The COVID-19 crisis has both created billions of pounds of new costs for and demands on councils’ budgets and has hit many of their sources of income. Previously we looked at the potential scale of these pressures in England and the extent to which the government was helping address them, both in the short- and medium-term. Since then, we’ve seen a second and third national lockdown and the government has announced extra money for councils in both the current and the coming financial years. So, as we enter the second year of the crisis, this observation – the final output of a project on the financial effects of the COVID-19 crisis funded by the Local Government Association – provides updated figures for the year about to end, and looks at what the future might hold given the funding plans set out by the government in last November’s Spending Review and this month’s Budget.

We find that across the sector as a whole, the government has largely addressed forecast pressures in 2020-21. And, if the pandemic largely abates by the summer, the funding provided for the coming financial year may in aggregate be sufficient too – with the potential for top-ups from a £12 billion COVID-19 reserve possible if necessary.

However, financial pressures have been, and will continue to be, uneven across councils. As a result, underlying the aggregate picture, many councils still face at least some shortfall this year – particularly among shire districts.

And the longer-run effects of the COVID-19 crisis, as well as pre-existing spending pressures, when combined with current plans for government spending mean the picture for 2022-23 and beyond looks very challenging across the sector. With poorer areas potentially set to see bigger long-term increases in spending needs from the crisis, and being less able to raise revenues themselves, they may particularly suffer if additional central government funding is not found.

Most in-year COVID-19 financial pressures have been addressed, although shire districts in particular still face some shortfall

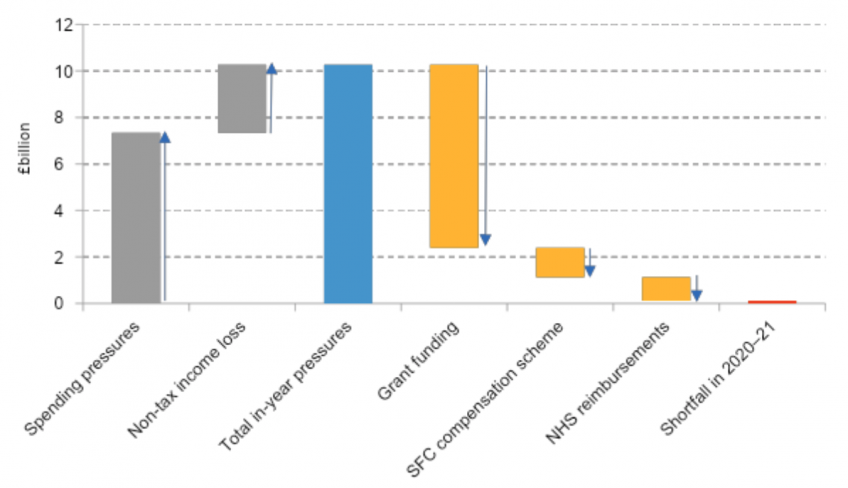

The Ministry of Housing, Communities and Local Government (MHCLG) has been collecting information on the financial pressures facing English councils as a result of the COVID-19 crisis since last April. Figure 1 shows how the latest figures (collected last month) on spending increases and falls in non-tax income compare to the funding that they and other government departments have provided to councils during 2020-21.

Figure 1. COVID-19 financial pressures and funding for English councils in 2020-21

Source: Authors’ calculations using MHCLG Financial Monitoring Information returns, February 2021 and allocations and rules for grant and compensation schemes. See methodology notes for further details.

Looking first at the financial pressures, councils forecast they will have spent £7.3 billion more than planned prior to the COVID-19 crisis, meeting rising costs and demands for existing services such as social care, and taking on new responsibilities such as local Test and Trace and outbreak management. They also expect to have lost £2.2 billion in income from sales, fees and charges (SFCs) – for example from car parking and leisure centres – and forecast a further £0.7 billion in losses from commercial income and other sources. This means forecast in-year pressures of £10.3 billion, equivalent to almost one-fifth of their combined pre-COVID-19 crisis annual revenues.

Turning to the financial support provided, MHCLG has provided £4.6 billion in additional general-purpose grants during 2020-21, and we estimate that councils will have received a further £3.3 billion in other grants by the end of the financial year. This includes £0.7 billion from the start of January to support Test and Trace and outbreak management costs during the third national lockdown.

In addition, councils will have been reimbursed £1 billion by the NHS for additional adult social care costs. And we estimate that the eventual value of government compensation for councils’ losses of sales, fees and charges income – it is covering three-quarters of any loss above 5% – is likely to be around £1.3 billion. This brings total support for the sector in 2020-21 to £10.1 billion.

Across the sector as a whole, therefore, government support broadly matches the latest forecasts for pressures, with a remaining aggregate funding gap of around £100 million. Underlying this aggregate figure, 106 councils (31%) appear to have received more funding in 2020-21 than they have forecast for in-year pressures. The remaining 233 councils are collectively ‘under-funded’ by a total of around £800 million, equivalent to 3.2% of their pre-COVID-19 crisis revenues. They will have to draw down reserves (or request special borrowing powers from the government if they have no usable reserves) or seek savings in at least some parts of their budgets.

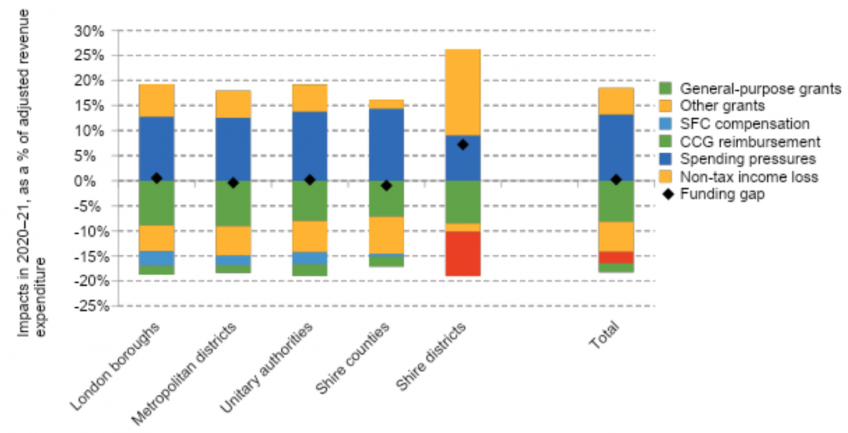

Shire districts are particularly likely to find themselves in this situation. Figure 2 shows that they are the only type of council which, in aggregate, have a notable remaining funding gap – around 7% of their combined pre-COVID-19 crisis revenues.

Figure 2. Financial pressures, government support and estimated funding gap, 2020-21, by council type

Source: Authors’ calculations using MHCLG Financial Monitoring Information returns, February 2021 and allocations and rules for grant and compensation schemes. See methodology notes for further details.

This reflects two main factors. First, falls in income from sales, fees and charges and commercial activities are relatively much larger for shire district councils than for other types of councils, and the government is only partially compensating for these (in order to ensure councils still have an incentive to try to generate such income). Second, shire districts are ineligible for many of the more specific COVID grants, such as for local Test and Trace and outbreak management efforts as these are seen to be the responsibility of larger county councils.

Further information on the financial impacts of the COVID-19 crisis can be found in this spreadsheet.

Council funding in 2021-22 set to fall short of government projections, but may be sufficient to meet COVID-19 pressures if the pandemic largely abates by the summer…

Turning to the future, the government is also providing funding for COVID-19 pressures in the coming financial year – albeit far less than over the last year:

- £1.55 billion of general grant funding;

- £400 million to support local Test and Trace and associated public health and enforcement activities;

- £341 million to pay for enhanced infection control measures and rapid testing in adult social care services;

- £670 million to help pay for more generous and more numerous means-tested council tax discounts;

- An estimated £762 million to cover three-quarters of the shortfall in council tax and business rates collections in 2020-21 – which accounting rules mean will actually hit councils’ main budgets over the next three years;

- And an extension of a scheme covering three-quarters of any shortfalls of more than 5% in income from sales, fees and charges.

As well as this £3.5 billion or so in COVID-related funding, councils with social-care responsibilities are being allowed to increase their council tax by 5% without calling a referendum of local residents, and non-COVID grant-funding is being increased by around £300 million. All told, the MHCLG argues that this would represent a further £2.2 billion in funding.

In reality, the increase is likely to be at least several hundred million pounds smaller for two reasons. First, not all councils will make use of the full 5% council tax increases allowed – although one could argue that they should have if they go on to claim insufficient funding. Indeed, recent estimates from CIPFA suggest the average increase will be 4.3%. Second, and very largely outside councils’ control, is that the council tax base – which is a measure of how much would be raised if tax rates were left unchanged – is unlikely to perform as well as the MHCLG has assumed. In particular, they assume that it will continue to grow at the same rate as it did in the late 2010s, when rising employment reduced the cost of means-tested discounts for low income households. Falls in employment and a push from the government for more generous support schemes mean these costs are now rising instead, reducing the size of the council tax base.

Even so, if the COVID-19 pandemic largely abates by the summer, and spending and income pressures significantly fall in the rest of the year, the funding provided in the coming financial year may be sufficient to address these pressures. If it is not – for instance, if it takes longer to bring the pandemic under control, there is a rebound later in the year, or spending on PPE and Test and Trace needs to remain at very high levels to help prevent this happening – there would also be scope to allocate additional funding from the government’s £12 billion COVID reserve for the coming financial year.

… But the outlook for 2022-23 and beyond looks very challenging under current plans

Looking beyond the coming financial year though, the financial situation looks much more difficult.

The government has not yet allocated any funding to address longer-term impacts of the COVID-19 crisis on the demand for and cost of public service provision. Evidence from past economic crises suggest they may need to do so: levels of ill-health (and especially mental ill-health) and child abuse rise, increasing pressure on a range of council-provided services. And of course, the COVID-19 crisis isn’t an ordinary economic crisis, with lockdowns impacting mental health and children’s education, and ‘long COVID’ potentially meaning more people needing help with their daily activities.

Moreover, councils’ income may still be under pressure if – as a range of evidence suggests – changes in shopping and commuting habits persist, hitting car parking, commercial property and business rates revenues.

And all these new pressures come on top of existing financial pressures councils were facing prior to the COVID-19 crisis, such as a £1.5 billion gap between what benchmark values imply providers need to receive for social care services, and what councils have historically been able to pay.

Finding extra money to address these issues from the spending totals set out in the Budget earlier this month would be very difficult. As explained in a piece yesterday, day-to-day funding for unprotected departments – which includes the MHCLG – is, at least under current plans, set to fall by 3% in real-terms between 2021-22 and 2022-23. And compared to the pre-COVID plans set out in the March 2020 Budget, the amount available for unprotected departments in 2022-23 and beyond is set to be around 8% lower – despite additional spending pressures in many areas.

Unless the Chancellor chooses to top-up his spending plans in the Spending Review planned for later this year, councils may therefore find themselves stuck between a rock and a hard place: trying to address underlying demand and cost pressures, with longer-run COVID-19 pressures coming on top; but potentially with continued restrictions on what they can raise themselves via council tax.

Updating the ‘middle’ scenario from funding projections we published last September suggests that increases in council tax of around 5% a year would be needed across the sector as a whole even if:

- MHCLG was able to find the cash to increase grant funding in line with inflation, rather than being cut in real terms in line with the overall cut facing unprotected departments, and;

- The only longer-term financial effects of the COVID-19 crisis were modest falls in income from parking and business rates and a modest increase in the cost of means-tested council tax discounts.

Cuts in grant funding and/or increases in demand for services following the COVID-19 crisis and/or addressing shortfalls in social care payment rates would mean even bigger increases in council tax would be required or for cuts, on top of those delivered in the 2010s, to be found in parts of council budgets.

It is also important to bear in mind that councils in poorer areas – where populations are likely more vulnerable to the longer-run effects of the COVID-19 crisis – are less able to raise revenues than councils in richer areas. Each 1% increase in council tax rates raises the equivalent of just over 0.3% of overall revenue in the most deprived tenth of council areas, compared to almost 0.7% in the least deprived tenth, for example.

In 2021-22, the government will offset this by allocating more of the increases in grant funding to poorer areas (the winding down of the New Homes Bonus will also hit poorer councils less hard than richer ones). When grants are being frozen or cut though, giving more to poorer areas can only be achieved by cutting grant funding from richer ones. This may be politically more difficult and is something the government has previously baulked at – cancelling plans to increase business rates ‘tariffs’ on councils able to raise relatively more from council tax, for instance (these plans were commonly described as imposing ‘negative revenue support grant’).

These distributional issues mean that councils’ financial future will be highly dependent on not only the Spending Review but also the Fair Funding Review, aimed at updating and improving the method for allocating funding between councils. Given uncertainty about how the COVID-19 crisis will affect the spending needs and revenue-raising capacities of different councils, completing this review over the next year will not be easy. But a system for ensuring funding is allocated sensibly across councils will be even more important if funding levels are constrained.

Update: 22/03/2021

This note was updated on 22/03/2021 to reflect £341 million of additional funding in 2021-22 for adult social care services, as part of an additional £7 billion allocation for health and social care. This is being paid for out of the COVID-19 reserve for 2021-22, reducing it to £12 billion (from the previously stated £19 billion).