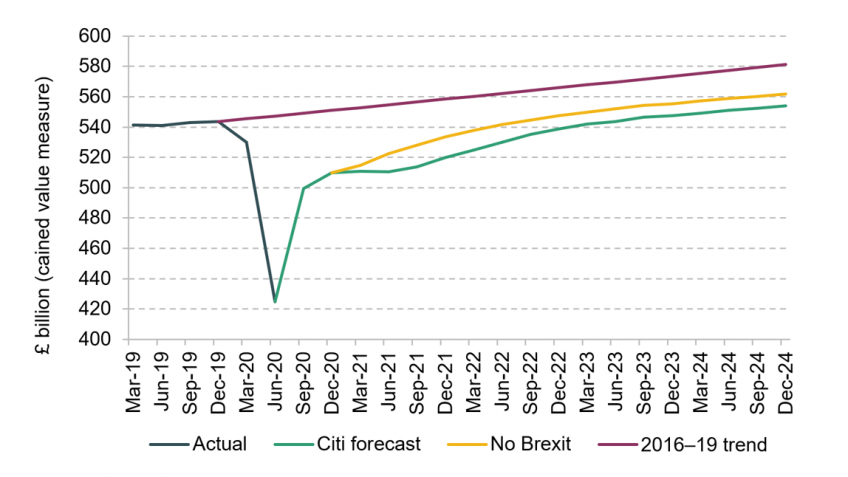

All indications point to only a thin trade deal (if any) with the European Union after the Brexit transition period ends in December. Despite over four years passing since the referendum, many of the associated economic costs still likely lie ahead. The shock from Brexit will affect different sectors from the COVID shock, meaning that Brexit is likely to cause additional economic pain even as the economy recovers from the virus-driven downturn. In addition, we think COVID is likely to have hampered public and private preparations for the end of the Brexit transition period, compounding the near-term economic cost. We expect GDP growth in 2021 to be 2.1% lower than in the event the UK were to remain in the EU Single Market and Customs Union. In a normal year, this would be enough to push the economy into recession. Some of this growth is likely to be made up in 2022.

The UK has traditionally shown itself to be a relatively flexible economy. This reputation is likely to be tested to the extreme over the coming years. We expect substantial restructuring of the UK economy in the years ahead as it responds to the new shape of demand from UK consumers in the wake of COVID-19 and the new shape of trading relationships in the wake of Brexit. Such restructuring implies a more protracted economic recovery and a substantial loss of economic capacity as some of the expertise and capital specific to now shrinking sectors becomes surplus to requirements. Persistent policy support will be needed to help the economy through this transition. However, fiscal policy will also have to tread a fine line between supporting growth in the near term and charting a path to fiscal sustainability in the medium term. This is a significant challenge.

UK real quarterly GDP in various policy scenarios (2016 prices)

Source: Figure 3.1 in Chapter 3.

Key Findings

1. Brexit remains a substantial economic challenge for the UK. The options currently on the table appear to be restricted to only a thin trade deal or a no-deal exit. We anticipate that the former case would leave the UK economy 2.1% smaller in 2021 than in a counterfactual where the transition period continues indefinitely; a no-deal exit could see output depressed by an additional 0.5–1.0%.

2. The path that Brexit-related economic impacts take over the next 12–24 months will depend on when changes associated with the UK’s exit from the Single Market and Customs Union begin to materialise, and the extent to which firms have already acted to improve their resilience. We think the majority of Brexit-related adjustment lies ahead. Weak sterling since 2016 has provided an incentive for many firms to maintain UK operations where they can, even if now unviable in the longer term. Low investment to date may reflect some long-term adjustment, but also reduces overseas firms’ economic ties to the UK. Brexit-related adjustments could now therefore prove more front loaded.

3. Both COVID and Brexit are likely to result in medium-term economic reconfiguration, as well as near-term disruption. The UK labour market, in particular, has shown itself better able to adjust during previous downturns than other countries. Even so, the ‘double whammy’ of COVID and Brexit will make adjusting to the new normal a huge challenge.

4. Adjustment to a post-COVID, post-Brexit new normal will have economic costs that last into the long term. A rebalancing away from the consumer services sector (COVID) and some parts of manufacturing and financial/ business services (Brexit) would make much of the accumulated capital and skills in these sectors less valuable. For workers, the longer they remain unemployed, the worse their prospects in the labour market. This can have consequences that last for decades.

5. The economic response to COVID-19 has seen monetary and fiscal policy complement each other, as the Bank of England and the government both seek to support the economy. However, this complementarity is less assured in the medium term: upward pressure on inflation (and particularly inflation expectations) could lead to the Bank tightening monetary policy even if fiscal policy still needs to remain loose. The UK’s dependence on foreign credit remains a notable additional vulnerability. More fiscal support will likely be needed in the near term. But getting the public finances on a sustainable trajectory in the medium term is also now a key challenge.