Last week the Prime Minister David Cameron told MPs that he was determined to “deal with” the “problem of deeply discounted alcohol in supermarkets and other stores” and said that the Government was considering the results of a consultation into a proposed minimum unit price for alcohol.

New analysis by IFS researchers, published as an IFS Briefing Note today, argues that a reformed system of alcohol excise taxes focused on strong drinks would be more effective at targeting those drinking above recommended levels than would a minimum unit price for alcohol.

A tax-based reform would also raise additional tax revenues for the government. In contrast, minimum pricing would generate significant windfall revenues for alcohol retailers and manufacturers and reduce revenue from alcohol taxes.

Together, these findings point to a tax-based approach as preferable to minimum unit pricing in dealing with problem drinking. Since tax reform would require EU-wide agreement, we argue that the government should work now to win the necessary support to enable such reforms to be implemented, even as the debate about the compatibility of minimum unit pricing with EU legislation continues to rage.

The research draws on data recording the off-trade alcohol (purchased in supermarkets and off-licences) bought by more than 21,000 British households during 2010. Two main policy reforms are compared:

1. A minimum price for alcohol of a 45p per unit;

2. A reform of alcohol excise taxes so that the tax rate depends explicitly on alcohol content. Rates vary across alcohol types and increase directly in line with alcohol strength.

The total amount of off-trade alcohol purchased following each reform falls by the same amount: around 2.4 billion units (where a ‘unit’ is 10ml of pure alcohol) from an initial level of 37 billion. However the effects of the policies differ in important ways. The research compares how these policies impact on households according to the average amount of alcohol they buy. This gives an important measure of whether or not they are well-targeted on heavy drinkers. The impact on government tax revenue and industry revenues is also assessed.

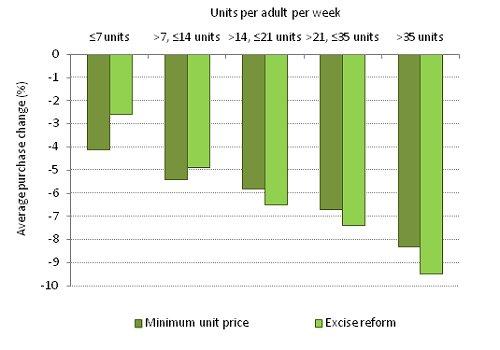

Figure 1 shows the average percentage change in alcohol units purchased across households grouped by initial purchase levels. For heavy drinkers (those purchasing more than 35 units per adult per week on average), a 45p per unit minimum price reduces alcohol purchases by around 8%. For moderate drinkers (fewer than 7 units), the fall is 4%. Reform to the system of excise taxes would reduce purchases by heavy drinkers by 9.5%. Moderate drinkers would see a fall of just 2.6%. This tax reform is better targeted on heavy drinkers than the minimum price.

Figure 1. Average change in units of alcohol purchased, by policy and purchase group

Sources: Calculated from Kantar Worldpanel 2010 data.

Both policies raise total consumer spending on off-trade alcohol by a similar amount, around £550 million for the minimum price, and £640 million for the tax reform. The policies differ enormously in how that extra spending is distributed between government tax revenue and industry revenue. The minimum unit price reduces tax revenue by £290 million (drinkers reduce their purchases without any compensating increase in tax rates), but increases industry revenue by £840 million. In contrast, tax reform would increase tax revenues by £980 million.

Both reforms would probably be slightly regressive. Low-income drinkers tend to buy cheaper and stronger alcohol than high-income drinkers purchasing similar amounts of alcohol units. The government should be more concerned with the distributional effects of policy as a whole. Nonetheless, if policy makers were concerned about the distributional consequences of alcohol pricing policies in particular then some of the revenue raised through tax reform could be used to help ameliorate this concern. This is an option not available for minimum pricing.

The analysis looks only at off-trade alcohol which accounts for about three in every four alcohol units purchased. Minimum unit pricing and tax reform are likely to have different implications for the on-trade (alcohol in pubs and restaurants). On-trade prices are much higher, so a minimum unit price would have little direct impact there. Tax reforms would affect on-trade alcohol as well. To the extent that problem drinking takes place in the on-trade it is not clear that we would only want price reforms to affect off-trade consumption. If those who drink to excess on-trade purchase stronger products, then an excise tax reform would still look well-targeted. Furthermore, a tax reform targeted on alcohol strength may well still raise off-trade prices relative to on-trade since, on average, alcohol purchased off-trade is stronger than alcohol purchased on-trade.

It is somewhat curious that the recent debate around alcohol pricing has focused so much on a minimum unit price. Much less has been made of the fact that the current, complex set of alcohol taxes does a poor job of targeting harmful drinking. Reforming the way in which we tax alcohol could provide a better route to reducing harmful drinking than the introduction of a minimum price. It would reduce alcohol purchases among heavy drinkers, have less impact on moderate drinkers, and raise additional useful revenue for the government. Heavy drinkers also buy cheap alcohol, but a minimum price would be less well targeted than the tax reform, reduce tax revenues and increase the revenues of alcohol retailers and manufacturers.