Introduction

In his first Budget, in March 2023, Chancellor Jeremy Hunt announced the abolition of the pensions lifetime allowance. The following day Shadow Chancellor Rachel Reeves stated ‘Labour will reverse the changes to tax-free pension allowances. It is the wrong priority, at the wrong time, for the wrong people’. What is the pensions lifetime allowance and would it be a good idea to reinstate it?

What is the pensions lifetime allowance?

The lifetime allowance was a limit on the total value an individual’s private pensions could reach before high tax rates were applied. Between 2006–07 and 2022–23 (inclusive), it applied when funds in a pension were first made available for withdrawal (crystallisation) and/or on reaching age 75 (or at death for those who died before age 75). If the value of the pension was above the lifetime allowance then the lifetime allowance charge was levied at a rate of 55% on the value of the fund above the lifetime allowance if taken as an otherwise tax-free lump sum, or 25% if taken as taxable income (which equates to 55% if combined with higher-rate income tax or 40% if combined with basic-rate income tax). For example, if the lifetime allowance was £1 million and someone had a pension worth £1.2 million when they crystallised it, they might have to pay up to £110,000 (55% of £200,000) tax on the excess.

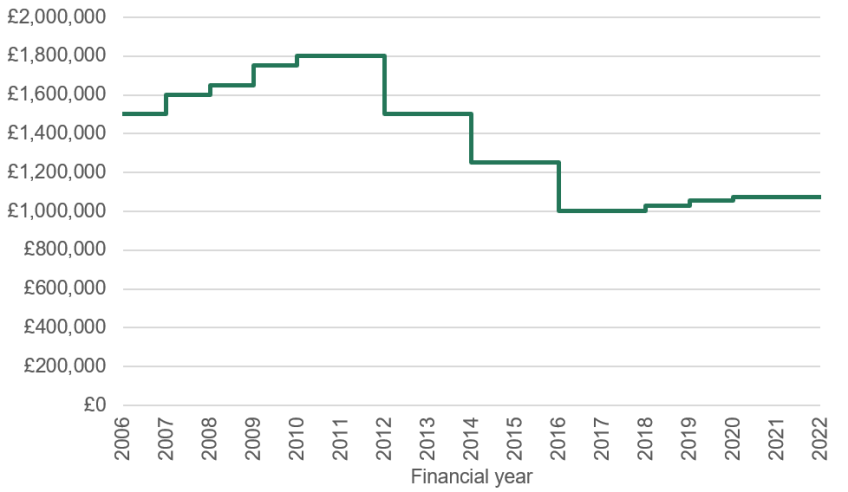

As shown in Figure 1 the value of the lifetime allowance changed substantially (in nominal terms) over its 17-year existence:

- It was first introduced by the then Labour government in April 2006 at £1.5 million, which in real terms is equivalent to £2.5 million in April 2024. In its first few years it was increased relatively rapidly, reaching £1.8 million in April 2010 – equivalent to £2.7 million in today’s prices.

- It was then cut substantially by Conservative Chancellor George Osborne so that it fell to £1 million in April 2016.

- Subsequent Conservative Chancellors increased the allowance modestly in cash terms, so that it reached £1,073,100 in April 2020. The lifetime allowance was then frozen.

- Then, in another change of direction, in his first Budget of March 2023, Mr Hunt announced that from April 2023 the charge on pensions worth more than the lifetime allowance would be set to zero, and that from April 2024 the allowance would be abolished.

Figure 1. The nominal value of the lifetime allowance from 2006 to 2022

The number of people paying the charge varied correspondingly over this period, rising from under 1,000 a year in the late 2000s to over 11,000 in 2021–22. But that is not a good measure of the number of people affected by the lifetime allowance (and its abolition), since a large part of its effect will have been to discourage people from exceeding that level. In the extreme case, if everybody chose to stay below the lifetime allowance in order to avoid the charge, nobody would have paid the charge but that would not mean it had no effect: quite the opposite. It is difficult to know how many people would have saved more than the lifetime allowance in a pension in the absence of the charge.

Alongside the abolition of the lifetime allowance, Mr Hunt introduced a new cap on the amount of pension income that can be taken tax-free. Previously, up to 25% of an accumulated pension could be withdrawn entirely free of income tax. This is now capped at 25% of the old value of the lifetime allowance, £1,073,100, so that an individual can take a maximum of £268,275 from their own pension free of income tax.

In 2021–22 £500 million was paid in lifetime allowance charges, implying an average charge of just over £40,000 each for the 11,000 individuals that paid it. The upfront cost of abolition is higher than that, as some people will save more in a pension in response to the reform and will therefore get more upfront tax relief. The Office for Budget Responsibility costed the abolition of the lifetime allowance (combined with the introduction of the new cap on tax-free withdrawals) as an £800 million a year tax cut. But some of this upfront give-away will be recouped later, as the people saving more in a pension in response to the reform will pay more tax on their pension income in future.

Would it be a good idea to reinstate the pensions lifetime allowance?

Pensions policy is about long-term decisions. So – as far as possible – stability is desirable. Reintroducing the lifetime allowance would represent yet another change in direction, following the period of instability shown in the Figure above. However, all else equal, there is a case for a lifetime allowance. In a report published a month before Mr Hunt’s surprise decision, in research funded by the abrdn Financial Fairness Trust, we set out a detailed blueprint for the taxation of pensions in the UK. This put forward a set of reforms that would rebalance the incentives provided by the tax system to save in a private pension so that it no longer provided ‘overly generous tax breaks to those with the biggest pensions, those with high retirement incomes and those receiving big employer pension contributions’. We argued that, once they had implemented our recommended reforms, policymakers could be much more relaxed about the lifetime (and annual) limits on pension saving.

Nothing like our proposed package of reforms has been implemented: the pensions tax regime is still overly generous to those who already have big pensions, those with high retirement incomes and those getting big employer pension contributions (as these escape National Insurance contributions). It remains the case that such a package would represent a major improvement and would be the most desirable course of action for this or any future government.

But in the absence of an appetite for comprehensive reform, there is a case for restricting the amount of tax-relieved pension saving that an individual can do. For example, again as an earlier IFS report pointed out, we currently have ‘the bizarre situation where pensions are treated more favourably by the tax system as a vehicle for bequests than they are as a retirement income vehicle’. The abolition of the lifetime allowance provides high-wealth individuals with even greater ability to reduce the inheritance tax on their estate by simply using defined contribution pensions for this purpose. Therefore the Labour Party has some justification for suggesting that there is a role for a limit – though, to repeat, a more thoroughgoing reform to create a more rational system and reduce other elements of excess generosity to the wealthy would be preferable and would reduce the need for a cap. We now consider some of the key questions around how this policy might best be implemented.

How should the lifetime allowance be reintroduced?

One option would simply be to reinstate the lifetime allowance at around its previous level of £1,073,100. Costing such a reform is difficult, but given that the Office for Budget Responsibility’s assessment was that abolishing the allowance cost £800 million a year in the medium term, reversing it might be expected to raise almost as much. This would be a plausible way to proceed. However, it would raise some tricky, though not insurmountable, transitional issues. In particular:

- How should individuals whose pension wealth is above (or in future grows above) the reinstated lifetime allowance, perhaps as a result of contributions made following the March 2023 Budget announcement, be treated?

- What about those who had large uncrystallised pension pots but who have made withdrawals – or turned age 75 – since April 2024 when there was no lifetime allowance in place?

With the first, the question is how we ought to treat pension accumulation that occurred during the period when the lifetime allowance was not in place. This was an issue when the lifetime allowance was first introduced and when it was subsequently lowered. A similar approach to the special protections put in place at those times (for example, allowing those whose pension wealth was already above the newly introduced/reduced allowance to avoid the charge, provided they did not make any further pension contributions thereafter) could be taken again, complex and imperfect though they were.

With the second, the issue is that (for example) the tax treatment of those with big pension pots who first access their pension this year (when the lifetime allowance is not in place) could be much more generous than those who did this in 2022–23 or after the lifetime allowance is reintroduced. This means that, if people are expecting the reintroduction of the lifetime allowance, they may access their pension now in an attempt to reduce their subsequent tax bill. The expected reduction in tax from doing so could be as much as 25% of withdrawals made above the value of the reintroduced lifetime allowance, although whether this turned out to be the case would depend on the final details of Labour’s policy. An incoming Labour government could simply accept this, and that reintroducing the lifetime allowance would raise less revenue as a result; if it wanted to prevent that outcome and attempt to count withdrawals made now towards a reintroduced lifetime allowance, it would – as set out in this briefing by former pensions minister Sir Steve Webb, who is now a partner at Lane Clark Peacock – probably need to introduce some ‘pretty rough-and-ready rules’ to do so.

A trade-off that Ms Reeves would face is that the more generous any transitional provisions, the longer it would take for the full revenue impact of reinstating the lifetime allowance to materialise. These transitional issues also mean that she would be best advised to implement any change as swiftly as possible in order to reduce the amount of time in which pension pots can rise above the value of the reinstated lifetime allowance or since individuals could have first withdrawn funds from their pensions.

An additional way to ease the transitional issues would be to reinstate the lifetime allowance but at a higher level than £1,073,100. This could, for example, take into account reasonable asset returns and the fact that the annual allowance (that is the maximum amount that can be contributed to a pension in a given year) is £60,000 (and was £40,000 prior to April 2023). In this context it might be worth noting that the last Labour government set the lifetime allowance at £1.8 million in April 2010; it could, for example, reintroduce it at that level – or the equivalent adjusted for inflation, which would be around £2.7 million today.

Options for going beyond a simple reintroduction of the lifetime allowance

Of course, the higher the level at which a lifetime allowance is reintroduced, the less revenue it would raise. But there are features of the system that could be improved, and in a way that raised revenue.

- The lifetime allowance valued defined benefit pensions at twenty times the pension income that they provide (plus any tax-free lump sum). Given actuarially fair annuity rates this was – and were it to return would still be – overly generous. It is also particularly generous for those taking their defined benefit pension earlier. Addressing this – by increasing the multiple from twenty (making the lifetime allowance treatment of defined benefit arrangements less generous) and increasing it by more for those making earlier withdrawals – would be sensible. One advantage is that it could alleviate the extent to which a reinstated lifetime allowance might induce some high skilled individuals such as NHS clinicians to retire early: those drawing their pension later would be rewarded with a boost to their lifetime allowance.

- Our earlier report argued that, rather than having a lifetime limit on the value of pensions, it would be better to have a lifetime limit on contributions to defined-contribution pensions and benefits accrued in defined-benefit pensions. These are easier to measure accurately and transparently and would have the advantage of not distorting the investment decisions of those with large pension pots.

- Mr Hunt’s new cap on the amount of pension from which 25% can be taken tax-free means that those with, say, £900,000 in a private pension can still receive a tax subsidy on additional pension saving. In our February 2023 report – prior to the March 2023 Budget announcement – we pointed out that, for example, a cap of £400,000 would still allow individuals to withdraw a six-figure sum entirely free of income tax. This would only affect about one-in-five of those retiring in the next few years (although almost half of those who had been employed in the public sector).

- Pension pots should be included in the value of estates at death for the purposes of inheritance tax. If the government were not willing to do this, it could introduce a cap on the amount that can escape inheritance tax, and this cap could be set at a lower level than a reinstated lifetime allowance. For example, a cap on the amount of pension wealth that can escape inheritance tax could be aligned with a reduced cap on the amount of pension on which a 25% tax-free lump sum can be taken. Such a cap set at £400,000 would mean that a homeowning couple could still bequeath up to £1.8 million in total free of inheritance tax, but those with more could face an additional bill.

One potential criticism of reintroducing a lifetime allowance will be that it might lead to some, such as highly skilled NHS clinicians, retiring earlier. It should however be remembered that many of the issues with the tax treatment of doctors resulted from the annual allowance and how it is tapered down for high-income individuals, rather than from the lifetime allowance. For example, while the section on ‘pensions tax’ in the 2023 submission from NHS England to the Review Body on Doctors’ and Dentists’ Remuneration claimed that ‘the impact of pension tax charges appears to be influencing staff behaviour’ it only actually described the annual allowance, not the lifetime allowance. Alongside the subsequent announcement that the lifetime allowance was to be abolished, the annual allowance was substantially increased (from £40,000 to £60,000) and its tapering has been made much more generous, with the minimum taxable income plus pension contributions among those affected having been increased substantially from £150,000 in 2019–20 to £260,000 in 2024–25.

It remains the case that it makes more sense to have a lifetime allowance than to have an annual allowance, and it makes no sense for the annual allowance to be tapered down for those on very high incomes. More generally, this is a reminder that any change to the lifetime allowance should not be seen just as a means of raising some extra revenue over the Treasury’s scorecard period, but should ideally be part of a broader – and clearer – strategy for pensions taxation.

Conclusions

Absent more radical reform, there is a case for placing a limit on the amount that individuals can accumulate in tax-favoured private pensions. There is therefore a case for Labour’s proposed reinstatement of the lifetime allowance and, were Labour to form the next government, it would be best advised to implement any reform swiftly. It would also be sensible to go beyond a simple reintroduction of the lifetime allowance at its previous level. One option would be to reinstate the lifetime allowance at a higher value than its old level alongside a reduction in the new limit on the amount of pension from which 25% can be taken free of income tax and a new limit (ideally zero, but any limit would be an improvement) on the amount of pension that can be bequeathed free of inheritance tax. A reinstated lifetime allowance should also be less generous for defined benefit pensions (relative to defined contribution pensions) than the one that was in place from 2006 to 2022, and particularly so for those who take their defined benefit pensions earlier. It would also be worth considering reintroducing the lifetime allowance as a cap on contributions to defined contribution pensions and accrued benefits in defined benefit pensions, rather than on the pensions’ estimated value.