This morning the ONS published its first estimates of the public finances over the whole of the financial year 2020-21.

Responding to the figures, Isabel Stockton Research Economist at the Institute for Fiscal Studies, said: “Today’s figures confirm that government borrowing reached a peacetime record in the financial year that ended last month, with an initial estimate of borrowing of £303 billion, or almost 15%% of national income. The increase on the pre-pandemic forecast is unprecedented and highlights the extraordinary impact of the pandemic on government revenues and spending. We can also expect this estimate to be revised up, perhaps quite significantly, as the non-repayment of government backed loans by businesses is incorporated.

This has increased national debt to £2,142 billion or almost 100% of national income. With the lowest interest rates in history this is currently perfectly manageable, but rising interest rates could create difficulties for the government finances. This is one of many uncertainties which the Chancellor will have to manage over the coming years. While the most recent Budget plans suggest a return to the Government borrowing only to pay for investment spending by 2025–26 this depends on a swift recovery, big tax rises and very tight spending. There is a good chance that at least one of these will not happen.”

Further details

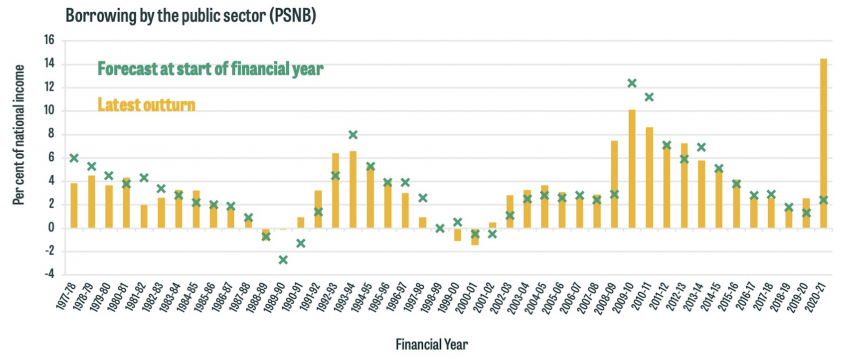

Today, the ONS published its initial estimate of public sector borrowing in the financial year that ended last month. Borrowing is estimated to have reached £303 billion, or 14.5% of national income. This is £52 billion less than the £355 billion forecast by the Office for Budget Responsibility at the Budget in early March. However, it is a staggering £248 billion, or 12.1% of national income, higher than forecast just before the financial year began – and more to the point, just prior to the economic impact of Covid-19 started to be felt in the UK – in March 2020. Figure 1.1 shows that borrowing in each financial year back to 1977-78 compared to the official forecast made at the start of each year. For example, it shows that borrowing in 2008-09 turned out much higher than forecast in the March 2008 Budget – as the global financial crisis hit – but much lower in the following two financial years than was forecast in March 2009 and March 2010 respectively. The figure makes clear that while the typical changes in a year are by no means insignificant, a revision of the scale seen in 2020-21 is unpredented, once again highlighting the enormous impact of the pandemic on the public finances. Unlike, for example, during the financial crisis, much of the increase in borrowing is attributable to the direct cost of emergency measures, in particular the employment support schemes and additional funding for the NHS and other public services. The initial estimate for day-to-day central government spending is £942 billion, compared to £754 billion expected before the pandemic.

Figure 1. Borrowing forecast at the start of each financial year, and the latest outturn

Notes: “Forecast at start of financial year” is the forecast closest to the March at the end of the previous financial year (in 1996-97 and 1997-98, the forecasts shown are 16 months out as they related to the November 1995 and November 1996 Budgets, respectively). Forecast adjusted for in-year classification changes from 2011-12 onwards.

The initial outturn of borrowing for a financial year is always subject to revision as more complete data become available. However, this year’s data are more than usually uncertain. Some of the costs of the pandemic have yet to be counted: most notably, the ONS’s figure does not yet include the expected cost of defaults on the substantial government-backed loans during the pandemic. As of March 21, with just ten days left for new applications, £47 billion of loans had been approved under the government’s three main coronavirus business loan schemes. The Office for Budget Responsibility expects a large share of this than never to be repaid and for £27 billion to be added to borrowing once these costs are fully accounted for, the bulk of which relates to the Bounce Back Loans.

Other costs are included in the outturn, but are likely to be revised substantially in the months to come. For example, the full impact of the pandemic on this year’s tax revenues depends on the amount of tax that has been deferred but will actually never be paid because firms have gone out of business.

The additional borrowing has pushed up the national debt to £2,142 billion or 98% of national income. With the lowest interest rates in history this is currently perfectly manageable, but rising interest rates could create difficulties for the government finances. This is one of many uncertainties which the Chancellor will have to manage over the coming years. While the most recent Budget plans suggest a return to the Government borrowing only to pay for investment spending by 2025–26 this depends on a swift recovery, big tax rises and very tight spending. There is a good chance that at least one of these will not happen.