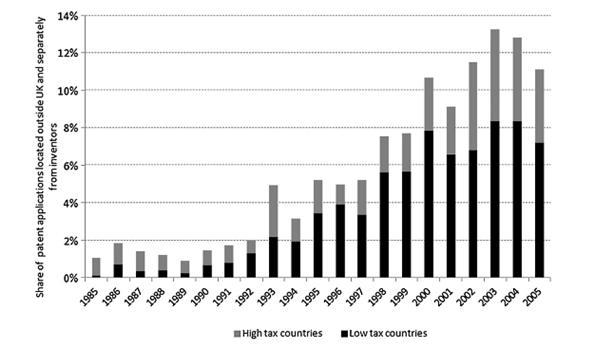

Intellectual property accounts for a growing share of firms’ assets. It is more mobile than other forms of capital, and could be used by firms to shift income offshore and to reduce their corporate income tax liability. We consider how influential corporate income taxes are in determining where firms choose to legally own intellectual property. We estimate a mixed (or random coefficients) logit model that incorporates important observed and unobserved heterogeneity in firms’ location choices. We obtain estimates of the full set of location specific tax elasticities and conduct ex ante analysis of how the location of ownership of intellectual property will respond to changes in tax policy. We find that recent reforms that give preferential tax treatment to income arising from patents are likely to have significant effects on the location of ownership of new intellectual property, and could lead to substantial reductions in tax revenue.