The UK is coming to the end of the fifth year of what is now planned to be an nine-year fiscal tightening. The fiscal consolidation is forecast to total £185 billion (in 2015–16 terms) and to be completed by 2018–19. This is £54 billion larger than was originally planned in the June 2010 Budget but £15 billion smaller than the plans set out in the December 2014 Autumn Statement.

In his first Budget, George Osborne outlined a plan to complete the fiscal consolidation by the end of next financial year (2015–16). However, worse-than-expected economic news over the last few years, coupled with the fact that he is now aiming to achieve a tighter fiscal position, has led to Mr Osborne increasing the size of the planned tax rises and spending cuts. As a result, even though Mr Osborne has implemented virtually all the policies he originally announced, the consolidation is not now expected to be complete until the end of 2018–19.

However, the latest plans (from Budget 2015) imply a somewhat smaller fiscal consolidation than was planned in December 2014, and one that finishes a year earlier than was then planned. This is in spite of the fact that the underlying outlook for the UK economy and public finances was little changed between December 2014 and March 2015 – in other words, this change in planned consolidation appears to reflect a change in Mr Osborne’s long-term economic thinking, rather than a response to new information.

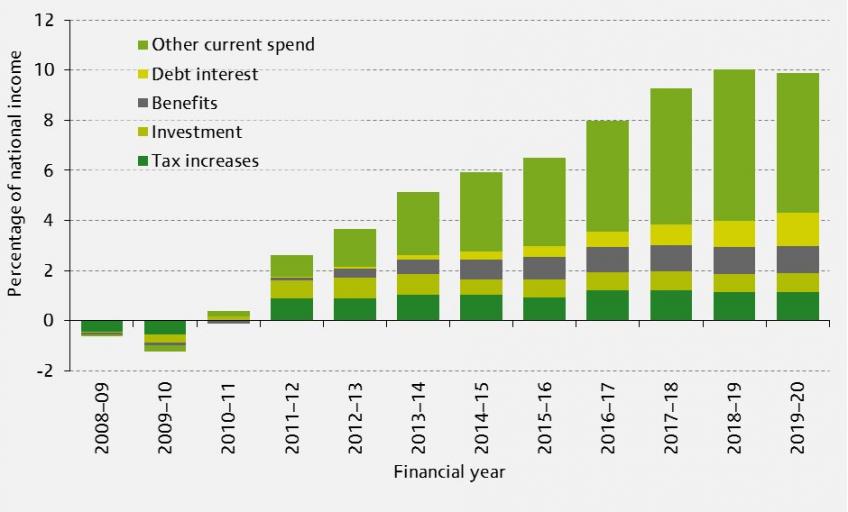

By the end of this financial year, 60% of the total consolidation is expected to have been implemented. However, within this nearly all the tax increases and cuts to investment spending will have been implemented, while only a little over half of the cuts to non-investment, non-welfare spending will have been done. The result is that of the consolidation to date 82% has come from spending cuts and 18% has come from net tax rises, whereas for the consolidation to come the plans imply a mix of 98% spending cuts and 2% net tax rises. The figure below shows the size and timing of the currently planned fiscal consolidation as a share of national income. This shows the combined effect of tax and spending measures announced and implemented by the previous Labour government and the current coalition government since March 2008. Only a small amount of additional fiscal consolidation is planned for next year – amounting to 0.6% of national income – but the pace of consolidation is then expected to pick up again in 2016–17 and 2017–18.

Figure: Timing and composition of the fiscal consolidation

Note: This Figure updates the numbers presented in Figure 1.6 of the 2015 IFS Green Budget to include the policy announcements made in Budget 2015. The Green Budget contains details of the methodology and sources used to construct this figure. The data underlying this figure can be downloaded here.