Downloads

barnardos_tc_reform.pdf

PDF | 453.19 KB

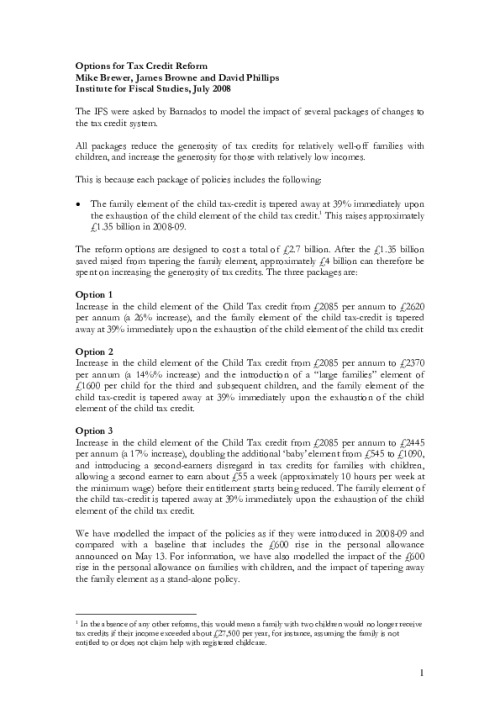

IFS was asked by Barnardo's to model three reforms of the tax credit system, each designed to reduce child poverty to the government's 2010/11 target in a different way. Here we detail the policy options and their impact on family incomes, work incentives and child poverty.

A full copy of the report in which this work was used, How to halve child poverty by 2010: options for redirecting resources to reduce child poverty is available on the Barnardo's website.

Authors

Mike Brewer

James Browne

Associate Director

David is Head of Devolved and Local Government Finance. He also works on tax in developing countries as part of our TaxDev centre.

Report details

- Publisher

- IFS

Suggested citation

M, Brewer and J, Browne and D, Phillips. (2008). Options for Tax Credit reform. London: IFS. Available at: https://ifs.org.uk/publications/options-tax-credit-reform (accessed: 1 July 2024).

More from IFS

Understand this issue

Election Special: Your questions answered

27 June 2024

What is the two-child limit in benefits?

27 June 2024

Election Special: The big issues politicians haven't spoken about

25 June 2024

Policy analysis

How would the parties’ tax and spending plans affect Scotland and Wales?

28 June 2024

What are the parties’ plans for benefits and taxes?

24 June 2024

How should we interpret parties’ public spending pledges this election?

23 June 2024

Academic research

Intertemporal income shifting and the taxation of business owner-managers

24 January 2024

Insurance, redistribution, and the inequality of lifetime income

2 November 2023

The menopause "penalty"

18 March 2024