The COVID-19 outbreak and the policy response to it have not just dominated the economic and fiscal developments in 2020 so far; they also set the starting point for the rest of the year and 2021. As long as the virus remains a significant health threat – with no vaccine and no highly effective treatment – the situation remains too volatile to provide a definitive assessment of the global economic impact.

What is clear is that countries around the world have seen historic hits to their economies in the first half of 2020; GDP fell by 10% in the US, 14% in the EU and 22% in the UK. While the lockdown measures implemented in the spring and early summer were unprecedented in most countries, some countries have succeeded in getting the virus under control (and are now reaping economic and political benefits).

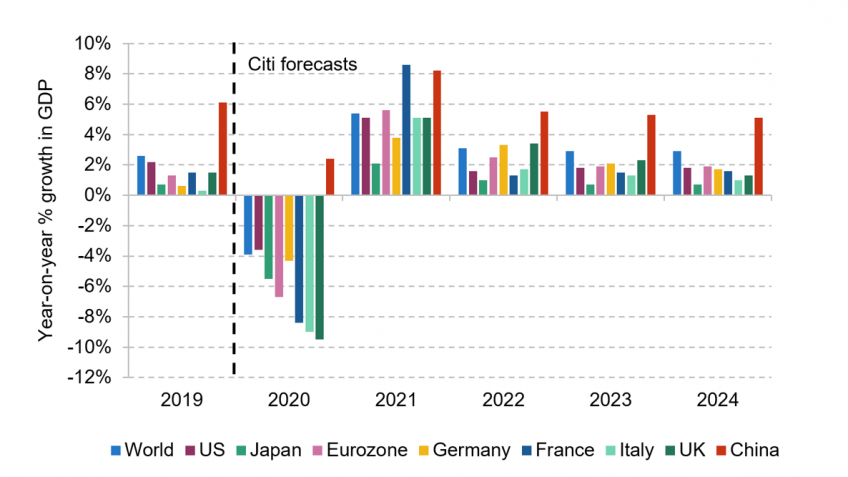

Over the third quarter of 2020, most countries have started to see a sharp but incomplete economic recovery. But recovery faces risks from cautious consumers, high rates of unemployment, low investment during the first half of 2020, the rise of private sector debt, and disruptions to international trade. Citi forecasts that GDP will reach pre-crisis levels mostly in 2021 or 2022. Even so, we expect all economies to remain smaller than either our pre-COVID forecast or a simple extrapolation of pre-COVID trends would imply.

Year-on-year % growth in GDP across countries, actual and Citi forecast

Source: Figure 1.14 in Chapter 1.

Key findings

1. The fiscal and monetary response has been even swifter and more comprehensive than after the 2008–09 crisis. Governments initially responded with a ‘first wave’ of measures aimed at protecting household and business incomes. This was followed over the summer by a ‘second-wave’ response targeted at boosting demand as lockdowns eased. Finally, some countries – most notably in the EU – have started to introduce ‘third-wave’ packages to help support the transition to a new normal. Timely, well-targeted and generous support should significantly improve the chances that scarring will be minimised and a more complete economic recovery achieved.

2. The ‘first-wave’ fiscal response saw considerable support for the labour market, which helped to keep workers attached to their jobs. In Germany, the UK, France and Italy, traditional measures of unemployment remained in single digits over the summer, but rates of furloughing pushed total unemployment rates to nearly 25% in the latter three countries.

3. In virtually every economy, the collapse of economic output in the first half of 2020 was historic. GDP fell by 10.2% in the US, 11.5% in Germany and 14.3% in the EU as a whole. Other countries suffered much worse economic shocks; GDP fell by 17.6% in Italy and 18.9% in France. Of 28 major economies, Spain and the UK had the worst falls in GDP (of 22.7% and 22.1% respectively). Only China continued to grow in the first half of 2020, but growth of 0.4% is a far cry from its usual growth rates.

4. After an economically disastrous first half of the year, most countries experienced a sharp – but generally incomplete – recovery. We expect that, even avoiding another round of major lockdowns, most economies will not return to pre-pandemic levels of output until 2021 or 2022.

5. Even when the pandemic itself is over (with the development and roll-out of a vaccine or effective medication), there will be lingering economic effects. Supply will feel the impact of depressed investment in 2020, as well as ongoing hygiene measures. Demand will be affected by ongoing caution, shifts in behaviour and unemployment. We therefore expect all economies to remain smaller than either our pre-COVID forecast or a simple extrapolation of pre-COVID trends would imply.

6. Citi forecasts big GDP declines and sharp recoveries almost everywhere, with GDP reaching pre-crisis levels mostly in 2021 or 2022. On current forecasts, China and the US look set to outperform European economies. Inflation and interest rates should stay low. There is a significant risk of divergence between the best- and worst-performing economies in this crisis; going into the final quarter of 2020, the UK has one of the worst starting points among major economies.