The first of April 1991 seems a world away. Arsenal sat atop the English First Division, Mikhail Gorbachev was President of the Soviet Union and Chesney Hawkes topped the charts with The One and Only. This Observation wouldn’t have been read online on 1st April 1991, as the world wide web only became publicly accessible in August of that year. In fact, this Observation wouldn’t have been written at all, as one of its authors was born that very day 30 years ago, and the other was only to follow 6 months later!

Much has changed over those thirty years. Arsenal, The Soviet Union and Chesney Hawkes are no longer the powers they once were. A pint of draught lager would have set you back £1.32 on average in April 1991, but today that’s £3.80. Average weekly earnings, which were £215 in 1991, stand at £572 today. Moving closer to our subject of interest, property prices in England have more than quadrupled over that period, far outstripping the growth in earnings.

One thing that hasn’t changed in England and Scotland over those three decades is the property valuations on which council tax is based (in Wales, there was a revaluation in 2005)[1].

That matters hugely because property price appreciation has not only been substantial over that period, but it has varied dramatically across the country. House prices in the North East of England are three times as high as in 1991, but in London they have grown six-fold in that time. Even within the same areas, some properties have seen bigger price increases than others.

The fact that revaluation hasn’t happened in England when house price growth has been so varied has several implications. First, two households living in the same Local Authority (LA) in properties that are now equally valuable can find themselves paying tax bills hundreds of pounds apart, just because their properties were worth different amounts in 1991 (and have seen different price appreciation in the intervening years). Second, as central government funding to LAs depends on these outdated valuations, councils in areas where values have gone up relatively little have to charge taxes that are a substantially higher share of current values than councils in areas where values have gone up a lot. Finally, council tax was regressive when it was established – with higher valued properties paying less as a share of their value than lower valued properties – but this has only been exacerbated because properties that were more valuable in 1991 have tended to see faster price growth over the last 30 years. As a result, if councils in London and the North East set the same Band D tax rates, average bills in London would be only around 40% higher than those in the North East, despite average property prices in London being over three times higher.

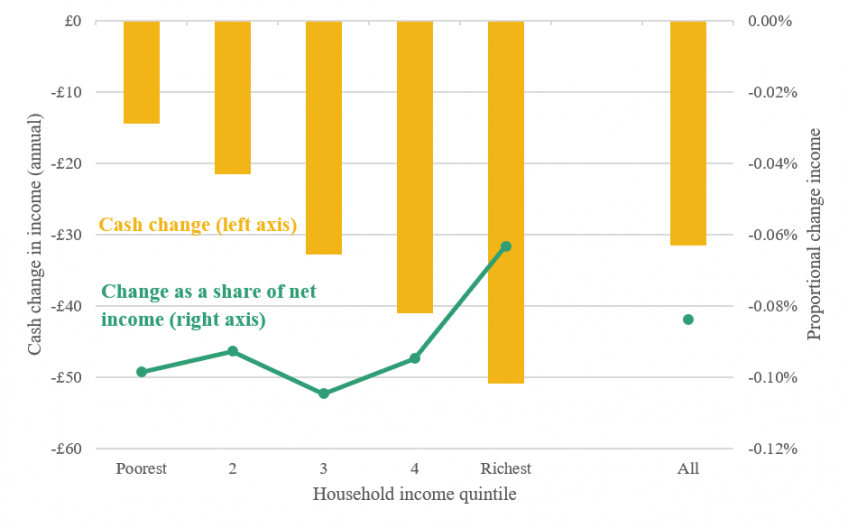

The current system is unfair and arbitrary. These effects are only made stronger when council tax increases in real terms – as it does in England tomorrow. The Spending Review last year allowed councils in England to increase council tax rates this year by up to 5% without needing to hold a local referendum; and many councils have chosen to take advantage of that policy, with rates increasing by 4.4% on average. Figure 1 shows the impact of these changes across the household income distribution. In proportional terms, the highest income households are affected the least – a consequence of council tax rates being less as a share of property value for high-valued homes. Middle income households are affected (slightly) more than poorer ones on average, because some poorer households are partly or fully protected from council tax increases via council tax support, a means-tested benefit targeted at those with low incomes.

Figure 1. Distributional impact of the (real terms) rise in council tax rates in England in 2021–22

Notes: Assumes full take-up of benefits. Does not include temporary council tax support expansions brought in during the pandemic.

Sources: Authors’ calculations using the Family Resources Survey 2018–19 and TAXBEN, the IFS tax and benefit microsimulation model.

It is high time for reform. This 30th anniversary – and the impetus for tax reform brought about by the pandemic – provides just the opportunity. As discussed in an IFS report last year, simply conducting a revaluation – i.e., basing council tax rates on the current value of the property rather than its value 30 years ago – would remove some of the arbitrariness and geographic inequities of council tax, and have fairly similar impacts on poorer and richer households. On average, those in London and the South East would pay more, and those in the North of England would pay less – potentially contributing to the government’s levelling up agenda. Making council tax rates proportional to the value of the property, rather than the current approach of levying higher rates on cheaper ones, would fully alleviate council tax’s geographic inequities and have progressive distributional effects, with the richest fifth of households seeing an increase in council tax bills and the poorest 70% a decrease.

Will this 30th anniversary be a moment for government to take action, finally, in this area? Or will policy analysts being born today be writing similar notes in 30 years’ time?

[1] While the valuations were made in 1991, Council Tax was introduced in 1993.