Taxes on motoring raise around £40 billion a year for the exchequer (around 5% of government revenue), equivalent to about £750 per adult in the UK. Most of this comes from fuel duties, which in 2019–20 are expected to raise £28 billion in their own right plus an additional £5.7 billion from the VAT payable on the duties. Another £6.5 billion comes from vehicle excise duty (VED) and £0.2 billion from the London congestion charge.

These taxes also affect people’s decisions about the vehicles they buy and how much, when and where they drive them. This is important because motoring gives rise to a number of social costs that would not otherwise be reflected in the prices people pay – such as congestion, greenhouse gas emissions, local air pollution, accidents and noise. Well-designed motoring taxes can be used to influence these behaviours and reduce the social costs associated with driving.

Fuel duty revenue has been eroded by a combination of cash-terms freezes and improving fuel efficiency. With the advent of electric cars, revenue from this tax is set to disappear altogether in the coming decades if the government meets its commitment to reach zero net emissions by 2050. Good news for emissions is bad news for the government coffers.

Alternative taxes will be needed to ensure the social costs of motoring are reflected in the prices people pay. The government should take the opportunity it has now to set out both its long-term strategy for taxing motoring and how it will get there. There is a window of opportunity to do this quickly, before revenue from fuel duties disappears entirely. In this chapter, we examine both how satisfactorily tax policy treats motoring as we find it today and how it might be made ready for the future.

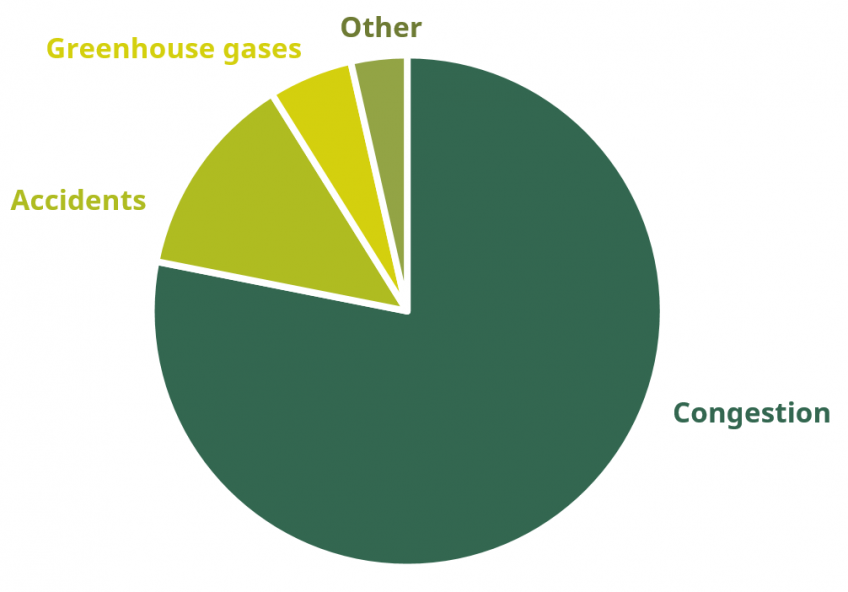

The average social costs of motoring (per additional kilometre driven, 2015 estimates

Key findings

- Driving imposes costs on wider society. According to government estimates, the biggest of these by far is congestion (80% of the total). Government estimates for 2015 suggest that each additional kilometre driven caused an average of 17p of societal harm. Other costs include accidents, greenhouse gas emissions, local air pollution and noise. While the additional cost of greenhouse gas emissions, at 1p per kilometre driven, may sound small, this still equates to £4 billion per year across the UK.

- Fuel duties and the VAT paid on them account for more than four-fifths of revenue from motoring taxation and they are very well targeted at emissions. But they do a poor job of capturing the costs of congestion, which vary hugely by time and place. Fuel duty rates are set higher than can be justified by emissions alone, but are much too low – and too poorly targeted – to reflect the costs of congestion.

- Fuel duties have a roughly equal impact (as a share of spending) across the income distribution, but among car owners make up a greater share for lower-income households. For nearly one household in twenty, fuel duties (and the VAT on them) make up a tenth of their total non-housing budget and for many driving is a necessity, one reason why this is an unpopular tax.

- A 2p/litre cut in fuel duty rates would cost about £1 billion a year.But revenue from existing motoring taxes (which raise £40 billion a year) will all but disappear anyway in the next few decades if the government’s goal of achieving zero net emissions by 2050 is met.

- This meansthe government needs to rethink how it taxes motoring. It should start now, before the revenue disappears and expectations of low-tax motoring become ingrained. It should lay out how it plans to tax low-emissions driving in the long term whilst incentivising the take-up of lower-emissions cars in the short term.

- A system of road pricing where charges vary by time and location is the best way to incorporate the costs of congestion into the prices paid by drivers. Such systems are technologically feasible and are used in a number of cities worldwide. Failing that – or, better, as a stepping stone towards it – the government could introduce a flat-rate tax per kilometre driven, which would at least continue to raise revenue and discourage driving once alternatively fuelled vehicles replace petrol and diesel ones.

- In the meantime, with conventionally fuelled cars still common, the government should move to monthly indexation of fuel duties in line with the Consumer Prices Index. There is no case for the recurrent ritual of the past eight years, when planned inflation uprating of fuel duties has been repeatedly cancelled for one more year while assumed to recommence thereafter. But to tackle the harm that driving does, now and in the future, the government should look beyond the existing set of taxes.

This is a pre-released chapter from the IFS Green Budget that will be published on October 8th. The Green Budget is being produced in association with Citi and is funded by the Nuffield Foundation.