Isabel Stockton is a Senior Research Economist at the Institute for Fiscal Studies. Responding to today's ONS figures on public finances, they said:

“Today’s data on government spending, borrowing and revenues underscore the challenges facing the Chancellor as we head into the week of the Spring Statement. The forecast will include costings for cuts and a tightening of eligibility for health-related benefits announced this week, although as we have seen from previous reforms the eventual impact will depend on the way individuals respond to the changes. There are risks here. But having boxed herself in with promises to meet her fiscal targets, not to raise taxes further and not to return to austerity for public services, easy or risk-free options for the Chancellor are in short supply.”

Today, the Office for National Statistics published new figures on government revenues, spending and borrowing, which means we now have provisional data that cover the first 11 months of the financial year 2024–25. This is the last such data release before next Wednesday’s Spring Statement.

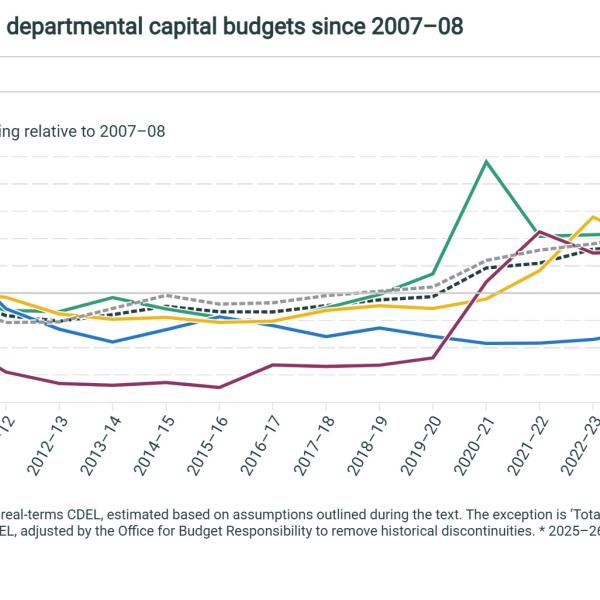

- In the first eleven months of the financial year 2024–25, the public sector borrowed £132 billion. A simple extrapolation suggests that whole-year borrowing could come in at £151 billion, £23 billion more than forecast by the Office for Budget Responsibility (OBR) in October 2024. That forecast itself included a big upward revision to borrowing, largely reflecting much higher spending than anticipated in March 2024, before the General Election, when borrowing this year was forecast to be just £87 billion. So borrowing this year could be £63 billion higher than was forecast a year ago.

- Borrowing in 2023–24, the financial year ending almost a year ago, stands at £131 billion, or £9 billion higher than estimated last October, and £17 billion higher than the forecast made in March 2024. The size of the revision is another illustration of the complexities and uncertainties involved in measuring the state of the public finances, never mind forecasting to 2029, the year targeted by the Chancellor’s fiscal rules.

- A large share of self-assessment income tax revenue is paid in January each year, but the data become more reliable once those payments which slip into February revenues are also be taken into account. Today’s release largely confirmed the January data: taken together, January’s and February’s self-assessment revenues were still £4 billion, or 14%, below the OBR’s October forecast.

- The government spent just under £9 billion on servicing its debt in February, slightly above the October 2024 forecast. Markets now expect interest rates to remain higher into the medium term compared to when the OBR prepared that forecast. Current market expectations mean that debt interest spending could be around £6 billion higher in 2029-30.

The OBR’s forecast for next week has already been finalised and, more broadly, monthly snapshots of data matter less than the outlook going forward. The Chancellor’s fiscal rules, which were only being met by a hair’s breadth back in October, bind in 2029–30. But the data nevertheless underline the challenges of faltering growth, weakness in tax revenues, and high and volatile debt servicing costs.

Figure 1 Borrowing forecasts, out-turn and extrapolation

Sources: Office for National Statistics, Public Sector Finances Time Series (series ID J5II) and Office for Budget Responsibility, Economic and Fiscal Outlook (October 2024): monthly profiles

IFS researchers set out the Chancellor’s fairly unenviable options in a pre-Statement report earlier this month. They will present their initial analysis of the Chancellor's announcements the day after the Spring Statement, Thursday 27th March, at an online webinar.