Carbon pricing will be one of the most talked about policy options at COP26. The idea of carbon pricing is that putting a price on the emission of greenhouse gases (GHGs) to reflect the social costs of climate change should provide producers and consumers with strong incentives to reduce such emissions. In this observation, we consider the opportunities and risks from introducing carbon taxes in developing countries, with reference to Ethiopia and Ghana as case studies.

Low-income countries account for small share of global emissions

Two main types of carbon pricing approaches are currently in use: emissions trading systems (ETS) and carbon taxes. ETS and carbon tax initiatives currently cover 21.5% of global emissions, with 16.4% covered by ETS and 5.6% covered by carbon taxes (some emissions are covered by both). However, their coverage in developing countries is low. In sub-Saharan Africa, only South Africa has implemented a carbon tax and according to the World Bank, carbon taxes are only under consideration in two other countries, Côte d'Ivoire and Senegal.

Many poorer countries account for only a relatively small share of global emissions. South America accounts for 3% of CO2 emissions and the entire African continent accounts for just under 4% (and both even less on a historical, cumulative basis). Thus, they are not the countries where carbon pricing is most needed. Despite this, the economic rationale for carbon pricing applies everywhere: the contribution of each tonne of carbon emitted into the atmosphere to climate change does not depend on where in the world it occurs. In recognition of this, and mirroring recent developments in international corporate taxation, calls have also been growing for a global agreement on minimum carbon prices, which could involve minimum prices differing by country groups in recognition of differential historical responsibilities and levels of development. As developing countries are most exposed to climate change risks, such a proposal would also benefit them disproportionately.

A progressive source of revenue in many developing countries

Even in the absence of global cooperation, however, there are good reasons for developing countries to seriously consider carbon pricing, and carbon taxation in particular. Firstly, without a carbon price now, individuals and companies may make investments in technologies that are later wasted. For example, power companies will invest in new power plants that use high-carbon technologies. These will later either need to be scrapped, wasting the investment, or will lock countries into a higher emissions pathway over the medium term. A carbon price now provides a strong signal that should help to avoid these “lock-in” effects.

Secondly, carbon taxes offer an important and administratively feasible revenue source. Raising more tax revenue is an important part of the development agendas of many countries as they seek to expand public investment and social safety nets, and the COVID-19 pandemic has heightened this need while also adding to concerns about the sustainability of the public finances in some countries. Applying carbon prices in the form of taxes on fossil fuels – as has been done in Colombia and South Africa – is administratively feasible in most countries, since such goods are often already taxed (or subsidised) to some extent. In contexts where the informal economy accounts for a large share of economic activity, carbon taxes are thus likely to be less administratively costly than other tax types, and provide a way of reducing the tax wedge between the formal and informal sectors.

Estimating the revenue potential from a new tax is difficult, but taking Ghana as an example, the estimated tax base from carbon dioxide equivalent (CO2e) embedded in fossil fuels in 2018 was nearly 14.7 million tonnes. At a carbon tax rate of $30 per tonne, this suggests revenue potential of close to 0.7% of GDP.[1]

Of course, who bears the burden of this revenue is a crucial consideration. A key concern for carbon pricing in developed countries is its distributional consequences. Research in the UK and other similar contexts typically finds that increasing the cost of carbon would be regressive. However, this is less likely to hold in developing economies: higher-income households in these countries are much more likely to use fossil fuels and electricity, for instance, and thus would be more likely to be impacted by carbon pricing.

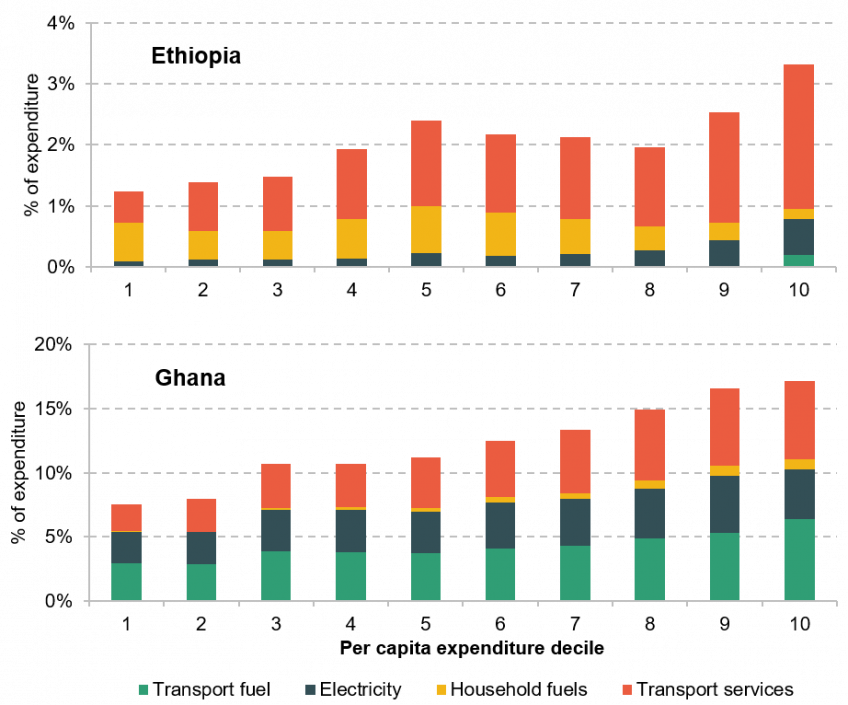

Our analysis of household surveys from Ethiopia and Ghana (Figure 1) confirms that consumption connected with emissions is tilted towards better-off households. In Ghana, electricity consumption accounts for nearly 4% of expenditure in the top expenditure decile of households, compared to 2.5% in the bottom decile. In Ethiopia the same comparison is even starker, though the levels are very different: 0.6% in the top decile and below 0.1% in the bottom decile.

Figure 1. Household budget shares for carbon-intensive purchases in Ethiopia and Ghana

Note and source: Authors’ calculation based on the Ethiopian Household Consumption Expenditure Survey (HCES) for 2015-16 and the Ghana Living Standards Survey Round 7 (GLSS7) for 2016-17. Transport fuel includes fossil fuels used for vehicles; household fuels include kerosene, butane and other gas for household use; transport services include only transport services connected with fossil fuel use (e.g. taxis, buses, trains) and exclude transport powered by humans or animals. Expenditure includes both cash and in-kind purchases.

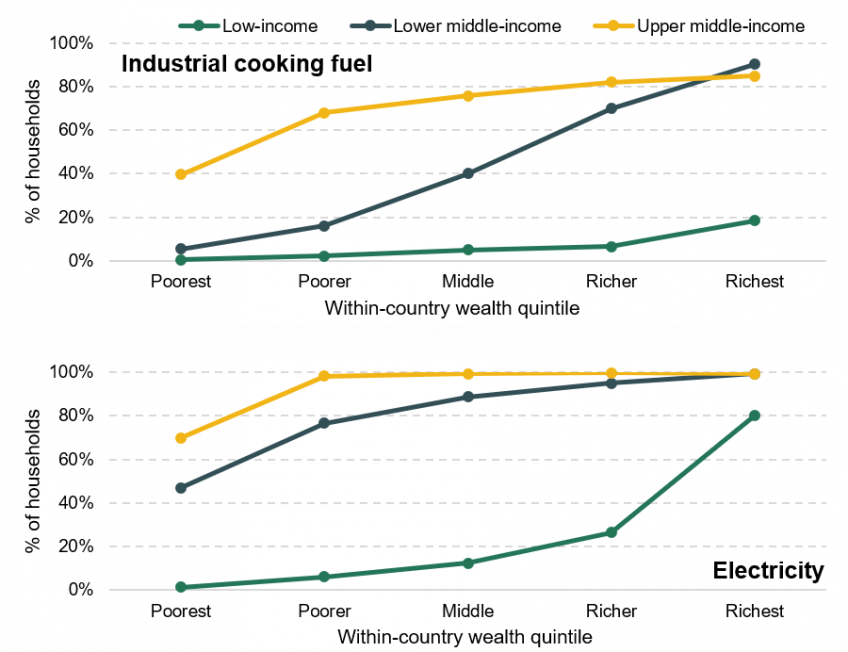

Figure 2 makes the same point – albeit more bluntly – over a broader range of countries. It shows the share of households in each wealth quintile across countries at different income levels that use industrial fuels (as opposed to traditional fuels – see notes for details) as their main source of cooking fuel (top graph), and the share with access to electricity (bottom graph). In poorer countries, use of energy sources that could be covered by a carbon tax is strongly concentrated among richer households. This suggests that any revenue raised from a carbon tax would overwhelmingly come from richer households in these countries (though these may still be relatively poor at a global level).

Figure 2. Average share of households which use industrial cooking fuel (top) and with household electricity access (bottom) by national income level and within-country wealth quintile

Note and source: Authors’ calculation based on Demographic and Health Surveys (DHS). Sample includes 71 countries in total; for each case we use the latest year available, which ranges from 1994 to 2019. Countries grouped into low-income (19 countries), lower middle-income (35 countries) and upper middle-income (17 countries) based on the latest World Bank classification, which does not necessarily correspond to income level in the survey year used. Averages are based on population-weighted estimates. Industrial fuels include electricity, kerosene, and liquefied petroleum gas/natural gas/biogas (collectively termed “clean” fuels in DHS); households not using industrial fuels use traditional fuels, which include charcoal, wood, straw/shrubs/grass, agricultural crops, and animal dung (collectively termed “solid” fuels in DHS).

Risks for developing countries

Despite these appealing properties, pricing (or taxing) carbon does carry risks that are particularly salient in developing country contexts. Even if progressive, some poor households would be made worse off, and potentially pushed (further) into poverty. Effective compensation schemes (for example, unconditional or targeted cash transfers) could help to offset these effects using the tax revenue raised but poorer countries often have less developed mechanisms for effective redistribution. Just like in richer countries, distributional concerns thus loom large for carbon taxes in the developing world – even when such policies are progressive.

In addition, higher energy costs have implications for access to technologies considered an important part of economic development. Figure 2 highlights starkly the lack of access to modern energy for many poor households in developing countries. For example, less than half of households in sub-Saharan Africa had access to electricity in 2019 and very few households have their own motor vehicle (there were just 26 vehicles per 1,000 residents as of 2015, for example). This points to another risk of carbon pricing in developing countries: the widespread use of fuel sources such as firewood, which can be locally sourced and would be outside the scope of taxation. If carbon prices prompted substitution towards such fuel sources, the impact on carbon emissions would be blunted, while also bringing other, more localised environmental costs.

These two related concerns relate to potential challenges for the political economy of these types of reforms, which are less specific to developing country contexts. Increasing the cost of fuel and energy is often a risky political proposition; indeed, many countries continue to subsidise fossil fuels, let alone pricing their carbon content. While strategies for successful reform will be context-specific, setting out a clear reform path in advance with an effective public information campaign – including credible expenditure-side commitments – can be important components of reform packages.

Finally, concerns about international competitiveness are crucial. Global carbon prices would address this problem, but in the absence of such an agreement developing countries may rightly be wary of pursuing unilateral action, which would do little to address climate change as a whole while making domestic producers selling tradable goods less competitive – unless a comprehensive policy of adjusted carbon tariffs on imports and rebates on exports could be implemented, which is unlikely. The complexity of the EU’s proposals to apply adjusted carbon tariffs on imports highlights the scale of this challenge.

Summary

Global carbon pricing would be hugely beneficial for the developing world. The costs of climate change would be disproportionately borne by poorer countries; equivalently, the benefits from reducing carbon emissions would be greater too. A coordinated international approach to pricing carbon would be a huge step towards achieving this goal but even aside from this, taxing carbon offers a progressive way of raising tax revenue in developing countries. The crucial thing with any such reforms will be to ensure that mitigating measures are considered in parallel – to compensate poor households, invest in energy access, and address international competitiveness, if necessary.

[1] Calculation is based on production-based CO2e and so does not adjust for trade, and uses an exchange rate of 0.21 USD per Ghanaian Cedi.