This observation summarises some of the key facts about how National Insurance contributions (NICs) work and who will be paying more in NICs from April 6th 2022.

1. Who pays NICs?

National Insurance contributions (NICs) are a tax paid by employees and the self-employed on their earnings, and by employers on the earnings of those they employ. NICs are not charged on those with low earnings, or on pension income or investment incomes (such as dividends or capital gains). Employee and self-employed NICs are not levied on the earnings of those over the state pension age.

A full explainer of how NICs work can be found here.

2. What is changing on April 6th?

Rates are rising

Table 1 shows the main rates of NICs. On April 6th, the rates of NICs increase by1.25 percentage points. This means, for example, that the main rate for employees rises from 12% to 13.25%.

Rates of dividend tax also increase by 1.25 percentage points from April 6th 2022. The dividend tax rate for basic-rate income taxpayers will therefore increase from 7.5% to 8.75%. For higher-rate tax payers it will rise from 32.5% to 33.75%.

The increase in NICs was legislated as a means to increase spending on health and social care. From April 2023, the 1.25 percentage point NICs increase will be replaced by a new Health and Social Care Levy (i.e. NICs rates will revert to their current levels). At that point, the Health and Social Care Levy is also due to be applied to the earnings of those above the state pension age.

The point at which people start to pay NICs will rise

In the 2021-22 tax year, the main rates of employee and self-employed NICs started to be paid on earnings (or profits) above £9,568. From April 6th, this threshold increases to £9,880 (Thresholds tend to increase each April to account for inflation).

From July 6th 2022, the threshold will be increased to £12,570. This change was announced in the Spring Statement.

The higher-rate threshold will remain at £50,270.

Table 1: Rates of National Insurance contributions

| 2021-22 rates |

|

| Rates from April 6th 2022 | |

| Main rate | Rate above higher rate threshold |

| Main rate | Rate above higher rate threshold |

Employee NICs | 12% | 2% |

| 13.25% | 3.25% |

Self-employed NICs | 9% | 2% |

| 10.25% | 3.25% |

Employer NICs | 13.8% | 13.8% |

| 15.05% | 15.05% |

3. Who will pay more in tax?

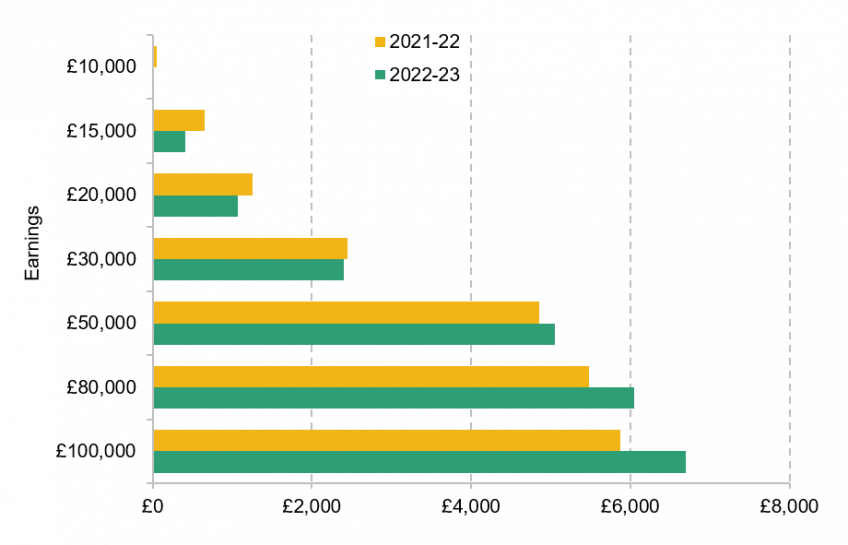

Figure 1 shows annual NICs bills for 2021-22 (in yellow) and for the financial year 2022-23 (in green) for employees with different levels of earnings.

Relative to 2021-22 NICs bills, two things will change on April 6th. First, the threshold at which NICs starts to be paid increases (to £9,880) – this will reduce NICs bills. Second, the rates of NICs increase. From April 6th, almost everyone who pays NICs will face a higher tax bill as a result of the increase in tax rates.

From July, the threshold will increase to £12,570, reducing tax bills. The green bars in Figure 1 show the NICs bill across the whole of 2022-23 – this is the combined effect of being subject to a threshold of £9,880 for a quarter of the year, and to a threshold of £12,570 for the remainder of the year.

Taking the higher rates and the higher threshold together, those earning less than around £35,000 will see a fall in their overall NICs bill in 2022-23 relative to 2021-22. Those earning more than this will see an increase in their overall NICs bill.

Figure 1: Annual NICs bills for employees with different earnings

Source: Author's calculations

The self-employed pay less in NICs than employees, but will face the same annual changes (because they are subject to the same change in threshold and the same rate rise).

The effects on employees would be larger than shown here to the extent that an increase in employer NICs leads wages to be lower than they otherwise would be.

Overall the increases in NICs bills in 2022–23 are forecast to raise £10.9 billion in revenue, with the revenue from the increase in NICs rates from April forecast to raise substantially more (£17.2 billion) than the reduction in revenue from the increases in thresholds from July (£6.3 billion).

This observation was updated 5 April 2022 to include changes announced in the Spring Statement. Our analysis of the Spring Statement can be found here.