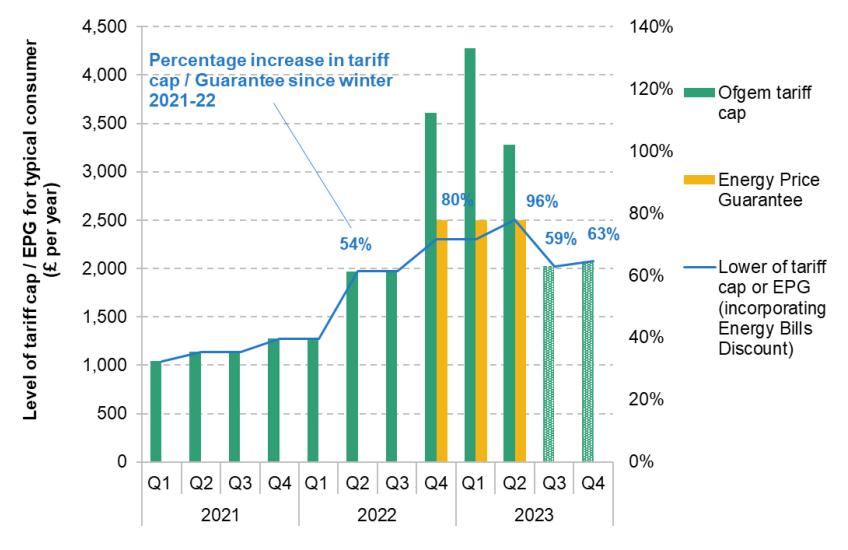

We expect to see a substantial fall in the headline rate of inflation next month when data for April will be published, as energy inflation will finally start to fall. But this fall in energy price inflation will not bring immediate relief to households. Energy prices in April remained at the same level as they had been over the winter, implying a £2,500 annual bill for a typical household. But inflation is a measure of price changes not price levels. The fact that the Ofgem tariff cap increased from £1,277 to £1,971 between March and April 2022 means that the annual increase in typical energy bills will be 96% this month, but only 27% next month.

This fall in the rate of energy price increase will feed into a lower headline rate of inflation in April, even when households will have seen no change to energy prices. In addition, the £400 energy bills discount (which is not included in measures of energy price inflation) came to an end this month. As a result, annualised bills will be higher in April than they were over the winter (see Figure). Most recent forecasts suggest that energy prices for consumers will only fall from July this year.

Figure. Level of tariff cap and EPG for a typical consumer, over time

Source: Authors’ calculations using tariff cap data from Ofgem and tariff cap predictions from Cornwall Insight (shaded bars, forecast published 31 March 2023).

Notes: Prices expressed as annualised bills. Actual energy bills will depend on energy usage in each quarter.

Heidi Karjalainen, a Research Economist at the Institute for Fiscal Studies, said:

“Inflation in March remained high, but we expect to see a substantial fall in the rate of inflation next month as energy inflation will finally start to fall. This does not mean that the energy prices that consumers face are falling - just that they are rising less quickly. Households are only expected to start seeing lower gas and electricity prices from July this year. And even when energy prices start to fall, prices of other categories such as food are likely to continue rising so the squeeze on household finances is far from over."