Summary

Following last Friday’s publication of the ONS’s preliminary estimates of public sector revenues, spending and borrowing in 2020-21, this observation updates our projections of Scotland’s implicit budget deficit published last August. It also briefly discusses the pre-COVID-19 crisis fiscal situation of the other nations and regions of the UK.

While there is still much uncertainty, we now project Scotland’s budget deficit in 2020–21 to have spiked at between 22% and 25% of national income, up from 8.6% of national income in 2019–20, although less than our previous projection. It is also still higher than a forecast deficit of 16% of national income for the UK as a whole for the same year.

Scotland’s implicit budget deficit will fall as the public finance effects of the COVID-19 crisis recede, but is set to remain substantially higher than for the UK as a whole unless oil revenues rebound or there is a significant change in relative economic performance. This reflects the higher levels of public spending per capita – largely for devolved public services – in Scotland, and slightly-lower than average levels of tax revenues per capita than for the UK as a whole. The fiscal gaps in Wales and Northern Ireland are and will continue to be even larger, again reflecting higher levels of public spending but also substantially-below-average levels of tax and other revenues.

The fiscal transfers made to Scotland, Wales and Northern Ireland (and indeed the North and Midlands and of England) are normal within a fiscal union – but would cease under independence or ‘full fiscal autonomy’. To offset the end of these fiscal transfers, some combination of tax rises or spending cuts would be needed, unless faster economic growth could be quickly delivered in an independence or full fiscal autonomy scenario.

Over the last decade, analysis based on the Scottish Government’s Government Expenditure and Revenue Scotland (GERS) publication has become central to political debate. The figures have proved contentious, and like any statistics they are not perfect, but their status as National Statistics means they have been independently assessed as being based on sound methods and being produced free from political interference. And while backwards looking they do provide the most sensible starting point for assessing the kind of fiscal challenges and opportunities that Scotland would initially face under full fiscal autonomy or independence, as recognised by the SNP’s Sustainable Growth Commission.

The Office for National Statistics (ONS) produces similar statistics for each of the nations and regions of the UK, although they are currently a little less up to date than the Scottish Government’s figures. These similarly provide the most sensible starting point for assessing Wales’, Northern Ireland’s and the regions of England’s underlying public finances.

Updating our projections for Scotland

The latest figures for Scotland’s public finances in GERS cover the fiscal year 2019-20, all but the last couple of weeks of which was before the COVID-19 crisis hit the UK economy. It is possible, however, to project figures for subsequent years using UK-wide provisional outturns for the year just ended, 2020-21, and forecasts for the current year, 2021-22, and beyond.

These projections are subject to two kinds of uncertainty. First, particularly for later years, it is uncertain how the public finances of the UK as a whole will evolve. This will depend on the speed and extent of economic recovery from the COVID crisis, the degree to which this brings in additional revenues, and the government’s tax and spending policies. Second, Scotland’s economy and public finances will not follow exactly the same path as that of the UK as a whole. However, estimates suggest that Scottish and UK GDP have followed very similar paths so far, and UK government COVID measures have either applied in Scotland as in England (like with the furlough scheme) or resulted in an equivalent funding boost for the Scottish Government to spend on its own measures (e.g. with health spending and business grants and rates reliefs). It therefore seems a reasonable central assumption that public spending and revenues in Scotland follow the same path as forecast for the UK as a whole.

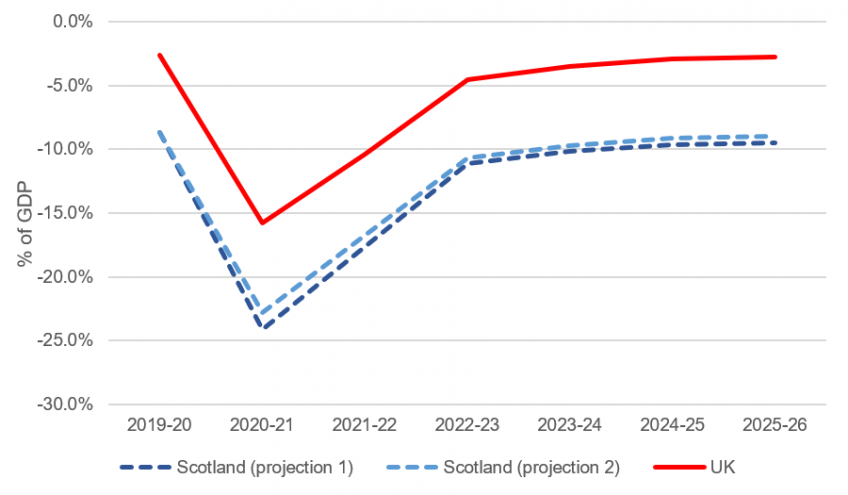

Figure 1 does this, using the ONS’s recent preliminary estimates for government revenue and spending in 2020-21, and the OBR’s March 2021 Economic and Fiscal Outlook.

Figure 1. Projections of Scottish and UK budget balances, 2019-20 to 2025-26

Notes: Positive figures are surpluses, negative figures deficits. Measure is the Net Fiscal Balance including a geographic share of North Sea revenues for Scotland. See methodology note for information on projection methodology.

Source: Government Expenditure Revenue Scotland 2019-20, and the Office for Budget Responsibility’s March 2021 Economic and Fiscal Outlook and the Office for National Statistics March 2021 Public Finance Statistics.

Focusing first on the picture for the UK as a whole, it shows that after accounting for the OBR’s forecast of write-offs of COVID-19 business loans, the budget deficit is expected to have reached 15.8% of GDP last financial year. This is lower than the OBR was expecting last summer, despite extensions of the furlough and self-employment income support scheme, and additional funding allocations to public services. In turn, this reflects better than expected nominal GDP and revenue performance, and underspending of some funding allocations (most notably by the NHS).

Turning to Scotland, Figure 3 shows that Scotland’s implicit budget deficit would have been just over 24% of GDP in 2020-21 if revenues per person fell and spending per person increased at the same percentage rate as the UK as a whole (projection 1). The deficit would instead have been just under 23% of GDP if spending increased by the same in cash terms per person as in the rest of the UK (projection 2). Both figures are lower than our equivalent projections from last August, reflecting the lower figure for the UK as a whole.

Looking to the future, the OBR forecasts a reduction in the UK’s budget deficit as COVID-19 spending falls to zero by 2022-23, as the economy recovers, and as corporation tax and income tax rises boost revenues. In particular, the UK’s deficit is forecast to fall to 4.5% of 2.8% of GDP by 2025-26, although with significant uncertainty around these figures.

If Scottish revenues and public spending follow similar trends, Scotland’s implicit deficit would also decline substantially. But the gap with respect to the UK as a whole would remain, with a projected deficit of between 10% and 11% of GDP in 2022-23 and around 9% of GDP in 2025-26, albeit again with a significant degree of uncertainty.

The fiscal position of the other UK nations

GERS only provides figures for Scotland and the UK as a whole. However, the ONS’s Regional Public Finances publication provides figures for the other UK nations, and breaks down England’s figures for its major regions. These data show that Scotland is far from alone among the nations and regions of the UK in having a large implicit budget deficit. Indeed, the implicit deficits of Wales and Northern Ireland are even larger than for Scotland, and those of the North and Midlands of England, broadly similar.

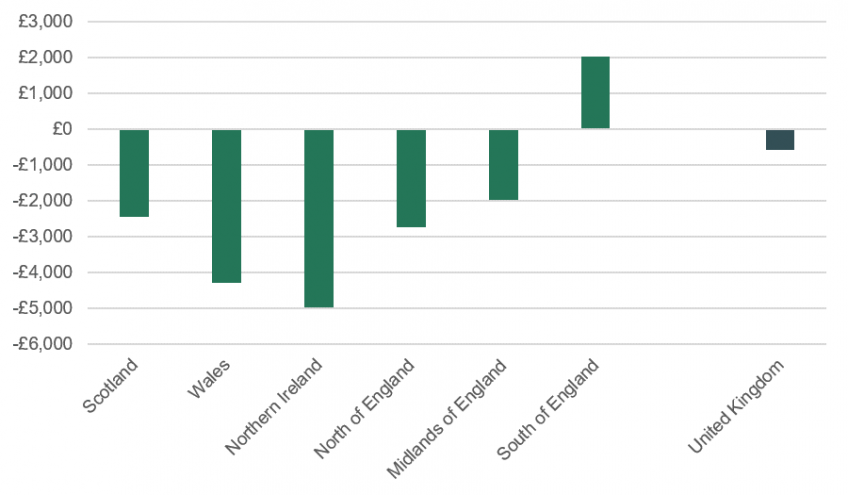

Figure 2 shows the ONS’s estimates of the fiscal deficit per person as of 2018-19, the latest year for which data are available, for the devolved nations and the North, Midlands and South of England, updated for revisions to UK-wide tax and revenue figures.

Figure 2. Estimated fiscal balances per person by nation and region, 2018-19

Notes: Positive figures are surpluses, negative figures deficits. Measure is the Net Fiscal Balance including a geographic share of North Sea revenues for Scotland and the regions of England.

Source: ONS regional public finances statistics, 2018-19, updated to account for updated UK wide revenue and expenditure estimates (apportioned proportionately to each region).

It shows that in 2018-19, Scotland’s fiscal deficit of around £2,450 per person, was substantially lower than that of Wales (just under £4,300) and Northern Ireland (just under £5,000). It was also slightly below that of the North of England (just over £2,700). In contrast, driven by the South East and particularly London, the South of England is estimated to have had a fiscal surplus of just over £2,000 per person in that year.

Scotland’s estimated implicit fiscal deficit does therefore not stand out in terms of its size. However, it is unusual in what is driving it. For example, the figures imply that public sector revenues in Scotland were just under £12,100 per person in 2018-19, only a little below the £12,500 average for England as a whole. But public spending was much higher (around £14,500) than in England (just under £12,600). And in contrast to other regions of the UK with large implicit fiscal deficits, Scotland’s is overwhelmingly driven by high levels of public spending, rather than low levels of revenues. In turn, this reflects high levels of UK government funding for devolved public services, as discussed by recent IFS and Institute for Government research.

In Northern Ireland, and especially Wales’ case, large fiscal deficits reflect not only relatively high levels of public spending but also significantly lower revenues, mirroring low levels of earnings and GDP. For example, in Wales, while public sector expenditure per person is estimated to have been 9% higher than in England in 2018-19, revenues raised per person are estimated to have been 25% lower.

What are the implications of these figures?

Under current constitutional arrangements the implicit budget deficits and surpluses for the nations and regions of the UK are subsumed within the deficit of the UK as a whole. The UK government manages the overall public finances on behalf of whole country, and in effect, transfers revenues from those areas with surpluses (or smaller deficits) to the areas with (bigger) deficits.

The fiscal transfers that Scotland, Wales and Northern Ireland (and indeed the North and Midlands and of England) receive are normal within a fiscal union. But they would cease under independence or ‘full fiscal autonomy’. In that case, the implicit deficits would become real and the responsibility of the newly independent (or fiscally autonomous) governments.

Structural deficits of the scale of Scotland’s, and particularly Wales’ and Northern Ireland’s, would not be sustainable on an ongoing basis. They would need to be tackled by some combination of spending cuts and/or tax rises, in the absence of a rapid increase in economic growth post-independence, which is probably unlikely. (Indeed, recent research suggests disruptions to and increases in the cost of trade would likely adversely affect the economy, at least in the short-to-medium term.) In Scotland’s case, the SNP’s Sustainable Growth Commission was admirably upfront about the need for a fiscal adjustment post-independence, although its honesty did not extend to admitted that its proposed solution of holding down spending to 0.5% a year above inflation growth would mean imply austerity for at least some public services.

None of this means that Scotland cannot afford to be independent, nor that there aren’t a range of opportunities for better policy to improve performance and better address Scottish needs and preferences. If such policies can be developed and implemented, this could in the longer-term allow more to be spent on public services and more to be kept in Scottish people’s pockets. The same is true for Wales and Northern Ireland – although the extra growth that would be required to offset the loss of fiscal transfers from (the South of) England in these cases would be several times greater. And saying you are going to boost economic performance through better policy making is, of course, easier than designing and implementing the necessary policies.

Whether faster growth would be likely or not; the policies that would help achieve – or could end up hindering – such growth; the impact of other changes such as trade relations and migration policy; the broader pros and cons of independence. These are all issues for reasonable debate, and reasonable disagreement. Not the fact that Scotland – like most of the UK outside of the South of England – currently has a significantly weaker underlying fiscal position than the UK as a whole, and therefore relies on fiscal transfers to fund part of the public spending it benefits from. While not perfect, the GERS statistics tell such a clear story that that debate shouldn’t currently be a debate at all.

Notes on methodology for projecting Scotland’s fiscal position beyond 2019–20

In order to project forward the GERS 2019–20 figures to the period covering 2020–21 to 2025–26 using figures from the ONS’s March 2021 Public Sector Finance Statistics and the OBR’s March 2021 Economic and Fiscal Outlook, the following method is used:

- Spending is projected forward assuming that amount spent per person in Scotland grows in line with amount spent per person in the UK as a whole. This means spending per person in Scotland is projected to be 112.5% of the average for the UK as a whole, as in 2019–20. As an alternate scenario, we assume spending per person changes each year between 2019-20 and 2022-23 by the same amount in cash terms as the UK as a whole, and the same percentage rate thereafter.

- Onshore taxes are projected on the basis that the amount paid per person in Scotland grows in line with forecast growth in onshore revenues per person for the UK as a whole. This means onshore tax revenues per person in Scotland are projected to be 97.5% of the average for the UK as a whole, as in 2019–20.

- Offshore (oil and gas) taxes are projected under the assumption that Scotland’s share of overall UK offshore tax revenues remains the same as in 2019–20 at 111.4% (i.e. revenues from the rest of the UK are projected to be negative as they were in 2019–20).

We have chosen the assumptions on the basis of their simplicity and as a reasonable baseline case. As with any economic or fiscal forecast or projection, the projections outlined in this observation will differ from eventual outturns. This includes the ONS estimates and OBR forecasts for the UK as a whole; and trends in spending and government revenues in Scotland relative to the UK.