Like most other developed countries, income and productivity growth has been very slow in the UK since the financial crisis of 2008–09. But on a per person basis, economic growth has been slower than in the US, the EU27 and Germany in that time. The slowdown has been particularly stark given that the UK economy, and its productivity, were growing quite quickly prior to 2008. While employment growth has been strong, average earnings growth has been dreadful - for which read almost non-existent. Gross Domestic Product per head is today nearly £11,000 lower than it would have been had pre crisis trends continued.

Much of that slowdown is a result of international factors well outside the control of any government: the fallout from the financial crisis, Covid, the energy price spike. But low investment, policy mistakes, political instability, and Brexit, have combined to hold back growth by more than in many comparable nations.

In a contribution to Anthony Seldon and Tom Egerton’s forthcoming book The Conservative Effect, 2010-2024, we also take stock of tax and spending decisions:

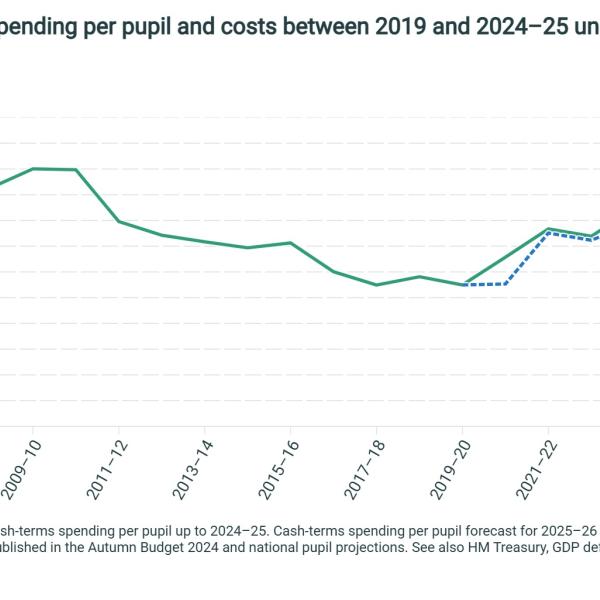

- The government response to the deficit created by the financial crisis was a remarkable period of spending cuts: about a 4% real terms cut in public service spending between 2010 and 2019, even as the economy and population grew – something wholly unprecedented in modern times. Other countries also responded to fiscal problems created by the crisis, but most made more use of tax increases relative to spending cuts.

- The period since 2019 has been very different. Taxes and spending have both risen substantially such that taxes are now close to their highest level as a proportion of national income in more than 70 years.

- Tax policy has been notable for its inconsistency. Corporation tax rates were cut then increased; the income tax personal allowance was raised substantially then cut hard; the lifetime allowance for saving in pensions was tightened dramatically then abolished; NIC rates were increased then cut.

- Tax changes have favoured those on average earnings, hitting those on high incomes hard. Benefit changes have reduced the incomes of many poorer households.

A working paper version of the chapter can now be downloaded from the IFS website here.

Nick Ridpath, Research Economist at the IFS, said:

‘The period between 2010 and 2024 has been economically remarkable. For most of the period, interest rates were at their lowest level in history. Earnings grew at their slowest rate in, probably, more than 200 years. The 2010s saw the biggest and most sustained cuts in public spending since World War II, while the current parliament has seen a bigger increase in tax revenues as a share of national income than any other over that same period. At the heart of it all was a period of abysmal growth in productivity, and with it, living standards.’

Carl Emmerson, Deputy Director at the IFS, said:

‘Britain’s slow recovery from the Great Financial Crisis was far from unique among developed economies, but the gap between Britain and its neighbours in household income has widened. Lower investment than the rest of the G7, particularly in the aftermath of the vote to leave the European Union, will not have helped and risks storing up challenges for the future.

Whoever is Chancellor after the forthcoming election will face the unenviable mix of a weak outlook for growth and the combination of much elevated debt and higher interest rates leading to much greater spending on debt interest than we have become accustomed to. Taxes are high by UK standards, but many public services are under very visible signs of strain. There are evident opportunities to improve growth through shifting policy on investment, education, planning, tax, trade and elsewhere, but an incoming government will need to pursue any such policies from the starting point of a difficult fiscal situation.’