Amid continuing debate over university tuition fees there remains confusion over some important numbers. We showed before that scrapping tuition fees for new students would increase borrowing by £11 billion a year. It has more recently been suggested that debt accumulated by graduates under the £9k a year tuition fee regime should be written off. If that policy were implemented immediately it would have almost no effect on government debt in the short run, but due to reduced future repayments from graduates, would increase debt by around £20 billion by 2050. If implemented after an election in 2022 the cost would be much higher, adding around £60 billion to debt in the long run. Suggestions that debt would rise by £100 billion are wrong. £100 billion is the outstanding value of all tuition fee and maintenance debt since 1998 – it is not the answer to the question: what would be the impact on public debt of writing off fee loans accumulated under the £9,000 tuition fee regime?

Citing concerns about access to university, Labour’s election manifesto proposed to scrap tuition fees for all future students. Our previous work outlines the impact of this on graduates and the government finances. However, following the release of the manifesto, Labour leader Jeremy Corbyn went further than this, stating in an interview with NME that he would “deal with” the debt burden of those with “the historical misfortune of being at university during the £9,000 period”1.

This sparked considerable debate, with some reports suggesting this would cost approximately £100 billion. In fact, the £100 billion figure is the total value of all outstanding tuition fee and maintenance debt right back to 1998. The outstanding fee debt of graduates who entered university after 2012 stands at £34 billion. If that were written off in its entirety it would have almost no effect on government debt in the short run, but due to reduced future repayments from graduates, would increase debt by around £20 billion by 2050 (in current day terms). The difference is made up of loans the government expects to write off anyway. Of course, if the write-off were not to occur until after a 2022 general election, the costs of writing off all tuition fee debt would be much higher – we estimate this would add roughly £60 billion to debt by 2050.

As with the policy of scrapping fees for future cohorts, it is the highest earning graduates that would benefit the most, with the lowest earning graduates benefiting very little from reduced compulsory loan repayments.

Government finances

Figures from the Student Loan Company show that, as of March 2017, £100.5 billion was outstanding in student loans. However, as shown in the Table, this includes £11.2 billion of Welsh, Scottish and Northern Irish loans, which are administered separately, as well as £44.1 billion in pre-2012 English loans. Furthermore, only around £30 billion of the remaining £45.3 billion in post-2012 loans consists of tuition fee loans including the interest accumulated on those, with the rest made up of maintenance loans. Adding the approximately £4 billion in fee loans that will have been paid to universities since March, the current level of total outstanding fee debt of students having entered university after 2012 will be around £34 billion.

NI, Welsh and Scottish loans | £11.2bn |

English loans - pre-2012 cohorts | £44.1bn |

English loans - post-2012 cohorts | £45.3bn |

Of which: Tuition fee loans | £29.7bn |

Maintenance loans | £15.5bn |

Total outstanding UK student loans | £100.5bn |

See End Note 2

Writing off the post-2012 tuition fee loans would weaken the public finances. The impact on the deficit would be rather complicated, with a substantial increase in the first year, by up to as much as the full value of the debt written off – that is there would be a one off increase in the deficit of up to £34 billion. Beyond that it would be increased only by the loss of interest that would otherwise have been accrued on the outstanding debt. Depending on how the write-off is scored it is possible that the deficit would actually be reduced in future years as less debt will be written off in those years. But of course this would all be dwarfed by the £11 billion a year cost if loans were replaced by “free” tuition going forward.

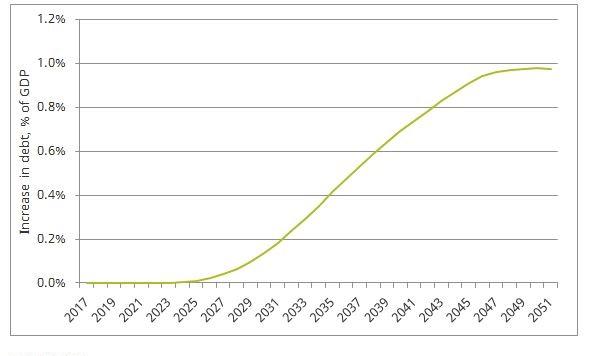

The impact on government debt of writing off these £9k loans (and ignoring any change to the tuition fee regime going forward) is more straightforward. In future years, the Government would receive lower loan repayments and therefore debt would increase. Figure 1 summarises our estimates of the pattern of this increase. In the short run, there would be no impact on government debt as new graduates would be making repayments on their maintenance loans, meaning overall receipts are unaffected. However, the impact starts to increase as more students clear their maintenance debts, resulting in the government losing out on repayments from graduates. Government debt would continue to rise above its counterfactual level for 30 years, before levelling off at the point where outstanding student loans would have been written off anyway. Thereafter the only cost to the public finances would be the interest paid by government on the extra debt accumulated, while government debt would be permanently higher.

Figure 1. Increase in Government debt from writing off post 2012 English tuition fee loans

See End note 3

The figure highlights that with all other government policy unchanged, this policy would increase the debt by around 1% of national income by 2050; equivalent to around £20 billion in today’s terms. If instead only the amount in excess of the £3,465 charged to those going to university in 2011 were to be written off, government debt would be around £10 billion higher in 2050 as a result of the policy.

Obviously the level of outstanding post-2012 fee debt will increase under the current system as new cohorts experience the higher fees, increasing the cost of writing off these loans. For example, if a government were to come to office in 2022 set on writing off all outstanding fee debt from the post-2012 cohorts, outstanding tuition fee debt would be in the region of £100 billion4. Writing this debt off would increase government debt by roughly 3% of national income, or £60 billion, in 2050.

Wider implications

With all else held constant, the main beneficiaries of this proposal would be high earning graduates, with low earning graduates standing to benefit very little. Under the current system, high earning graduates make the highest student loan repayments and repay the largest proportion of their debt. If a significant part of the debt were to be written off, their total repayments would therefore be reduced most. Low earning graduates, on the other hand, are forecast to repay very little of this final part of the loan; indeed around one-third would see no change at all to their student loan repayments as a result of the policy as they will never earn enough to clear even their maintenance loans.

Furthermore, not all students take out the full fee loans available to them – for example, around 7% of students starting university in 2014–15 chose to pay their fees upfront, while others did not borrow the full amount or have already made repayments on their tuition fee debt. Unless there will be some form of compensation for those that paid their fees (or part thereof) upfront, those graduates would not benefit (or not benefit as much) from any writing off of tuition fee debt. They (or their families) might reasonably feel cheated.

Writing off the tuition fee debts of those who paid the post 2012 fees in England might also place pressure for additional spending in Scotland, Wales and Northern Ireland whose populations would otherwise not benefit from this change.

There is also of the issue of those who went to university before 2012, who themselves faced tuition fees; 2011 students incurred fee debts of more than £10,000 for their degrees, for example. While these debts are considerably lower, leaving these individuals’ debts untouched while trying to address the “historical misfortune” of attending university after 2012 would seem contradictory. Adding these earlier debts to the write-off would of course add to the long run costs considerably.

Of course, our forecasts for the impact on government debt in the long run assume no policy changes designed to recoup some of the money. The government could, for example, pay for this with a modest increase in the top rate of income tax. This would do something to alleviate concerns that the policy is regressive, although high earners without student debt – people who didn’t go to university as well as those who went but do not have any outstanding debt – would lose out.

End Notes

1. The NME interview with Jeremy Corbyn can be found at http://www.nme.com/news/jeremy-corbyn-will-deal-already-burdened-student-debt-2082478 .

2. Figures from March 2017 Student Loan Company report “Student Loans in England: Financial Year 2016-17”.

3. Uses OBR central projection of GDP. The discontinuity in 2046 occurs because this is where students start to have their debts written off. The figure only includes the additional debt impact of writing off the stock of post-2012 tuition fee loans, it does not include any debt impact from scrapping tuition fees going forward.

4. This uses the estimated increase in student debt, including interest, from the OBR’s March 2017 Economic and Fiscal Outlook and assumes that tuition fee loans will stay constant as a proportion of total loans given out. It has been put in today’s prices.