The coronavirus pandemic, and governments’ responses to it, have caused a large fall in equity prices. Between the beginning of January and the beginning of April, the FTSE all-share index fell by 30%, wiping out all the gains of the last 8 years. Prices have since rebounded slightly, but are still around 20% below their level at the start of the year. How and when equity prices recover will depend on whether restrictions on economies around the world are eased over the next few months, as is hoped, without a resurgence of the pandemic.

The fall in stock markets has reduced the wealth of those who directly hold shares. It also reduces the wealth of those with defined contribution (DC) pension pots that are invested in equities. In the (unlikely) scenario that the values of equities recover to where they would have been in the absence of the crisis, then these wealth falls will be temporary for many. But if prices do not recover, or do not do so by the time individuals need to draw on their accumulated retirement saving, then those with DC pensions invested in equities will either need to make do with less in their retirements, delay their retirement, or save more to fill the gap.

Even if equity prices do recover to where they would have been without this crisis, there would still be permanent consequences for those drawing down on their pension pot in the interim. Since 2015 and the introduction of ‘pension freedoms’, it has been possible for all those aged 55 or over to access their DC pension saving in flexible ways – for example, drawing a flexible income or ad hoc lump sums or even withdrawing the entire fund in one go – rather than purchasing an annuity. Statistics released by HMRC today show that during the first quarter of 2020, nearly 350,000 individuals made taxable withdrawals from DC pensions in these ways. According to data from the Financial Conduct Authority, in 2018-19 around a third of DC pension pots accessed for the first time started to be withdrawn flexibly (a further 55% were fully withdrawn and 11% were used to purchase an annuity). The current circumstances highlight the difficult choices that many of these individuals must make and the risks they face.

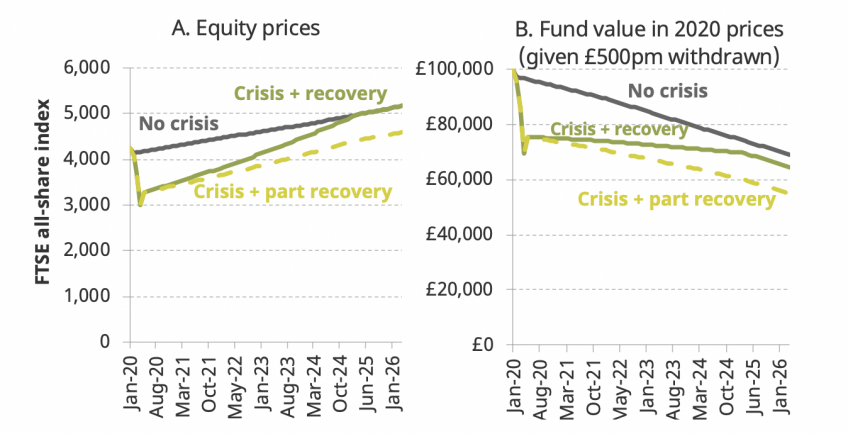

To illustrate this, consider an individual with a £100,000 pension fund invested in equities at the start of January 2020, who is withdrawing £500 per month as a regular income. The dark grey line illustrates a “no crisis” scenario for equity prices over the next 6 years, where equities are assumed to grow at an annual rate of 3.7% (1.8% in real terms). With the individual withdrawing £500 per month (in real terms), their fund would decline from £100,000 to £74,000 between January 2020 and April 2025.

The green line (labelled “crisis and recovery”) shows an alternative path for equities – one that mirrors the recent movements in the FTSE all-share index, with a decline of 29% between January 2020 and April 2020, before a bounce back of 10% by the end of April 2020. Going forwards, we illustrate a steady improvement in equity prices, such that these have recovered to the level of the “no crisis” scenario 5 years later, in April 2025. This is an optimistic scenario (although not as optimistic as the Office for Budget Responsibility’s recent Coronavirus Reference Scenario) designed to illustrate the effects of even a temporary fall in equity prices. A third scenario in yellow (labelled “crisis and part recovery”) shows the implications if equities only recover at half the rate of the “crisis and recovery” scenario.

Under our “crisis and recovery” scenario, the individual’s fund value obviously falls dramatically with the stock market crash. But what is important is that if the individual were to continue to withdraw £500 per month (the same as in the “no crisis” scenario), their fund value would never recover to the “no crisis” level, even though equity prices would do. In these illustrations their fund remains 6% lower in April 2025 as a result of the crisis. Even in this relatively optimistic scenario for stock market recovery the individual would be left at greater risk of running out of money before the end of their retirement. If equities only recover half of their lost ground by April 2025, and the individual continued to make withdrawals of £500 per month, then their wealth would be 19% lower as a result of the crisis.

Figure 1: Illustrative pension fund depletion given alternative equity performance scenarios

Note: The ‘no crisis’ scenario assumes growth in equity prices consistent with the Office for Budget Responsibility (OBR) March 2020 forecast, averaging 3.7% per year. The ‘crisis and recovery’ scenario assumes a 29% fall between January 2020 and April 2020, and a 10% recovery by May 2020. For future months the ‘crisis and recovery’ scenario assumes 8.9% growth per year until April 2025 (when prices reach the level of the ‘no crisis scenario’) and 3.7% per year thereafter. The ‘crisis and part recovery’ scenario follows the ‘crisis and recovery’ scenario other than assuming growth of 6.3% per year from May 2020 to April 2025.

Individuals could offset the effects of a temporary fall in equities by reducing the amount they are withdrawing from their pension each month. If the individual in the “crisis and recovery” scenario reduced their monthly withdrawals by the same percentage that equity prices lie below the “no crisis” scenario each month, then their fund value in April 2025 would be the same as under the “no crisis” scenario. But this would come at the cost of significantly lower withdrawals in the short term – for example, only £359 (rather than £500) in April 2020, £393 in May 2020, and so on.

These results are illustrative and those whose pension pots are not fully invested in equities will only be partly exposed to these shocks. Recent analysis by the Financial Conduct Authority found that nearly a third of individuals drawing down their pension pots are in fact not invested in equities at all. Such individuals would be insulated from the current stock market shock, but face a different set of concerns: holding only cash is unlikely to be a good investment strategy over the length of a typical retirement.

What is clear is that individuals who are accessing their DC pension funds in flexible ways now face complex decisions about how to invest their funds, and whether and how to adjust their pension withdrawal in response to large stock market shocks. These decisions can have lasting financial consequences. This is quite different to the circumstances these individuals would have faced in the absence of “pension freedoms”. Prior to 2015, most individuals would have had to purchase an annuity with their accumulated DC pension saving. In other words, they would have exchanged their accumulated pension saving for a guaranteed income in each year of retirement. This income would have been unaffected by movements in the stock market and individuals would not have any decisions to make.

This does not necessarily mean that accessing pension saving in a flexible way is worse for individuals than purchasing an annuity. While the value of the stock market has currently fallen, in the long run individuals may get a better return investing themselves rather than purchasing an annuity. There are also other advantages, including more flexibility over the profile of withdrawals, and the ability to bequeath unused pension funds on death (and in a way that is ludicrously tax-favoured). However, it does highlight the level of financial understanding required to make informed decisions, and that, by not purchasing an annuity, individuals bear all of the investment risk (in addition to the uncertainty over how long they will live) themselves.

Government policy makers and regulators are already concerned with individuals’ ability to navigate the choices arising from ‘pension freedoms’, particularly given the majority do not use financial advice. Going forwards, government, regulators and the pensions industry all need to work to ensure that individuals make the best choices they can in these challenging circumstances. Otherwise, this crisis risks revealing ‘pension freedoms’ as another stark case of government policy putting risk and difficult decision-making in the hands of individuals who are not well-placed to deal with either.