Summary

New statistics released by the Department for Work and Pensions today give us the latest picture of who is claiming Universal Credit (UC) and how much the temporary uplift matters. By February this year there were 5 million UC claimants – double the number seen pre-pandemic. Almost all of these claimants are benefiting from the temporary £20 per week uplift in UC, due to expire at the end of September. How much that uplift matters to family incomes varies substantially. On average it represents 12% of entitlements, but for a quarter of claimants (1.2 million) it makes up at least 20%, while for another quarter it is less than 8%. That variation comes from differences in circumstances. Nearly a third of UC claimants are singles without children who are not liable for any rent, and are generally entitled to no more than £95 of UC per week, including the £20 boost, even if they have no other income. In general, the increase in the caseload since the eve of the pandemic has been among groups entitled to less UC. Making the uplift permanent would cost about £6 billion per year in the long-run, increasing the total amount spent on UC from £68 billion to £74 billion.

Background

In his initial response to the Covid-19 crisis in the March 2020 Budget, the Chancellor announced a temporary one-year uplift in entitlements to Universal Credit (UC) and Working Tax Credit (WTC), of £20 per week. In the following Budget – March 2021 – the UC increase was extended for another six months, and claimants of WTC were paid a one-off equivalent amount (£500). The UC expansion is due to expire at the end of September – the same time as when furlough is due to end – and the Chancellor and the Secretary of State for Work and Pensions have both announced that they do not intend to deviate from that plan. At the same time there have been various calls for the increase to be made permanent, including from the six previous Conservative Secretaries of State for Work and Pensions. This observation discusses the effect of the policy on UC entitlements, who claims UC, and the options the Chancellor faces.[1]

UC entitlements and the impact of the uplift

On the eve of the pandemic 2.6 million families were claiming UC (with another 4 million or so claiming the ‘legacy’ benefits that UC replaces).[2] Since then, the number on UC has nearly doubled to 5 million in February 2021. That increase is made up of both families who were previously not claiming any means-tested benefits, and families who were previously claiming one or more legacy benefits and had a change in circumstances (such as job loss) which caused them to transition to UC. It is also possible some claimants of legacy benefits will have chosen to move across to UC – not least because the £20 per week temporary uplift did not apply to legacy out-of-work benefits. On average claimants receive £156 per week in UC, so the removal of the uplift will cut their entitlements by 12%.[3]

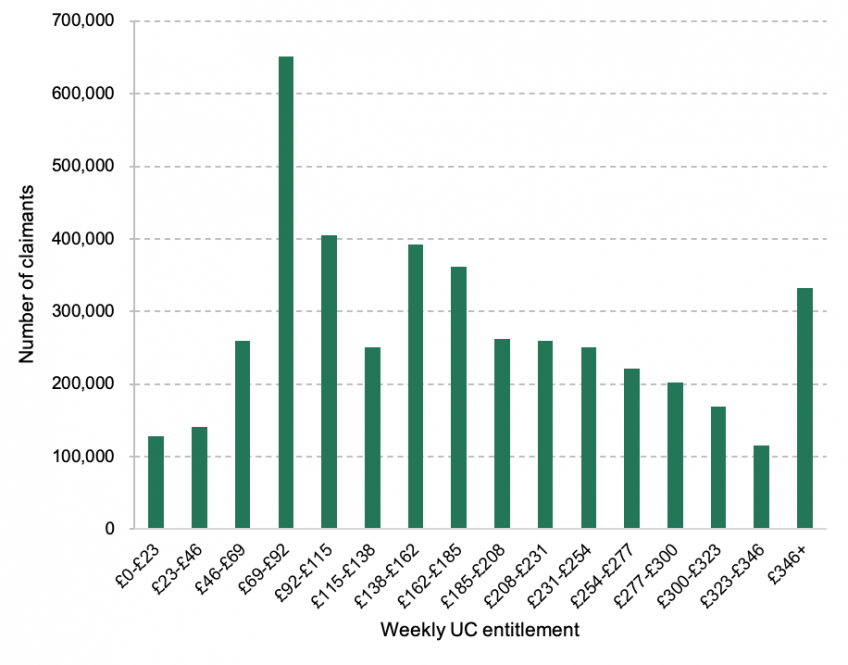

That average hides a lot of variation. About a quarter of claimants (1.2 million) receive less than £92 per week, for whom the uplift accounts for at least 20% of their entitlement. Another quarter receive over £254 per week, for whom the uplift accounts for at most 8% of their entitlement. The variation in weekly amounts is shown in Figure 1. For some families UC will be their only source of income; others will receive income from other sources such as earnings from employment and other benefits.

Figure 1. Weekly entitlements of Universal Credit claimants

Notes: Excludes 637,000 claimants who are listed as having “no payment”. Weekly values are calculated from monthly payments and rounded to the nearest pound. Figure shows amount actually paid, after accounting for deductions such as repaying advance loans. Data from February 2021.

Source: Authors’ calculations using DWP Stat-Xplore.

Who claims UC?

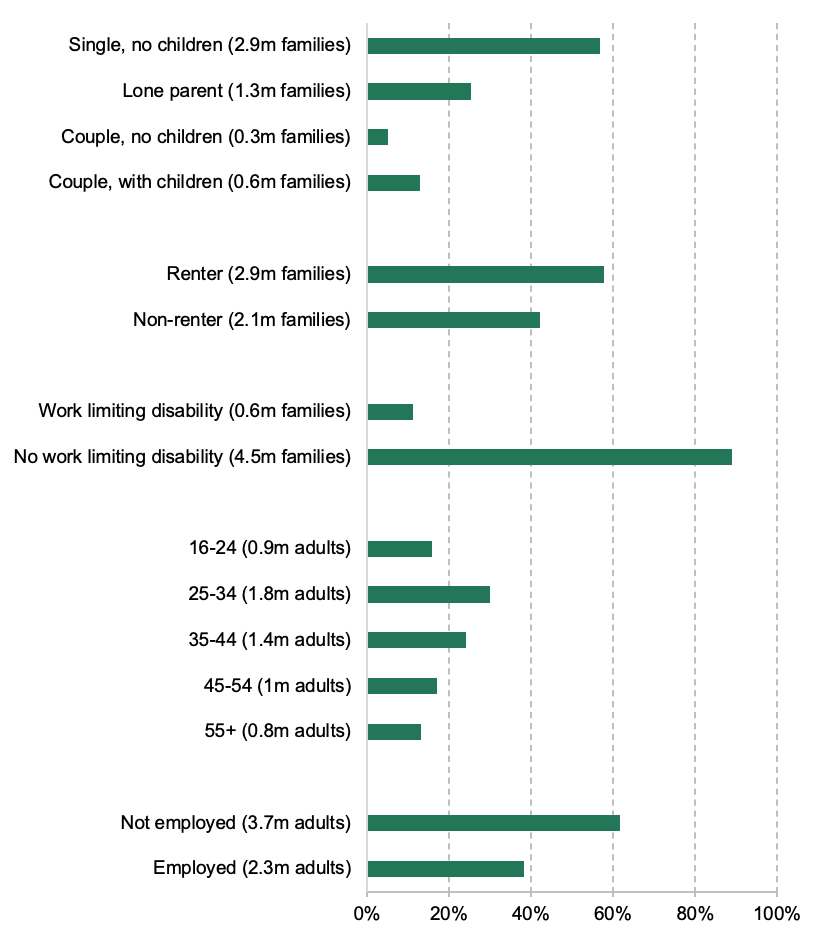

This variation in UC entitlement stems from families being in differing circumstances. Figure 2 describes the characteristics of the 5 million families on UC and the 6 million adults within them. They are largely single people – just one in five are couples – and particularly single without children. That is in part a consequence of the pandemic – 63% of the increase in the caseload has been from single people without children. Most claimants are renters, but a substantial share (42%) are not and in fact the share of claimants that are renters has declined over the pandemic. Both of these changes are important for understanding the effect of the £20 uplift: UC entitlements are considerably higher for those with children and for renters, meaning that in proportional terms the uplift has a much smaller effect on their UC award. But 1.6 million claimants – almost a third of the caseload – are single people without children, not paying rent.[4] The average UC entitlement among this group is £70 per week (compared to £195 for other claimants) – and so the removal of the uplift represents a 28% cut in their entitlement. Even someone in this group who has no other income will typically only receive £95 per week with the uplift, making its removal a 21% cut; those in work, or those repaying loans (‘advances’) to DWP generally receive less.[5] Around two in three of this group (non-renting single claimants without children) live entirely alone (i.e. not with parents or friends), meaning that their living standards are particularly exposed to periods of low income.

Only about one in nine UC receiving families contains an adult who has a health condition deemed to limit their capacity for work – which generally entitles them to significantly more UC. This share has fallen since the eve of the pandemic, with the increase in caseload overwhelmingly (94%) coming from those who do not have any such incapacity. Again this contributes to new claimants tending to have lower entitlements and thus be (in proportional terms) more exposed to changes in the uplift.

The figure also shows that UC claimants are generally likely to be younger, with 30% aged 25-34. Although younger adults have been more likely to be furloughed and lose their job during the crisis, the age distribution of UC claimants has remained almost entirely unchanged – possibly reflecting the fact that younger adults have if anything been slightly less likely than older adults to live in a household that becomes workless – thus protecting their living standards and reducing the likelihood that they claim UC.

38% of adults in families on UC are employed (including on furlough).[6] While some will have a working partner, most families on UC are workless.[7] Interestingly, the share of UC claimants who are employed has slightly increased since before the pandemic (from 35%). This may reflect a number of factors. First, the number of people without a job has risen only a little over the course of the past year and a half, with many more people going on furlough. Second, some working families will have seen a fall in earnings – through furlough or working fewer hours or loss of self-employment income – which may have made them entitled to UC. The £20 uplift itself also extends entitlement to more working families. Third, before the pandemic working families were more likely to be entitled to benefits but not claiming; such families may have applied to UC since the crisis if they were worried about losing their job (but subsequently kept it), or because the £20 uplift and the huge increase in UC claims attracted a lot of news coverage.

Figure 2. Characteristics of Universal Credit claimants

Notes: ‘Non-renters’ are those who do not get any support for rent in their UC claim. As well as those who own their home, this also includes families who do not own their home but are not liable for any rental payments (for example, an adult who lives with her parents and does not pay them any rent). Furloughed employees count as ‘employed’ for these purposes. Family type and housing tenure statistics relate to February 2021; age statistics to June 2021; and employment statistics to May 2021 (in all cases these are the latest data available).

Source: Authors’ calculations using DWP Stat-Xplore.

Conclusion

The £20 uplift represents a significant share in entitlements for many claimants – in particular those who are single without children, are not liable for rent, or are not judged to have a work limiting disability – all groups that have increased in frequency since the eve of the pandemic. For many of these people UC is their only source of income, with a majority of those on UC out of work and without a working partner. Other claimants will be significantly less affected in virtue of their already higher UC entitlements or because they or their partner are working.

The Chancellor has three main options for the uplift. First, it could be extended once more, perhaps for another six months. This option would look more attractive if the labour market were to weaken again – though in the three months to May vacancies had recovered to around their pre-pandemic levels. Second, it could be allowed to expire as planned. Third, the expansion could be made permanent, costing around £6 billion per year in the long-run.

In deciding between these latter two options, the Chancellor faces the standard trade-offs in benefit policymaking – keeping the uplift boosts incomes for poorer households, but weakens work incentives and means that at some point taxes must be increased or other spending cut to pay for it. (Another option, to adjust the uplift to only increase entitlements for working families, could strengthen incentives to be in work but would still need to be paid for). It is worth noting that the UC expansion represents the first significant real terms increase in entitlements for out-of-work claimants without children in half a century, despite the fact that earnings have doubled in that time (and therefore financial incentives to work have been substantially strengthened over this period). This lack of real increases has also left the safety net for those without children unusually thin by international standards, well below the average among developed countries. At the same time, the enormous increase in public debt incurred over the past 18 months – and the growing list of demands on the public purse – are no doubt at the front of the Chancellor’s mind.

This analysis was funded by the Nuffield Foundation as an early output of the 2021 IFS Green Budget.

The Nuffield Foundation is an independent charitable trust with a mission to advance educational opportunity and social well-being. It funds research that informs social policy, primarily in Education, Welfare and Justice. It also provides opportunities for young people to develop skills and confidence in science and research. The Foundation is the founder and co-funder of the Nuffield Council on Bioethics, the Nuffield Family Justice Observatory and the Ada Lovelace Institute. www.nuffieldfoundation.org | @NuffieldFound

Notes:

[1] If the Chancellor were to extend the UC uplift further, he would presumably also want to do something equivalent in WTC. In this observation we focus on UC claimants, both because the data available on WTC claimants are much more limited, and because any new claimants to benefits must claim UC rather than WTC. At 1.4 million, the number of WTC claimants, while certainly still significant, is considerably less than the number of UC claimants (5 million).

[2] Throughout this observation we use the term ‘family’ in the sense used by the government for the purposes of assessing benefit entitlements – an individual plus any partner and any dependent children. This means that a single person without any dependent children is classed as a family.

[3] This calculation incorporates the fact that 175,000 families are subject to the benefit cap and so generally do not benefit from the uplift.

[4] This includes both those who do not pay rent because they are homeowners, and those who do not own their home but are not liable for any rental payments (for example, an adult who lives with her parents and does not pay them any rent).

[5] Claimants under the age of 25 and those with significant assets are entitled to less than this, while some qualify for more due to being deemed to have health problems that limit their ability to work.

[6] The low rate of employment among UC claimants, even prior to the pandemic, partly reflects the nature of its rollout. Those who are claiming legacy benefits and then lose their job usually have to transition onto UC, tilting the UC caseload away from working families.

[7] The precise number of workless families on UC is not available, but even if we assumed that there were no two-earner couples on UC, the figures available indicate that only 45% of UC claiming families would have someone in work.