Featured key questions

What are the options for reforming pensions taxation?

There are various reforms that could improve the targeting of pension saving incentives or alleviate inequities in the current system.

Should tax be used to encourage entrepreneurship?

There are reasons to promote entrepreneurship, but low headline tax rates on income from business are poorly targeted at that goal.

Should income from business be taxed like income from employment?

There is a strong case to tax business income at the same rates as employment income – if the tax base is also reformed.

Are preferential tax rates for the self-employed justified?

Lower headline tax rates on self-employment than on employment aren’t justified by differences in benefits or employment rights, and are poorly targeted at improving investment incentives.

Where does the government get its money?

The Government raises around £1 trillion in revenue each year. Most comes from the three biggest taxes: income tax, NICs and VAT.

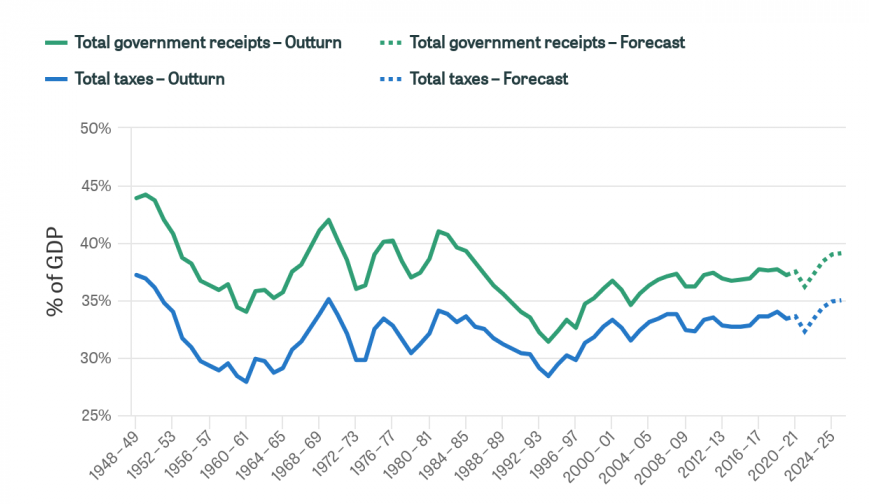

How have government revenues changed over time?

UK tax revenue is forecast to reach its highest ever level. One major trend since the 1970s has been a shift towards VAT.

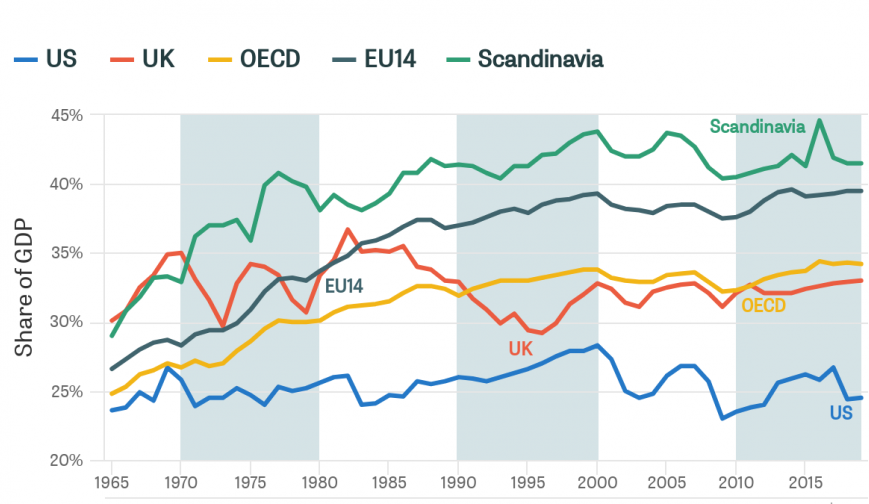

How do UK tax revenues compare internationally?

UK tax revenue is below the average of other developed economies. The UK stands out as raising less from social security contributions.

How did COVID affect government revenues, spending, borrowing and debt?

The COVID-19 crisis entailed a record-breaking fall in output and increase in government spending. The economy will bounce back but debt remain high.

What does the government spend money on?

In 2022–23, government spending was almost £1,200 billion, or around 45% of GDP. Health spending is a growing share of the total.

Should income tax and National Insurance be merged?

Yes. There is a strong case for creating a single tax on income. This would make our biggest taxes much more transparent.