The new prime minister has expressed a desire to radically overhaul the direct personal tax system. During his leadership campaign, Boris Johnson announced plans to cut income taxes for high-income individuals by raising the higher-rate threshold (HRT) from £50,000 to £80,000, and to raise the point at which people start paying National Insurance contributions (NICs) to help low earners. The new chancellor has expressed similar intentions to lower taxes and also to simplify the tax system.

This chapter sets out the impacts of the prime minister’s proposed policies. We argue that these are big – and costly – reforms, both of which will predominantly help those in higher-income households. We also examine other ways the government could cut taxes for high-income individuals whilst at the same time simplifying the system, and analyse a more targeted way to boost the incomes of low-earning families by raising work allowances in universal credit.

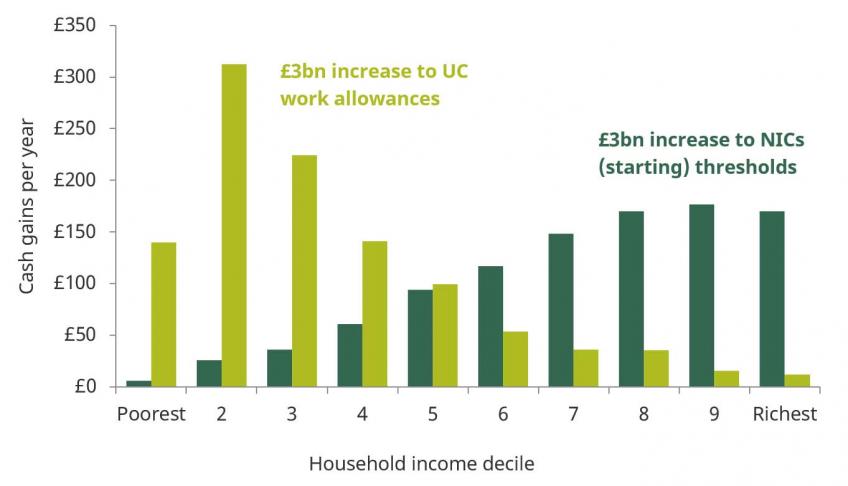

Distributional effects of spending £3 billion on raising NICs thresholds versus raising work allowances in universal credit (UC)

Key findings

- Raising the higher-rate income tax threshold (and the National Insurance contributions thresholds that are aligned with it) from £50,000 to £80,000 in 2020–21 would cost £9 billion per year and cut taxes for the highest-income 8% of individuals. The cost of the policy would be lower, both in the short and long run, if the threshold were raised more gradually. For example, an £80,000 threshold in 2024–25 would cost £8 billion per year relative to current plans.

- This is a substantial and expensive tax cut from which only those on high incomes would gain. It would offset some of the big tax increases that have affected the very highest earners since 2009.

- Raising the higher-rate threshold to £80,000 in 2020–21 would take 2.5 million people out of paying the higher rate, reversing the increase over recent decades and taking the number of higher- (or additional-) rate taxpayers to its lowest level since the UK’s individual tax system began in 1990–91.

- The government should remove the tapered withdrawal of the personal allowance from £100,000 per year, which creates a £25,000-wide 60% marginal income tax band and affects ever more people each year. Raising the higher rate of income tax from 40% to 45% above the proposed new higher-rate threshold of £80,000 would cover most of the cost to the exchequer of removing this bizarre and opaque feature of our income tax system.

- Raising the point at which employees and the self-employed start to pay National Insurance contributions (NICs), from its planned level of £8,788 per year in 2020–21, would cost about £3 billion for every £1,000 by which it is raised. If the employer NICs threshold were raised alongside this, the total cost would be £5 billion. Raising NICs thresholds would benefit everyone who currently pays NICs – all workers above the bottom 12% of the weekly earnings distribution, or any employee aged 25+ working at least 20 hours per week at the national living wage.

- Raising the NICs threshold is the best way to help low and middle earners through the tax system, but if the aim is to help the lowest earners, increasing work allowances under universal credit is much more effective. Only 3% of the total gains from raising the NICs threshold (either by £1,000 or to the personal allowance threshold) would accrue to the poorest fifth of households. Spending £3 billion on increasing work allowances could raise the incomes of the poorest fifth of households by 1.5%, compared with less than 0.1% under an equally costly NICs cut.

This is a pre-released chapter from the IFS Green Budget that will be published on October 8th. The Green Budget is being produced in association with Citi and is funded by the Nuffield Foundation.