On 6 January, the main rate of National Insurance contributions (NICs) will be cut by 2 percentage points for employees. This is a sizeable tax cut. It costs the government around £9 billion per year. For an employee on average full-time earnings (£35,000 per year), it will lead to an annual tax saving of about £450. But this comes in the context of an ongoing, multi-year freeze to personal tax thresholds.

This year, 2024, will see both the NICs rate cut and a tax increase via the planned freeze in income tax and NICs thresholds and allowances in April. Put the two together and this is, overall, actually a tax increase. But the effect will vary across people. An employee earning £35,000 will gain about £130 more from the NICs cut than they lose from this April’s freeze in thresholds. Those with slightly higher earnings will gain a bit more than this, whereas taxpaying employees earning less than £29,000 will almost all lose out.

And we are in the midst of a much bigger tax rise as tax allowances and thresholds are set to be frozen all the way from 2021–22 through to 2027–28. That is a tax increase of over £40 billion by 2027–28 (the last year of the planned freezes). By then, an employee earning £35,000 will be paying about £440 a year more in direct tax overall as a result of all the changes to income tax and NICs since 2021.

How NICs are changing and who it affects

From 6 January, the main rate of employee NICs will be cut from 12% to 10%. From 6 April, the main rate of self-employed NICs will be cut from 9% to 8%. These rates apply to earnings between £12,570 (the point at which the tax starts to be paid) and £50,270 (above which the rate of NICs remains at 2%). From April, Class 2 NICs – which is charged at £3.45 per week when self-employed profits exceed £12,570 – will be scrapped.

Overall, the NICs cuts will benefit almost 30 million workers at a cost of around £9 billion per year. Anyone earning more than £12,570 per year will benefit. The size of the benefit varies with earnings. These are some examples for employees:

| Annual employee earnings | Gain from NICs cut |

|---|---|

| £12,570 or less | £0 |

| £15,000 | £48.60 |

| £20,000 | £148.60 |

| £35,000 | £448.60 |

| £50,000 | £748.60 |

| £50,270 or more | £754.00 |

Overall tax changes including threshold freezes

Most thresholds in the personal tax system have been frozen in cash terms since at least April 2021, rather than going up in line with inflation. This includes a freeze to the personal allowance – the point at which people start to pay income tax. The freezes are due to continue until 2027–28 and to raise the government over £40 billion a year by that point – many times more than originally intended, because of higher-than-expected inflation.

The revenue raised from freezing thresholds in April 2024 alone – rather than uprating them by 6.7%, in line with the usual inflation measure – is greater than the annual cost of cutting the NICs rate; overall personal taxes will be higher in 2024–25 than if the NICs rates were remaining unchanged and thresholds not being frozen that year.

The effects of the measures vary depending on income, however. An employee on average full-time earnings (£35,000 per year) will gain about £130 more from the NICs cut than they lose from this April’s freeze in thresholds. Those with slightly higher earnings will gain a bit more than this, whereas taxpaying employees earning less than £29,000 will almost all lose out.

For average earners, the NICs cut will actually offset the impact on their incomes in 2024–25 of all the freezes in tax thresholds up to that point. But for both the highest- and lowest-earning taxpayers, the tax increase coming from freezing thresholds from 2021 to 2024 is much larger than the NICs cut.

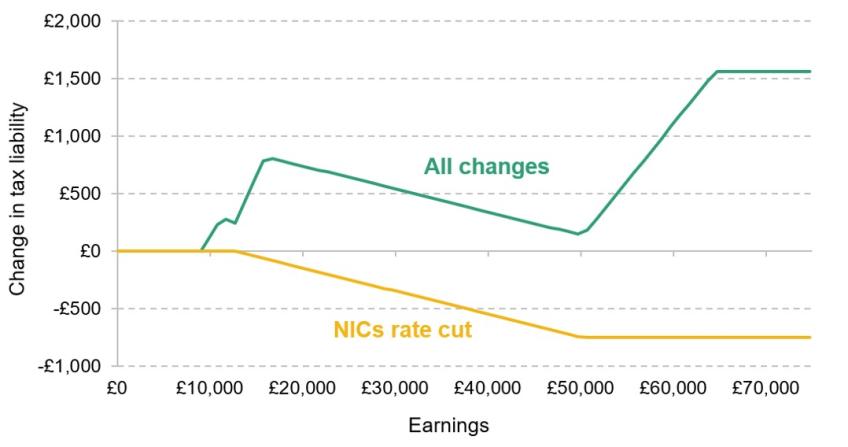

Considering all of the reforms to rates and thresholds of income tax and NICs from 2021 up to and including 2027–28, these taxes will be rising for almost everyone who pays them. Figure 1 shows the effect of reforms for employees. For someone earning £35,000 in 2027–28, the cut in the NICs rate is a tax saving of £443 per year but the effect of all changes together is a tax increase of about £440 per year.

Figure 1. Change in 2027–28 income tax and NICs liability from reforms announced from March 2021 onwards, by employee’s pre-tax earnings

Note: ‘All changes’ line assumes that changes to employer NICs are fully incident on the relevant employee, and therefore includes the loss of additional earnings (and knock-on consequences for income tax and employee NICs liabilities) from employers passing on employer NICs changes.

Source: Authors’ calculations using OBR, ‘Economic and Fiscal Outlook – November 2023’.