The proposed reforms are a small step in the right direction …

In 2017, the Scottish Government increased the relative tax rates (termed ‘tax relativities’) applied to properties in bands E–H by between 7.5% and 22.5% in an effort to raise revenues and reduce the regressivity of council tax. It is currently consulting on proposals to increase the relative tax rates by a further 7.5% to 22.5%, with the same objectives in mind.

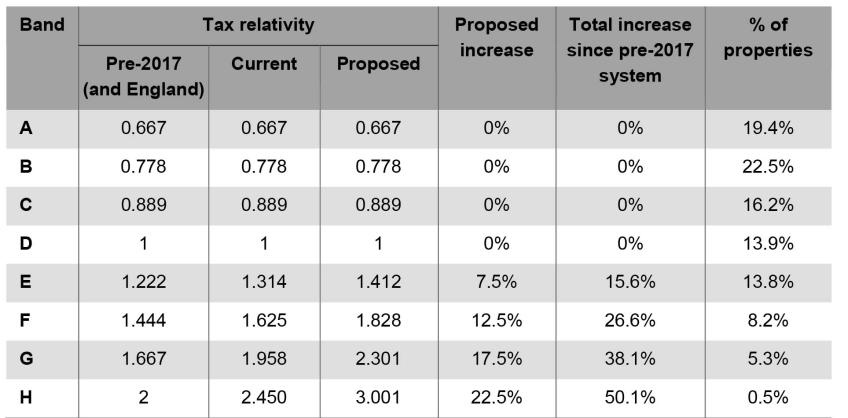

Table 1 shows the relative tax rates applied to properties in each council tax band as a multiple of the rates applied to properties in band D for the pre-2017, current and proposed Scottish council tax systems. It shows that taken together, if the proposed reforms go ahead, the tax rate applied to a band H property would be 50% higher relative to a band D property than it was prior to 2017. In particular, a band H property would face a tax bill 3 times as high as a band D property and 4.5 times as high as a band A property, compared with 2 and 3 times higher, respectively, prior to 2017 in Scotland and in England to this day. The proposed reforms would therefore make the Scottish council tax less regressive than is currently the case, and particularly compared with the pre-2017 and English situations.

Table 1. Tax bands and relativities in Scotland

Their impact on council tax revenues and bills is less clear. That is because while the Scottish Government determines the relative tax rates applied to different tax bands, it is councils that set the overall level of council tax (by choosing a band D rate). The impact of the proposed reforms on council tax revenues and bills will therefore depend on councils’ decisions.

Suppose that the Scottish Government were to provide the same level of grant funding to councils that it would have in the absence of the reforms. If councils decided to spend the same amount on services that they otherwise would have as well, they would need to raise the same amount from council tax as they would have in the absence of the reform. Because of the higher relative tax rates applied to properties in bands E–H, they could do this while setting a lower band D tax rate. That would mean that the reform would lead to a fall in the council tax bills faced by properties in bands A–D, and that the increase in bills for properties in bands E–H would be smaller than the 7.5–22.5% increase in their relative tax rates.

Conversely, if the Scottish Government decided to cut the grant funding it gives councils, or councils decided to spend more, council tax revenues would increase following the reform. Given a difficult financial situation facing both the Scottish Government and councils, such an increase in revenues is probably to be expected. If councils set the same band D rate as in the absence of the reform, for example, properties in bands A–D would see no change in their bills and properties in bands E–H would see their bills increase by 7.5% to 22.5%. Based on current average council tax rates in Scotland, this would be an increase of between £140 for a band E property and £780 for a band H property, raising up to £175 million per year (the amount in future years would grow in line with band D tax rates set by councils).

The words ‘up to’ are important here because the Scottish Government has suggested fully exempting single adults without children with net incomes up to £16,750 per year and other households with net incomes up to £25,000 per year from the increase in tax rates on band E–H properties, provided they have savings below £16,000 (for every £1 of income above these thresholds, households have to pay 20p of the increase in tax bills). A similar exemption is in place for the increases already made as part of the 2017 reforms, with households applying for the exemptions via councils’ means-tested council tax reduction scheme (CTRS). Combined with the fact that the very low-income households that have their bills covered by the standard CTRS would not pay any of the increase in bills, a special exemption for other low- to middle-income households would somewhat reduce the potential increase in revenues as a result of this reform.

… but could go further, …

By increasing the tax rates on high-band properties relative to low-band properties, the Scottish Government’s proposed reforms would reduce the regressivity of council tax. The reforms are therefore a step in the right direction, and compare well with the situation in England, where reform seems increasingly less likely, whoever wins the next election. However, Scottish council tax would remain highly regressive with respect to property value, particularly at the very bottom and very top of the property value distribution.

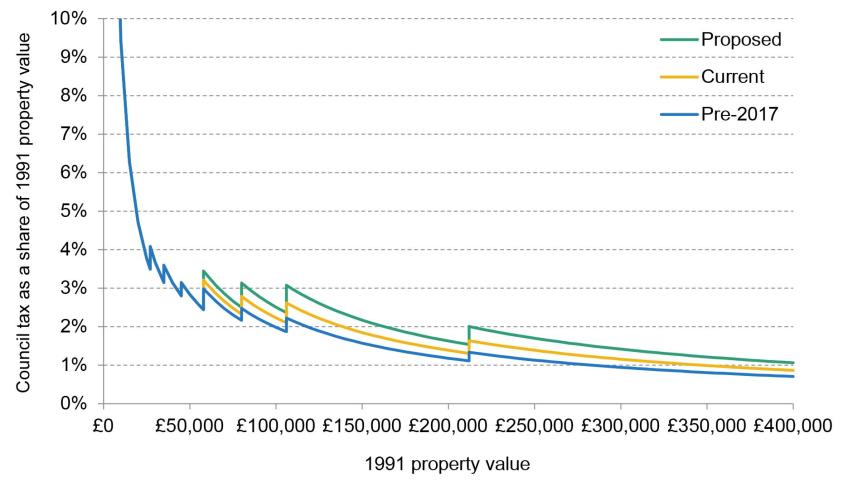

Both points are illustrated in Figure 1, which shows average council tax bills as a percentage of estimated 1991 property values for the pre-2017 system, the current system and the proposed system (assuming the same band D rate under each system). It shows that by increasing the relative tax rates applied to high-band properties, the 2017 and proposed reforms reduce the discrepancy in effective tax rates between low-band (low-value) and high-band (high-value) properties. However, band H properties were worth at least 8 times as much as band A properties as of 1991, and would face a tax bill that is still only 4.5 times as large following the proposed reforms. That means that measured as a share of property value, they would face a tax rate that is at most not much more than half as high as a band A property. And for the highest-value properties, the differences are even starker: for example, a property worth £400,000 in 1991 would face a tax rate of just 1.1% of its 1991 value, compared with 4.7% for a property worth £20,000 in 1991.

Figure 1. Council tax bills as a percentage of 1991 property values, by property value

Thus, while a step in the right direction, the proposed reforms are only a relatively modest step. Ideally, council tax would be made proportional to property value: there is no good reason for the tax rate on housing wealth or consumption to decrease as housing value rises. Even if the Scottish Government did not want to make its overall tax system as progressive as a proportional council tax would imply, it could choose to make offsetting changes to other devolved taxes such as land and buildings transaction tax (LBTT) and income tax to achieve its desired overall level of tax progressivity. Raising more from high-value properties via council tax and less from the highly distortive LBTT would improve both the fairness and economic efficiency of the tax system: there is no good reason why properties that change hands and people who move more often should be more highly taxed, gumming up not only the property market but also the labour market. Given the scope for high-income individuals to avoid increases in income tax by changing their behaviour – to such an extent that the Scottish Fiscal Commission assumes that 90% of the revenues from increases in the top rate of income tax are lost as a result of such behaviour – it might make sense to focus more on council tax as a way to raise more from the best-off Scots. After all, it is much harder to move a house than move home, or hide a house than hide income.

… duck the need for a revaluation …

An even bigger missed opportunity is to continue to use 1991 values in the council tax system. Despite it being recommended in 2016 by the government-appointed Commission on Local Tax Reform, a pledge by the SNP for a Citizens’ Assembly on wholesale reform of the local government finance system in its 2021 manifesto, and support from Scottish Labour, the Scottish Greens and the Scottish Lib Dems, the idea of revaluing properties is entirely absent from the Scottish Government’s consultation.

The reason why using 1991 values is increasingly absurd is not that average property values have increased almost fivefold in the intervening 32 years. It is that the value of different properties in different parts of the country have changed by very different amounts in that period. For example, even just since 2004, when data begin, ONS estimates suggest that values have gone up over twice as fast in East Lothian as in Aberdeen, Glasgow and North and South Ayrshire. Such big differences in changes in value mean that even if new bands based on updated values were set so that the same fraction of properties across Scotland as a whole was in each band as now, many properties would end up in a different band.

Work commissioned from Heriot-Watt University by the Commission on Local Tax Reform estimated that even 10 years ago, only 43% of properties in Aberdeenshire, Argyll and Bute, Dumfries and Galloway, Dundee, Edinburgh, Fife and Inverclyde would have been in the same band if up-to-date values were used instead. In other words, 57% of properties in these council areas were in the ‘wrong band’ and hence facing the wrong tax bill.

These local areas may not be fully reflective of Scotland as a whole, and values will have changed further over the 10 years since the data used in the Heriot-Watt analysis relate to. But it is probably reasonable to assume that half or more of the properties in Scotland are in the wrong band.

The lack of a revaluation means that properties now worth very different amounts may face the same tax bill, just because they were worth similar amounts over 30 years ago. Conversely, properties with very similar values today may face different tax bills because they were worth different amounts in 1991. Both situations are unfair.

… and have been presented in a potentially misleading way

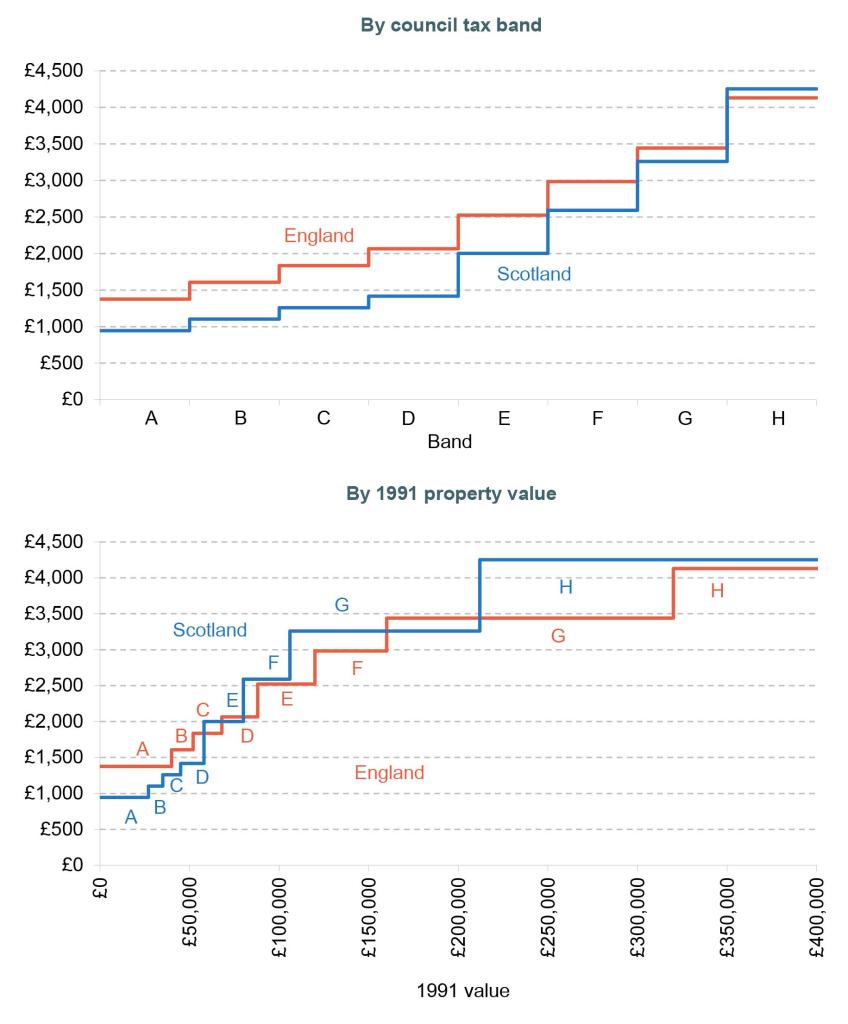

In the press release announcing the consultation and making the case for its reforms, the Scottish Government highlights that even after the proposed increases, the average tax bills for properties in bands E–G in Scotland will still be lower than for properties in bands E–G in England. This is true, as illustrated in the top panel of Figure 2, and reflects the lower average band D rate charged by Scottish councils (in part because there are no precepts for the police, fire service or community councils). For example, based on the current average band D tax rate, the average bill for a band E property in Scotland would be £2,001 after the reform, over 20% less than the £2,524 charged in England.

Figure 2. Average council tax bills, England and Scotland (after proposed reform)

Note: Average council tax bills for England include police, fire and other precepts. Average tax bills for both countries are based on the average band D rates as of 2023–24.

However, this neglects to mention the fact that council tax thresholds are lower in Scotland than in England (and have been since the system was put in place in 1991), reflecting lower average property values in Scotland. For example, properties with a value of £58,000 to £80,000 as of 1991 are in band E in Scotland. However, in England, those with a value in 1991 of between £58,000 and £68,000 would be in band C, while those with a value of between £68,000 and £80,000 would be in band D. The bottom panel of Figure 2 therefore compares the taxes paid in England and Scotland according to their 1991 values. It shows that whereas properties worth up to £58,000 in 1991 (bands A–D in Scotland, accounting for just under three-quarters of all properties) face lower average tax bills in Scotland than in England, for most values above this level, average tax bills would be higher in Scotland than in England following the proposed reforms. For example, based on the current average band D rate, a property worth £60,000 in 1991 would face an average tax bill of £2,001 in Scotland, compared with £1,836 in England. And a property worth £85,000 in 1991 would face an average bill of £2,590, compared with £2,065 in England.

Moreover, property values have increased by somewhat less in Scotland (4.9-fold) than in England (5.5-fold) since properties were valued in 1991. This means that based on current values, it is even more the case that properties in bands E–H in Scotland are likely to face higher, not lower, council tax bills than properties with the same value in England.

Concluding remarks

In summary, while the Scottish Government’s proposed reforms would (further) reduce the regressivity of Scotland’s council tax system, and compare favourably with the lack of action in England, they could and should go further and they fail to grasp the real nettle: the use of massively outdated property values.

At some stage, continuing to base council tax on 1991 values will graduate from the absurd to the lunatic: does the Scottish Government envisage its successors continuing to use 1991 values in 2091? And the longer reform is delayed, the harder it will likely be. With a mandate for reform, and previous supportive noises from three of the four other parties in the Scottish Parliament, it is disappointing this can looks to have been kicked down the road again.

It need not be like this. The Welsh Government has committed to revaluation and more fundamental reform of council tax, despite some political heat when a previous revaluation was undertaken in Wales in 2005. If its reforms are better received this time around, hopefully it could catalyse an overdue revaluation and more ambitious reform in Scotland (and perhaps even in England).