This Briefing Note, produced in advance of the 2017 Election, analyses the impact of tax and benefit changes since May 2015 on the incomes of different kinds of households. We look both at reforms already implemented, and those planned by the current government (but not at any potential manifesto commitments, which will be analysed later).

IFS Election 2017 analysis is being produced with funding from the Nuffield Foundation as part of its work to ensure public debate in the run-up to the General Election is informed by independent and rigorous evidence. For more information go to www.nuffieldfoundation.org

Key findings

Increases to the income tax personal allowance and higher-rate threshold, costing the government around £5 billion per year, have been the biggest change to taxes or benefits so far this parliament. |

| These have benefited most basic-rate taxpayers to the tune of £160 a year, while most higher-rate taxpayers have gained £380 a year. However, for the latter group, all this giveaway is doing is reversing most of the effect of the cuts in the higher-rate threshold in the last parliament. And cuts in pension tax relief, on top of a large number of tax increases in the last parliament, have hit those with the very highest incomes. |

While cuts to benefits have been small as yet, government plans for future cuts would significantly reduce the incomes of low-income working-age households, particularly those with children. |

| The most important changes are the cash freeze in most benefit rates, cuts to child tax credit and the continued roll-out of the less generous universal credit. |

If these planned cuts were fully in place now, nearly 3 million working households with children on tax credits would be an average of £2,500 a year worse off, with larger families losing more. |

| The 1 million families with children and nobody in paid work would be £3,000 a year worse off on average. But it is important to stress that many of the changes will not create immediate losses of benefit income, because of protections for existing claimants. |

Planned cuts will have a bigger effect on the entitlements of the poorest families than the cuts made by the coalition. |

| More broadly, the period since 2010 has seen lower-income households lose as a result of benefit cuts and the richest households lose from increases in income tax. But those on average and moderately high incomes, as well as most pensioners, have seen their incomes almost completely protected on average. |

This analysis does not tell you what has actually happened to the incomes of different types of households. That depends on changes in earnings, employment and inflation as well as changes to taxes and benefits. For analysis of overall trends in household income see here and here. Further IFS election analysis to be published shortly will provide the latest picture on what we know about overall trends in household incomes.

Tax and benefit reforms since May 2015 have so far had little effect, but there are big benefit cuts to come

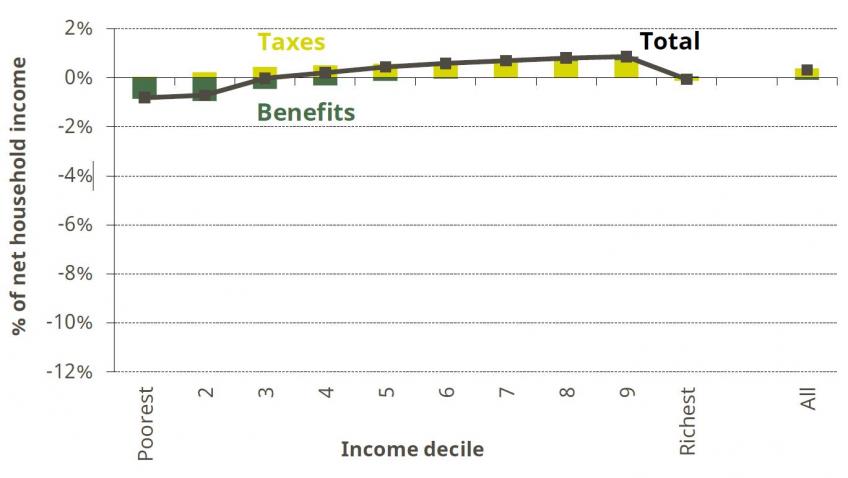

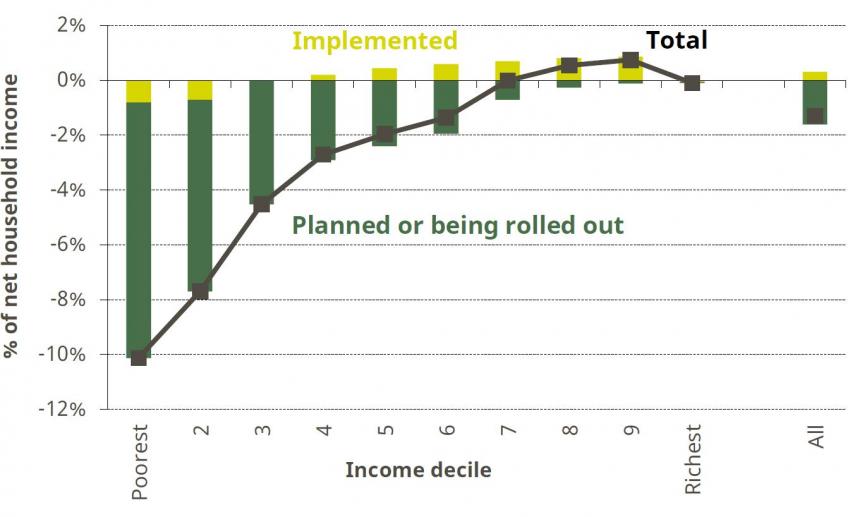

Figure 1. Impact of tax and benefit reforms implemented between May 2015 and June 2017 by income decile [download the data]

Note: For the cash equivalents of these impacts, please see Appendix B. Income decile groups are derived by dividing all households into 10 equal-sized groups according to net income adjusted for household size using the McClements equivalence scale. Assumes full take-up of means-tested benefits and tax credits.

Source: Authors’ calculations using TAXBEN run on uprated data from the 2015–16 FRS and 2014 LCFS.

The key point to take from Figure 1 is that the average impact of tax and benefit changes since May 2015 has been relatively small – less than 1% of income in each income decile. Cash impacts are shown in Appendix B.

Cuts to income tax – the above-inflation increases in the income tax personal allowance (to £11,500 rather than £10,710) and the higher-rate threshold (to £45,000 rather than £42,815) – largely explain the gains for higher-income households. Together, these tax cuts will cost the government around £5 billion in 2017–18, with most basic-rate taxpayers gaining £160 a year and most higher-rate taxpayers gaining £380 a year. In the top decile, those changes have been roughly offset on average by increases in tax on income that is paid into private pensions, although those rises predominantly affect those towards the top of the top decile.

For lower-income households, there has been a cash freeze in most working-age benefits – affecting 11 million households. But low inflation over the last two years has meant that this has only amounted to a 1% real cut so far. Meanwhile, the reduction in the benefit cap, while hitting some households very hard, has affected fewer than 100,000 households. Hence, the overall scale of benefit cuts seen over the past two years has been small.[1]

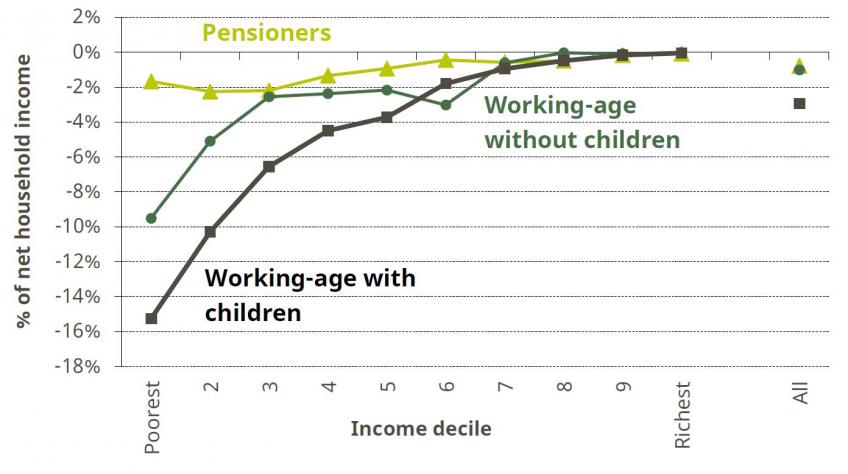

Figure 2. Long-run impact of tax and benefit reforms since May 2015 by income decile [download the data]

Note: For the cash equivalents of these impacts, please see Appendix B. Income decile groups are derived by dividing all households into 10 equal-sized groups according to net income adjusted for household size using the McClements equivalence scale. Assumes full take-up of means-tested benefits and tax credits, and that all planned changes are fully in place.

Source: Authors’ calculations using TAXBEN run on uprated data from the 2015–16 FRS and 2014 LCFS.

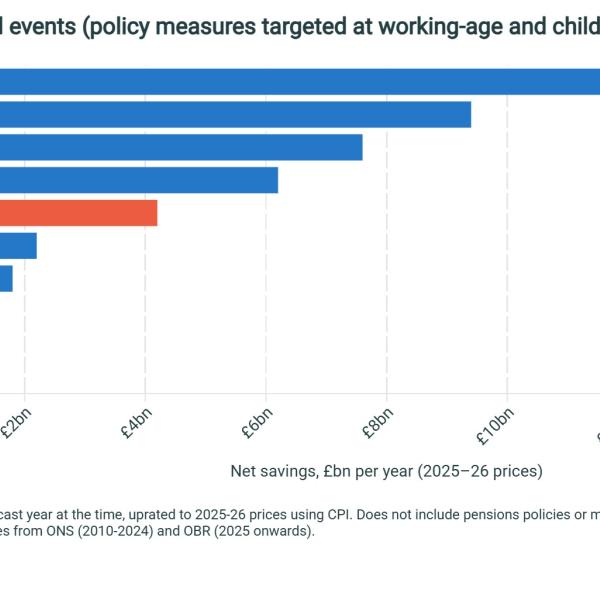

Looking ahead, Figure 2 adds the long-run impact of tax and benefit changes that are now being rolled out or are planned by the current government. The large losses for low-income households (more than 4% of income, on average, in each of the bottom three deciles) are mostly explained by three planned benefit cuts:

- the continued freeze in most working-age benefit rates until March 2020; under current inflation forecasts, this will reduce the real value of these benefits by 5% between now and 2020, and reduce government spending by over £3 billion a year;

- cuts to the generosity of tax credits for families with children – limiting entitlement to two children and removing the ‘family element’ – that are expected to reduce government spending by around £5 billion a year in the long run;

- the roll-out of universal credit, expected to reduce government spending by around £5 billion a year in the long run.

The small number of tax measures due to be implemented in the coming years will have a very limited impact. We do not include the effects of meeting the 2015 Conservative manifesto commitment to a £12,500 personal allowance and a £50,000 higher-rate threshold (although note that standard inflation uprating is expected to get these thresholds most of the way to those commitments by 2020, without any further policy action). Later IFS election work will analyse the potential effects of 2017 manifesto commitments.

Figure 3. Long-run impact of planned tax and benefit reforms by income decile and household type [download the data]

Note: For the cash equivalents of these impacts, please see Appendix B. Income decile groups are derived by dividing all households into 10 equal-sized groups according to net income adjusted for household size using the McClements equivalence scale. Assumes full take-up of means-tested benefits and tax credits, and that all planned changes are fully in place.

Source: Authors’ calculations using TAXBEN run on uprated data from the 2015–16 FRS and 2014 LCFS.

Figure 3 focuses on the impact of future tax and benefit changes (those being rolled out or planned by the current government, shown by the green bars in Figure 2), and splits households within each decile into working-age households with children, working-age households without children and those containing a pensioner.

Pensioner households are mostly protected from future benefit cuts. By contrast, the impact on the incomes of working-age households with children is large, with average losses of more than 10% in the bottom two income deciles. This reflects the overall importance of benefit income for these households, as well as the specifics of the reforms chosen. Looking in more detail at the impact of future cuts on working-age households with children, if all planned cuts were fully in place now:

- the 1 million households with children and no one in paid work would be an average of £3,000 a year worse off;

- the 3 million working households with children currently entitled to tax credits (those with lower earnings) would be an average of £2,500 a year worse off;

- the 4 million working households with children not entitled to tax credits (generally those with higher earnings) would be an average of £100 a year worse off.

It is important to stress that many of the changes will not create immediate losses of benefit income, because of protections for existing claimants. Rather, they will significantly reduce the generosity of the system in the long run.

These changes come on top of lots of reforms made by the coalition government

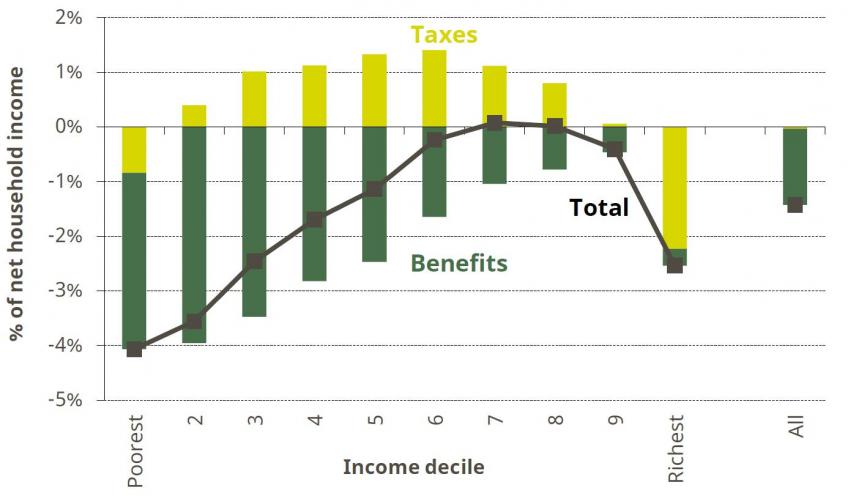

Figure 4. Impact of tax and benefit reforms implemented between May 2010 and May 2015 by income decile [download the data]

Notes and sources: Figure 3.1 of Browne and Elming (2015) http://www.ifs.org.uk/publications/7534.

For the cash equivalents of these impacts, please see Appendix B.

Figure 4, taken from our 2015 election analysis, shows the average gain or loss in each income decile resulting from tax and benefit changes between May 2010 and May 2015, as a percentage of income. It shows the following:

- The cuts to working-age benefits made by the coalition government led to significant reductions in household income across the lower-income half of households (of over 3% in each of the bottom two income deciles, on average).

- The top income decile faced large tax increases on average, both as a result of cuts to the higher-rate threshold, and due to other measures targeting predominantly those on the very highest incomes (approximately the top 1%). Indeed, if one were also to include measures introduced in the final months of the last Labour government, the top decile lost the most as a share of income over the period of fiscal consolidation up to May 2015 (6.5%).[2]

- Households in the sixth to ninth income deciles were protected from the impact of reforms over this period to a remarkable degree. That is because, on average, large increases in the income tax personal allowance and cuts in fuel duty roughly offset the increases in VAT and NICs and the benefit cuts for this group.

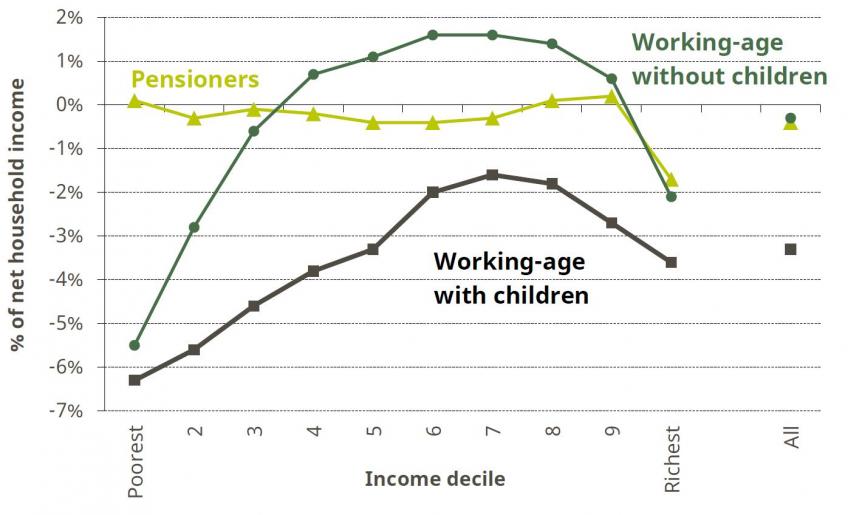

Figure 5. Impact of tax and benefit reforms implemented between May 2010 and May 2015 by income decile and household type [download the data]

Note: For the cash equivalents of these impacts, see Table 5 in Appendix B.

Source: Figure 3.4 of J. Browne and W. Elming, ‘The effect of the coalition’s tax and benefit changes on household incomes and work incentives’, IFS Briefing Note BN159, 2015, https://www.ifs.org.uk/publications/7534.

Figure 5, again taken from our 2015 election analysis, shows the effects of tax and benefit reforms over the same period, but this time splitting households within each income decile into working-age households with children, working-age households without children and pensioner households (households containing someone aged over the state pension age).

Pensioners outside of the top income decile were broadly unaffected by tax and benefit changes on average. They did not gain from increases in the personal allowance, but they were also unaffected by the increase in NICs and mostly protected from benefit cuts. Losses from the increase in VAT were broadly cancelled out by gains from the ‘triple lock’ on the basic state pension (and knock-on increases in pension credit).

Meanwhile, working-age households without children did much better than those with children – in fact, the former group actually gained on average in the fourth to ninth income deciles. This divergence is explained by the fact that families with children were affected by benefit cuts to a much greater extent. It is worth remembering, however, that there were large increases in the generosity of benefits for families with children under Labour, which were only partly offset by the cuts implemented by the coalition government.[3]

[1] Small gains from benefit reforms in the top half of the income distribution are explained by the introduction of ‘tax-free’ childcare.

[2] See figure 3.2 of J. Browne and W. Elming, ‘The effect of the coalition’s tax and benefit changes on household incomes and work incentives’, IFS Briefing Note BN159, 2015, https://www.ifs.org.uk/publications/7534.

[3] See figure 3.5 of J. Browne and W. Elming, ‘The effect of the coalition’s tax and benefit changes on household incomes and work incentives’, IFS Briefing Note BN159, 2015, https://www.ifs.org.uk/publications/7534.

Please see pdf version of this briefing note for appendices.

IFS Election 2017 analysis is being produced with funding from the Nuffield Foundation as part of its work to ensure public debate in the run-up to the general election is informed by independent and rigorous evidence. For more information, go to http://www.nuffieldfoundation.org.