Over the last 25 years, the UK has embraced globalisation as well as the establishment, extension and constant deepening of the European Single Market more than many other advanced economies. The UK is a world leader in advanced-economy service provision and has been more successful than most in attracting international capital and workers. This successful specialisation has coincided with the UK economy mostly outperforming others in the G7.

In this context, however, the UK is now facing challenges, including its own vote to leave the EU and the broader challenges to globalisation – in terms of both the slowing pace of integration and the political backlash in many countries against globalisation.

In this part of Citi’s contribution to the Green Budget, we take a prospective look at the international environment for the UK economy. This includes an assessment of the near-term growth outlook of the UK’s major trade partners. But more importantly, it includes a discussion of the UK’s vulnerability to a reversal of economic and financial integration, be it at the global level (reversal of globalisation) or at a regional level (in the form of the UK’s exit from the European Union).

Key findings

- The UK has adapted well to globalisation opportunities. Over the past 25 years, it has been a world leader in advanced-economy service provision and some manufacturing industries. The UK imports consumer and industrial goods. UK manufacturing has high shares of imported goods in its value added by international standards, making it especially vulnerable to increased trade barriers.

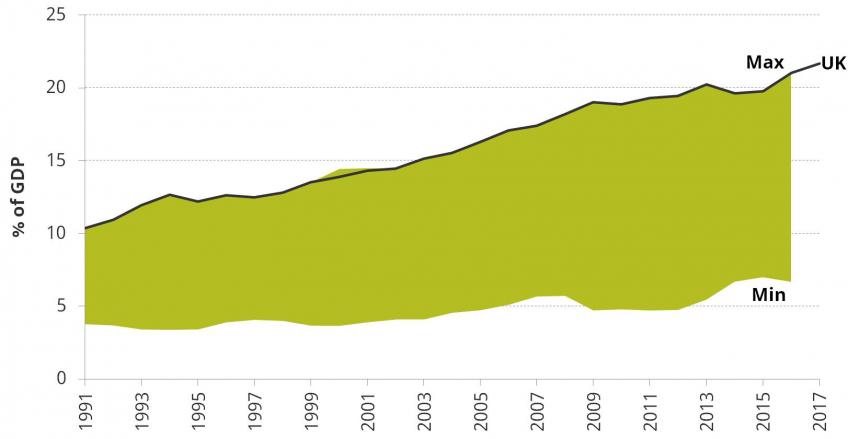

- Services trade as a fraction of national income is higher in the UK than in many other major economies and has grown substantially over the last two decades. This increase has in part been helped by the establishment, extension and deepening of the EU Single Market. The UK has a trade surplus in services of 5.5% of national income, three-quarters of which came from financial and professional services. Trade in these highly regulated industries depends particularly on trust and cooperation between jurisdictions.

- The UK depends on global capital and migrant labour, and has been successful in attracting both. It has become a destination of choice for direct investment and internationally mobile workers. The UK depends on both to fund its large current account deficit and to close skills gaps.

- Working-age immigrants from the EU are substantially more likely to be in paid work than either those born in the UK or immigrants from the rest of the world. Foreigners accounted for more than half of UK employment growth in the last two decades, but the contribution from EU citizens has recently fallen sharply. Should this persist, the direct effect would be to halve trend UK GDP growth.

- Even leaving Brexit aside, the business models of many globalised economies are being challenged. First, as labour cost differentials diminish, the rush to offshore production may have peaked. Second, there is the US-forced reordering of international trade relations, with a risk of sustained alienation between the US and China in particular. Third, there is a rising aversion to immigration in many advanced economies.

- The global outlook is for strong growth but with growing discrepancies. The fiscal-stimulus-fuelled US economy is firing on all cylinders and Europe is still growing nicely, but the synchronised upswing of 2017 is past and risks are emerging.

Figure. Services trade intensity of selected large OECD economies

Note: Exports + Imports divided by GDP. UK, US, Germany, France, Italy, Spain, Canada, Japan and South Korea.

Source: OECD and Citi Research.