Excise duties make a significant contribution to UK government revenues. In 2014–15, the duties levied on fuel, tobacco and alcohol raised £47 billion, comprising 7.2% of total receipts. However, the future of these taxes is uncertain. Revenues from existing duties are set to decline in coming years, and new planned and proposed regulations, such as plain packaging for cigarettes and minimum pricing for alcohol, would be likely to act to accelerate this process if enacted. At the same time, public health bodies have proposed introducing new duties on foods and beverages with high sugar contents. In this chapter, we consider the current structure of excise duties and the principles that should underpin them. We argue that current duties are not always well designed and we raise similar concerns with regard to proposed sugar taxes. Overall, there is a need for a clear long-term strategy for this part of the tax system, informed by economic principles and empirical evidence.

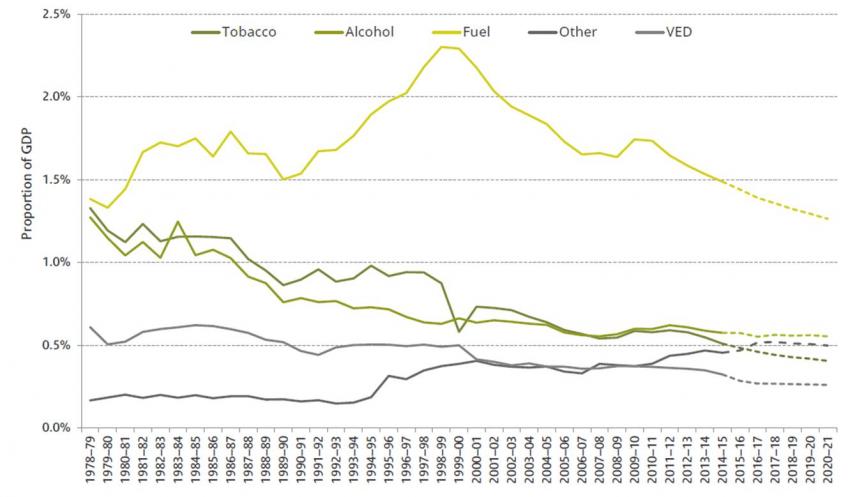

Figure: Revenue from duties as a percentage of national income, 1978–79 to 2020–21

The main points covered by this chapter include:

- Excise taxes on tobacco, fuel and alcohol comprise 7.2% of total receipts, which is a large share by international standards. However, revenues from these duties have already fallen from 10.3% of receipts in 1978–79 and are forecast to fall to 6.0% of receipts by 2020–21. Had these duties maintained their 1978–79 share of national income, they would be raising £26 billion more than they currently raise.

- Specific taxes on these goods are justified by the costs their consumption imposes on others (externalities) and/or costs on the consumer themselves that they may not fully take into account when making their consumption decision (internalities). Taxes should seek to target the externality- or internality-generating activity and should be set based on the incremental social harm associated with consumption.

- Real cuts to rates of fuel duties, combined with recent falls in oil prices and improving vehicle fuel efficiency, have pushed the average cost of driving a new vehicle a kilometre to its lowest level since at least 1997. The main social cost from motoring is congestion and this is rising. This suggests the price of motoring has not been tracking its social cost. Petrol and diesel duty increases of 41% and 31% respectively would return the average cost of driving a new vehicle to its 1997 level and raise £9 billion a year. However, fuel duties are poorly targeted at congestion; the government should move towards a system of road pricing.

- The current structure of alcohol duties is not well targeted at harmful alcohol consumption. As heavy drinkers tend to consume stronger alcoholic drinks, reversing the long-run trend towards lower spirits duties would target the system better at them. Action to tackle the very low levels of duty charged on strong cider would also make sense: a litre of 7.5% ABV beer is liable for duty of 138p, while a litre of 7.5% ABV cider attracts duty of only 39p. Changes of this nature should take precedence over imposing minimum prices, which has legal obstacles and which would likely result in windfall profits for drinks companies.

- There is also potentially a case for higher taxes on particular foods associated with diet-related disease. There have been calls for a tax on sugar, and sugar-sweetened soft drinks in particular. But the issues are more complex than may initially appear.

- A sugary soft drinks tax is likely to lead consumers to switch away from taxed products, but the efficacy of the policy will depend on what products they switch to and how firms change their prices. Some consumers might switch to chocolate, for example, which is also high in sugar and contains saturated fat to boot. Some manufacturers and/or retailers might respond to the tax by increasing the prices of diet drinks, dampening the extent of any consumer switching to these products.

- An alternative policy would be to levy a broad-based sugar tax. This would have the advantage of targeting all sources of dietary sugar. However, the effect of such a tax on consumption of other nutrients, and hence overall diet, is highly uncertain.

This chapter was presented at the Green Budget launch on 8 February 2016. All presentations are available to view on our Youtube Green Budget 2016 playlist.