Boris Johnson has today announced that a Conservative government would not go ahead with the planned reduction in the rate of corporation tax from 19% to 17% next April.

The government’s estimates imply that cuts to the headline rates of corporation tax from 2010 to 2019 cost £13 billion a year. The additional reduction from 19% to 17% that was due next April would have cost a further £6 billion – money that a Conservative government would now have available to spend on other things.

Corporation tax revenue has increased since 2010 even while the headline rate has been cut. But that does not mean that rate reductions have increased revenue.

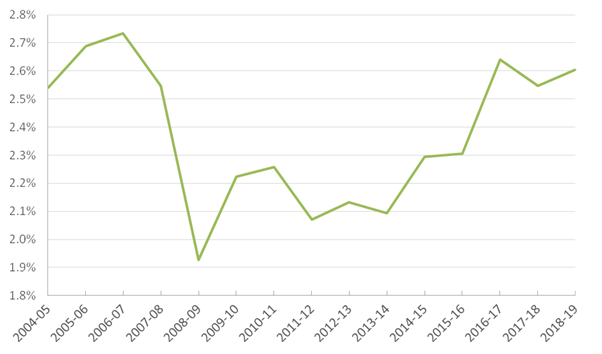

First, as Figure 1 suggests, much of the rise in revenue since 2010 is simply recovering from the effects of the financial crisis and recession. We would have expected a recovery in profits even if the corporation tax rate had not been cut.

Figure 1. Onshore corporation tax revenue as a share of national income

Source: OBR Public Finances Databank, accessed November 2019

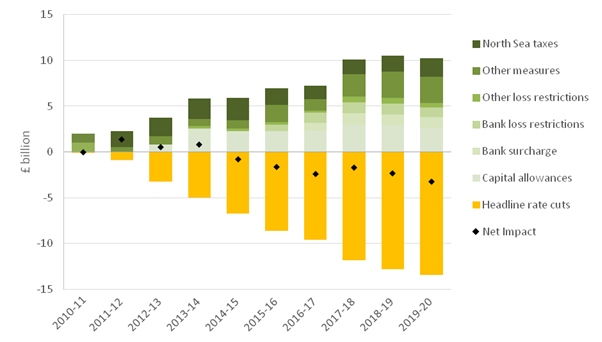

Second, while the government has reduced the headline rate of corporation tax, at the same time it has increased corporation tax in other ways, including reducing capital allowances for investment, introducing the bank surcharge, restricting companies’ ability to offset past losses against future profits, and a raft of anti-avoidance measures. As shown in Figure 2, taken together these measures recoup around £10 billion of the £13 billion spent reducing the headline rate: the net effect of reforms (shown by the diamonds in Figure 2) has therefore only been to cut corporation tax by about £3 billion a year.

Figure 2. Impact of reforms on corporation tax revenue, by year

Source: OBR Policy Measures Database, and IFS calculations using various HM Treasury Budget documents

Stuart Adam, a Senior Research Economist at the IFS, said: "Corporation tax revenues today are at much the same the level they were at before the financial crisis, despite a 7 percentage point cut in the headline rate. That is largely because a series of other changes have increased the effective rate of corporation tax: the headline rate is not all that matters. Abandoning the proposed further 2 percentage point cut will leave the government with about £6bn a year more revenue than it would have received had it gone ahead with the cut."