The public health and economic effects of the COVID-19 crisis are creating a perfect storm for councils’ finances, simultaneously increasing spending and reducing incomes. For example, personal protective equipment (PPE) and social distancing requirements have increased unit costs for a range of services, and most notably adult social care, where many service users are particularly vulnerable to the health effects of COVID-19. Councils are taking on additional responsibilities to house rough sleepers, support those shielding at home, and help with the testing, tracing and control of COVID-19 outbreaks. And the wider economic effects of the crisis are hitting councils’ various income sources to different extents as households and businesses radically change their behaviour and struggle to pay tax bills, rents and service charges.

Building on previous work by researchers at IFS on the financial risk and resilience of different councils and by the Local Government Association (LGA) on councils’ own expectations of the financial impact of the COVID-19 crisis as reported to the Ministry of Housing, Communities and Local Government (MHCLG), this report:

- examines the scale and nature of forecast impacts on spending and income from sales, fees and charges (SFCs) and commercial and other sources;

- explores how impacts may vary across council types, regions and council characteristics;

- compares the impacts with the financial resources provided to councils by central government and with the resources available to them in the form of reserves;

- considers the implications for future funding policy.

It is important to be upfront about the limitations of this approach. Forecasting spending and income during such an uncertain period is, of course, difficult. And different councils will have made different assumptions and may have interpreted some questions asked of them differently. This means estimates are subject to potentially significant margins of error, which we can only partially address via robustness and sensitivity checks. However, reported pressures are comparable to costs in Wales, where funding for councils is distributed on the basis of claims for verifiable costs. And patterns across councils align with the risk factors – such as particular reliance on SFCs and commercial income – identified in our earlier work. This suggests there is genuine and valuable information that is worth exploring.

A multi-billion-pound problem …

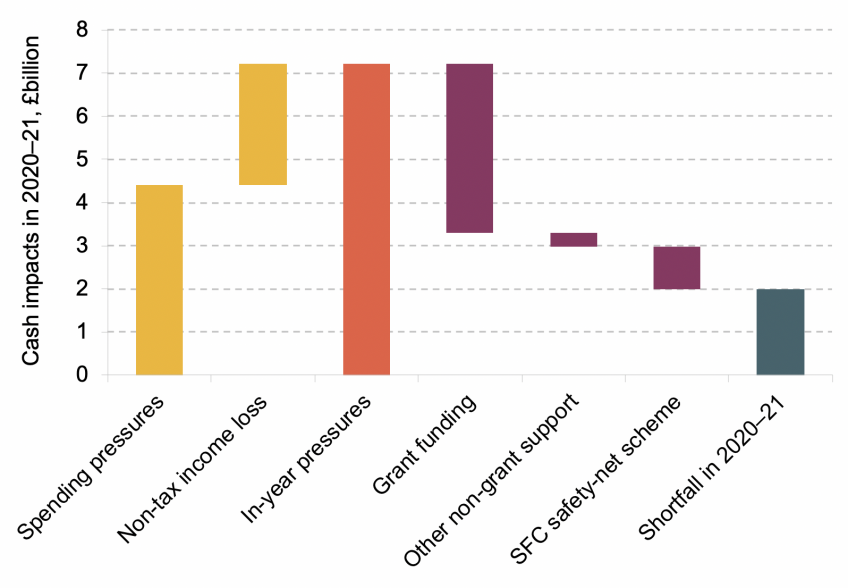

Bearing these caveats in mind, councils forecast spending pressures of £4.4 billion during 2020–21, with around £1.8 billion of those estimated to have been incurred between April and June. They also forecast a £2.8 billion shortfall in non-tax income, with £1.3 billion of this arising between April and June. Taken together, this means in-year pressures are forecast to be £7.2 billion, with billions of pounds more in losses in local tax collections also hitting councils’ main budgets from next year.

Estimates vary significantly across councils, with shire districts especially hard hit on the income side and hence facing the biggest hit overall, measured as a percentage of their pre-crisis expenditure. Income losses are relatively more important for areas with high population densities and low levels of deprivation. Spending pressures are relatively more important for areas with high levels of deprivation.

… that has only been partly addressed

The forecast pressures exceed the funding and support provided by central government. Councils have been provided with £3.6 billion of additional general-purpose grant funding and, following stakeholder discussion, we assume that they have access to around £0.3 billion of specific grant funding and £0.3 billion in other non-grant support to address their stated spending pressures. In addition, we estimate councils could have almost £1 billion of losses in SFCs (around half the total) compensated by the new SFC safety-net scheme – although this is tentative given that the data available so far do not allow us to model this scheme particularly accurately. However, taken together, this £5.2 billion in additional financial support still leaves a shortfall of £2.0 billion across the sector as a whole relative to current forecasts of pressures, as illustrated in Figure ES.1.

Figure ES.1. Baseline forecast of unmet spending and non-tax income pressures in 2020–21 (£ billion)

Note: Baseline scenario, which takes councils’ forecasts of spending and income pressures as given. ‘Non-tax income loss’ excludes council tax and business rates (losses of which will affect councils’ main budgets next year). ‘Grant funding’ includes general-purpose and specific grants. ‘Other non-grant support’ refers to NHS cost-sharing and Coronavirus Job Retention Scheme.

Source: Table 3.2.

Altogether, councils report that they are holding £3.3 billion in reserves that they could use to absorb such shortfalls this year. But these reserves are not distributed in line with forecast pressures. Over four in ten councils would still face a shortfall if they used all the reserves they consider to be ‘available’ for use this year, with the remaining shortfall for these councils amounting to £0.9 billion. Of course, councils may in fact be able to use more reserves than they say they could, especially given that almost one in five say none of their reserves are usable. But without additional funding, if they were to address forecast spending and non-tax income pressures in full by drawing down reserves, just over one in four would be left with reserves (relative to their pre-crisis expenditure) of less than one-half of the pre-COVID average for their council type, up from around one in six in March this year.

Pressures may, of course, turn out to be higher or lower than currently forecast. And further pressures loom in the coming years too, with shortfalls in council tax and business rates revenues this year having to be reflected in councils’ main budgets from next year, and the potential for ongoing impacts to spending and income, especially if a COVID-19 vaccine is delayed. If the government wants to avoid cuts to services, additional funding will therefore be needed in the coming years. Additional support and/or financial flexibilities – especially if pressures are revised further upwards – may also be needed for 2020–21 if the government wants to avoid some councils depleting a significant portion of their overall reserves or making in-year cuts to services.

Key findings

- Councils forecast spending pressures of £4.4 billion and non-tax income pressures of £2.8 billion in 2020–21. Taken together, this equates to a financial hit equal to 13.0% of pre-crisis expenditure. Adult social care accounts for £1.8 billion of the spending pressures, with unspecified unachieved efficiency savings accounting for the next-biggest chunk, at £0.6 billion. Reductions in SFCs on transport account for £0.8 billion of the loss in income, with reductions in commercial income (such as from commercial rents and trading companies) forecast to be £0.6 billion.

Approximately 41% of the spending pressures (£1.8 billion) and 45% of the income pressures (£1.3 billion) are estimated to have taken place between April and June (Q1). This implies that pressures are forecast to be less than half their Q1 levels in the remainder of the financial year. Of course, forecasting is subject to significant uncertainty, especially in the current environment, and pressures may abate by more or less than councils have assumed. If pressures in the remainder of the year turn out to be two-thirds of Q1 levels, for example, annual spending pressures and non-tax income pressures would each be around £1 billion higher than councils have forecast.

- There is significant variation in forecast pressures across councils, especially for non-tax income. For example, just over three in ten councils expect non-tax income to fall by the equivalent of less than 5% of their pre-crisis expenditure, while almost one in six expect a reduction of 20% or more. Shire districts, which are especially reliant on income from SFCs and commercial activities, are forecasting combined pressures averaging 23% of pre-crisis expenditure, compared with less than 15%, on average, for other council types. Differences across regions are not robust to sensitivity checks, but there is more robust evidence that non-tax income losses are higher in more densely populated areas, which typically rely more on the most at-risk income sources such as parking fees.

- The government has provided £4.8 billion of general and specific grant funding for councils to meet spending and non-tax income pressures this year. However, discussions with stakeholders suggest that councils may not have accounted for all of this – and the new responsibilities entailed – when forecasting their pressures. In our baseline scenario, we therefore account for around £3.9 billion of additional grant funding. On top of this, councils forecast savings of £27 million due to furloughing people as part of the Coronavirus Job Retention Scheme and £293 million of cost-sharing by the NHS. We also tentatively estimate councils could have around £1 billion of their losses in SFCs compensated by the ‘safety net’ scheme announced last month.

- Taken together, councils’ forecasts for spending and non-tax income and our baseline scenario for funding imply a funding shortfall of approximately £2 billion this year, although uncertainty about pressures and funding availability means there is scope for the gap to be much bigger or smaller. For example, if pressures in the remainder of the year are two-thirds (as opposed to less than half) of those between April and June, the shortfall would be around £3.5 billion.

Relying on reserves to meet these unfunded pressures would lead to a significant increase in the number of councils with low reserves relative to their pre-crisis expenditure. Under our baseline scenario, for instance, the proportion with reserves below half of the pre-crisis average for their council type would increase from around one-in-six to just over one-in-four. The proportion with reserves below a third would increase from around one-in-sixteen to around one-in-seven. Councils in such a situation could face a tricky trade-off between making in-year cuts or making cuts in coming years to rebuild their reserves.

- If the government wants to ease this trade off, several options are available. The simplest approach would be to increase the general grant funding it gives councils. But providing additional funding to all would be a costly way to support those councils facing the greatest problems, and more targeted support would be cheaper. One option would be to follow the example of Wales, where councils submit claims based on the additional costs they have incurred, subject to some vetting. Temporary powers to borrow to cover day-to-day spending could also be considered, and have been identified by the OECD as a sensible way to give local areas more flexibility and autonomy to respond to the crisis as they see fit.