English local government finance is part way through a series of major changes that will see its focus shift from being based on redistribution according to spending needs, towards more emphasis on providing financial incentives to tackle needs and increase local revenue-raising capacity. In this context, the government is undertaking a ‘Fair Funding Review’. This is aimed at designing a new system for allocating funding between councils.

In particular, the Review will update and improve methods for estimating councils’ differing abilities to raise revenues and their differing spending needs. The government is looking for the new system to be simple and transparent, but at the same time robust and evidence based.

This paper focuses on the issues that arise in assessing the spending needs of different councils. A companion paper looks at the assessment of revenue-raising capacity, and discusses options for the overall design of the new funding system. Read a combined Executive Summary of both papers here.

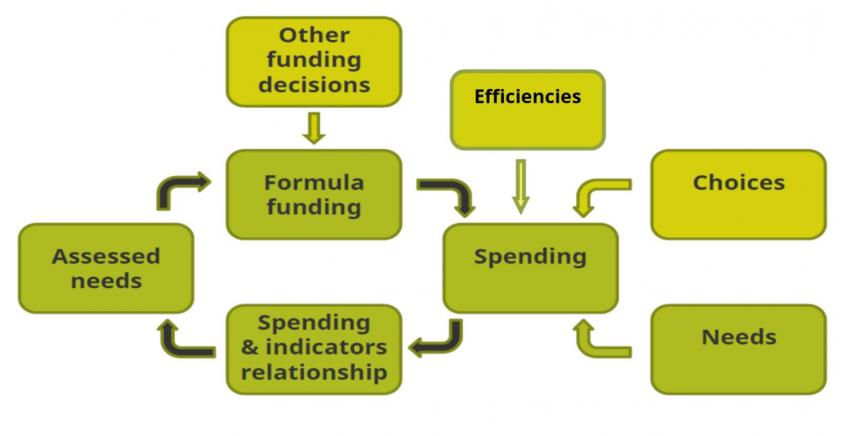

Assessments of spending needs using council-level spending patterns can be impacted by previous government funding decisions

- For a number of service areas, including environmental, protective and cultural services (EPCS) the government proposes to base formulas to estimate spending needs on the statistical relationships between councils’ spending and their socio-economic and geographic characteristics. This is a better approach than many alternatives but it can run into problems.

- In particular, the statistical relationships between spending and local characteristics could be partly driven by factors other than needs – such as variation across councils in preferences over tax and spending and in the efficiency of service delivery.

- One such factor which is likely to be important is past funding decisions by central government. Since 2009–10, for instance, government policy has led to much bigger cuts in the budgets of councils serving deprived areas than for councils serving less deprived areas. A funding formula for EPCS based on recent spending patterns would therefore weight deprivation less highly when calculating councils’ spending needs than one based on 2009–10 spending patterns. It would therefore be less generous to deprived and more generous to more affluent councils.

Assessments of spending needs can be sensitive to the choice of local characteristics included in spending needs formulas

- We examine the sensitivity of spending needs estimates for EPCS to the inclusion (or exclusion) of employment density, the share of the population that is aged under 16 or 75 and over, and several other local characteristics as needs indicators. We find that the new estimates are most sensitive to the choice of indicators for those councils assessed to have the highest spending needs under the existing formula – which are often in inner London.

- We also find that the new estimates are likely to be lower than existing estimates of spending needs for EPCS for those councils that have the highest spending needs under the existing formula. Conversely, they are likely to be higher for those councils that have the lowest spending needs under the existing formula.

The use of subcouncil-level data for assessing social care spending needs is welcome

- For children’s services and adult social care services, the government proposes to develop spending formulas based on patterns of spending or service utilisation across individuals or small geographical areas with different characteristics. Spending needs formulas based on such subcouncil-level patterns should be significantly more robust than formulas based on council-level variation.

- But it is important to clear that no assessment of spending needs can be objective – although it can and should be evidence-based, and utilise the best methods and data. Judgement inevitably plays a part in deciding what year of data to use, what indicators to include, and what (if any) adjustments to make to formulas developed using statistical analysis of spending patterns if there is a concern that they are being biased by non-needs factors.

Figure. The expenditure-based regression approach to assessing spending needs