In April 2022 Ofgem’s tariff cap increased by 54%, or nearly £700 per year for an average household. Yesterday the CEO of Ofgem said that Ofgem expect the default tariff cap to increase by another £800 in October, leading to a cap of £2,800 on average annual gas and electricity bills. This increase of £800 to the current cap means a 117% increase – more than doubling – of the tariff cap between October 2021 and October 2022.

The increases in gas and electricity prices will disproportionally hit poorer households, as they spend a much larger share of their total household spending on gas and electricity – the bottom 10% of households in terms of income spend on average almost three times as much of their budgets on gas and electricity compared to the highest-income tenth (11% versus 4%).

Just last week IFS analysis of the ONS figures showed that inflation is already hitting the poorest households harder. In April, the bottom 10% of the population in terms of income faced an inflation rate of 10.9%, which was 3 percentage points higher than the inflation rate of the richest 10%.

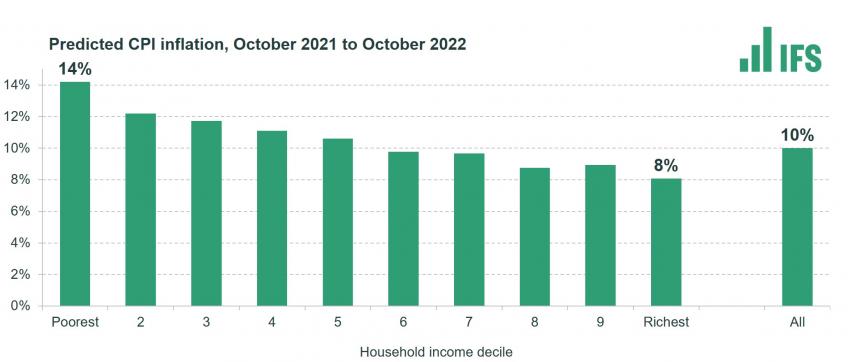

New IFS analysis incorporating an £800 increase to Ofgem’s tariff cap in October shows that the pattern of poorer households being hit harder by inflation is likely to continue. A more than doubling of prices of gas and electricity will further increase the difference in the rate of inflation experienced by richer and poorer households. Assuming an average rate of inflation of 10%, as currently projected by the Bank of England, the analysis suggests that the poorest households may face average inflation rates of as high as 14%, compared to 8% for the richest households.

IFS Research Economist Heidi Karjalainen said:

"Ofgem now predicts that the average annual tariff cap will reach £2,800 in October. This means a more than doubling of the tariff cap compared to October 2021. As poorer households spend more of their budgets on gas and electricity, this increase is likely to hit poorer households harder. This is also likely to further widen the gap between rates of inflation faced by the poorest and richest households. Assuming an overall rate of inflation of 10%, as projected by the Bank of England, the poorest 10% of households may face inflation rates of as high as 14%, compared to 8% for the richest households.”