Executive Summary

Of the 8.4 million children in English state schools, 3.4 million are eligible to get a free meal at school each day. Just under 2 million of these children are eligible through the means-tested system, which includes children whose families are receiving certain means-tested benefits and on very low incomes. Since 2014, all children in the first three years of primary school – Reception, Year 1 and Year 2 – have been eligible for free school meals.

Options to expand free school meals have been frequently discussed. London Mayor Sadiq Khan recently announced that, in 2023–24, all primary-age children in state schools in London will be eligible for a free school meal, expanding eligibility by 270,000 pupils beyond the 550,000 who are already eligible. Other proposals suggest expanding entitlement to free school meals by increasing the earnings threshold for eligibility from the current £7,400 a year (after tax). For example, the National Food Strategy suggested a threshold of £20,000 a year after tax.

In this report, we discuss the options and trade-offs in expanding free school meals in England. We focus on several potential reforms that would expand the generosity of the free school meal system, either by increasing the value of free school meals or by expanding eligibility to a wider range of pupils, and set out the costs of these policies, their distributional impacts, and their potential effect on parents’ work incentives.

Key findings

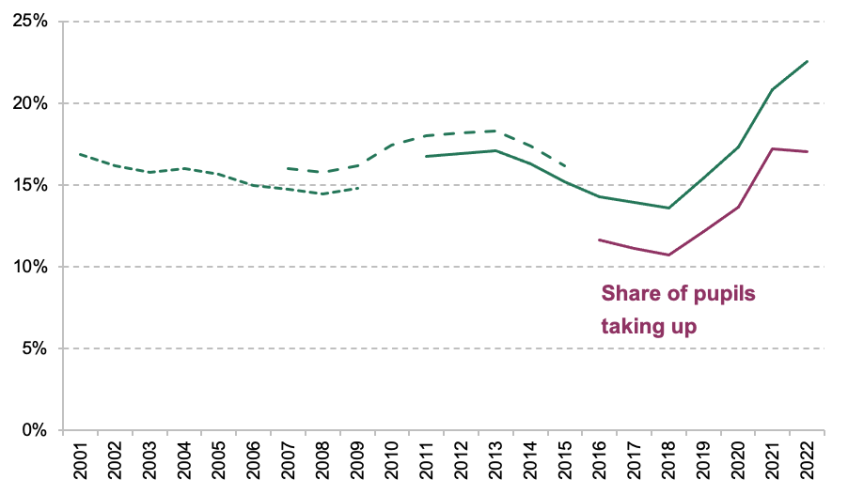

1. Just under a quarter of pupils in England are eligible for means-tested free school meals this year, compared with a long-run average of about one in six. The recent rise in eligibility is mainly the result of ‘transitional protections’ that exist due to replacement of the legacy benefit system with universal credit, but it also reflects changes to the labour market during the pandemic. Total spending on free school meals throughout term-time is around £1.4 billion a year in England.

2. Evidence from England and internationally suggests that free school meals reduce the amount that families spend on groceries, but usually by less than the value of the meals (suggesting that families respond partly by increasing the quantity or quality of food they consume). While the evidence for health benefits is mixed (though generally positive outside the United States), there is a fairly strong evidence base suggesting that children who receive free school meals benefit academically, largely because school meals on average offer better nutritional value than packed lunches. Some of these benefits persist into adulthood.

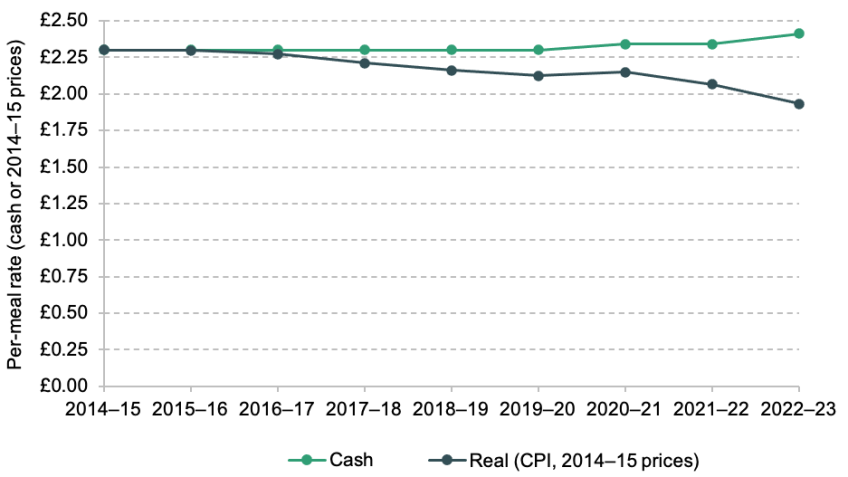

3. Funding for free school meals has not kept pace with inflation. Since 2014, the per-meal funding rate has lost 16% of its value in real terms. The funding rate currently stands at £2.41 per meal; if it had increased in line with inflation as measured by the Consumer Prices Index, it would now be £2.87. Increasing the funding rate to this level would cost an extra £250 million a year in current prices (rising to £300 million when extra funding for devolved nations is included).

4. At the moment, families on universal credit are only eligible for means-tested free school meals if their after-tax income is less than £7,400 a year. This income cap for (means-tested) free school meals means that 1.7 million children whose families are entitled to universal credit – 69% of this group – are not eligible for free lunches.

5. Rates of food insecurity are significantly higher for families claiming universal credit: overall, nearly 30% of families claiming universal credit were classified as food insecure in 2021–22, six times the rate among families not claiming universal credit. Even amongst universal credit claimants, though, food insecurity was highest among the lowest-income families: more than half of families claiming universal credit and earning £200 a week or less (before tax) were food insecure, compared with a third of families earning between £200 and £400 a week.

6. Expanding eligibility to all children whose families claim universal credit could cost about £1 billion a year in the longer term, a 70% increase in spending on free school meals. Raising the income cap to £20,000 a year (as proposed in the National Food Strategy) would be a less expensive reform, bringing about 900,000 children in relatively low-income families into eligibility. This would cost around £425 million a year and would mean that around two-thirds of children whose families get universal credit also get means-tested free school meals.

7. Several jurisdictions both within England and in the rest of the UK are experimenting with universalising free school meal provision, at least for primary school pupils. Extending free school meals to all primary state school pupils, as Scotland has pledged and London is about to pilot, would cost an additional £1 billion a year in the longer term, similar to the costs of extending free school meals to all pupils whose families receive universal credit in both primary and secondary school. Offering free school meals to all primary and secondary pupils (up to Year 11) would cost an extra £2.5 billion a year.

8. In addition to the long-term running costs of expanded school meal provision, significant expansions in eligibility could require up-front funding to improve school kitchens and dining areas. In 2014–15, the government provided £150 million in capital funding to support the universal infant free school meals policy, roughly £100 per pupil made eligible in the first year of the policy. On the other hand, if there is significant underutilised capacity in the system, capital costs could be much lower.

9. Under the current system, free school meals are not ‘tapered away’ gradually (families either get them or they do not). Parents who are earning near the £7,400 income cap therefore have a financial incentive to avoid earning a little more if it would mean losing access to free meals. For a single parent with two school-aged children, this ‘cliff edge’ means that earning £7,399 and keeping free school meals would be financially preferable to earning anything up to £9,400. That is equivalent to turning down an extra four hours of work each week at the National Living Wage.

1. Introduction

The 1944 Education Act required local education authorities to provide lunches in school in England and Wales. The motivation was grounded in health and nutrition, aiming to ensure that eligible children received a meal ‘suitable in all respects as the main meal of the day’.

There are several reasons why policymakers might want to make school lunches free for at least some children. Most obviously, this is a policy that effectively offers an in-kind transfer to low-income families with children. If parents value school meals similarly to what the government pays for them, a year’s worth of free school meals is worth around £460 per child.

School meals can also have benefits for child nutrition and health – as set out in the original 1944 legislation. Particularly as school food standards have risen, researchers find that school lunches are on average more nutritious than the packed lunches that children might otherwise bring (Parnham et al., 2022). A final potential benefit from free school meals is their impact on wider outcomes, such as educational attainment or social and emotional development. For example, children who eat better at lunch might find it easier to concentrate and behave well in class, helping them – and their classmates – to learn more in the afternoons.

The evidence for these three motivations is summarised in Box 1. Overall, the evidence suggests that free school meals do help families to spend less on groceries, freeing up funds to spend on other goods and services or to save. But food expenditure typically falls by less than the value of school meals, suggesting that families respond partly by increasing the quantity or quality of food they consume. While the evidence for health benefits is mixed (though somewhat more positive outside the US), there is a fairly strong evidence base suggesting that children who receive free school meals benefit academically. Some of these benefits persist into adulthood. There could be additional benefits to free school meal policies if they improve social skills as children eat and socialise together or if universal programmes reduce stigma, but evidence on these are more limited.

In this report, we first outline the current policy and funding landscape for free school meals in England. Given that there is interest from some policymakers in expanding free school meals, including from the Mayor of London, we then discuss several options for their potential expansion: both increasing the generosity of free school meals for existing families and expanding eligibility to cover more children. We estimate how much these reforms would cost and how they would affect the distribution of spending. Finally, we analyse the impact that the current eligibility rules for free school meals have on parents’ work incentives: losing eligibility to free school meals all at once means that some parents will be better off working less for a lower salary, and keeping their free meal entitlements.

Box 1. Overview of the evidence base for (free) school lunches

Impacts on family income: Free school lunches save families money on the lunchtime foods they no longer have to buy. In strict financial terms, the savings to households are usually considerably less than the amount that the government pays for free lunches. For example, one evaluation of England’s universal infant free school meals suggested that spending on food fell by about £230 a year, compared with a cost of £437 for a year’s worth of free school meals (Holford and Rabe, 2022); results in the US suggest smaller savings of around $130 a year, despite the policy covering both breakfasts and lunch (Marcus and Yewell, 2022). Of course, households may choose to use some of the funds freed up by free school meals to buy more or better-quality food for other meals, reducing the financial savings but still providing a boost to their standard of living.

Impacts on health and nutrition: There is mixed evidence on how free school meals affect children’s health and body weight. While the pilot study for universal free school meals in England found almost no effect on pupils’ diet quality (Kitchen et al., 2012), a subsequent evaluation of universal infant free school meals concluded that they reduced obesity, at least in the short term (Holford and Rabe, 2022). International evidence also points to the potential for reductions in obesity, for example in South Korea (Bethmann and Cho, 2022). But in some countries, such as the US, school nutrition programmes actually increase obesity. This occurs partly because the meals themselves are high in calories and partly because pupils do not reduce their food consumption outside school by enough to compensate for the new, free meal (Schanzenbach, 2009; Corcoran, Elbel and Schwartz, 2016).

Impacts on wider outcomes: There is an international evidence base suggesting that increasing the take-up of school lunches (including by expanding eligibility for free meals) can benefit children’s attainment. The pilot of universal free school meals in England concluded that universal entitlement led to improved attainment in primary school, particularly among those from less affluent families (Kitchen et al., 2012). Studies from the US typically find similar educational benefits from universal school lunches (e.g. Schwartz and Rothbart, 2020; Gordanier et al., 2020; Ruffini, 2021). The nutritional content of school meals seems to be an important driver of these attainment effects: Belot and James (2011) find positive effects on primary school attainment following a campaign to improve school food standards in Greenwich; by contrast, a Chilean school meals programme that focused on calorific content rather than nutritional composition saw no impact on a range of educational outcomes (McEwan, 2013).

Long-term impacts: Evaluations of some of the earliest school feeding programmes suggest that some benefits for health and attainment persist into adulthood. For example, the introduction of nutritious lunches in Swedish schools raised educational attainment, improved health in adulthood and increased earnings by around 3% (Lundborg, Rooth and Alex-Petersen, 2022). The earliest American school lunch programmes – which had less of a focus on nutrition than their Swedish counterpart – also raised education levels, though with little lasting impact on health (Hinrichs, 2010).

2. Current policy landscape

Around 1.9 million children in England are currently eligible for means-tested free school meals. Another 1.5 million ‘infants’ (in Reception, Year 1 and Year 2) can receive free meals through the Universal Infant Free School Meals programme introduced in England from September 2014.1 In addition, older children living in some – generally relatively deprived – local authorities benefit from universal programmes that offer free school meals throughout primary schools.2 The largest expansion of free school meals will come in 2023–24, when the Greater London Authority will run a one-year ‘pilot’ of universal free school meals throughout state primary schools in the capital.

Eligibility for free school meals

Eligibility for means-tested free school meals is a ‘passported’ benefit, available to families on certain means-tested benefits.3 Most eligible families are claiming either child tax credit or universal credit. Eligibility for free school meals is subject to an additional means test: families on child tax credit cannot have an annual pre-tax income above £16,190, while those on universal credit must earn less than £7,400 a year (after tax). These thresholds have been frozen in cash terms since 2010–11 for child tax credit recipients and since 2018–19 for universal credit recipients. Had it risen in line with inflation (as measured by the Consumer Prices Index) since 2018–19, the income cap for universal credit recipients would now be around £8,700.

Despite the frozen thresholds, as Figure 1 shows, eligibility for free school meals has risen quickly in recent years. During the 2000s and early 2010s, between 14% and 18% of pupils were known to be eligible for free school meals. After falling to its lowest level in 2018, the eligibility rate has since risen by more than half. By 2022, 23% of pupils were eligible for a (means-tested) free school meal.

Figure 1. Share of pupils registered for, and taking up, means-tested free school meals

Note: Breaks in the data series over time are represented with different line patterns. Data for 2001–09 cover primary and secondary schools only. Data for 2007–15 include state-funded nursery and primary schools, state-funded secondary schools, special schools, and pupil referral units, but exclude those in independent schools. Data for 2011–22 include state-funded nursery and primary schools, state-funded secondary schools, special schools, pupil referral units, and local authority alternative provision, as well as pupils attending independent schools.

Source: 2001–05 – tables 2a and 2b, ‘Pupil characteristics and class sizes in maintained schools in England, January 2005 (provisional)’. 2006–09 – table 3a, ‘Schools, pupils and their characteristics: January 2009’. 2007–08 – table 3b, ‘Schools, pupils and their characteristics: January 2011’. 2009–15 – table 3b, ‘Schools, pupils and their characteristics: January 2015’. 2011–15 – table 4a, ‘Schools, pupils and their characteristics: January 2019’. 2016–22 – ‘Schools, pupils and their characteristics: January 2022’.

This steep increase is partly due to the transitional protections introduced in April 2018 to cover the roll-out of universal credit. Under these protections, pupils who are eligible for free school meals at any point from 1 April 2018 onwards remain eligible until they finish the phase of schooling they are in during the 2022–23 academic year. During the COVID-19 pandemic, universal credit caseloads grew as a result of both economic disruption and temporary increases in the generosity of the benefits system; this also increased the share of pupils eligible for free school meals.

Some pupils who are not eligible for free school meals will nevertheless be eating school lunches (but their families will be paying for them). It is difficult to know the precise share of pupils who pay for school meals, but some surveys suggest that perhaps a third of children are eating paid school lunches (Wollny et al., 2015). This blunts the potential for expansions of free school meals to benefit either these children’s nutrition and health or their educational attainment: newly-free school meals would primarily change who pays for their meal, but not what they eat at school. Of course, the increase in disposable family income that comes from the saving on school meals could lead to other benefits for the child.

Box 2. School nutrition policies in the devolved nations

School meals are a devolved policy area, meaning that the rules in England differ from those in Scotland, Wales and Northern Ireland.

In Scotland, free meals are universal in Primary 1 through 5 (ages 5–10). While the Scottish Government had planned to extend universal provision to all primary school pupils by August 2022, the roll-out has been delayed. The Scottish Government has instead committed to offer free school meals to all primary pupils by the end of this parliamentary term, which runs until May 2026. Scotland also has a slightly higher income cap than England; families on universal credit must earn (net of tax) no more than £7,920 a year, compared with £7,400 in England.

Wales offers means-tested free school meals on a similar basis to England, but it is rolling out universal free provision in primary schools by 2024. As of April 2023, most Welsh local authorities are expected to offer universal meals to children in Reception through Year 2. Welsh primary schools can also request their local authority to fund free school breakfasts if there is sufficient demand from parents.

Northern Ireland does not offer any universal school meal provision. However, it does have a much higher income cap than the other three parts of the UK: parents claiming universal credit can earn up to £14,000 a year (net of tax) and still qualify for free school meals.

Funding for free school meals

Funding for free school meals is calculated based on a per-meal rate, which for the 2022–23 academic year stands at £2.41. As Figure 2 shows, the rate had initially been set at £2.30 in 2014–15 (when universal infant free school meals were introduced), and remained frozen in cash terms for the next five years. During this period, it lost 8% of its value in real terms. Subsequent cash-terms increases have largely not kept up with inflation, leaving the value of per-meal funding 16% lower in real terms than it was in 2014. If funding had kept pace with inflation, as measured by the Consumer Prices Index (CPI), the rate would now stand at £2.87. Given that current inflation is particularly high in food prices and energy costs, the pressure on free school meal budgets could be even higher than these figures indicate.

Figure 2. Funding rate (per meal) for free school meals in England

Note: Real-terms value is given in 2014–15 prices based on the Consumer Prices Index.

Source: Office for National Statistics, ‘CPI index 00: all items’, series ID: D7BT.

3. Options for expansion

There have been repeated calls to reform free school meals, expanding eligibility to more (or all) children in state schools. These proposals gained particular prominence during the COVID-19 pandemic, with high-profile campaigns from figures such as footballer Marcus Rashford and chef Jamie Oliver to expand eligibility for, or the generosity of, free school meals. The National Food Strategy also initially recommended extending eligibility for free school meals to all children in families claiming universal credit (National Food Strategy, 2020). Because of rising costs resulting from a growing universal credit caseload during the pandemic, in the second report the recommendation was made somewhat more modest (National Food Strategy, 2021): increasing the earnings threshold from £7,400 to £20,000 in post-tax income.

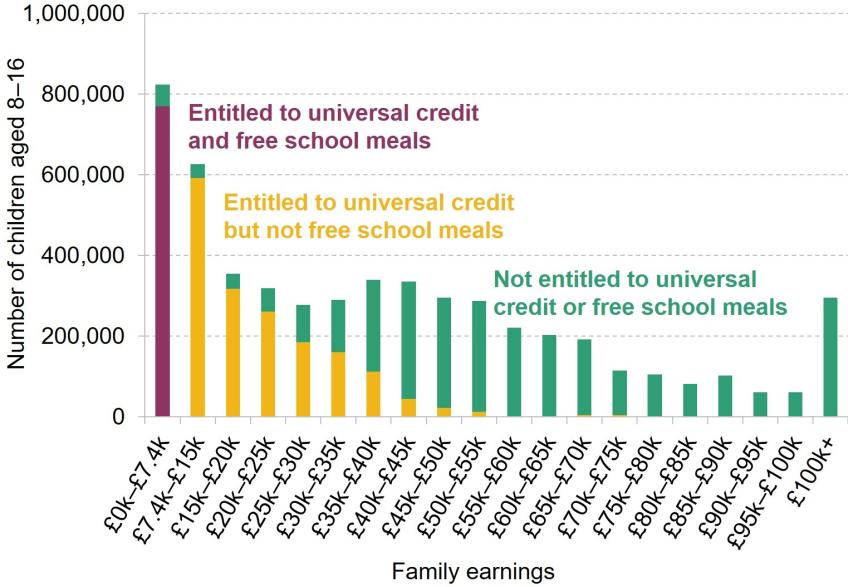

Figure 3 plots (using data from 2019–20) the number of children aged 8–16 in England, by their family’s post-tax, pre-benefits earnings. Currently, only children shown in the purple bar are eligible for means-tested free school meals.4

Figure 3. Number of children aged 8–16 in England, by family net earnings

Note: Horizontal axis shows net (post-tax) family earnings. Children in private education excluded. According to official statistics, there were just over 1 million children in Years 3–11 who were eligible for free school meals in 2019–20; the slightly lower figure here is largely due to modelling instantaneous eligibility under universal credit without accounting for transitional protections; we also account for the £7,400 threshold being frozen in cash terms while nominal earnings grow, which reduces eligibility.

Source: Authors’ calculations using Family Resources Survey, 2019–20, uprated to 2023–24 prices, and TAXBEN, the IFS tax and benefit microsimulation model.

Around 1.7 million children – those represented by the yellow bars – are in families who are deemed poor enough to be eligible for at least some universal credit but are nonetheless not eligible for free school meals, because their family’s post-tax annual earnings are £7,400 or above. Data from the Family Resources Survey suggest that, in 2021–22, among families with children, households claiming universal credit were five times more likely to have used a food bank in the past month than households not claiming universal credit. Nearly 30% of families claiming universal credit had ‘low’ or ‘very low’ food security, six times the rate among families not claiming universal credit.5 Even amongst universal credit claimants, though, food insecurity was highest among the lowest-income families: more than half of families claiming universal credit and earning £200 a week or less (before tax) were food insecure, compared with a third of families earning between £200 and £400 a week. (These earnings are measured before tax, so are not directly comparable with the free school meals income cap, which is based on post-tax income.)

Raising the income cap to £20,000 for families on universal credit, as advocated in the National Food Strategy, would expand eligibility to the two left-most yellow bars in Figure 3. This would bring about 900,000 children in low-income families into eligibility, meaning that around two-thirds of children whose families get universal credit would also get means-tested free school meals.

It is worth noting that entitlement to universal credit is dependent upon a number of factors beyond earnings – including rent, whether the family is a single adult or a couple, number of children, childcare expenditure, and savings. This is why there are some low-earning families ineligible for universal credit and some higher-earning ones who are eligible.

Options to expand free school meals provision

Expanding free school meals provision could be done straightforwardly in three broad ways. First, the eligibility criteria could be left unchanged, but there could be more spent on the already eligible – those in the purple bar in Figure 3. This could be done by providing meals during the holidays, by providing breakfasts as well as lunches, or by increasing the amount spent on each meal (presumably with increased quality). This would focus increased resources on roughly the poorest sixth of families with children.

Second, eligibility could still be restricted to those on universal credit, but with a higher earnings threshold. This would amount to extending eligibility to some or all of the children represented by the yellow bars in Figure 3. The earnings threshold could be abolished entirely and free school meals be extended to all children in families on universal credit.

Third, universal provision could be extended. Rather than universal provision finishing in Year 2, it could go up to the end of primary school (as in Scotland and, in 2023–24, in London) or extend to all children at school regardless of age. Assuming that it was restricted to children who are educated in state schools, it would not include the roughly 7% of children educated in independent schools, who are disproportionately from the very highest-income families.

Box 3. Other potential reforms to child nutrition policies

The options for reform that we set out in this section vary the generosity and targeting of free school meals. There are a variety of other ways in which the government could introduce more significant reforms to free school meals and wider child nutrition policies.

Geographic targeting: A handful of local authorities already offer more generous free school meal programmes, with universal eligibility among all primary school pupils. Other local authorities could follow suit; if this happened predominantly in more disadvantaged local authorities, it would bring more children from low-income families into eligibility. However, local councils are facing considerable budgetary pressure already: local government budgets faced substantial cuts during the 2010s, and have only just recovered in real terms to 2015–16 levels. Any geographically driven reform is likely to be less efficient at targeting the poorest pupils than raising the income cap for families on universal credit, though it could open up potential economies of scale in delivering school meals.

Building in tapering of support: Free school meals are offered as a discrete, in-kind benefit. This means that they have an unusually strong impact on parents’ work incentives particularly right around the eligibility threshold (discussed in Section 4), since it is possible for parents to become worse off by earning more if it means they lose out on free school meal eligibility.

If the government were particularly concerned about these impacts on work incentives, it could explore options to taper away support. For example, with cash card systems, it could gradually reduce the share of the school meal price covered by the government as parents earned more. This would bring risks of significantly lower take-up (if low-income families did not top up these cash cards) as well as greater administrative complexity.

Another option would be to continue to provide free school meals, but to reduce the benefits income of higher-earning families on universal credit by including the assessed value of the free meals in the ‘income’ used to calculate benefit entitlement. This would implicitly assume that families value school meals at the cost to the government to provide them – if families place a lower value on the benefit, their other benefit income would be reduced by ‘too much’ under this system.

Healthy Start: While free school meals target children of school age, the evidence base suggests that interventions even earlier in a child’s life can have greater impacts. In England, the Healthy Start programme offers low-income pregnant women and children aged 3 and under monthly payments to be spent on fruit, vegetables, milk and infant formula. Past research has shown that providing such payments for these items increases household purchases of healthy foods (Griffith, von Hinke and Smith, 2018).

Healthy Start support is more tightly targeted than free school meals (with an annual post-tax income cap of £4,896 for universal credit recipients, compared with £7,400 in the free school meals system). Healthy Start benefits are also worth considerably less than free school meals: the weekly value of Healthy Start is currently £4.25 per child under the age of 4 (children under 1 get twice as much), compared with a weekly value of just over £12 for free school meals. If the government’s priority is to support nutrition among very low-income families with children, it could look towards expanding eligibility for or raising the value of Healthy Start support.

Costs of and beneficiaries from expanding free school meals provision

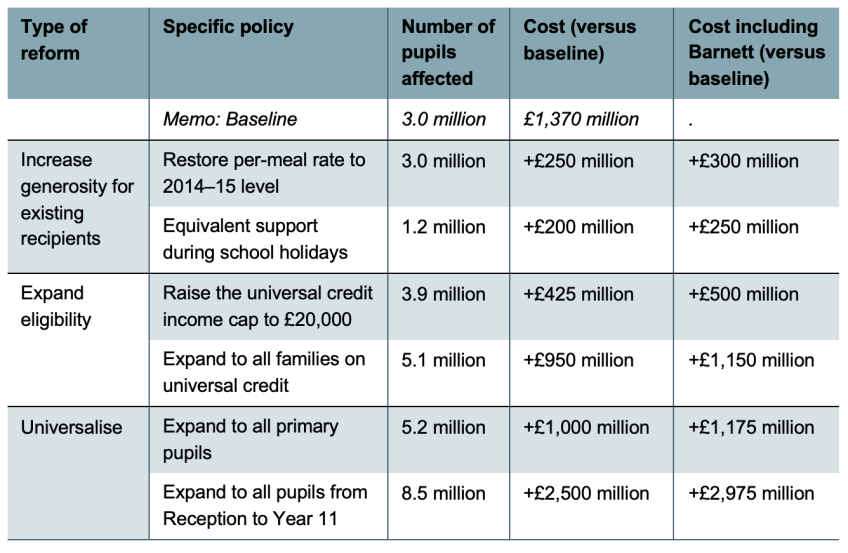

In practice, these broad ways of expanding free school meals provision – increasing the generosity for children who are already entitled, expanding eligibility for those on universal credit, or universalising the programme for some or all ages – can cover a range of different policy options. In Table 1, we summarise the number of direct beneficiaries and the direct costs of six possible reforms to free school meals:

Option 1 – spending more on those who are already eligible:

- restoring the per-meal rate to its 2014–15 level in real terms (£2.87 in 2022–23 prices);

- offering support equivalent to the value of free school meals outside of term-time (only for pupils eligible for means-tested free school meals);6

Option 2 – raising the earnings threshold for eligibility:

- raising the income cap to £20,000 for pupils whose families claim universal credit;

- expanding free school meals eligibility to all pupils whose families claim universal credit;

Option 3 – making eligibility universal:

- providing free school meals to all pupils in state primary schools;

- providing free school meals to all pupils in state schools from Reception to Year 11.

Our costings assume full take-up and (apart from the first policy) a per-meal rate of £2.41 that is kept constant in real terms. In practice, if this per-meal rate is insufficient to meet schools’ costs, significant expansions in free meal eligibility might require schools to cross-subsidise from other budget lines. We also assume that the costs of delivering each meal will not change with the changes in eligibility. Put another way, we assume that there are no economies of scale from expanding eligibility to cover more children.

We model the long-run cost of these policies, excluding the impacts of the transitional protections currently in place. Since the transitional protections raise the cost of the existing free school meals system (by making more children eligible), they imply higher costs for policies that are more generous to existing beneficiaries (such as raising the per-meal funding rate or bringing in support for school holidays). But they lower the price of reforms that expand eligibility: under transitional protections, some children who would otherwise be ineligible for free school meals are already eligible; that means that there are fewer extra children brought into eligibility by, for example, extending free school meals to cover all children.

Importantly, we ignore any up-front capital costs that will be required to deliver these policies. When universal infant free school meals were introduced in 2014, the Department for Education allocated £150 million in the first year to support improvements to school kitchens and facilities (though demand for the programme far exceeded the available funding pot). At a very rough level, that equates to just under £100 per additional eligible child in a cohort. This suggests that some of the policies discussed below might require significant up-front funding to ensure that they are deliverable. Of course, to the extent that there is underutilised capacity in the system as it stands, that will reduce the need for capital spending.

Because free school meals are a devolved policy area (see Box 2 earlier), any extra funding for free school meals from Westminster that is not found from within existing departmental budgets or an explicit tax rise tied to the new spending will require extra funding for the devolved nations through the Barnett formula. This works out to another 19% on top of the cost of implementing the policy in England.

Offering financial support equivalent to the value of free school meals outside of term-time would – if extended just to those on means-tested free school meals – cost the government around £200 million a year. Of course, if this reform instead involved schools actually delivering meals outside of term-time, that could bring additional cost and logistical challenges.

Policies that expand eligibility for free school meals are considerably more expensive. Raising the income cap for families on universal credit from £7,400 to £20,000 a year (as proposed by the National Food Strategy) would cost around £425 million in today’s prices. Offering free school meals to all children whose families receive universal credit would be more than twice as expensive, costing nearly £1 billion a year (plus an extra £200 million for devolved governments).

Alternatively, the government could choose to universalise free meals for some or all ages. Offering free lunches to all primary school pupils would cost about £1 billion a year, similar to the cost of offering free meals to all children (primary and secondary) whose families receive universal credit. Going one step further and offering free school meals to all children from Reception to Year 11 would cost over £2.5 billion per year – nearly trebling current spending.

Distributional consequences of expanding free school meals provision

Free school meals are tightly targeted on the very poorest families. Reforms to expand provision will not directly benefit the lowest-earning sixth of families, but could still bring some children from low-income households into eligibility. Of course, the higher the income cap rises, the less targeted support will be. On the other hand, reforms that increase the generosity of provision for children who are already entitled will benefit the poorest children, but will do nothing to help pupils whose parents are earning just slightly more than the £7,400 net earnings cap.

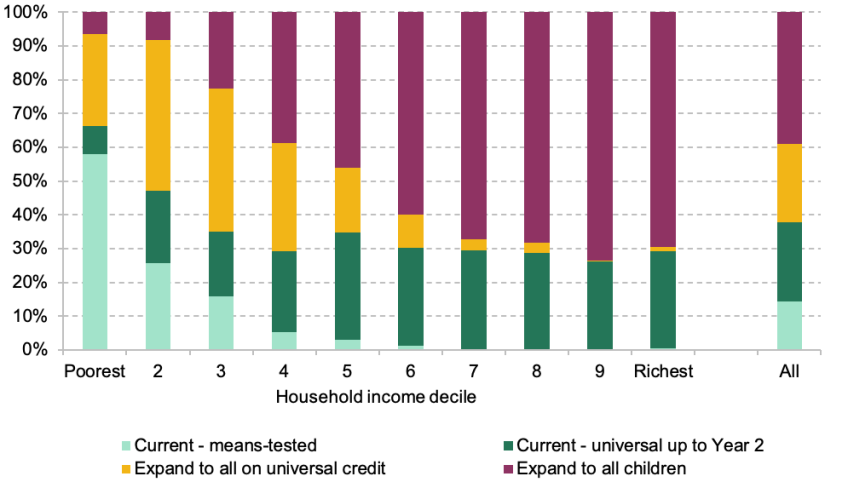

These distributional trade-offs are summarised in Figure 4, which shows the share of children in each income decile (tenth) who would receive free meals under three different policies. The status quo – universal provision up to Year 2, then means-tested provision above that – is shown by the light and dark green bars.

Figure 4. Entitlement to free school meals under alternative policies, by household income

Note: Deciles are assigned using household equivalised income among the English population as a whole. Children in private education are excluded. Children in Year 2 or below who would be entitled to free school meals on a means-tested basis, were universal provision for their age group not available, are categorised as being entitled through means-testing.

Source: Authors’ calculations using Family Resources Survey (England only), 2019–20 uprated to 2023–24 prices, and TAXBEN, the IFS tax and benefit microsimulation model.

Spending more on this group – such as by increasing the per-meal rate – would be broadly progressive, benefiting poorer children more than richer ones, though the progressivity of such a change would be lessened by the existing universal provision up to Year 2. Policies that are limited to children accessing means-tested meals (for example, equivalent cash support during school holidays) would be even more strongly progressive, as children in Reception, Year 1 and Year 2 from middle- and high-income families who nevertheless get universal infant free school meals would not benefit.

Expanding free school meals to all children in families on universal credit would largely benefit those in the bottom half of the income distribution, though it would have a bigger impact on households in deciles 2–4 than on the very poorest since most of the latter group are already entitled.

Going beyond that to make free school meals entirely universal – i.e. adding on the purple bar – would only have a modest direct impact on poorer children, as the substantial majority would already be entitled. It would primarily directly benefit middle- and high-income households. Of course, universal provision might have wider indirect benefits – for example, simplifying the system, easing administrative burdens or reducing stigma. All of this could boost take-up among children from low-income families who are currently eligible for free school meals.

4. Work incentives

Any welfare programme that targets receipt to having earnings below a certain level is going to reduce work incentives. Free school meals are no different. One thing that makes them a little different from conventional benefits is that the extent to which free school meals affect work incentives is determined by the value that parents place on them. If parents only put a small amount of value on free school meals then they will only have a small effect on work incentives. We do not have any evidence on the value parents place on free school meals, so here we assume that they value them at the rate the government pays (i.e. £2.41 per meal, or just under £460 per year).

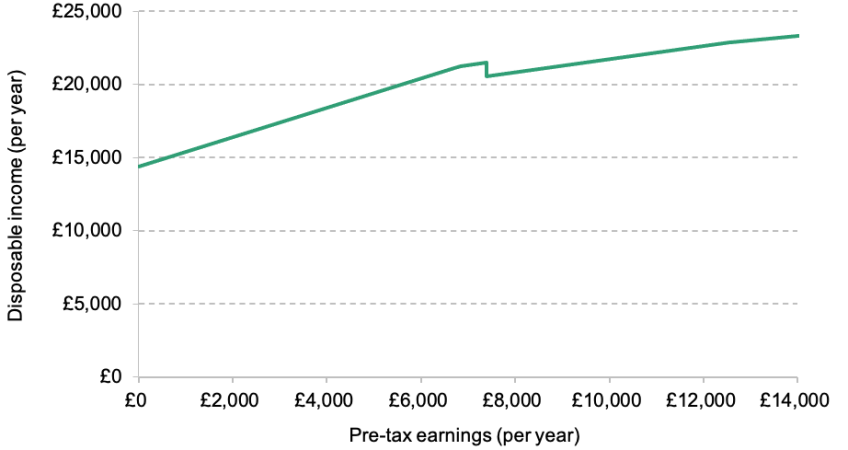

Figure 5 shows how the net income of an example single parent with two children changes as her earnings increase. If her annual earnings are just below £7,400, she has a net income (including free school meals along with other benefits) of £21,500 per year. If she earns slightly more – and therefore her children become ineligible for free school meals – her net income falls to £20,580. As the figure highlights, the ‘cliff edge’ of free school meals entitlement means that there is a £2,000-wide range of earnings where this parent would be financially better off taking a pay cut. That is equivalent to four hours of work each week at the National Living Wage. Put another way, someone in this situation earning just under £7,400 per year receives no financial return by working an extra four hours per week.

Figure 5. Budget constraint for an example single parent

Note: Figure shows the gross (pre-tax) earnings and net income (after taxes and benefits) of a single parent homeowner with two children, both above Year 2. Council tax and council tax support are ignored.

Source: Authors’ calculations using TAXBEN, the IFS tax and benefit microsimulation model.

Changing free school meals policy would change this picture. Expanding eligibility to all on universal credit would move the ‘cliff edge’ seen in Figure 5 to the level of earnings when the family loses the last of its universal credit. Increasing the generosity of the policy to those already eligible (for example, providing breakfasts in term-time or meals in holidays) does not move the cliff edge, but it does make the cliff edge larger. Making free school meals universal would remove the cliff edge entirely, since families would not lose eligibility when their income rises.

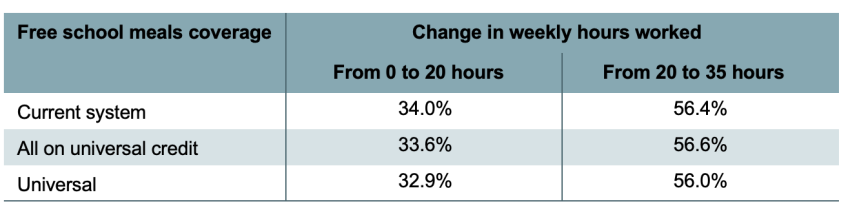

What would this do to workers’ work incentives? In Table 2, we summarise work incentives under three different policy regimes for workers who have at least one school-age child above Year 2. We show the ‘effective tax rate’ – the share of earnings lost in higher taxes and lower benefits – as a worker moves from unemployment to part-time work (20 hours per week) and then from part-time to full-time work (35 hours per week). A higher effective tax rate implies weaker work incentives.

Table 2. Average effective tax rates on different increases in hours of work, for workers with one child in Years 3–11

Note: The sample is restricted to those in England who are observed in work, and have at least one child in a state school above Year 2. This includes workers who, even if they did not work, would not be entitled to universal credit and thus their effective tax rates are unaffected by the extension of free school meals to all families on universal credit.

Source: Authors’ calculations using TAXBEN, the IFS tax and benefit microsimulation model.

Expanding free school meals entitlement would strengthen the incentive to be in work at all (lowering the average effective tax rate), as fewer families would lose free school meals when a parent moves into work. Extending entitlement to all on universal credit would weaken incentives to move from part- to full-time work, as some families would only be eligible for free school meals when a worker is working part-time (but, under the current system, are ineligible when working part- or full-time). Making free school meals entirely universal implies the strongest work incentives (lowest effective tax rates), as families would no longer lose free school meals entitlement from working more. These results are similar, albeit somewhat larger in magnitude, if we restrict our attention to those with low levels of education (who are more likely to be on benefits and thus affected by these decisions).

The existing evidence (e.g. Meghir and Phillips, 2010) suggests that workers’ choices about whether to work at all are more responsive to financial incentives than the choice about how many hours to work once they are employed. This suggests that the modest weakening in the incentive to move from 20 to 35 hours of work per week when expanding eligibility to all on universal credit would likely cause only a small reduction in hours worked, and could be outweighed by the strengthening of the incentive to be in work at all. If additional spending on expanding free school meals were funded through raising taxes (rather than cutting spending elsewhere), there would also be wider impacts on the incentives of other people or firms to work, save or invest (depending on the tax used).

5. Conclusions

Of the 8.4 million children in English state schools, 3.4 million are eligible to get a free meal at school each day during term-time, costing around £460 per year per child in 2022–23. A range of evidence suggests that free school meals and related policies can benefit the living standards, nutrition, and educational performance of those children who receive them.

Different potential expansions target different groups, have different exchequer costs, and create different work incentives for (potentially) eligible families. Broadly, expanding the generosity of the existing scheme would target more funds towards many (but not all) of the poorest children in the country.

At the other end of the spectrum, expanding the universal free school meals programme to older children would primarily (directly) benefit middle- and higher-income households. Universalism could boost take up, reduce the stigma of receiving free school meals, and would improve the incentives to move into work and earn more. But the cost of offering free school meals to all state school pupils from Reception to Year 11 would nearly treble current school meals spending.

The final option we consider is a limited expansion in eligibility, such as increasing the income cap to £20,000 a year post-tax, or offering free meals to all those who are receiving universal credit. At present, a net household income cap of £7,400 a year means that 69% of children whose families receive universal credit are not eligible for free school meals. Expanding eligibility to all on universal credit would make more than 90% of the lowest-income fifth eligible for free school meals, and have very little impact on eligibility for children of higher-income families. Such an expansion would generally improve the incentive to move into work, but reduce the incentive to work additional hours.

A final consideration is the practical introduction of any scheme. Increasing the per-meal rate would potentially create the fewest difficulties, easing the funding squeeze that resulted from years of below-inflation funding increases or cash-terms freezes. Significantly increasing eligibility to a wider group of pupils could require up-front capital investment to increase school kitchen capacity; the 2014 introduction of universal infant free school meals included capital funding of £150 million in 2014–15 to expand eligibility to roughly 1.6 million additional pupils in September 2014. These up-front, fixed costs make it more difficult to justify short-term pilot programmes that require schools to invest significant funds up front on capacity that will not be needed if the pilot is discontinued.