The Conservatives have ruled out revaluing and reforming council tax in England as part of what they term their ‘Family Home Tax Guarantee’. The Conservatives also pledge not to increase stamp duty land tax, paid when properties change hands.

David Phillips, an Associate Director at the Institute for Fiscal Studies responded:

“The new ‘Family Home Tax Guarantee’ would mean perpetuating the increasingly absurd situation whereby the council tax that households pay is based on the value of their property relative to others in England on April 1st 1991 – a third of a century ago, when Mikhail Gorbachev was President of the Soviet Union and Chesney Hawkes topped the charts with The One and Only.

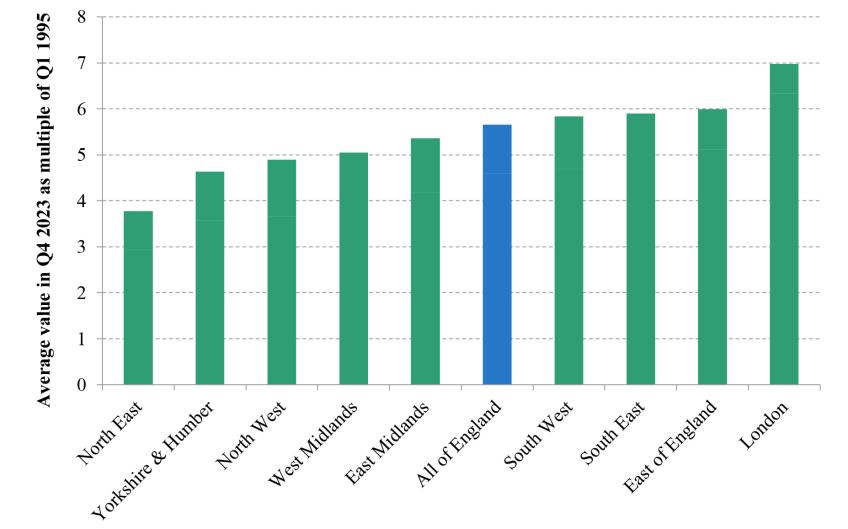

Since this one and only valuation of houses, values have increased by massively different amounts around the country, meaning that at least half are now effectively in the ‘wrong band’. Households in the North and Midlands are often in too high a band – and pay too much – while those in London and its environs too low a band – and pay too little – compared to what they would under a modernised tax. In other words, in its current form council tax works against levelling up.

In contrast the pledge not to increase stamp duty land tax is sensible. It is one of the most economically damaging taxes levied by the government, significantly increasing the cost of moving and gumming up both the housing and labour market. It should not be increased – rather it should be reduced or, ideally, abolished.

The revenue from stamp duty would be very hard to give up though. A good package would be one that combined the abolition of stamp duty with a revaluation and reform of council tax. Raising less from high-value properties via stamp duty and more from a revalued-and-reformed council tax would be fairer and better for growth. Fairer because the tax system would no longer penalise people who move more, or whose property's value has not kept pace with the rest of the country. And better for growth because it would no longer hinder people from moving to better suit their circumstances and for work.

By ruling out revaluation and reform of council tax, Jeremy Hunt has made it harder to deliver growth-enhancing reforms to the tax system. Labour and other parties should not follow suit.”

Policy background and analysis

IFS researchers analysed the potential impact of revaluing and reforming council tax in England in a report published in 2020. It considered several options from a simple revaluation to a revalued and continuous, proportional residential property tax. The full report and a summary of key findings can be downloaded here.

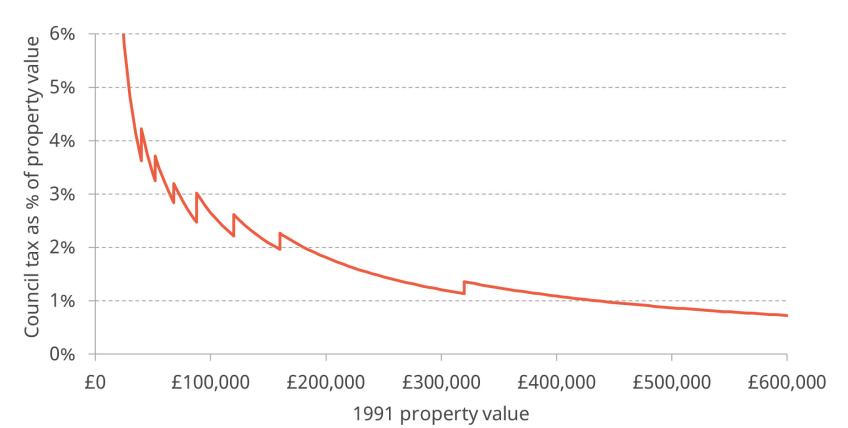

Two updated figures from this report illustrate the key problems with our current council tax system: that it is out of date, and highly regressive with respect to property value.

Average property values have increased by massively different amounts in different parts of England since properties were valued for council tax – around twice as much in London as the North East of England

Source: Author’s calculations using HM Land Registry house price data.

Note: January 1995 is the first month for which values are available by region. At a national level there was little change in property values between April 1991 and January 1995.

Council tax is a much higher share of property value for low value properties than high value properties

Source: Author’s calculations using the average council tax band D rate in 2024-25 and tax rates by band.

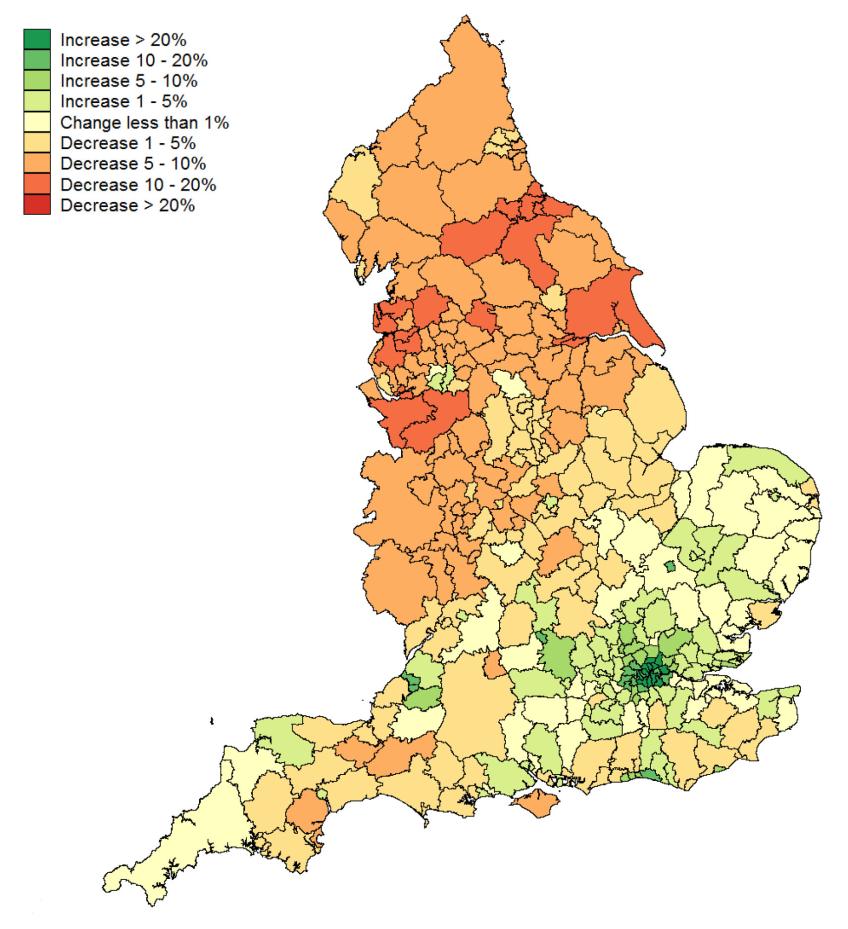

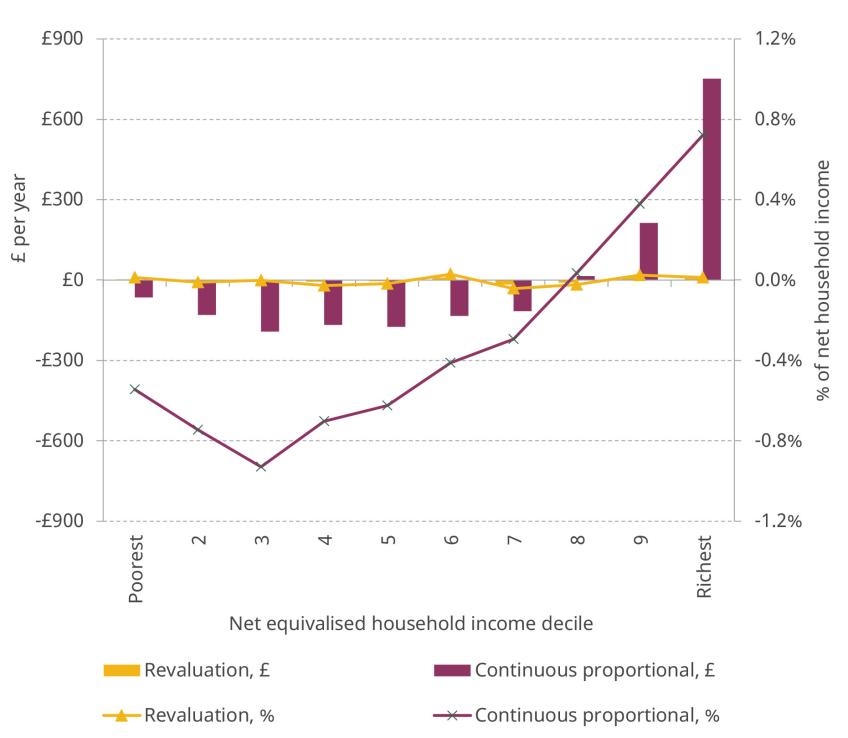

Two figures illustrate the potential impacts of council tax revaluation and reform. These are based on property values as of 2019 and recent changes would mean the patterns now differ slightly but the broad patterns across places and the income distribution would be very similar.

Revaluing council tax and adjusting funding for councils appropriately alongside this would mean falls in average bills across most of the North and Midlands, and increases in average bills in London and nearby areas

Source: Figure 4.7 of https://ifs.org.uk/publications/revaluation-and-reform-bringing-council-tax-england-21st-century.

Revaluation, on its own, would do little to affect the progressivity of council tax across the income distribution. Making council tax proportional to value would see low and middle income households gain and high income households lose, on average

Source: Figure 5.4 of https://ifs.org.uk/publications/revaluation-and-reform-bringing-council-tax-england-21st-century