Many of today’s workers ought to be at least a little worried about how they are going to finance their retirement.

There will be some exceptions of course. Higher earners who have paid off their mortgages relatively young and have sizable inflation-protected pensions from previous employers will be fine.

But the era of traditional ‘defined benefit’ pensions, paying out from retirement until death has largely come to an end outside of the public sector.

Most private sector workers are instead saving into a different type of pension – a ‘defined contribution’ arrangement – which at its heart is basically a tax-advantaged savings account that you cannot touch until you are in your late 50s.

There are three problems with this sort of pension. The first is that most people don’t contribute much, generally only between 5pc and 8pc of salary.

The second is that the individual bears all the risk on the returns to their invested savings.

Third, if you want to turn your pension ‘pot’ into a guaranteed pension income, you need to find a company to sell you an annuity. And it takes a lot to provide a decent pension.

Even a pot of £400,000 – considerably more than most will accumulate – will yield a pension of just £17,000 a year from age 65 (protected from inflation). Particularly if you end up renting (rather than owning your home), your private pension won’t get you very far.

One option could be for the state to help out a little more.

More state spending on pensioners would mean people were not as reliant on their own pensions.

But the state already plays that role to a great extent. Even for middle income pensioners, state support makes up more than half of their income.

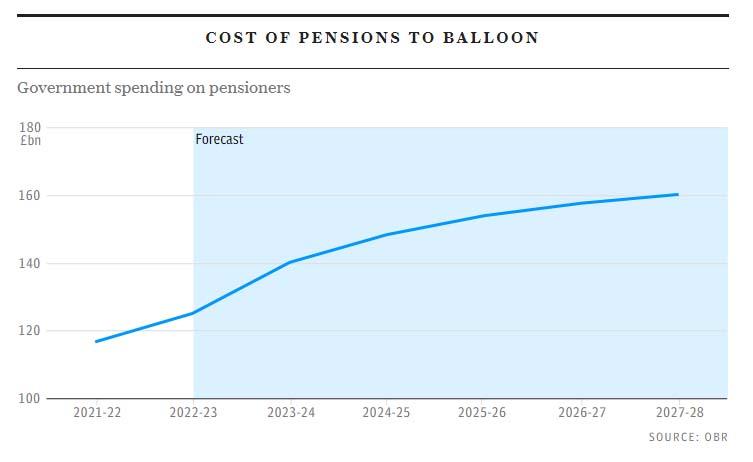

For people who want more state spending on future pensioners to help out, the difficulty is the state may struggle to do more than is currently planned.

Under current policy, spending on pensions and pensioner benefits is already set to rise from almost 6pc of national income now to almost 10pc by 2070.

Maybe that doesn’t sound like a lot, but that is equivalent to an extra £100bn per year in today’s money – therefore an extra £100bn per year to be raised in tax.

The pressures on NHS spending are even greater still.

Ultimately, the ageing population (with a third of the population over 65 in 2070 compared to a quarter today) is going to place significant stress on the public finances, making it harder for the state to support any section of society more than planned.

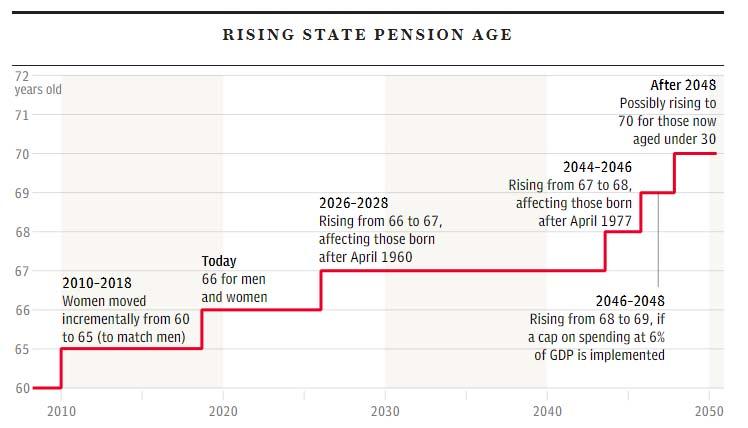

The recent government-commissioned review of the state pension age suggested a new cap on state pension spending.

The bad news for many of today’s workers is that if this cap were kept to, then by the early 2050s either the state pension age would need to be increased beyond age 68 or the value of the state pension would need to be cut back in some other way.

2050 might sound like a long while off – but these are the timescales on which pension planning needs to be done. What is to be done?

I am not honestly not sure right now.

But my colleagues and I at the Institute for Fiscal Studies are, in partnership with abrdn Financial Fairness Trust, today launching “The Pensions Review” to try to work out the best options.

We are going to be working hard on this thorny problem – how to secure the future of financial security in retirement even while the public finances are under strain. We will report back as soon as we can.