’s assumptions about growth and inflation five years hence. It would not be desirable for the government to take immediate policy action in response to a minor forecast change that puts it on track to miss the letter of its fiscal rules – not least due to the uncertainty involved. Stepping back, the case for permanent tax cuts or spending increases that are not offset elsewhere is no stronger now than in the autumn.

Unlocking public sector pay disputes will almost certainly require extra funding from the Treasury: as it stands, departments can ‘afford’ pay awards of at most 3.5% in 2023–24, when both inflation and private sector awards are expected to run considerably higher. But the public finance outlook will make extra Treasury funding for higher awards difficult. Consolidated pay awards would represent permanent increases in spending – increases which could not be financed from any short-term savings on the Energy Price Guarantee. The Treasury’s £13–14 billion spending ‘Reserve’ could be the key to resolving disputes in the near term, but this would not alter the long-term calculation. One-off pay awards, or awards backdated to the start of 2023, would pose fewer fiscal challenges but would leave public sector staff permanently worse off.

The overarching fiscal conundrum for the Chancellor is that with poor economic growth and elevated debt interest payments, even currently planned tax increases may not be sufficient to meet the increasingly urgent demands on public spending.