UK households hold around £230bn of unsecured or consumer debt – including loans, credit card debt, hire purchase agreements and overdrafts. This equates to an average £8,000 per household. The bulk of that debt is held by those on relatively high incomes and in normal times its repayment tends not to cause financial difficulties. But in a minority of cases, debts can put stress on households’ budgets with consequences for living standards and mental health.

The coronavirus pandemic, and the resulting social distancing policies that have inhibited normal working for many, is resulting in falls in household incomes. Evidence of this has already been seen with the dramatic increase in new claims for Universal Credit. Such income falls have the potential to make existing debt more of a challenge for some households, particularly where debt repayments already absorb a significant share of household income. The crisis could also result in more households borrowing, or existing borrowers increasing their levels of debt, in order to cover expenses when incomes fall.

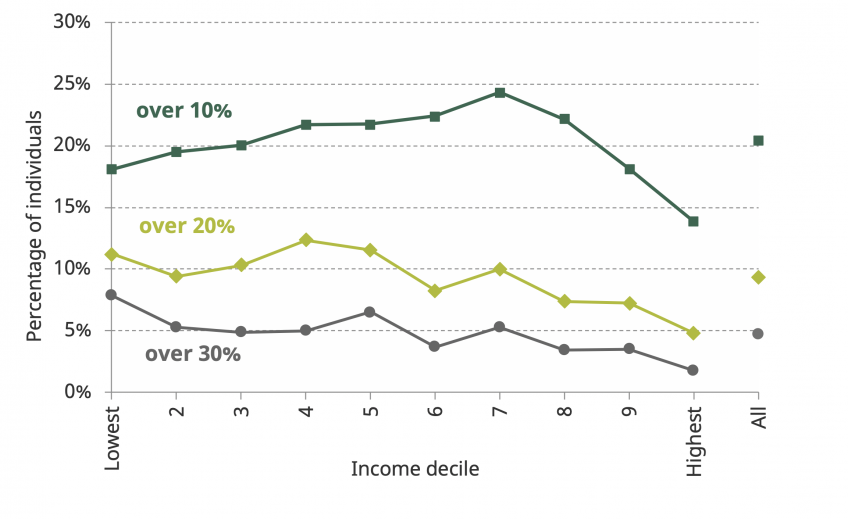

Previous IFS research has examined ‘problem debt’ in some detail. Updating that analysis for more recent data indicates that over one-in-five individuals live in a household where more than 10% of income is spent on unsecured debt repayments, one-in-ten are in households that spend over 20% of income on debt repayments and one-in-twenty are in households that spend over 30% of income on debt repayments. Figure 1 shows that those on middle-incomes – who have the potential to see significant income falls as a result of the crisis – are most likely to have significant levels of debt repayments: almost one-in-four of those in the 7th income decile spend more than 10% of their income on debt repayments, and 12% of those in the 4th income decile spend over 20% of their income on debt repayments. As Figure 1 also shows, debt repayments are most likely to consume very high shares of income (of over 30%) at the very bottom of the income distribution, but income may not be able to fall much further for these households.

Figure 1: Percentage of individuals in households with debt payments over 10%, 20% and 30% of net income (by income decile)

Note: Income deciles are calculated based on equivalised income and calculated within 10-year age-groups.

Source: Author’s calculations using the Wealth and Assets Survey, round 6.

Looking across age-groups, those in their 30s and 40s are most likely to be making substantial debt repayments as a share of income. For example, 15% of those aged 35 to 39 are in a household spending over a fifth of its income on debt repayments, compared to 6% of those aged 65 to 69.

Recent weeks have seen the Financial Conduct Authority introduce several measures designed to take financial pressure off households struggling with income falls. These include provisions for 3-month repayment freezes for credit cards and consumer loan debt (though interest may still accrue on debts held over this period). The FCA has today announced similar measures for motor finance and a 1-month interest-free freeze of repayment for high-cost short-term credit (“payday loans”). These measures could prove to be an important means of mitigating financial stress and its consequences for households in the immediate-term – not least by avoiding defaults and the associated damage these cause to an individual’s credit rating.

However, further challenges remain. Individuals may well continue to face debt repayment problems, either due to additional debt being taken out to cover for falling incomes, household incomes failing to recover, or accruing interest increasing the burden of debt repayments. The aforementioned IFS analysis found that episodes of ‘problem debt’ are particularly persistent for households on lower incomes, and that exits from ‘problem debt’ were often associated with strong rises in incomes. In the current economic climate, pay rises and new jobs may not be so forthcoming. The crisis therefore risks a new set of households getting ‘stuck’ in a difficult financial situation that may have consequences for years to come.

David Sturrock, a Senior Research Economist at the IFS, said:

“Before the current crisis hit, up to quarter of households in some relatively high income brackets were spending more than 10% of their income on repaying unsecured debts. Significant numbers were spending more than a fifth of their income on such repayments. With many households facing sharp falls in incomes, payment holidays will provide a temporary reprieve. But once those holidays are over, some of those households will struggle to return to pre-crisis income levels. Some, who thought they had manageable debts given their expected incomes, are now likely to end up struggling to cope.”