The Chancellor’s fiscal objective is to close the budget deficit – which stands at 1.8% of national income (£37 billion) – by the middle of the next decade. Against the backdrop of this challenging target, the government has promised an additional £20 billion of funding for the NHS. Meeting both of these commitments will require lower spending elsewhere or higher taxes.

This chapter considers where the Chancellor might look if he wanted to increase tax receipts by about 1% of national income – enough to pay for the promised increase in NHS spending. We investigate how various possible tax rises differ in the revenue they would raise, the people who would pay them, and the extent to which they would weaken work incentives and improve or worsen other distortions.

Key findings

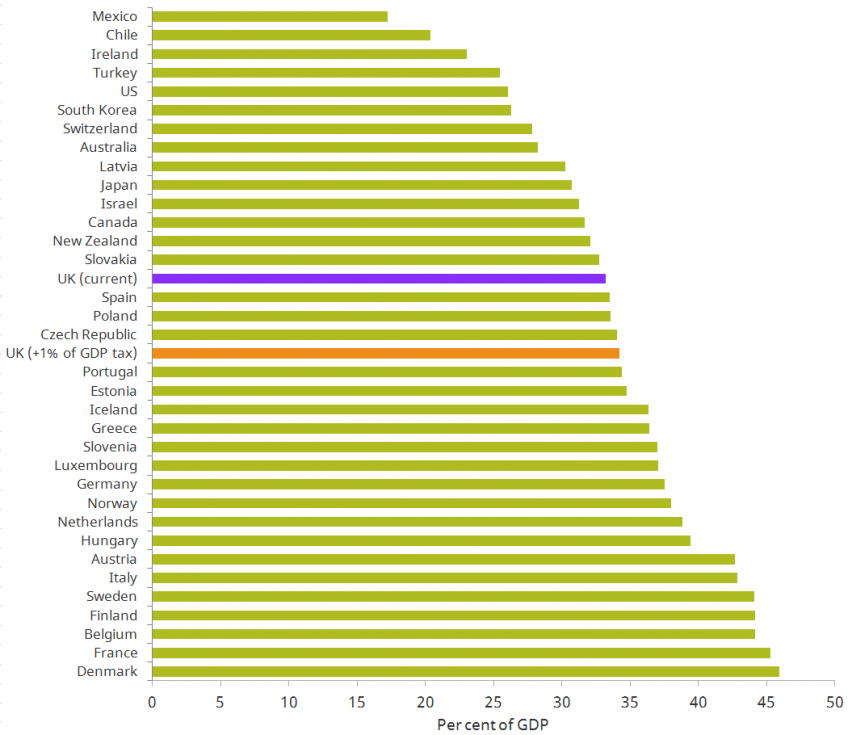

- Raising tax revenue by 1% of national income would put the tax burden in the UK at around the highest level seen in the post-war era. Such an increase, which would take tax receipts to around 35% of national income, would still leave the UK’s tax burden ranked near the middle of OECD countries.

- Increases in the rates of income tax, National Insurance contributions (NICs) or VAT could raise substantial sums. Adding 1 percentage point (ppt) to all income tax rates, or all employee and self-employed NICs rates, or the main rate of VAT, would each raise a similar amount – between £5.4 billion and £6.2 billion. In all cases, the revenue would come disproportionately from higher-income households – though this is truer for income tax and NICs than it is for VAT.

- Labour proposals for substantial rises to income tax rates on those with incomes over £80,000 would likely raise a lot less than these 1ppt increases – perhaps £2½ billion a year (though there is much uncertainty about that). Increases in tax rates on those with high incomes need to be implemented in the knowledge that we are already dependent on a small number of very-high-income individuals for a large fraction of tax revenue (over a quarter of income tax revenue comes from 0.6% of adults) and that there is great uncertainty over how they might respond to tax rises.

- There are many inequitable and inefficient parts of the tax system which need reform and which could, if so desired, raise more from the wealthy. Council tax is paid at a lower fraction of property value on higher-value properties. Doubling it on the top four bands would raise over £8 billion a year. Capital gains tax should be charged at death and entrepreneurs’ relief abolished. The current treatment of pension pots that are bequeathed is indefensibly generous.

- NICs could be charged on the earnings of those over state pension age, raising perhaps £1 billion a year (though with big potential impacts on the work decisions of those near retirement age). There is also a case for levying a low rate of NICs on private pensions in payment, to reflect the fact that NICs were never paid in respect of employer contributions.

- Corporation tax increases could bring in substantial revenue, but are not a free lunch. Cancelling the planned cut from 19% to 17% due in 2020–21 would raise around £5 billion in the short run, while the increases proposed in Labour’s 2017 manifesto could raise a further £14 billion a year in the short run – though less in the longer term. Like all taxes, corporation tax rises are always borne ultimately by households, through lower wages for workers, higher prices for consumers or lower returns for shareholders.

Figure. Tax as a share of national income across OECD countries