In recent years, there has been renewed interest in the question of whether additional taxes should be devolved to English local government:

- The past decade has seen a number of changes to how local government is funded, including the introduction of business rates retention. Broadly, these changes have focused on giving councils more control over their funding and providing stronger financial incentives to councils to drive local growth and development. Devolution of additional tax revenues and powers could be seen as a natural extension of this agenda.

- After years of cuts, councils in England face serious short-term funding pressures. In the longer term the costs of funding social care are likely to increase faster than the revenues councils receive from council tax and business rates. While these issues could be addressed by using national taxation to increase the grant-funding given to councils, devolution of additional tax revenues and powers could also play a role.

This report: looks at the taxes currently devolved to local government in England and in other countries; sets out criteria which can be used to assess whether different taxes and tax powers are in fact suitable for devolution; applies these to a range of taxes; and looks at how much could be raised in different parts of England from different options.

Download the 8-page summary here.

Key policy messages

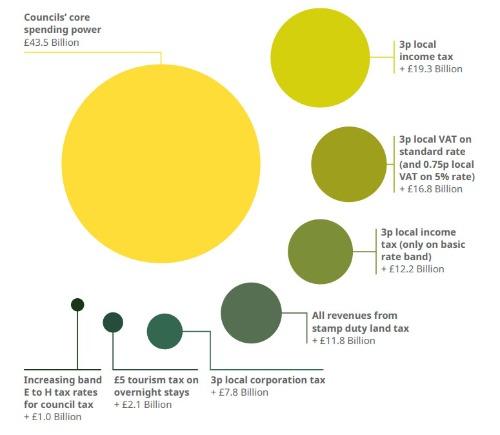

- Of the large taxes we look at, income tax seems the most promising candidate for partial devolution. Concerns about tax competition between councils and about volatility and inequality in revenues could be mitigated by restricting councils’ powers to a flat rate local income tax: a 3p tax on all income bands, for example, would raise £19bn. However, a local income tax would still involve some additional administration and compliance costs, and mean tackling a number of tricky technical issues.

- Giving councils substantial new powers over council tax – such as the ability to revalue properties in their area – could pose problems for the redistribution of funding between councils. In particular, it would make assessing the revenue raising capacity of different councils – a vital step in this process – much more difficult. It is likely to be better to revalue and reform council tax at a national level: this is overdue and could make the tax fairer and, if desired, raise more revenues.

- There is currently significant interest in tourist taxes. While such taxes would be administratively feasible and would raise useful amounts in a few well-visited areas, they would raise little money in many more places. The economic case for such a new tax is also far from clear cut.

- While tax devolution could give councils more options and discretion over how to raise funding, it is not a panacea for their funding issues. Ultimately, what’s needed is either tax increases (whether at a local or national level) or lower expectations of what councils can provide.